CryptoBully

لا يوجد محتوى حتى الآن

CryptoBully

تم التعبئة على $DOGE طول جزئي أيضًا

تحرك السعر +30% من أدنى مستوى 0.11، والآن يعيد اختبار منطقة الطلب مرة أخرى. تم ملء بعض أوامر الشراء المزعجة التي أغلقتها جزئيًا، لكنني على استعداد للمخاطرة مرة أخرى في التعرض الطويل إذا ملأنا الظل

الهدف سيكون العودة نحو مستوى $0.135

نسبة المخاطرة والمكافأة مبررة هنا، حيث أن الإلغاء قريب جدًا، إذا فقد السعر أدنى مستوى اليوم يمكنك القطع بدلاً من الانتظار للإلغاء الكامل (القبول أدناه الطلب باللون الأخضر)

تحرك السعر +30% من أدنى مستوى 0.11، والآن يعيد اختبار منطقة الطلب مرة أخرى. تم ملء بعض أوامر الشراء المزعجة التي أغلقتها جزئيًا، لكنني على استعداد للمخاطرة مرة أخرى في التعرض الطويل إذا ملأنا الظل

الهدف سيكون العودة نحو مستوى $0.135

نسبة المخاطرة والمكافأة مبررة هنا، حيث أن الإلغاء قريب جدًا، إذا فقد السعر أدنى مستوى اليوم يمكنك القطع بدلاً من الانتظار للإلغاء الكامل (القبول أدناه الطلب باللون الأخضر)

DOGE1.31%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

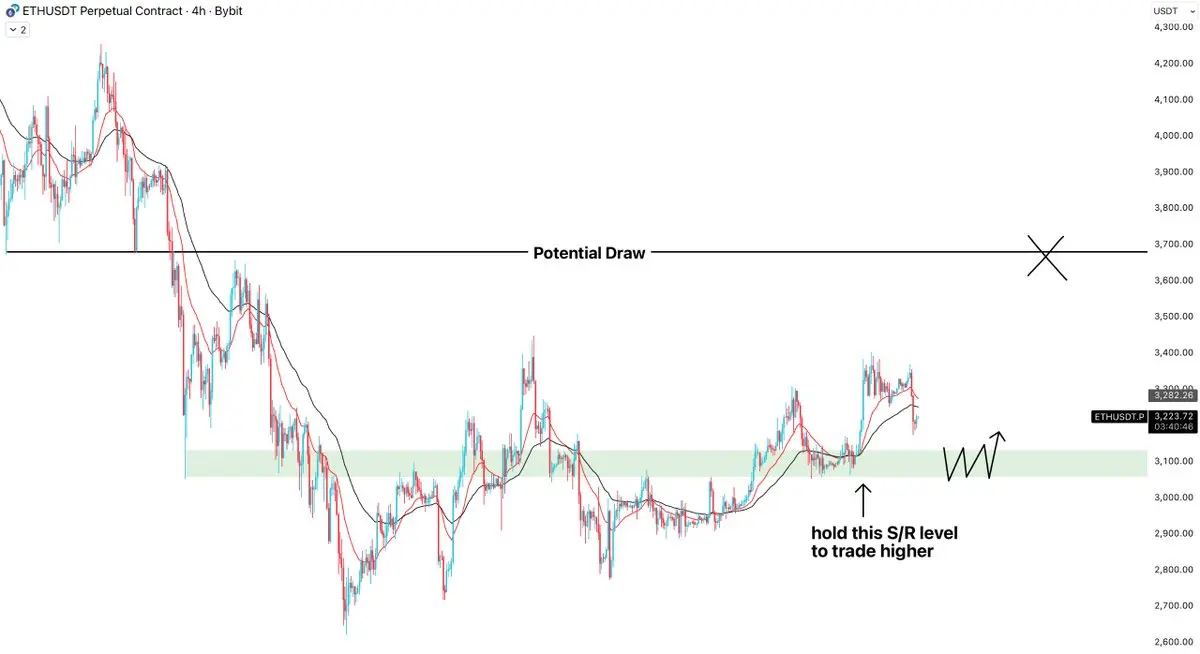

أنا أفتح مركز شراء مرة أخرى على $ETH وسأضيف عند إعادة اختبار كما هو محدد

من الناحية الهيكلية، أنا متفائل على الأطر الزمنية الأعلى. لدي عروض عند مستوى الدعم/المقاومة الأخضر لاحتمال التحرك نحو $3100 إذا بدأنا نرى إغلاقات أدنى من هذا المستوى على الأطر الزمنية الأعلى، سأغلق المركز الطويل

