Sweep1

Chưa có nội dung

Sweep1

Trong 30 ngày qua, tôi đã tránh 38.549 quảng cáo nhờ trở thành người dùng cao cấp X

Điều này có nghĩa là trong một năm tôi sẽ tiết kiệm được 260 giờ xem quảng cáo 🤯

Xem bản gốcĐiều này có nghĩa là trong một năm tôi sẽ tiết kiệm được 260 giờ xem quảng cáo 🤯

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Tôi đang xây dựng một trợ lý AI thuật toán cho các nhà sáng tạo X.

Bạn dán bản nháp vào. Nó kiểm tra nó dựa trên mã nguồn mở của X.

Sau đó, nó cho bạn biết chính xác những gì cần thay đổi trước khi đăng.

Nó theo dõi các sự kiện lan truyền theo thời gian thực và giúp bạn tạo ra các bài đăng phù hợp với những gì thuật toán đang thúc đẩy ngay bây giờ.

Đây là điều mà mọi người đều mong X đã xây dựng.

Truy cập sớm?

Xem bản gốcBạn dán bản nháp vào. Nó kiểm tra nó dựa trên mã nguồn mở của X.

Sau đó, nó cho bạn biết chính xác những gì cần thay đổi trước khi đăng.

Nó theo dõi các sự kiện lan truyền theo thời gian thực và giúp bạn tạo ra các bài đăng phù hợp với những gì thuật toán đang thúc đẩy ngay bây giờ.

Đây là điều mà mọi người đều mong X đã xây dựng.

Truy cập sớm?

