Arc:オープンなLayer-1ブロックチェーンを活用し、次世代のグローバル金融インフラを構築

Arcとは

(出典:arc)

Arcは、パブリックブロックチェーンの枠を超えたオープンなLayer-1金融インフラであり、グローバル経済に特化して設計されています。インターネット時代のEconomic OSとなることを目指し、プログラム可能なマネーとオンチェーン金融の革新を融合。世界中の開発者、金融機関、発行者が融資、為替、資本市場、決済など多様な金融アプリケーションを構築できる基盤を提供します。

コア原則

Arcのアーキテクチャは、ブロックチェーン上で大規模な金融取引を可能にするため、次の4つのコア原則を軸に構築されています。

- Stable Fee Model:ガスとしてUSDCを採用し、米ドル建てで予測可能かつ低ボラティリティの取引手数料を提供

- Deterministic Finality:すべての取引を1秒未満で確定し、不可逆性によって金融レベルの信頼性を確保

- Opt-in Privacy:暗号化と権限付き閲覧のオプション機能により、ユーザーの機密性と規制遵守を両立

- Enterprise-Grade Usability:Circleの各種ツールやAPIを統合し、開発者がステーブルコイン流動性や決済サービスを簡単に利用可能

ArcはDeFiだけでなく、Web2金融機関や企業、開発者がWeb3へ参入するための入口としても機能します。

安定手数料設計

一般的なブロックチェーンでは、ガス代がネイティブトークン(例:EthereumのETH)に連動し、市場の変動でコストが大きく変動します。ArcはUSDCを決済単位・媒体とすることで、1取引あたり約1セント(≒$0.01)に手数料を安定化。この仕組みにより、

- ユーザーは取引コストを正確に予測でき、トークン価格変動による予算管理が不要

- 企業の財務・会計プロセスが効率化され、全てのコストや決済が米ドル連動ステーブルコインで統一

- 開発者は手数料推定の追加実装が不要となり、Arcの自動スムージング機構が料金管理を担う

手数料スムージング機構

Arcの手数料調整はEthereumのEIP-1559モデルを基盤に、指数加重移動平均(EWMA)アルゴリズムを組み合わせて実現。ブロック利用状況に応じてガス代を段階的に調整し、ブロックごとの急激な変動を抑え、長期的な手数料安定性を維持します。今後はEURC、USDT、MXNBなど複数ステーブルコインでの決済も対応予定。Paymaster機能も導入され、アプリケーションがユーザーの手数料を負担することで利用障壁をさらに低減します。

金融グレード決済と決定的ファイナリティ

Arcは独自のMalachiteコンセンサスエンジン(高性能なBFT実装)を採用し、サブ秒でのブロック確定を実現。一般的なPoWやPoSチェーンでは複数回の承認が必要で、最終確定まで再編成が発生する可能性があります。

Arcの決定的ファイナリティにより、取引は「保留」または「永久確定」のいずれかとなり、不確実性が排除されます。開発者は再編成や再実行のロジックを考慮する必要がなく、Arcのファイナリティによってスマートコントラクトが即時かつ確実に実行されます。

