توقعات سعر LM لعام 2025: تحليل توجهات السوق والعوامل المؤثرة في مستقبل معادن الليثيوم

مقدمة: الموقع السوقي لـ LM وقيمته الاستثمارية

تُعد LeisureMeta (LM) من الرواد في تجسيد قيم Web 3.0، وقد أحرزت تقدماً بارزاً منذ انطلاقها. في عام 2025، بلغ رأس المال السوقي لـ LeisureMeta نحو 5,409,583 دولاراً، مع معروض متداول يقارب 3,218,074,832 توكن، وسعر مستقر حول 0.001681 دولار. وتلعب هذه الأصول، المعروفة باسم "مُمكّن Web 3.0"، دوراً محورياً متزايد الأهمية في قطاعي SocialFi وابتكارات البلوك تشين.

يتناول هذا المقال تحليلاً مفصلاً لاتجاهات أسعار LeisureMeta بين 2025 و2030، بالاعتماد على الأنماط التاريخية، توازن العرض والطلب، تطور النظام البيئي، والعوامل الاقتصادية الكلية، لتوفير توقعات سعرية مهنية واستراتيجيات استثمار عملية للمستثمرين.

I. مراجعة تاريخ أسعار LM والوضع الراهن للسوق

المسار التاريخي لتطور سعر LM

- 2023: بلغ أعلى مستوى تاريخي عند 0.76269 دولار في 16 مارس، ما شكّل محطة فارقة لـ LM

- 2024: تسببت تقلبات السوق بتذبذب مستمر للأسعار طوال العام

- 2025: شهدت الدورة السوقية هبوطاً، حيث انخفض السعر من الذروة إلى 0.001591 دولار في 10 أكتوبر

الوضع الحالي لسوق LM

في 11 أكتوبر 2025، يُتداول LM عند 0.001681 دولار، مع هبوط حاد بنسبة 18.63% خلال 24 ساعة مضت. وسجّل التوكن أداءً سلبياً في فترات زمنية مختلفة، بانخفاض 18.99% خلال الأسبوع الماضي و25.22% خلال الشهر الأخير. يعكس السعر الحالي تراجعاً بنسبة 97.8% مقارنة بأعلى قيمة تاريخية بلغت 0.76269 دولار في 16 مارس 2023.

يبلغ رأس المال السوقي لـ LM حالياً 5,409,583 دولاراً، محتلاً المرتبة 1675 بين العملات الرقمية. وحجم التداول خلال 24 ساعة بلغ 28,591 دولاراً، ما يشير إلى نشاط متوسط. ويبلغ المعروض المتداول 3,218,074,832.13 من أصل معروض كلي قدره 4,668,074,832.13 ومعروض أقصى 5,000,000,000، بنسبة تداول تبلغ 64.36%.

تُظهر مؤشرات السوق أن المزاج العام حول LM سلبي، إذ سجل التوكن أدنى مستوى له على الإطلاق في اليوم السابق. هذا التحرك السعري الأخير يدل على أن LM يواجه ظروفاً سوقية صعبة وضغطاً هبوطياً قوياً.

انقر لعرض السعر السوقي الحالي لـ LM

مؤشر معنويات السوق لـ LM

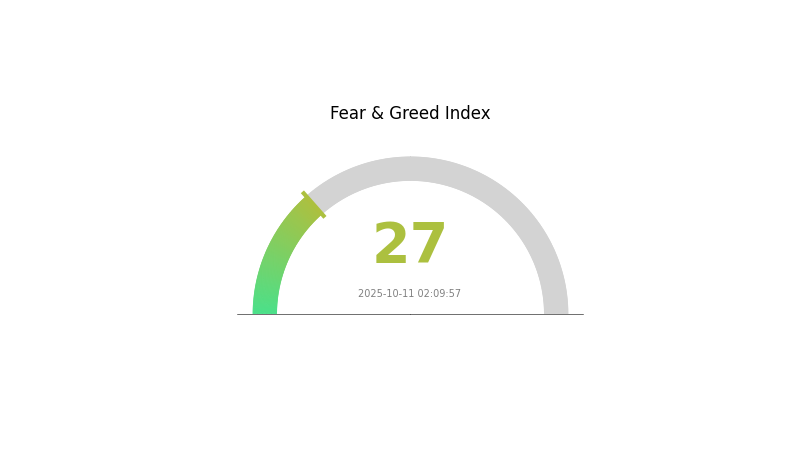

11-10-2025 مؤشر الخوف والطمع: 27 (خوف)

