NextGame

saya menganalisis pasar btc/eth. semua yang Anda baca di pos saya adalah tanggung jawab Anda sendiri. saya tidak memaksa Anda untuk melakukan tindakan apapun. semua yang saya tulis bersifat informatif semata dan tidak lebih dari itu.

Sematkan

NextGame

#CelebratingNewYearOnGateSquare

$BTC

Saya bermimpi tentang kosmos dan bintang-bintang dan mendengar musik top terkait kehidupan, lalu saya melihat lilin merah Bitcoin yang mencoba menakut-nakuti semua trader, TAPI! kemudian muncul lilin hijau, dan di sekitarnya seolah-olah ada roket dan dia meluncur ke atas menuju bintang-bintang, begitu cepat sehingga banyak yang tidak sempat mengikuti dan takut itu jebakan, lalu lilin hijau kedua bergerak lebih cepat ke atas, kemudian berhenti sejenak untuk mengumpulkan short-seller dan pada lilin ketiga kembali bergerak ke atas dan semua trader mulai pani

$BTC

Saya bermimpi tentang kosmos dan bintang-bintang dan mendengar musik top terkait kehidupan, lalu saya melihat lilin merah Bitcoin yang mencoba menakut-nakuti semua trader, TAPI! kemudian muncul lilin hijau, dan di sekitarnya seolah-olah ada roket dan dia meluncur ke atas menuju bintang-bintang, begitu cepat sehingga banyak yang tidak sempat mengikuti dan takut itu jebakan, lalu lilin hijau kedua bergerak lebih cepat ke atas, kemudian berhenti sejenak untuk mengumpulkan short-seller dan pada lilin ketiga kembali bergerak ke atas dan semua trader mulai pani

BTC-3,21%

- Hadiah

- 1

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍#CelebratingNewYearOnGateSquare

$BTC

Fase pengujian dukungan: Dalam jangka pendek, ada kemungkinan tinggi penurunan dipicu oleh tekanan makroekonomi dan dinamika ETF yang negatif. Probabilitas skenario bullish — 42%, bearish — 58%. Volume yang melebihi 600 juta $ dapat mengubah impuls, tetapi saat ini keseimbangan condong ke penjual. Setelah pengujian dukungan yang mungkin, diharapkan akan terjadi konsolidasi atau rebound teknikal sementara.

Skenario bullish:Penguatan dolar dan peningkatan pembelian institusional melalui ETF dapat menciptakan kondisi untuk rebound dari zona 67.000 $. Indikat

$BTC

Fase pengujian dukungan: Dalam jangka pendek, ada kemungkinan tinggi penurunan dipicu oleh tekanan makroekonomi dan dinamika ETF yang negatif. Probabilitas skenario bullish — 42%, bearish — 58%. Volume yang melebihi 600 juta $ dapat mengubah impuls, tetapi saat ini keseimbangan condong ke penjual. Setelah pengujian dukungan yang mungkin, diharapkan akan terjadi konsolidasi atau rebound teknikal sementara.

Skenario bullish:Penguatan dolar dan peningkatan pembelian institusional melalui ETF dapat menciptakan kondisi untuk rebound dari zona 67.000 $. Indikat

BTC-3,21%

- Hadiah

- 2

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍#CelebratingNewYearOnGateSquare