من الناحية الهيكلية، أنا متفائل على الأطر الزمنية الأعلى. لدي عروض عند مستوى الدعم/المقاومة الأخضر لاحتمال التحرك نحو $3100 إذا بدأنا نرى إغلاقات أدنى من هذا المستوى على الأطر الزمنية الأعلى، سأغلق المركز الطويل

ETH-0.95%

- أعجبني

- 1

- 1

- إعادة النشر

- مشاركة

AngryBird :

:

مشاركة رائعة كما هو دائمًا استمر في تحديثنا بالمعلومات الجيدة

يوج لديه معرفة كبيرة ومحتوى رائع أيضًا

واصل العمل الممتاز

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

إعادة التمديد، أعدت إضافة التعرض الذي أزلته مع أهداف الربح الأسبوع الماضي

سيتم تقديم مزيد من التفاصيل لاحقًا

شاهد النسخة الأصليةسيتم تقديم مزيد من التفاصيل لاحقًا

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$SOL

أنا من المنطقة المنخفضة 120s لنفسي لحسابي الفوري (شارك على التلغرام المجاني في الوقت الحقيقي). قمت ببيع بعض عند $146 حيث أن السعر جرف القمم وحصلت على التنفيذات على الإطار الزمني اليومي والذي قد يؤدي إلى بعض التصحيح.

لذا المنطقة التي أبحث عن إضافة مرة أخرى حول $134 (متوسط النطاق)، أو بدلاً من ذلك إذا تخطى السعر واحتفظ فوق 146 دولار، سأعيد إضافة المخاطرة لمزيد من الاستمرارية.

أنا من المنطقة المنخفضة 120s لنفسي لحسابي الفوري (شارك على التلغرام المجاني في الوقت الحقيقي). قمت ببيع بعض عند $146 حيث أن السعر جرف القمم وحصلت على التنفيذات على الإطار الزمني اليومي والذي قد يؤدي إلى بعض التصحيح.

لذا المنطقة التي أبحث عن إضافة مرة أخرى حول $134 (متوسط النطاق)، أو بدلاً من ذلك إذا تخطى السعر واحتفظ فوق 146 دولار، سأعيد إضافة المخاطرة لمزيد من الاستمرارية.

SOL-0.21%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أعد إصدار أول دليل تفصيلي لي في عام 2026

300 إعجاب وسأنشره هذا الأسبوع

اقترحاتك أرسلها 👇

شاهد النسخة الأصلية300 إعجاب وسأنشره هذا الأسبوع

اقترحاتك أرسلها 👇

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

إذا كنت تريد المشي بسرعة إلى الأبد، فلن تصل بعيدًا في هذا العمل

إذا كنت تريد المشي ببطء، ستقضي سنوات بدون تقدم وستتلاشى السرديات

التداول وأي مهنة في العملات الرقمية تشبه الرياضي. انطلق بسرعة، تدرب بجد واسترح. المتثاقلون لا يربحون

شاهد النسخة الأصليةإذا كنت تريد المشي ببطء، ستقضي سنوات بدون تقدم وستتلاشى السرديات

التداول وأي مهنة في العملات الرقمية تشبه الرياضي. انطلق بسرعة، تدرب بجد واسترح. المتثاقلون لا يربحون

