Predicción del precio de SWARMS en 2025: análisis de las tendencias del mercado y el potencial de crecimiento para la red de inteligencia artificial descentralizada

Introducción: posición de mercado y valor de inversión de SWARMS

Swarms (SWARMS), como marco de colaboración multiagente para empresas, ha evolucionado notablemente desde su lanzamiento en 2024. En 2025, SWARMS cuenta con una capitalización de mercado de 18 339 721 $, una oferta circulante de unos 999 984 830 tokens y un precio que ronda los 0,01834 $. Este activo, denominado “framework colaborativo de IA”, gana protagonismo en sistemas multiagente y colaboración corporativa.

Este artículo analiza en profundidad la evolución del precio de SWARMS entre 2025 y 2030, abarcando patrones históricos, oferta y demanda de mercado, desarrollo del ecosistema y factores macroeconómicos. El objetivo es ofrecer previsiones profesionales sobre el precio y estrategias de inversión aplicables para ti como inversor.

I. Revisión histórica del precio de SWARMS y estado actual del mercado

Evolución histórica del precio de SWARMS

- 2025: SWARMS alcanzó su máximo histórico de 0,628 $ el 7 de enero, un hito relevante en su trayectoria.

- 2025: El proyecto sufrió una fuerte corrección, marcando su mínimo histórico de 0,0144 $ el 22 de junio, lo que refleja una volatilidad elevada.

- 2025: SWARMS ha tenido una recuperación considerable, aumentando un 6 774,28 % en el último año.

Situación de mercado actual de SWARMS

El 6 de octubre de 2025, SWARMS cotiza a 0,01834 $, con un volumen de negociación de 183 306,24 $ en las últimas 24 horas. El token ha bajado un 1,5 % en ese periodo, aunque muestra un avance del 1,22 % en la última hora. La capitalización de mercado actual es de 18 339 721,79 $, situando a SWARMS en el puesto 1 143 del ranking mundial de criptomonedas.

El suministro circulante es de 999 984 830,56 SWARMS, lo que supone el 99,998 % del suministro máximo de 1 000 000 000 tokens. A pesar de la caída de las últimas 24 horas, SWARMS ha crecido un 6 774,28 % en el último año. Sin embargo, el token ha retrocedido un 11,92 % en los últimos 30 días, lo que evidencia ciertos retos de mercado a corto plazo.

Haz clic para ver el precio actual de SWARMS

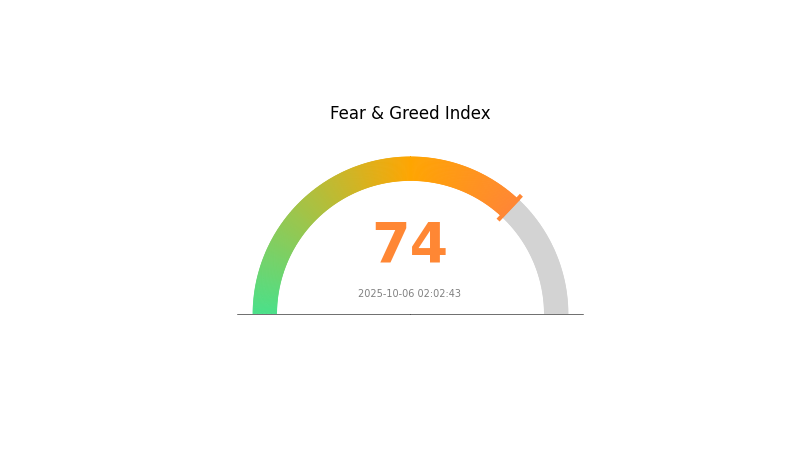

Indicador de sentimiento de mercado de SWARMS

06 de octubre de 2025 – Índice de Miedo y Codicia: 74 (Codicia)

Haz clic para consultar el Índice de Miedo y Codicia actual

El mercado cripto muestra señales de euforia, con el Índice de Miedo y Codicia en 74, lo que indica codicia. Esto apunta a un creciente optimismo entre los inversores, probablemente motivado por repuntes recientes o noticias positivas. Sin embargo, los niveles elevados de codicia suelen anticipar correcciones de mercado. Si operas, ten prudencia y valora tomar beneficios o reequilibrar tu cartera. Mantén la cabeza fría y no te dejes arrastrar por el FOMO (miedo a quedarte fuera) en estos momentos de euforia.