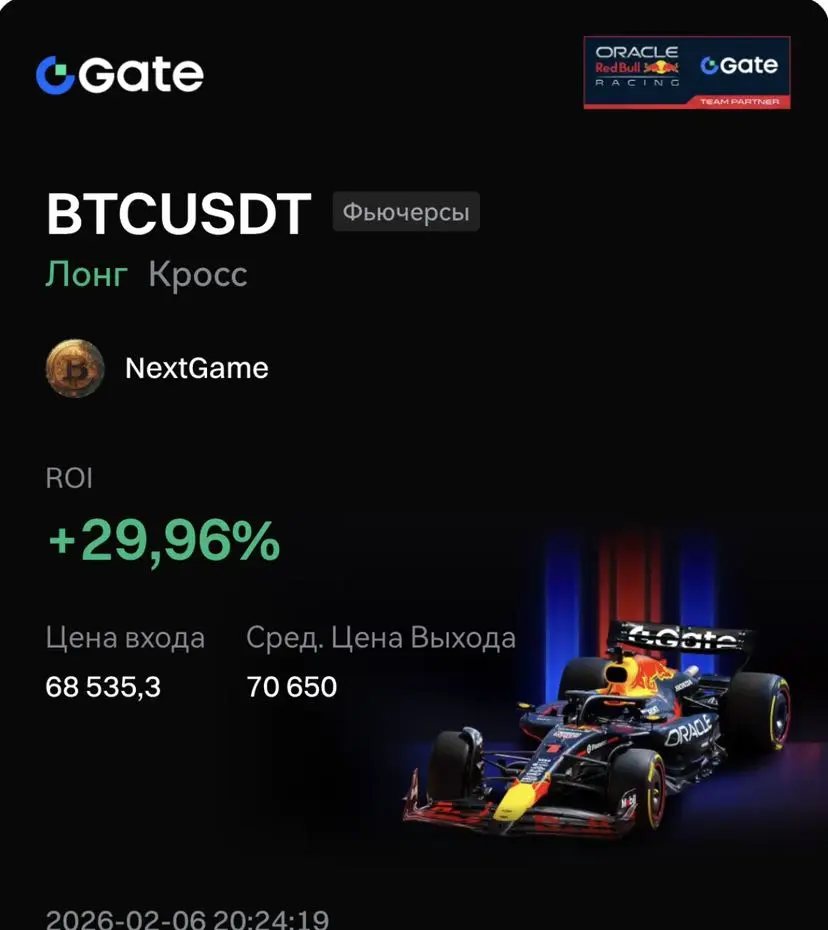

Tema tindakan: zona konsolidasi jangka pendek 68–72 ribu USD.

Pasar tetap campuran: kemungkinan kenaikan jangka pendek diperkirakan sebesar 57%, koreksi — 43%. Peningkatan volume saat mempertahankan level support akan memperkuat peluang rebound. Jika menembus 66 ribu, risiko impuls turun meningkat. $BTC

Skenario bullish:rebound dari support utama di 68 ribu didukung oleh arus masuk institusional ETF dan akumulasi oleh whale di Coinbase Pro. Altcoin ETH dan SOL juga menunjukkan pertumbuhan korelasional, yang mengonfirmasi pemulihan suasana hati secara umum.

Pem

Tema tindakan: zona konsolidasi jangka pendek 68–72 ribu USD.

Pasar tetap campuran: kemungkinan kenaikan jangka pendek diperkirakan sebesar 57%, koreksi — 43%. Peningkatan volume saat mempertahankan level support akan memperkuat peluang rebound. Jika menembus 66 ribu, risiko impuls turun meningkat. $BTC

Skenario bullish:rebound dari support utama di 68 ribu didukung oleh arus masuk institusional ETF dan akumulasi oleh whale di Coinbase Pro. Altcoin ETH dan SOL juga menunjukkan pertumbuhan korelasional, yang mengonfirmasi pemulihan suasana hati secara umum.

Pem

BTC-3,21%

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍#CelebratingNewYearOnGateSquare

$BTC

Fokus pada tembusan 70.000 USD: Kemungkinan kenaikan jangka pendek — 45%, kemungkinan penurunan lebih lanjut — 55%. Sentimen bearish mendominasi di tengah volume rendah dan ketakutan di pasar. Diharapkan pengujian ulang level 68.000 USD sebelum rebound ke 75.000 USD dengan syarat peningkatan aliran modal institusional.

Skenario kenaikan:Dalam kasus pemulihan aliran ETF dan mempertahankan aliran masuk sebesar 200–250 juta USD, dapat diharapkan rebound berikutnya dari dukungan saat ini. Sama halnya ETH mempertahankan RSI netral dan menunjukkan kesiapan untu

$BTC

Fokus pada tembusan 70.000 USD: Kemungkinan kenaikan jangka pendek — 45%, kemungkinan penurunan lebih lanjut — 55%. Sentimen bearish mendominasi di tengah volume rendah dan ketakutan di pasar. Diharapkan pengujian ulang level 68.000 USD sebelum rebound ke 75.000 USD dengan syarat peningkatan aliran modal institusional.