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

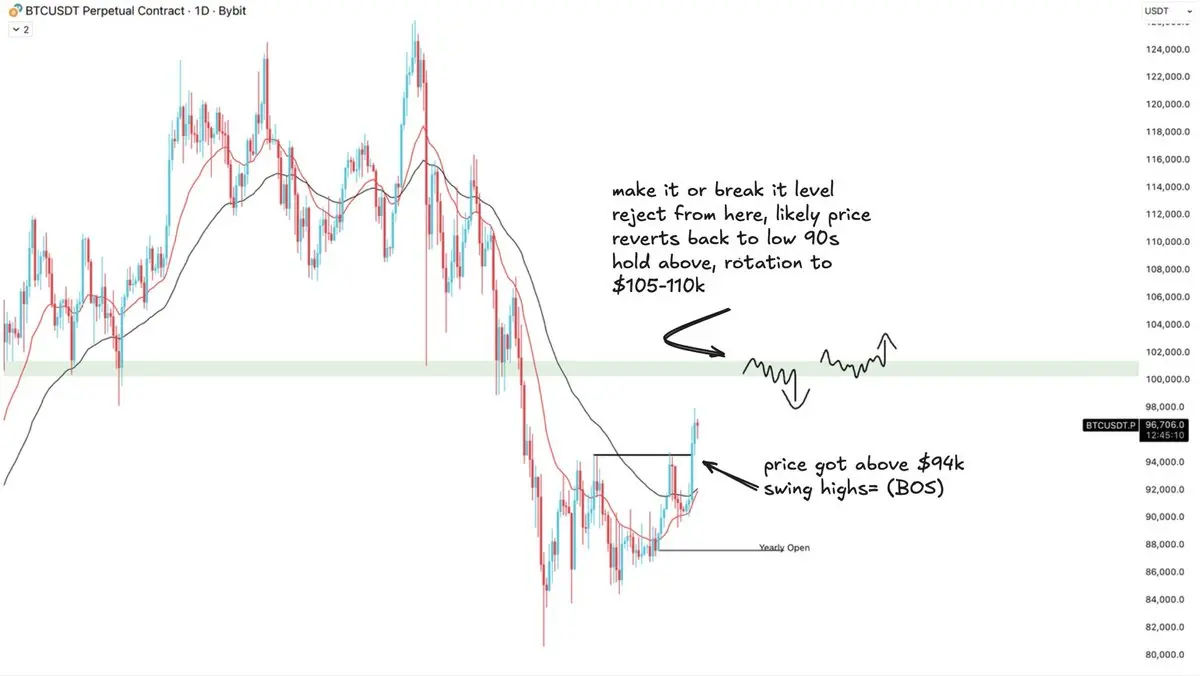

$BTC

- أول أهداف الربح الطويلة تم الوصول إليها أمس عند حوالي 97 ألف

- كلما تداولنا فوق 94-95 مع استقرار حجم الصفقات المفتوحة ( تم تصفية مراكز الشراء )

كلما زادت احتمالية أن يكون هذا تحولًا في الاتجاه الكلي

- المستويات الرئيسية نحو الصعود هي فوق 100 ألف أو تدفق الطلبات عند إعادة الاختبار

- 370 مليون دولار في عمليات التصفية أمس، أول فوز كبير للثيران منذ أكتوبر 2025. لا أعتقد أنه مجرد ضغط قصير، الحجم كبير جدًا لو كان كذلك

- أول أهداف الربح الطويلة تم الوصول إليها أمس عند حوالي 97 ألف

- كلما تداولنا فوق 94-95 مع استقرار حجم الصفقات المفتوحة ( تم تصفية مراكز الشراء )

كلما زادت احتمالية أن يكون هذا تحولًا في الاتجاه الكلي

- المستويات الرئيسية نحو الصعود هي فوق 100 ألف أو تدفق الطلبات عند إعادة الاختبار

- 370 مليون دولار في عمليات التصفية أمس، أول فوز كبير للثيران منذ أكتوبر 2025. لا أعتقد أنه مجرد ضغط قصير، الحجم كبير جدًا لو كان كذلك

شاهد النسخة الأصلية

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

حقق بعض الأرباح على التداول الفوري عبر جميع المراكز الطويلة، وأنا أحتفظ بهذا منذ حوالي 87 ألف وأقل من 2.7 ألف

قم بالتدرج في الدخول والخروج.