انقر لعرض مؤشر الخوف والطمع الحالي

لا تزال معنويات سوق العملات الرقمية حذرة، حيث يسجل مؤشر الخوف والطمع 27، ما يعكس حالة من الخوف. يشير ذلك إلى تردد المستثمرين واحتمال بحثهم عن فرص شراء. في مثل هذه الفترات، احرص على البقاء مطلعاً ودرس استخدام استراتيجيات متوسط التكلفة. تذكر أن الدورات السوقية طبيعية، وغالباً ما تسبق فترات الخوف موجات انتعاش محتملة. وكالعادة، أجرِ أبحاثاً دقيقة وادرس المخاطر جيداً عند التعامل مع تقلبات سوق العملات الرقمية.

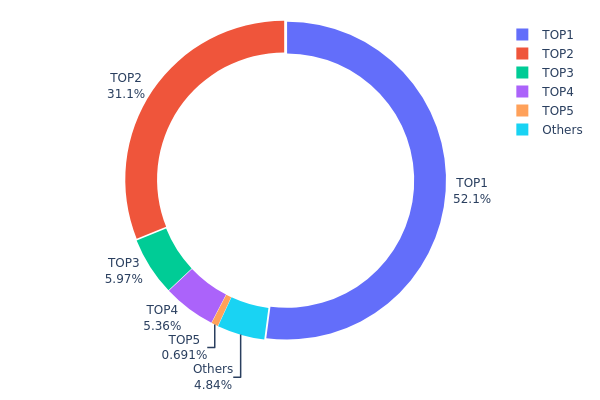

توزيع حيازة LM

تشير بيانات توزيع الحيازة إلى هيكل ملكية شديد التركّز لتوكنات LM، إذ يمتلك العنوان الأول 52.08% من إجمالي المعروض، بينما يستحوذ ثاني أكبر مالك على 31.06%. بذلك يشكّل هذان العنوانان أكثر من 83% من إجمالي توكنات LM. وتستحوذ أكبر خمسة عناوين معاً على 95.14% من المعروض، فيما يتوزع فقط 4.86% على بقية الحائزين.

هذا التركّز الشديد في LM يثير مخاوف كبيرة بشأن التلاعب بالسوق وتقلب الأسعار. فمع سيطرة بضعة عناوين على معظم المعروض، يزداد خطر تحركات البيع أو الشراء المفاجئة التي قد تؤثر بشكل كبير على سعر التوكن. كما يقوض هذا التركّز مبدأ اللامركزية، إذ يمنح نفوذاً غير متناسب لعدد محدود من الجهات أو الأفراد في منظومة LM وحوكمته.

تشير هذه البنية الحالية إلى سوق ناشئة وغير مستقرة نسبياً لتوكنات LM، وتعكس محدودية الانتشار وتثير تساؤلات حول استدامة التوكن وقدرته على مقاومة الصدمات أو التحركات المنسقة من كبار الحائزين.

انقر لعرض توزيع حيازة LM الحالي

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4e90...3fc615 | 2431590.45K | 52.08% |

| 2 | 0xb63b...4df412 | 1450000.00K | 31.06% |

| 3 | 0x9890...6266e6 | 278500.02K | 5.96% |

| 4 | 0x7a1c...bdbacc | 249999.99K | 5.35% |

| 5 | 0x2be4...602b70 | 32270.01K | 0.69% |

| - | Others | 225714.36K | 4.86% |

II. العوامل الرئيسية المؤثرة في أسعار LM المستقبلية

آلية العرض

- عرض النقود: التغيرات في عرض النقود تؤثر مباشرة على أسعار LM.

- النمط التاريخي: غالباً يؤدي ارتفاع العرض النقدي إلى زيادة الأسعار، بينما يسبب النقص انخفاضها.