Skenario kenaikan:Dalam kasus pemulihan aliran ETF dan mempertahankan aliran masuk sebesar 200–250 juta USD, dapat diharapkan rebound berikutnya dari dukungan saat ini. Sama halnya ETH mempertahankan RSI netral dan menunjukkan kesiapan untu

BTC-3,21%

- Hadiah

- 4

- 2

- Posting ulang

- Bagikan

Artyom_30_RB :

:

grafik lamaLihat Lebih Banyak

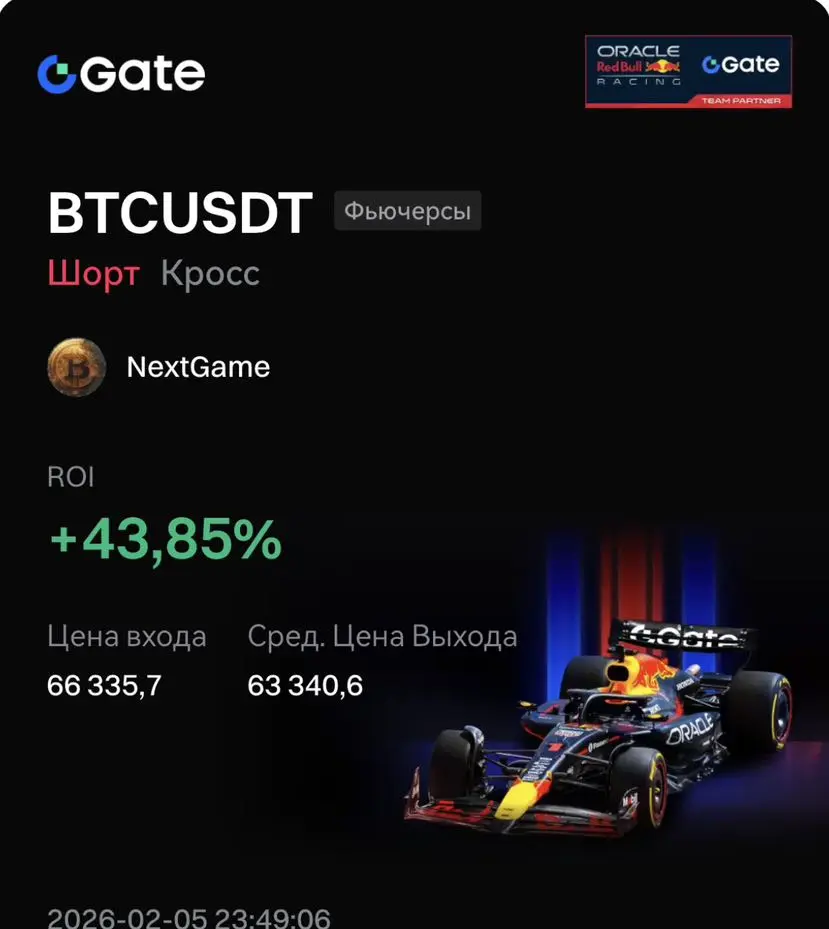

$BTC Tema tindakan: Beli di support, target 75K

Pasar menunjukkan keseimbangan kekuatan jangka pendek: kemungkinan kenaikan sekitar 63%, short — 37%; dominasi long semakin kuat saat mempertahankan level di atas 68.000 USD. Aliran dana ke ETF dan premi positif Coinbase mengonfirmasi pemulihan likuiditas dan potensi fase “short squeeze”.

Skema bullish:peningkatan aliran institusional ke ETF, akumulasi oleh whale, premi positif Coinbase; indeks ketakutan — 13, yang secara historis mendahului rebound sebesar 8–15%.

Pembelian jangka pendek📈

Titik masuk: 68.500 USDT (posisi 35%)

Stop-loss: 66.000 U

Pasar menunjukkan keseimbangan kekuatan jangka pendek: kemungkinan kenaikan sekitar 63%, short — 37%; dominasi long semakin kuat saat mempertahankan level di atas 68.000 USD. Aliran dana ke ETF dan premi positif Coinbase mengonfirmasi pemulihan likuiditas dan potensi fase “short squeeze”.

Skema bullish:peningkatan aliran institusional ke ETF, akumulasi oleh whale, premi positif Coinbase; indeks ketakutan — 13, yang secara historis mendahului rebound sebesar 8–15%.