قاعدة ذهبية اثنين للتداول السوينجي المربح:

1. التدرج في الدخول، لا تكن متعجرفًا جدًا لتظن أنك تستطيع اصطياد القيعان

2. التدرج في الخروج، استمر في جني الأرباح وأيضًا في التحويل للخارج. لا تكن متعجرفًا جدًا لتظن أنك تستطيع اصطياد القمم

شاهد النسخة الأصليةقم بالتدرج في الدخول والخروج.

قاعدة ذهبية اثنين للتداول السوينجي المربح:

1. التدرج في الدخول، لا تكن متعجرفًا جدًا لتظن أنك تستطيع اصطياد القيعان

2. التدرج في الخروج، استمر في جني الأرباح وأيضًا في التحويل للخارج. لا تكن متعجرفًا جدًا لتظن أنك تستطيع اصطياد القمم

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$ETH

إعداد مشابه لبتكوين.

لقد كانت 3200-3300 تمثل حدًا أقصى للسعر منذ فترة. إذا رأينا اختراقًا مع حجم تداول، سأقوم بالشراء على أمل الاستمرار.

من ناحية أخرى، إذا استمر السعر في التذبذب لفترة أطول، فإن احتمالية استهداف أدنى المستويات حول $2600 كبيرة، مما ينبغي أن يكون عرضًا جيدًا.

إعداد مشابه لبتكوين.

لقد كانت 3200-3300 تمثل حدًا أقصى للسعر منذ فترة. إذا رأينا اختراقًا مع حجم تداول، سأقوم بالشراء على أمل الاستمرار.

من ناحية أخرى، إذا استمر السعر في التذبذب لفترة أطول، فإن احتمالية استهداف أدنى المستويات حول $2600 كبيرة، مما ينبغي أن يكون عرضًا جيدًا.

ETH-0.95%

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$BTC

السعر كان في نطاق 80-94 ألف دولار منذ الربع الأخير. كل حركة نحو منطقة 92-94 ألف دولار أدت إلى انخفاض الأسعار.

نظرًا لأنه تم اختبار هذا المستوى عدة مرات، أميل أكثر إلى شراء اختراق هذا المستوى ( إذا حدث.

بدلاً من ذلك، إذا استمر التذبذب وتمكنا من التراجع دون الافتتاح السنوي. يبدو أن القيعان عند $80k جيدة للارتداد.

السعر كان في نطاق 80-94 ألف دولار منذ الربع الأخير. كل حركة نحو منطقة 92-94 ألف دولار أدت إلى انخفاض الأسعار.

نظرًا لأنه تم اختبار هذا المستوى عدة مرات، أميل أكثر إلى شراء اختراق هذا المستوى ( إذا حدث.

بدلاً من ذلك، إذا استمر التذبذب وتمكنا من التراجع دون الافتتاح السنوي. يبدو أن القيعان عند $80k جيدة للارتداد.

شاهد النسخة الأصلية

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

أداء حساب التداول خلال 3 أشهر: ~+50%

- بدأت هذا الحساب بعد أن استسلم أحد طلابي

- كانت المحاولة لإظهار أن التداول بالتأرجح على رافعة مالية بين 0.3-1.5x يكفي لتحقيق عوائد جيدة

الإحصائيات:

- 24 صفقة خلال 90 يومًا

- أقصى رافعة مالية 1.5x ( بشكل رئيسي على $BTC)

- يتداول في كلا الاتجاهين

- قيود ضيقة على الانخفاض، تم تخفيفها مع زيادة ربحية الحساب

- البقاء بدون اتجاه عندما لا يوجد تحيز اتجاهي

ليست عوائد فلكية. لكن هذه هي طريقتي المنضبطة لتداول العملات الرئيسية بأقل قدر ممكن من الرافعة المالية. تكرار هذا مرارًا وتكرارًا لسنوات، لا يوجد طريق مختصر

اترك ♥️ وتعليق أدناه. سأبذل قصارى جهدي للعمل مع المزيد م

- بدأت هذا الحساب بعد أن استسلم أحد طلابي

- كانت المحاولة لإظهار أن التداول بالتأرجح على رافعة مالية بين 0.3-1.5x يكفي لتحقيق عوائد جيدة