商業機密性とコンプライアンス透明性の両立

Arcのプライバシー設計はオプトイン型で、開発者や企業は機密情報を保護しつつ、必要に応じて監査透明性も確保できます。

第1段階:機密送金

- 取引金額は暗号化され、認可された当事者のみが閲覧可能

- 送信者・受信者アドレスは公開され、トレーサビリティや分析が可能

- すべての取引がパブリック取引と同じファイナリティと速度で処理

第2段階:View Keys

ユーザーは監査人やコンプライアンス部門に、取引データへの選択的アクセス権を付与でき、プライバシーと規制透明性を両立します。

システムアーキテクチャ

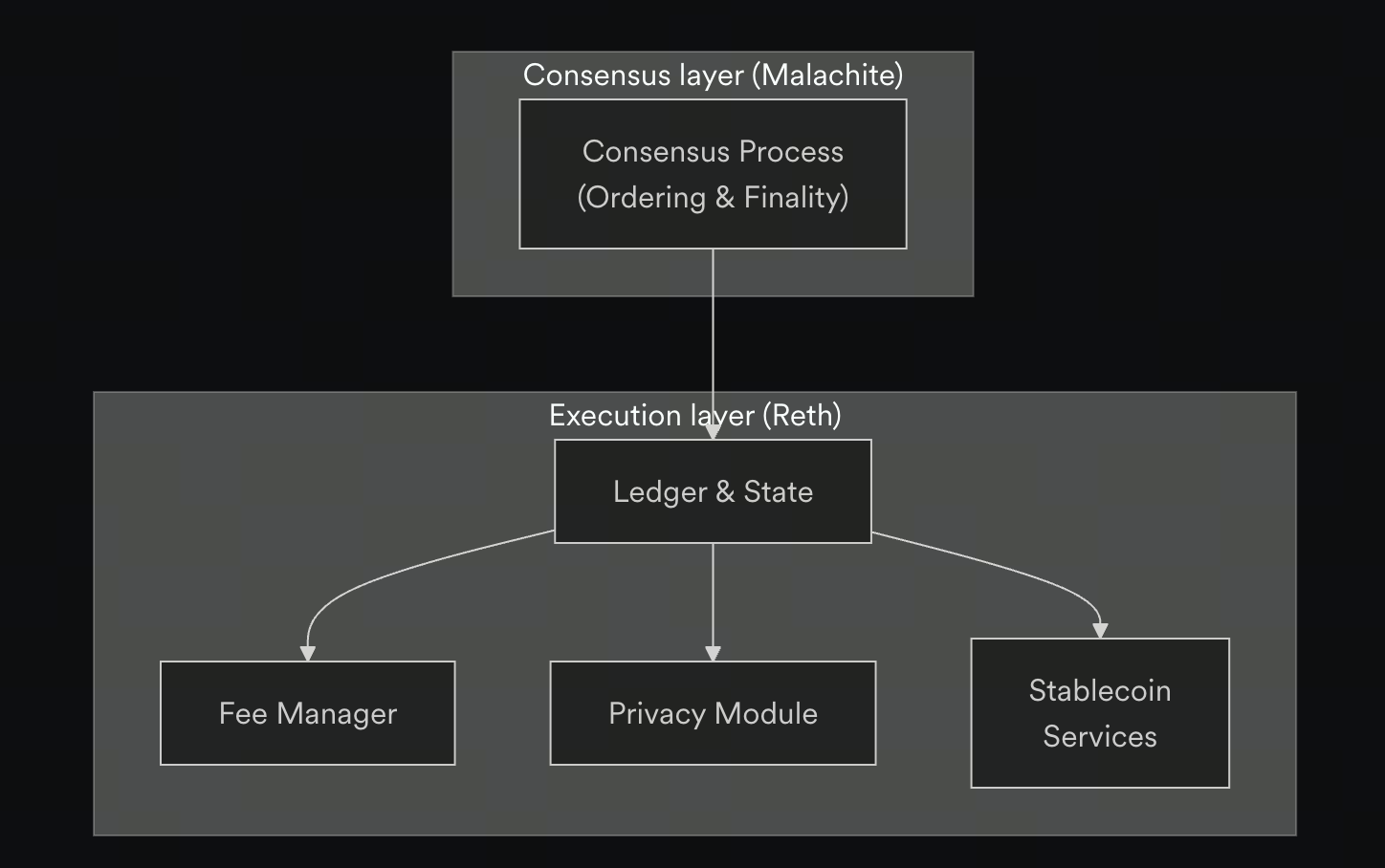

ArcはConsensus LayerとExecution Layerの2層構成で、安定手数料、瞬時ファイナリティ、プログラム可能なプライバシーなどの主要機能を提供します。

Consensus Layer — Malachite BFT

- 強化されたTendermint BFTプロトコルにより、不可逆な取引と高い障害耐性を実現

- 認定バリデーターによるProof-of-Authority(PoA)モデルでセキュリティを管理

- サブ秒ブロック確定で、エンタープライズレベルの信頼性とパフォーマンスを提供

Execution Layer — Reth(RustベースEthereum実行レイヤー)

- 完全EVM互換で、Solidity、Foundry、Hardhatなどの開発ツールを直接利用可能

- Fee Manager、Privacy Module、Stablecoin Servicesなど内蔵モジュールがステーブルコイン決済、FX変換、オンチェーン金融決済に対応

(出典:docs.arc.network)

この設計でArcはオープン性と、金融取引に求められる高度なセキュリティ、低遅延、監査性を両立します。

EVM互換性

Arcは完全なEVM互換性を持ち、開発者は既存のEthereumツールやフレームワークを活用し、スマートコントラクトのデプロイ、DAppsローンチ、API統合が可能です。主な特徴:

- USDCをネイティブガストークンに採用し、コスト管理・会計処理を効率化

- 取引に決定的ファイナリティを持ち、複数承認は不要

- リアルタイムのブロックタイムスタンプで従来のエポック方式を代替

- Permissioned Validatorモデルが安定した取引処理と強固なセキュリティを担保

さらに、ArcのUSDC ERC20インターフェースは6桁小数標準に対応し、他チェーンのUSDC実装とスムーズな互換性を確保しています。

Arcのビジョン

Arcのビジョンは、単なる高速・低コストなブロックチェーンの構築ではありません。リアル金融とオンチェーンイノベーションを結ぶグローバルFinancial OSの提供を目指しています。予測可能な手数料体系、サブ秒ファイナリティ、規制対応プライバシー設計を備え、Arcは企業、銀行、ステーブルコイン発行者、開発者に多層的なオンチェーン金融エコシステムを提供します。

Web3の詳細を学びたい方はこちらからご登録ください:https://www.gate.com/

まとめ

Arcはステーブルコイン、プライバシー、コンプライアンス、パフォーマンスが一つのフレームワークで融合する包括的かつオープンな金融基盤です。今後のマルチチェーン金融環境では、Arcは取引の基盤だけでなく、グローバル資本市場や決済ネットワーク、デジタル資産経済をつなぐ中核ハブとして機能します。

関連記事

Forkast (CGX): ゲームやインターネット文化向けに構築された予測市場プラットフォーム

Piコインを売却する方法:初心者向けガイド

Radiant Multi-Signature Attackを使用したBybitハックの分析を例に

$MAD: MemesAfterDark – The Ultimate Degen Token

Piノード:誰もが参加できるブロックチェーンノード