Pembelian jangka pendek📈

Titik masuk: 68.500 USDT (posisi 35%)

Stop-loss: 66.000 U

BTC-3,21%

- Hadiah

- 4

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍Topik tindakan: Masuk terkendali di support

Distribusi kekuatan: kemungkinan kenaikan jangka pendek ≈ 56 %, penurunan ≈ 44 %; pasar tetap bearish, tetapi tanda-tanda stabilisasi terlihat dari perilaku paus dan volume. Dengan mempertahankan level 58–60 ribu $, kemungkinan terbesar adalah pemulihan konsolidasi.$BTC $BTC

Skema kenaikan:kelebihan jual secara teknis (RSI 8), banyak posisi panjang yang dilikuidasi dan volume pembelian/penjualan yang seimbang (≈ 1:1) menciptakan dasar untuk short‑squeeze. Dukungan tambahan diberikan oleh pembelian institusional melalui ETH dan keranjang XRP, di mana

Distribusi kekuatan: kemungkinan kenaikan jangka pendek ≈ 56 %, penurunan ≈ 44 %; pasar tetap bearish, tetapi tanda-tanda stabilisasi terlihat dari perilaku paus dan volume. Dengan mempertahankan level 58–60 ribu $, kemungkinan terbesar adalah pemulihan konsolidasi.$BTC $BTC

Skema kenaikan:kelebihan jual secara teknis (RSI 8), banyak posisi panjang yang dilikuidasi dan volume pembelian/penjualan yang seimbang (≈ 1:1) menciptakan dasar untuk short‑squeeze. Dukungan tambahan diberikan oleh pembelian institusional melalui ETH dan keranjang XRP, di mana

BTC-3,21%

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍Topik: Koreksi terkendali ke 60 000 USDT

Analisis probabilitas: Probabilitas jangka pendek untuk kenaikan diperkirakan sebesar 40%, penurunan — 60%, yang menunjukkan pasar yang moderat-bearish. Dalam 24 jam ke depan, zona 68 000–60 000 USDT akan menjadi penentu. Penembusan di bawah 60 000 USDT dapat membuka jalan menuju 55 000 USDT, sementara keberhasilan mempertahankan level ini adalah sinyal untuk rebound ke wilayah 73 000 USDT. $BTC

Skenario bullish: ** Pemulihan permintaan dari institusional, perlambatan keluar dari ETF, pendanaan negatif yang mengimbangi short yang terlalu panas, dan RSI

Analisis probabilitas: Probabilitas jangka pendek untuk kenaikan diperkirakan sebesar 40%, penurunan — 60%, yang menunjukkan pasar yang moderat-bearish. Dalam 24 jam ke depan, zona 68 000–60 000 USDT akan menjadi penentu. Penembusan di bawah 60 000 USDT dapat membuka jalan menuju 55 000 USDT, sementara keberhasilan mempertahankan level ini adalah sinyal untuk rebound ke wilayah 73 000 USDT. $BTC

Skenario bullish: ** Pemulihan permintaan dari institusional, perlambatan keluar dari ETF, pendanaan negatif yang mengimbangi short yang terlalu panas, dan RSI

BTC-3,21%

- Hadiah

- 5

- 2

- Posting ulang

- Bagikan

Den_Bat :

:

Pegang erat 💪Lihat Lebih Banyak

- Hadiah

- 3

- 2

- Posting ulang

- Bagikan

KatyPaty :

:

Thank you so much for the informationLihat Lebih Banyak

Kejadian penurunan Bitcoin kemarin disertai dengan volume yang besar, volume perdagangan mencapai puncaknya dalam setengah tahun terakhir. Tingkat penurunan seperti ini hampir menembus semua stop-loss dan harga likuidasi dari posisi panjang sebelumnya. Saat ini, tingkat pendanaan tidak menyimpang jauh dari kisaran normal, yang menunjukkan adanya bullish di pasar, artinya penurunan belum selesai. Pertumbuhan saat ini dengan volume yang berkurang harus dianggap sebagai koreksi. $BTC $ETH

Lihat AsliKe mana harga akan bergerak?💲

Naik

1

1

Вниз

4

4

5 pesertaVoting finished

- Hadiah

- 4

- 2

- Posting ulang

- Bagikan

KatyPaty :

:

GOGOGO 2026 👊Lihat Lebih Banyak

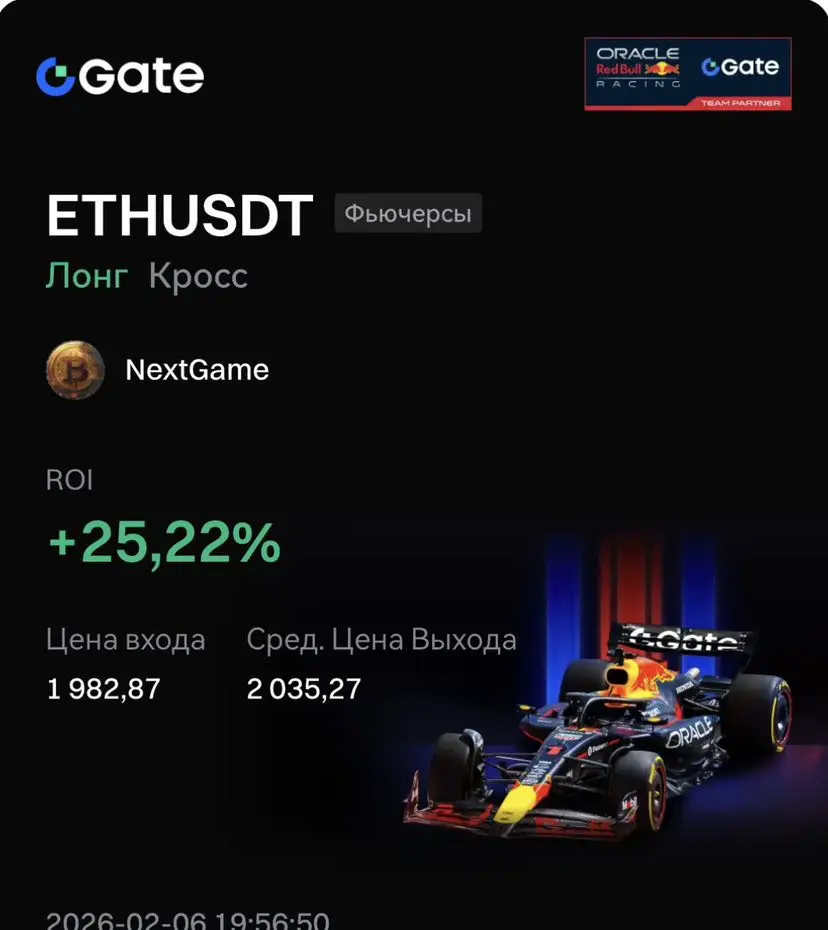

Tema: Operasi pendek terkendali dengan stop tetap. $BTC $ETH

BTC ≈ 65.660 USDT.

Rasio probabilitas saat ini: kemungkinan bullish jangka pendek = 35 % / beruang = 65 % — pasar tetap di bawah tekanan penjual, pengaruh faktor makroekonomi dan ETF‑keluaran tetap ada. Kemungkinan rebound sementara sebelum pengujian area 60.000 USDT.

Pembelian jangka pendek 📈

Kondisi masuk: saat dukungan 65.000–66.000 USDT bertahan, kemungkinan membuka posisi panjang kecil (hingga 30 % dari modal).

Pemicu: pemulihan RSI > 30 dan penurunan laju ETF‑keluaran di bawah 100 juta $ per hari; stabilisasi ETH di atas 1900

Lihat AsliBTC ≈ 65.660 USDT.

Rasio probabilitas saat ini: kemungkinan bullish jangka pendek = 35 % / beruang = 65 % — pasar tetap di bawah tekanan penjual, pengaruh faktor makroekonomi dan ETF‑keluaran tetap ada. Kemungkinan rebound sementara sebelum pengujian area 60.000 USDT.

Pembelian jangka pendek 📈

Kondisi masuk: saat dukungan 65.000–66.000 USDT bertahan, kemungkinan membuka posisi panjang kecil (hingga 30 % dari modal).

Pemicu: pemulihan RSI > 30 dan penurunan laju ETF‑keluaran di bawah 100 juta $ per hari; stabilisasi ETH di atas 1900

- Hadiah

- 3

- 2

- Posting ulang

- Bagikan

KatyPaty :

:

GOGOGO 2026 👊Lihat Lebih Banyak

Kontrol zona dukungan — pasar membentuk saluran menurun antara 68 000 USD dan 74 000 USD; kemungkinan penurunan lebih lanjut diperkirakan sebesar 60 % dibandingkan 40 % untuk rebound. Arah utama — transaksi pendek moderat sampai konfirmasi pembalikan. $BTC $ETH

Skenario pertumbuhan📈:mungkin terjadi jika aliran ETF stabil dan RSI naik di atas 35; di saat yang sama, aktivitas paus beralih ke pembelian. Positif dapat muncul jika terjadi pengembalian modal parsial ke ETH dan SOL — mereka sering memberi sinyal rotasi risiko awal.

