Previsão de preço SPON para 2025: análise das tendências de mercado e dos fatores potenciais de crescimento para o token SPON

Introdução: Posição de Mercado e Valor de Investimento do SPON

O Spheron Network (SPON), referência em infraestrutura de computação descentralizada, consolidou avanços significativos desde sua fundação. Em 2025, sua capitalização de mercado é de US$7.018.989, com aproximadamente 220.100.000 tokens em circulação e cotação perto de US$0,03189. Reconhecido como “Infraestrutura de IA impulsionada pela Comunidade”, o ativo vem ganhando protagonismo nos segmentos de inteligência artificial e computação descentralizada.

Este artigo apresenta uma análise detalhada das tendências de preço do SPON entre 2025 e 2030, contemplando históricos, dinâmica de oferta e demanda, evolução do ecossistema e fatores macroeconômicos, para oferecer previsões profissionais e estratégias de investimento adequadas ao perfil do investidor.

I. Histórico de Preço e Situação Atual do Mercado SPON

Evolução Histórica dos Preços do SPON

- Julho de 2025: SPON atingiu seu valor mínimo histórico de US$0,01553.

- Agosto de 2025: O token registrou máxima histórica de US$0,1445, em forte movimento de alta.

- Outubro de 2025: O SPON passou por correção de mercado, acumulando queda de 45,17% nos últimos 30 dias.

Situação Atual do Mercado SPON

Em 10 de outubro de 2025, o SPON negocia a US$0,03189. O token apresenta retração de 8,52% nas últimas 24 horas, com preços entre US$0,03142 e US$0,03553. A capitalização de mercado é de US$7.018.989, ocupando a 1597ª posição no ranking global de criptomoedas. O volume negociado em 24 horas é de US$89.558,03858, refletindo atividade moderada. O suprimento circulante é de 220.100.000 tokens, equivalente a 22,01% do total de 1.000.000.000. O valor de mercado totalmente diluído é de US$31.890.000.

Clique para acompanhar o preço atual do SPON no mercado

Indicador de Sentimento de Mercado do SPON

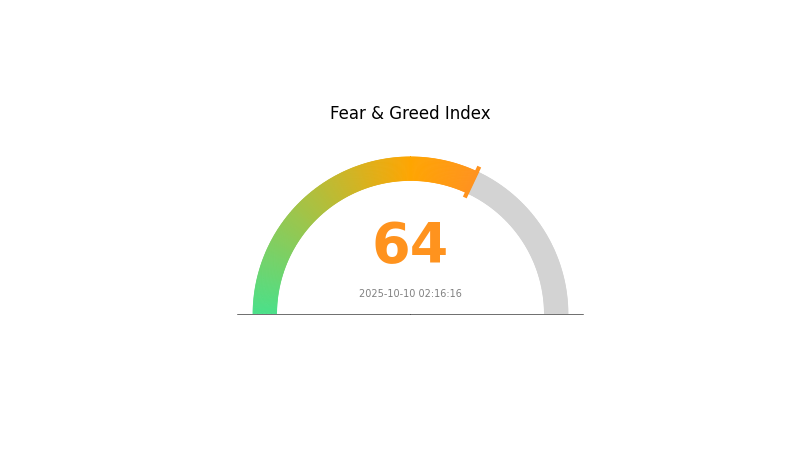

10-10-2025 Índice de Medo e Ganância: 64 (Ganância)

Clique para visualizar o Índice de Medo e Ganância atual

O mercado cripto apresenta cenário de ganância, com o Índice de Medo e Ganância em 64. O resultado indica forte otimismo e possível sobrecompra. Embora o sentimento positivo possa estimular novas valorizações, cautela é essencial. Traders experientes podem optar por realizar lucros ou proteger posições. Investidores iniciantes devem evitar decisões motivadas por FOMO e pesquisar cuidadosamente. O sentimento do mercado pode se alterar rapidamente; mantenha-se atento e faça gestão rigorosa de riscos.