الإحصائيات:

- 24 صفقة خلال 90 يومًا

- أقصى رافعة مالية 1.5x ( بشكل رئيسي على $BTC)

- يتداول في كلا الاتجاهين

- قيود ضيقة على الانخفاض، تم تخفيفها مع زيادة ربحية الحساب

- البقاء بدون اتجاه عندما لا يوجد تحيز اتجاهي

ليست عوائد فلكية. لكن هذه هي طريقتي المنضبطة لتداول العملات الرئيسية بأقل قدر ممكن من الرافعة المالية. تكرار هذا مرارًا وتكرارًا لسنوات، لا يوجد طريق مختصر

اترك ♥️ وتعليق أدناه. سأبذل قصارى جهدي للعمل مع المزيد م

شاهد النسخة الأصلية

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

$BTC تداول السوق الفوري لا يزال نشطًا

يجب أن تعزز أرقام NFP نظريًا فرص خفض السعر. إذا حافظت الأسهم على الدعم خلال افتتاح السوق الأمريكية

أعتقد أن البيتكوين يواصل الارتفاع الآن. إن شاء الله لا نحقق أرباحًا على هذا حتى 100 ألف

يجب أن تعزز أرقام NFP نظريًا فرص خفض السعر. إذا حافظت الأسهم على الدعم خلال افتتاح السوق الأمريكية

أعتقد أن البيتكوين يواصل الارتفاع الآن. إن شاء الله لا نحقق أرباحًا على هذا حتى 100 ألف

شاهد النسخة الأصلية

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

لقد قضيت الجزء الأكبر من اليومين الماضيين في تنظيم أبرز ملامحي ليكون مصدرًا تعليميًا (أكثر تنظيمًا من تصفح كامل الخلاصة)

اطلع على الملامح + المنشور المثبت وأخبرني برأيك. أعدك أنك ستخرج منه أكثر معرفة

شاهد النسخة الأصليةاطلع على الملامح + المنشور المثبت وأخبرني برأيك. أعدك أنك ستخرج منه أكثر معرفة

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

الضغط الطويل: حركة السعر + تدفق الأوامر

كيف تكتشفها؟

- مراقبة هيكل السوق

- الفائدة المفتوحة

- عمليات التصفية وتحركات الفائدة المفتوحة النسبية

شاهد النسخة الأصليةكيف تكتشفها؟

- مراقبة هيكل السوق

- الفائدة المفتوحة

- عمليات التصفية وتحركات الفائدة المفتوحة النسبية

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

الفرضية البسيطة لعام 2026 في مجال العملات الرقمية هي أننا قد تعرضنا للإهانة بما فيه الكفاية

الصخور تفوقت علينا

401K الخاص بجيل الطفرة تفوقت علينا

مؤشرات سوق الأسهم في العالم الثالث تفوقت علينا

لدينا:

- طابعة النقود بربر

- الرؤساء التنفيذيون لنظام بونزي يبيعون الأسهم مقابل الربح

حان الوقت

شاهد النسخة الأصليةالصخور تفوقت علينا

401K الخاص بجيل الطفرة تفوقت علينا

مؤشرات سوق الأسهم في العالم الثالث تفوقت علينا

لدينا:

- طابعة النقود بربر

- الرؤساء التنفيذيون لنظام بونزي يبيعون الأسهم مقابل الربح

حان الوقت

- أعجبني

- إعجاب

- تعليق

- إعادة النشر

- مشاركة

المواضيع الرائجة

عرض المزيد21.1K درجة الشعبية

333.53K درجة الشعبية

44.88K درجة الشعبية

6.75K درجة الشعبية

6.06K درجة الشعبية

Gate Fun الساخن

عرض المزيد- 1

茅台

茅台

القيمة السوقية:$3.46Kعدد الحائزين:10.00% - القيمة السوقية:$3.52Kعدد الحائزين:20.09%

- القيمة السوقية:$3.45Kعدد الحائزين:10.00%

- القيمة السوقية:$3.45Kعدد الحائزين:10.00%

- القيمة السوقية:$3.45Kعدد الحائزين:10.00%

تثبيت