Long jangka pendek📈

Masuk: ketika menembus 73 500 USD (volume 30

Lihat AsliSkenario pertumbuhan📈:mungkin terjadi jika aliran ETF stabil dan RSI naik di atas 35; di saat yang sama, aktivitas paus beralih ke pembelian. Positif dapat muncul jika terjadi pengembalian modal parsial ke ETH dan SOL — mereka sering memberi sinyal rotasi risiko awal.

Long jangka pendek📈

Masuk: ketika menembus 73 500 USD (volume 30

- Hadiah

- 3

- 3

- Posting ulang

- Bagikan

Plastikkid :

:

Vibe hingga 1000x 🤑Lihat Lebih Banyak

Tema tindakan :Pengujian dukungan utama — pasar cryptocurrency tetap dipengaruhi oleh ketakutan (kemungkinan kenaikan 40 % / penurunan 60 %), dan BTC ≈ 76.418,8 USDT tetap menjadi indikator risiko utama. Jika dukungan 74.000–74.500 USDT bertahan, kemungkinan rebound ke 78.000 USDT, jika tidak, penurunan ke 72.000 USDT. $BTC

Skenario bullish:Kembalinya arus ETF, akumulasi oleh pemegang jangka panjang dan minat yang meningkat dari institusi dapat memicu rebound sementara di atas 78.000 USDT. RSI di zona oversold dan stabilisasi volume menunjukkan perlambatan penurunan.

Pembelian jangka pendek📈

Skenario bullish:Kembalinya arus ETF, akumulasi oleh pemegang jangka panjang dan minat yang meningkat dari institusi dapat memicu rebound sementara di atas 78.000 USDT. RSI di zona oversold dan stabilisasi volume menunjukkan perlambatan penurunan.

Pembelian jangka pendek📈

BTC-3,21%

- Hadiah

- 2

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍Topik tindakan :Koreksi jangka pendek kemungkinan terjadi jika dukungan bertahan. Probabilitas kenaikan 60% dibandingkan penurunan 40%. Jika menembus 76.700, kemungkinan keluar ke atas menuju 82.600, jika turun di bawah 73.500 risiko memperdalam ke 70.000. $BTC

Skenario bullish:ETF menunjukkan pembalikan ke arus positif (4,2 miliar dolar), mentransfer lebih dari 1.300 BTC ke dompet dingin, yang mengurangi tekanan jual. MACD membentuk crossover emas, KDJ menunjukkan percepatan pergerakan ke atas.

Long jangka pendek📈

Masuk: 76.700 USDT (posisi 30%)

Stop: 73.500 USDT

Target: 82.637 USDT

Skenari

Skenario bullish:ETF menunjukkan pembalikan ke arus positif (4,2 miliar dolar), mentransfer lebih dari 1.300 BTC ke dompet dingin, yang mengurangi tekanan jual. MACD membentuk crossover emas, KDJ menunjukkan percepatan pergerakan ke atas.

Long jangka pendek📈

Masuk: 76.700 USDT (posisi 30%)

Stop: 73.500 USDT

Target: 82.637 USDT

Skenari

BTC-3,21%

- Hadiah

- 3

- 2

- Posting ulang

- Bagikan

DragonFlyOfficial :

:

GOGOGO 2026 👊Lihat Lebih Banyak

Perdagangan di dukungan : pasar berada di zona kritis, di mana keputusan jangka pendek memerlukan penyesuaian tingkat risiko yang tepat. Potensi pertumbuhan jangka menengah dengan mempertahankan dukungan diperkirakan di atas 60%, kemungkinan penurunan jangka pendek sekitar 40%.

Rasio probabilitas pertumbuhan/penurunan jangka pendek: 1.5 : 1, menunjukkan dominasi suasana hati bullish yang berhati-hati dengan volatilitas tinggi.$BTC

Skenario bullish:ketakutan ekstrem yang kuat (indeks 15), konsolidasi posisi institusional MicroStrategy, dukungan level fundamental 75.000 USD dan penurunan RSI da

Rasio probabilitas pertumbuhan/penurunan jangka pendek: 1.5 : 1, menunjukkan dominasi suasana hati bullish yang berhati-hati dengan volatilitas tinggi.$BTC

Skenario bullish:ketakutan ekstrem yang kuat (indeks 15), konsolidasi posisi institusional MicroStrategy, dukungan level fundamental 75.000 USD dan penurunan RSI da

BTC-3,21%

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍Tema tindakan: Rata-rata moderat atau posisi pendek spekulatif dalam kisaran.