Distribuição dos Detentores de SPON

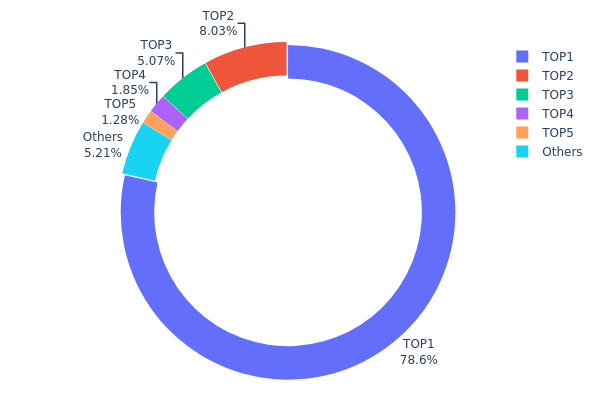

A distribuição dos endereços detentores do SPON evidencia forte concentração. O endereço principal detém 78,56% do suprimento total, e o segundo maior possui 8,03%. Esse grau de concentração traz preocupações sobre descentralização e riscos de manipulação no mercado.

Essa configuração pode gerar volatilidade intensa caso grandes detentores decidam liquidar posições. Além disso, pode comprometer a estrutura de mercado, permitindo que poucos agentes influenciem decisões de governança e o ecossistema do token.

O nível de concentração sugere que a estrutura on-chain do SPON está menos estável do que o ideal para projetos descentralizados. Apesar de 5,24% do suprimento estar distribuído entre pequenos detentores (“Outros”), o domínio dos principais endereços reforça a necessidade de ampliar a distribuição dos tokens para fortalecer a resiliência do mercado e mitigar riscos de centralização.

Clique para consultar a Distribuição dos Detentores de SPON

| Top | Endereço | Quantidade Detida | Participação (%) |

|---|---|---|---|

| 1 | 0x2cde...48f00c | 782.433,33K | 78,56% |

| 2 | 0x8fe1...3e26e3 | 80.000,00K | 8,03% |

| 3 | 0xd9e5...656e40 | 50.445,27K | 5,06% |

| 4 | 0x0d07...b492fe | 18.398,69K | 1,84% |

| 5 | 0x4e3a...a31b60 | 12.739,13K | 1,27% |

| - | Outros | 51.921,08K | 5,24% |

II. Principais Fatores que Influenciam o Preço Futuro do SPON

Mecanismo de Oferta

- Oferta Fixa: O SPON possui suprimento total limitado, o que pode gerar escassez e influenciar o preço conforme a demanda se altera.

Ambiente Macroeconômico

- Proteção contra Inflação: Por ser uma criptomoeda, o SPON pode funcionar como instrumento de hedge contra inflação, semelhante a outros ativos digitais.

Desenvolvimento Técnico e Ecossistema

- Aplicações no Ecossistema: O SPON deve atrair DApps e projetos integrados à sua rede, ampliando sua utilidade e valorização.

III. Previsão de Preço do SPON para 2025-2030

Perspectivas para 2025

- Cenário conservador: US$0,02903 - US$0,03190

- Cenário neutro: US$0,03190 - US$0,03286

- Cenário otimista: US$0,03286 - US$0,03381 (dependendo do sentimento positivo do mercado)

Perspectivas para 2027-2028

- Expectativa de ciclo de crescimento

- Faixas de preço projetadas:

- 2027: US$0,03304 - US$0,05119

- 2028: US$0,03500 - US$0,05950

- Principais catalisadores: Expansão da adoção e avanços tecnológicos

Projeções para 2029-2030

- Cenário base: US$0,05162 - US$0,05343 (crescimento estável do mercado)

- Cenário otimista: US$0,05524 - US$0,06145 (condições de mercado favoráveis)

- Cenário transformador: US$0,06145 - US$0,07000 (inovações disruptivas e adoção em larga escala)