- الأثر الحالي: التغيرات المتوقعة في العرض النقدي ستؤثر على أسعار LM تبعاً لذلك.

البيئة الاقتصادية الكلية

- تأثير السياسات النقدية: سياسات البنوك المركزية، خاصة أسعار الفائدة، تؤثر بشكل كبير على أسعار LM.

- خصائص التحوط من التضخم: يمكن أن تمثل LM أداة تحوط ضد التضخم، وربما تزداد قيمتها في فترات التضخم المرتفع.

- العوامل الجيوسياسية: التوترات والصراعات الدولية قد تدفع المستثمرين إلى LM كأصل ملاذ آمن.

التطور التكنولوجي وبناء النظام البيئي

- تطبيقات النظام البيئي: نمو DApps والمشاريع داخل منظومة LM يعزز فائدتها وطلبها.

III. توقعات سعر LM للفترة 2025-2030

نظرة 2025

- توقع متحفظ: 0.00086 - 0.00168 دولار

- توقع محايد: 0.00168 - 0.00195 دولار

- توقع متفائل: 0.00195 دولار (يتطلب ظروف سوق إيجابية واعتماداً متزايداً)

نظرة 2026-2027

- مرحلة السوق المتوقعة: نمو تدريجي وتماسك

- توقع نطاق الأسعار:

- 2026: 0.00105 - 0.00212 دولار

- 2027: 0.00110 - 0.00283 دولار

- العوامل المحفزة: التقدم التقني، توسيع حالات الاستخدام، وتعافي السوق العام للعملات الرقمية

نظرة المدى البعيد 2028-2030

- السيناريو الأساسي: 0.00240 - 0.00261 دولار (مع استمرار النمو السوقي والتبني)

- السيناريو المتفائل: 0.00271 - 0.00370 دولار (مع تسارع التبني وبيئة تنظيمية إيجابية)

- السيناريو التحويلي: 0.00370 دولار فأكثر (مع تطبيقات ثورية واندماج بالسوق السائد)

- 31-12-2030: LM عند 0.00370 دولار (كذروة محتملة بناءً على التوقعات المتفائلة)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00195 | 0.00168 | 0.00086 | 0 |

| 2026 | 0.00212 | 0.00181 | 0.00105 | 7 |

| 2027 | 0.00283 | 0.00197 | 0.0011 | 16 |

| 2028 | 0.00271 | 0.0024 | 0.00213 | 42 |

| 2029 | 0.00266 | 0.00255 | 0.00204 | 51 |

| 2030 | 0.0037 | 0.00261 | 0.00159 | 55 |

IV. استراتيجيات الاستثمار الاحترافية وإدارة المخاطر لـ LM

منهجية الاستثمار في LM

(1) استراتيجية الاحتفاظ طويل الأجل

- مناسب للمستثمرين ذوي تحمل المخاطر العالي والرؤية بعيدة المدى

- اقتراحات تنفيذية:

- جمع توكنات LM عند الانخفاضات السعرية

- الاحتفاظ بالتوكنات لمدة لا تقل عن 2-3 سنوات لتجاوز تذبذبات السوق

- تخزين التوكنات في محفظة أجهزة آمنة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة: استخدامها لتحديد الاتجاهات ونقاط الانعكاس

- مؤشر القوة النسبية (RSI): لمراقبة حالة التشبع الشرائي أو البيعي

- نقاط هامة لتداول السوينغ:

- تحديد نقاط الدخول والخروج بناءً على المؤشرات الفنية

- تفعيل أوامر وقف الخسارة للحد من الخسائر المحتملة

إطار إدارة المخاطر لـ LM

(1) مبادئ توزيع الأصول

- المستثمرون المحافظون: 1-3% من المحفظة الرقمية

- المستثمرون المعتدلون: 3-5% من المحفظة الرقمية

- المستثمرون الجريئون: 5-10% من المحفظة الرقمية

(2) حلول التحوط من المخاطر

- تنويع الأصول: توزيع الاستثمارات على عدة عملات رقمية

- أوامر وقف الخسارة: استخدامها للحد من الخسائر

(3) حلول التخزين الآمن

- توصية المحفظة الساخنة: Gate Web3 Wallet

- الحفظ البارد: محفظة أجهزة للاحتفاظ طويل الأجل

- إجراءات الأمان: تفعيل المصادقة الثنائية واستخدام كلمات مرور قوية

V. المخاطر والتحديات المحتملة لـ LM

مخاطر السوق لـ LM

- تقلبات مرتفعة: قد يشهد سعر LM تذبذبات كبيرة

- سيولة محدودة: قد تظهر صعوبات في تنفيذ الصفقات الكبيرة

- تأثر بالسوق: يخضع لاتجاهات سوق العملات الرقمية الأوسع

مخاطر LM التنظيمية

- بيئة تنظيمية غير واضحة: احتمال ظهور تنظيمات أكثر صرامة

- قيود عبر الحدود: اختلاف الوضع القانوني حسب الدول

- تحديات الامتثال: ضرورة التكيف مع متطلبات تنظيمية متغيرة

المخاطر التقنية لـ LM

- ثغرات العقود الذكية: وجود احتمالية للاستغلال أو الأخطاء

- قابلية التوسع: احتمال حدوث اختناقات في شبكة البلوك تشين

- تحديات التشغيل البيني: قيود في الربط بين السلاسل

VI. الخلاصة وتوصيات التنفيذ

تقييم القيمة الاستثمارية لـ LM

يُمثل LM فرصة استثمارية عالية المخاطر وعالية الإمكانات ضمن Web 3.0 وSocialFi. ورغم ما يقدمه من ابتكارات، ينبغي على المستثمرين الانتباه إلى تقلباته الشديدة وعدم اليقين التنظيمي المحيط به.

توصيات الاستثمار في LM

✅ للمبتدئين: ابدأ بمراكز صغيرة وركز على التعلم وفهم المشروع ✅ للمستثمرين ذوي الخبرة: اعتمد استراتيجية متوازنة تجمع بين الاحتفاظ الطويل والتداول النشط ✅ للمؤسسات: نفذ تدقيقاً شاملاً وادرس إدراج LM ضمن محفظة عملات رقمية متنوعة

طرق المشاركة في تداول LM

- التداول الفوري: شراء توكنات LM عبر Gate.com

- الستاكينغ: المشاركة في برامج الستاكينغ إذا توفرت

- تكامل DeFi: استكشاف فرص التمويل اللامركزي المرتبطة بـ LM

استثمارات العملات الرقمية تنطوي على مخاطر عالية جداً، ولا يُعد هذا المقال نصيحة استثمارية. يجب أن تتخذ قرارك بناءً على قدرتك على تحمل المخاطر، وينصح باستشارة مستشار مالي محترف. لا تستثمر أبداً أكثر مما يمكنك تحمله من خسارة.

الأسئلة الشائعة

ما هو الحد الأعلى المتوقع لـ XLM في 2025؟

وفقاً لتحليل السوق، من المتوقع أن يتراوح سعر XLM بين 0.382 و0.423 دولار في عام 2025، مع أخذ عوامل متنوعة مؤثرة في سوق العملات الرقمية بعين الاعتبار.

هل يمكن أن يصل XLM إلى 10 دولارات؟

رغم أن ذلك غير مرجح بالأسعار الحالية، إلا أنه ليس مستحيلاً. بلوغ XLM مستوى 10 دولارات يتطلب تغيرات سوقية جذرية واعتماداً واسع النطاق ونمواً كبيراً في منظومة العملات الرقمية.

هل سيرتفع XLM بقوة؟

XLM يمتلك إمكانيات نمو كبيرة مع تزايد الاعتماد والتطورات التقنية في شبكة Stellar. ومع ذلك، قد تؤثر تقلبات السوق والعوامل التنظيمية على مساره.

هل يمكن أن يصل XLM إلى 5 دولارات؟

رغم وجود احتمال نظري، إلا أن وصول XLM إلى 5 دولارات يُعتبر غير مرجح. يتطلب ذلك زيادة هائلة بمقدار 1000 مرة عن مستواه الحالي، وهو أمر غير مسبوق بالنسبة لوضع XLM السوقي وسجله التاريخي.

مشاركة

المحتوى