Pasar dinilai sebagai mayoritas bearish: kemungkinan kenaikan jangka pendek ≈ 40 %, kemungkinan penurunan ≈ 60 %. Momen panic sell tampak dekat dengan dasar lokal, tetapi konfirmasi teknis belum terbentuk. $BTC

BTC ≈ 78.688,3 USDT

Skema bullish:

Rebound mungkin terjadi jika terbentuk dasar ganda di 75.000 USDT dan RSI > 40. Dukungan berasal dari aktivitas dompet institusional dan tingkat pembiayaan negatif, menciptakan prasarat untuk “short‑squeeze”.

Pembelian jangka pendek📈

Masuk: 75.500 USDT (30 % posisi)

Stop‑lo

Pasar dinilai sebagai mayoritas bearish: kemungkinan kenaikan jangka pendek ≈ 40 %, kemungkinan penurunan ≈ 60 %. Momen panic sell tampak dekat dengan dasar lokal, tetapi konfirmasi teknis belum terbentuk. $BTC

BTC ≈ 78.688,3 USDT

Skema bullish:

Rebound mungkin terjadi jika terbentuk dasar ganda di 75.000 USDT dan RSI > 40. Dukungan berasal dari aktivitas dompet institusional dan tingkat pembiayaan negatif, menciptakan prasarat untuk “short‑squeeze”.

Pembelian jangka pendek📈

Masuk: 75.500 USDT (30 % posisi)

Stop‑lo

BTC-3,21%

- Hadiah

- 5

- 2

- Posting ulang

- Bagikan

GateUser-5a013bc3 :

:

nothing nothingLihat Lebih Banyak

Fokus pada titik kunci :Pasar secara operasional seimbang: kemungkinan pertumbuhan jangka pendek diperkirakan sebesar 55 %, dan penurunan — sebesar 45 %. Pertempuran utama berlangsung di sekitar 85.000 USDT: penembusan ke atas akan mengonfirmasi skenario bullish, penurunan di bawah 80.000 USDT akan mengaktifkan posisi pendek. $BTC

Skenario bullish:Penunjukan kepala Fed yang ramah terhadap kripto, peningkatan minat institusional, dan sinyal positif dari akun elit (long/short = 2.18) menciptakan potensi untuk pengujian 85.000 USDT. ETH dan XRP menunjukkan stabilisasi volume, yang memperkuat kep

Skenario bullish:Penunjukan kepala Fed yang ramah terhadap kripto, peningkatan minat institusional, dan sinyal positif dari akun elit (long/short = 2.18) menciptakan potensi untuk pengujian 85.000 USDT. ETH dan XRP menunjukkan stabilisasi volume, yang memperkuat kep

BTC-3,21%

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

NextGame :

:

Perhatikan dengan saksama 🔍Topik tindakan: pengujian level support 80 000 USD — titik balik utama.

Struktur pasar saat ini menunjukkan dominasi penjual dengan probabilitas posisi pendek sekitar 63 % dibandingkan posisi bullish sekitar 37 %. Kemungkinan pasar akan menguji 80 000 USD sebelum koreksi jika pembelian institusional menstabilkan harga.

$BTC

Skema bullish: jika arus masuk ETF berlanjut dan “paus” mempertahankan akumulasi, BTC dapat kembali ke atas 85 000 USD dengan peningkatan volume dan persilangan MACD pada 4 jam.

Pembelian jangka pendek 📈

Masuk: 83 000 USDT (25 % posisi)

Stop-loss: 80 000 USDT

Take-profit:

Struktur pasar saat ini menunjukkan dominasi penjual dengan probabilitas posisi pendek sekitar 63 % dibandingkan posisi bullish sekitar 37 %. Kemungkinan pasar akan menguji 80 000 USD sebelum koreksi jika pembelian institusional menstabilkan harga.

$BTC

Skema bullish: jika arus masuk ETF berlanjut dan “paus” mempertahankan akumulasi, BTC dapat kembali ke atas 85 000 USD dengan peningkatan volume dan persilangan MACD pada 4 jam.