- 31-12-2030: SPON US$0,06145 (possível pico do período)

| Ano | Preço Máximo Previsto | Preço Médio Previsto | Preço Mínimo Previsto | Variação (%) |

|---|---|---|---|---|

| 2025 | 0,03381 | 0,0319 | 0,02903 | 0 |

| 2026 | 0,03976 | 0,03286 | 0,01774 | 3 |

| 2027 | 0,05119 | 0,03631 | 0,03304 | 13 |

| 2028 | 0,0595 | 0,04375 | 0,035 | 37 |

| 2029 | 0,05524 | 0,05162 | 0,02943 | 61 |

| 2030 | 0,06145 | 0,05343 | 0,03794 | 67 |

IV. Estratégias Profissionais de Investimento e Gestão de Riscos para SPON

Metodologia de Investimento em SPON

(1) Estratégia de Holding de Longo Prazo

- Perfil indicado: Investidores de longo prazo e entusiastas de IA

- Recomendações de operação:

- Acumular SPON em períodos de baixa

- Acompanhar atualizações tecnológicas e novas parcerias do Spheron Network

- Guardar tokens em carteira física de alta segurança

(2) Estratégia de Trading Ativo

- Ferramentas de análise técnica:

- Médias Móveis: Identificar tendências e possíveis suportes/resistências

- RSI (Índice de Força Relativa): Avaliar condições de sobrecompra/sobrevenda

- Pontos para swing trade:

- Definir pontos claros de entrada e saída com base nos indicadores técnicos

- Monitorar novidades do setor de IA e marcos do Spheron Network

Estrutura de Gestão de Riscos do SPON

(1) Princípios de Alocação de Ativos

- Investidor conservador: 1-3% do portfólio cripto

- Investidor agressivo: 5-10% do portfólio cripto

- Investidor profissional: Até 15% do portfólio cripto

(2) Soluções de Hedge

- Diversificação: Investir em diferentes projetos de IA e blockchain

- Stop-loss: Usar ordens de proteção para limitar perdas

(3) Soluções de Armazenamento Seguro

- Wallet hot recomendada Gate Web3 Wallet

- Armazenamento a frio: Carteira física para holdings de longo prazo

- Segurança: Habilitar autenticação de dois fatores, adotar senhas fortes e manter chaves privadas offline

V. Riscos e Desafios Potenciais para o SPON

Riscos de Mercado do SPON

- Volatilidade: Oscilações intensas de preço típicas do mercado cripto

- Liquidez: Volume negociado reduzido pode impactar a estabilidade dos preços

- Concorrência: Novos projetos de blockchain focados em IA podem afetar o market share

Riscos Regulatórios do SPON

- Regulação incerta: Mudanças normativas podem impactar a operação do SPON

- Compliance internacional: Desafios de adequação às legislações globais

- Privacidade de dados: Riscos de questionamentos sobre práticas de tratamento de dados em IA

Riscos Técnicos do SPON

- Segurança: Vulnerabilidades potenciais na infraestrutura descentralizada

- Escalabilidade: Capacidade de atender à crescente demanda de IA

- Obsolescência: Avanços acelerados em IA exigem atualizações constantes

VI. Conclusão e Recomendações de Ação

Avaliação do Potencial de Investimento do SPON

O Spheron Network apresenta potencial relevante de longo prazo no segmento de IA e computação descentralizada. Porém, volatilidade de curto prazo e incerteza regulatória são fatores de risco importantes.

Recomendações para Investir em SPON

✅ Iniciantes: Priorize pequenas posições de longo prazo após análise criteriosa

✅ Investidores experientes: Aplique estratégia de preço médio com gestão rigorosa de riscos

✅ Institucionais: Avalie parcerias estratégicas e posições maiores utilizando hedge

Formas de Participação no Mercado SPON

- Spot trading: Disponível na Gate.com para compra direta de SPON

- Staking: Participe de Staking se disponível pelo Spheron Network

- Fornecimento de recursos: Contribua com GPUs/CPUs na rede para potenciais recompensas

Investimentos em criptomoedas envolvem riscos elevados; este artigo não constitui aconselhamento financeiro. Invista com cautela, considerando seu perfil de risco, e consulte especialistas. Nunca invista mais do que pode perder.

Compartilhar

Conteúdo