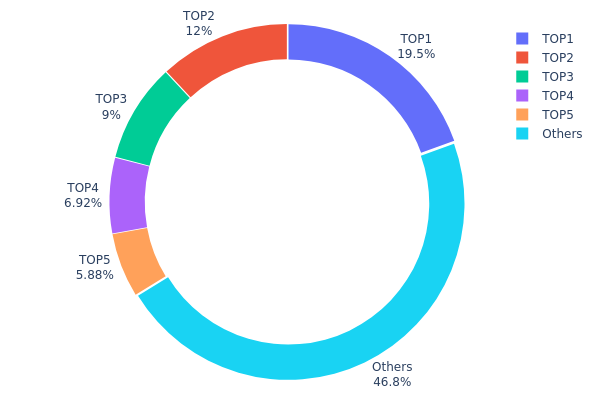

Distribución de tenencias de SWARMS

Los datos de distribución por direcciones revelan cómo se concentran los tokens SWARMS entre distintos monederos. El análisis demuestra una concentración considerable entre los principales titulares: la dirección líder posee el 19,47 % del total, mientras que las cinco primeras concentran el 53,21 % de los tokens.

Esta concentración implica una centralización moderada que podría afectar la dinámica del mercado. Grandes movimientos de los principales titulares pueden provocar volatilidad de precios. Aun así, el 46,79 % de los tokens se reparte entre otras direcciones, mostrando cierta amplitud en la distribución.

El patrón actual indica que SWARMS tiene un núcleo de grandes inversores, pero una parte significativa permanece en manos de minoristas. Esta estructura puede influir en la gobernanza, la toma de decisiones y la vulnerabilidad a la manipulación. Vigilar la evolución de esta distribución será clave para valorar el grado de descentralización y la salud del proyecto.

Haz clic para ver la distribución de tenencias de SWARMS

| Top | Dirección | Cantidad | Porcentaje |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 194 794,99K | 19,47% |

| 2 | A77HEr...oZ4RiR | 119 603,40K | 11,96% |

| 3 | EiiAnQ...GP11xw | 89 981,90K | 8,99% |

| 4 | 5Q544f...pge4j1 | 69 163,55K | 6,91% |

| 5 | Dsjzh2...3t8T5i | 58 807,11K | 5,88% |

| - | Otros | 467 626,56K | 46,79% |

Factores clave que influyen en el precio futuro de SWARMS

Dinámica institucional y de grandes tenedores

- Adopción empresarial: La integración creciente de Swarms en empresas impulsa la demanda del token. Cada vez más compañías lo incorporan en sus procesos, aumentando su utilidad y valor.

Entorno macroeconómico

- Función de cobertura frente a la inflación: Como criptomoneda, SWARMS puede servir como cobertura contra la inflación, igual que otros activos digitales.

Desarrollo tecnológico y del ecosistema

-

Algoritmo Swarms: El proyecto afronta desafíos en la colaboración multiagente a gran escala, como la detección de agentes, comunicación entre ellos, coordinación de tareas y gestión de memoria y conocimiento compartido.

-

Aplicaciones en el ecosistema: Swarms se está consolidando como framework de economía IA descentralizada sobre Solana, facilitando la colaboración y el intercambio de valor entre agentes autónomos de IA. Su enfoque es empresarial (B2B), dirigido a sectores como finanzas, seguros y salud.

III. Previsión de precios de SWARMS para 2025-2030

Perspectivas para 2025

- Pronóstico conservador: 0,01263 $ – 0,0183 $

- Pronóstico neutral: 0,0183 $ – 0,0194 $

- Pronóstico optimista: 0,0194 $ – 0,0205 $ (si las condiciones de mercado acompañan)

Perspectivas para 2027-2028

- Fase de mercado esperada: Potencial fase de crecimiento

- Previsión de rangos de precios:

- 2027: 0,01464 $ – 0,02335 $

- 2028: 0,02027 $ – 0,0289 $

- Impulsores clave: Adopción creciente y avances tecnológicos

Perspectivas a largo plazo 2029-2030

- Escenario base: 0,02523 $ – 0,03053 $ (crecimiento sostenido)

- Escenario optimista: 0,03053 $ – 0,04244 $ (rendimiento de mercado fuerte)

- Escenario transformador: más de 0,04244 $ (si se producen avances disruptivos y adopción masiva)

- 31 de diciembre de 2030: SWARMS 0,04244 $ (posible máximo)

| Año | Máximo previsto | Precio medio previsto | Mínimo previsto | Variación (%) |

|---|---|---|---|---|

| 2025 | 0,0205 | 0,0183 | 0,01263 | 0 |

| 2026 | 0,02017 | 0,0194 | 0,01067 | 5 |

| 2027 | 0,02335 | 0,01979 | 0,01464 | 7 |

| 2028 | 0,0289 | 0,02157 | 0,02027 | 17 |

| 2029 | 0,03583 | 0,02523 | 0,02422 | 37 |

| 2030 | 0,04244 | 0,03053 | 0,02595 | 66 |

IV. Estrategias profesionales de inversión y gestión de riesgos en SWARMS

Metodología de inversión en SWARMS

(1) Estrategia de inversión a largo plazo

- Indicado para: Inversores largos con alta tolerancia al riesgo

- Consejos operativos:

- Compra SWARMS en correcciones del mercado

- Fija objetivos para vender parcialmente en beneficios

- Guarda tus tokens en wallets no custodiales seguras

(2) Estrategia de trading activo

- Herramientas de análisis técnico:

- Medias móviles: Para identificar tendencias y posibles giros

- RSI (Índice de Fuerza Relativa): Controla zonas de sobrecompra y sobreventa

- Claves para el swing trading:

- Observa el sentimiento de mercado y noticias relevantes

- Utiliza órdenes stop-loss para limitar el riesgo

Marco de gestión de riesgos de SWARMS

(1) Principios de asignación de activos

- Perfil conservador: 1–3 % de tu cartera cripto

- Perfil agresivo: 5–10 % de la cartera cripto

- Perfil profesional: Hasta un 15 % de la cartera cripto

(2) Soluciones para cubrir riesgos

- Diversifica: Invierte en varias criptomonedas

- Órdenes stop-loss: Limita tus pérdidas potenciales

(3) Soluciones de almacenamiento seguro

- Wallet caliente recomendada: Gate web3 wallet

- Almacenamiento en frío: Hardware wallets para el largo plazo

- Seguridad: Activa la verificación en dos pasos y usa contraseñas fuertes

V. Riesgos y desafíos potenciales de SWARMS

Riesgos de mercado de SWARMS

- Alta volatilidad: El precio puede fluctuar ampliamente

- Liquidez limitada: Operaciones a gran escala pueden resultar difíciles

- Competencia: Otros frameworks de colaboración multiagente pueden aparecer

Riesgos regulatorios de SWARMS

- Entorno regulatorio incierto: La aparición de nuevas normativas puede afectar la utilidad del token

- Cumplimiento internacional: Desafíos para adaptarse a la regulación de distintos países

- Requisitos KYC/AML: Puede limitar el acceso y la operativa del token

Riesgos técnicos de SWARMS

- Vulnerabilidades en smart contracts: Posibilidad de exploits o errores en el código

- Escalabilidad: Problemas potenciales con el crecimiento de la red

- Interoperabilidad blockchain: Limitaciones en la funcionalidad entre cadenas

VI. Conclusión y recomendaciones

Valoración del potencial de inversión de SWARMS

SWARMS representa una oportunidad singular en colaboración multiagente empresarial. Ofrece potencial a largo plazo en los sectores de IA y blockchain, pero debes tener en cuenta la volatilidad y la incertidumbre regulatoria en el corto plazo.

Recomendaciones de inversión en SWARMS

✅ Si eres principiante: Limítate a posiciones pequeñas y a largo plazo tras investigar a fondo ✅ Si tienes experiencia: Aplica compras periódicas y una gestión de riesgos estricta ✅ Si eres institucional: Explora alianzas estratégicas y realiza una diligencia exhaustiva

Formas de operar SWARMS

- Trading spot: Disponible en Gate.com y otros exchanges compatibles

- Staking: Participa en programas de staking si el proyecto los ofrece

- Protocolos DeFi: Explora oportunidades de liquidez en plataformas compatibles

Invertir en criptomonedas implica riesgos muy elevados, y este artículo no constituye asesoramiento financiero. Decide siempre en función de tu tolerancia al riesgo y consulta a profesionales antes de invertir. Nunca arriesgues más de lo que puedas permitirte perder.

FAQ

¿Cuál es el futuro de la moneda SWARMS?

El futuro de SWARMS es incierto. Aunque las previsiones para 2027 son alcistas, el sentimiento general entre 2025 y 2030 es bajista. Se esperan posibles ganancias en 2025 y un precio medio de 0,029218 $ en 2029.

¿Qué riesgos conlleva invertir en SWARMS?

Invertir en SWARMS implica una alta volatilidad, posibles fluctuaciones de precio importantes y riesgos regulatorios que pueden afectar su valor.

¿Qué criptomoneda tiene la previsión de precio más alta?

Bitcoin lidera las previsiones, con estimaciones que apuntan a 140 652 $. Chainlink le sigue, con una máxima de 62,60 $.

¿Qué es la minería de SWARMS?

La minería de SWARMS consiste en utilizar tecnología descentralizada para tokenizar y negociar activos reales en una blockchain, junto a la minería tradicional de criptomonedas.

Compartir

Contenido