Pembelian jangka pendek 📈

Masuk: 83 000 USDT (25 % posisi)

Stop-loss: 80 000 USDT

Take-profit:

BTC-3,21%

- Hadiah

- 3

- 2

- Posting ulang

- Bagikan

GateUser-8063ff20 :

:

berarti masuk akalLihat Lebih Banyak

Taktik mempertahankan posisi bullish

Probabilitas bullish: ≈63%; Probabilitas bearish: ≈37%. Sebagian besar indeks menunjukkan dominasi bullish — pembelian institusional, korelasi positif pasar aset kripto, dan peningkatan dominasi BTC. Diperkirakan akan terjadi kenaikan bertahap ke 90.000–92.000 USDT dengan dukungan di 87.000 USDT.

Skema bullish:Permintaan aktif dari pemain besar dan indikator derivatif yang stabil mengonfirmasi potensi penembusan kisaran 90.000 USDT. RSI pada timeframe harian — 36–47, yang meninggalkan potensi kenaikan; volume pembelian melebihi penjualan sekitar 5%. ETH dan

Lihat AsliProbabilitas bullish: ≈63%; Probabilitas bearish: ≈37%. Sebagian besar indeks menunjukkan dominasi bullish — pembelian institusional, korelasi positif pasar aset kripto, dan peningkatan dominasi BTC. Diperkirakan akan terjadi kenaikan bertahap ke 90.000–92.000 USDT dengan dukungan di 87.000 USDT.

Skema bullish:Permintaan aktif dari pemain besar dan indikator derivatif yang stabil mengonfirmasi potensi penembusan kisaran 90.000 USDT. RSI pada timeframe harian — 36–47, yang meninggalkan potensi kenaikan; volume pembelian melebihi penjualan sekitar 5%. ETH dan

- Hadiah

- 3

- 1

- Posting ulang

- Bagikan

RedEnvelope :

:

Perhatikan dengan saksama 🔍Fokus pada pembelian saat koreksi: secara jangka pendek perlu berhati-hati, menggunakan koreksi untuk menambah posisi; dalam jangka panjang strategi tetap bullish dengan target di atas 95.000 USDT.$BTC

Rencana jangka pendek: Beli 📈

Masuk: 87.500 USDT (30% posisi)

Stop-loss: 85.000 USDT

Target/Take-profit: 92.000 USDT

Rencana jangka menengah: Beli 📈

Masuk: 86.000 USDT (50% posisi)

Stop-loss: 83.500 USDT

Target/Take-profit: 96.000 USDT

Rencana jangka pendek: Beli 📈

Masuk: 87.500 USDT (30% posisi)

Stop-loss: 85.000 USDT

Target/Take-profit: 92.000 USDT

Rencana jangka menengah: Beli 📈

Masuk: 86.000 USDT (50% posisi)

Stop-loss: 83.500 USDT

Target/Take-profit: 96.000 USDT

BTC-3,21%

- Hadiah

- 2

- 1

- Posting ulang

- Bagikan

RedEnvelope :

:

Perhatikan dengan saksama 🔍Penekanan pada masuk secara bertahap: secara jangka pendek, koreksi dapat digunakan sebagai titik masuk; secara menengah, potensi kenaikan tetap ada jika bertahan di atas 86 ribu USDT dan permintaan dari investor ETF kembali.$BTC

Rencana jangka pendek: beli📈

Masuk: 86.000 USDT (volume 30%)

Stop-loss: 82.000 USDT

Take-profit: 88.800 USDT

Rencana jangka menengah: beli📈

Masuk: 84.000 USDT (volume 40%)

Stop-loss: 80.000 USDT

Take-profit: 97.000 USDT

Rencana jangka pendek: beli📈

Masuk: 86.000 USDT (volume 30%)

Stop-loss: 82.000 USDT

Take-profit: 88.800 USDT

Rencana jangka menengah: beli📈

Masuk: 84.000 USDT (volume 40%)

Stop-loss: 80.000 USDT

Take-profit: 97.000 USDT

BTC-3,21%

- Hadiah

- 5

- 1

- Posting ulang

- Bagikan

RedEnvelope :

:

Perhatikan dengan saksama 🔍Topik Trending

Lihat Lebih Banyak22.97K Popularitas

10.09K Popularitas

4.83K Popularitas

36.56K Popularitas

251.51K Popularitas

Hot Gate Fun

Lihat Lebih Banyak- MC:$0.1Holder:10.00%

- MC:$2.4KHolder:10.00%

- MC:$0.1Holder:10.00%

- MC:$2.4KHolder:10.00%

- MC:$2.39KHolder:10.00%

Sematkan