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

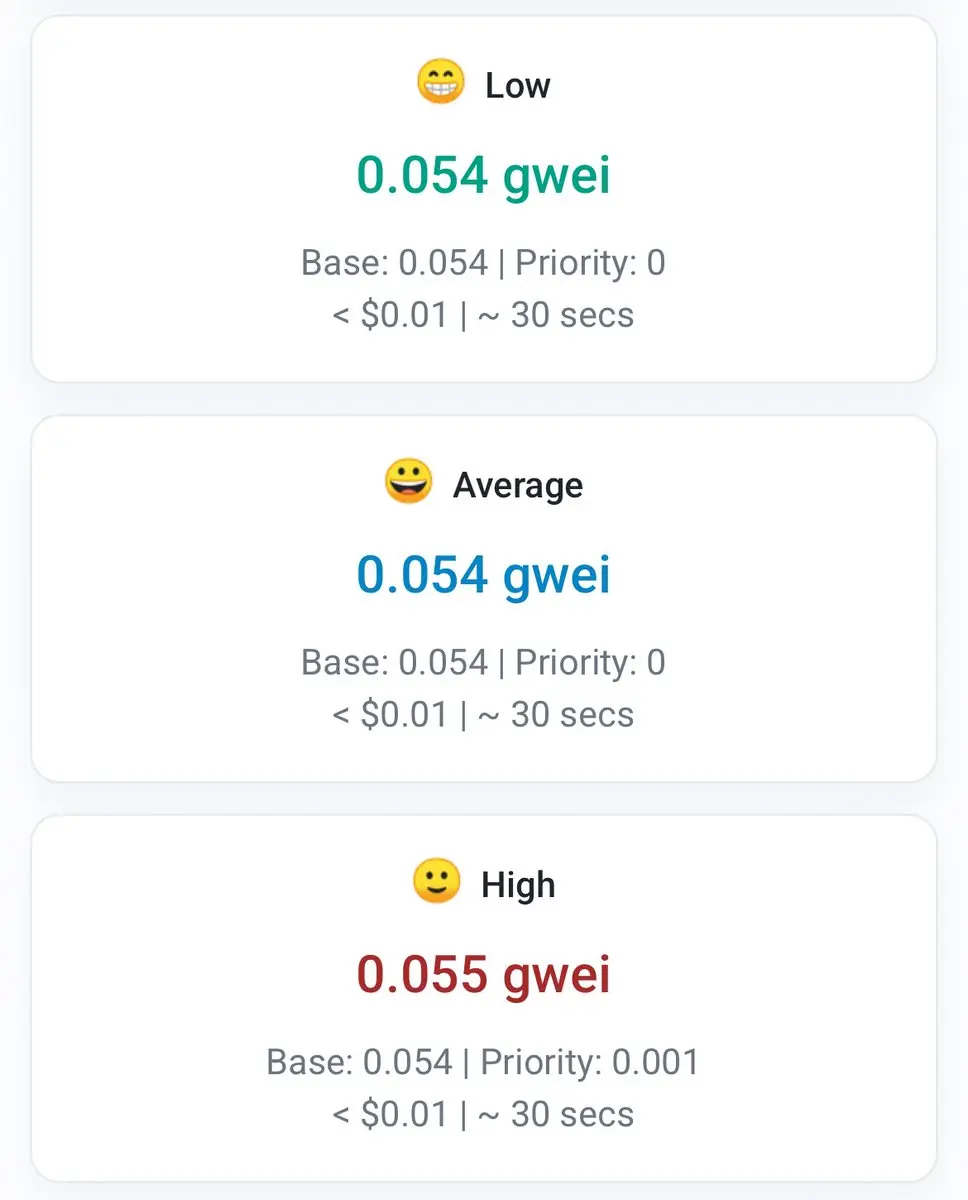

Chúng ta thực sự đang đặt cược vào điều gì ngày nay 😭

Xem bản gốc- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

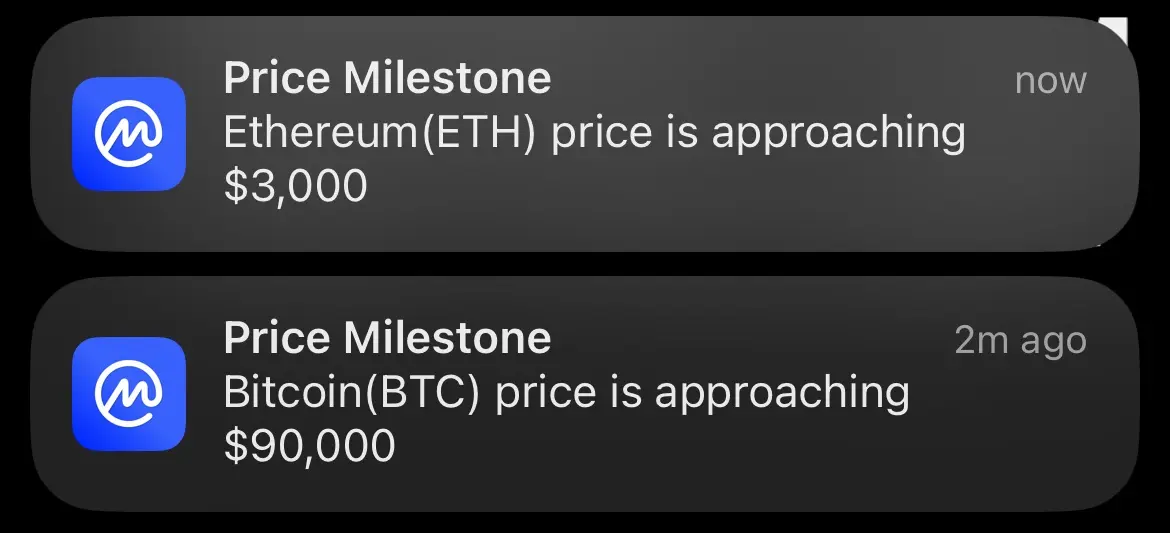

Tôi cần xem lại thông báo này bao nhiêu lần nữa 😭

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

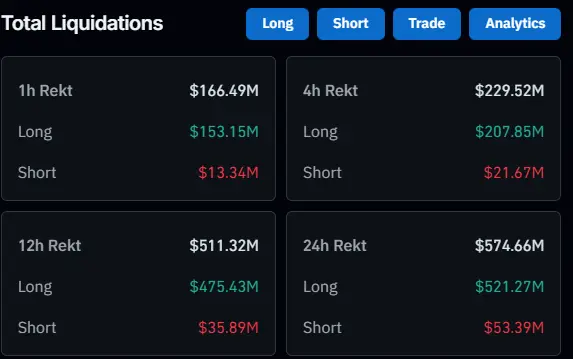

TIN NÓNG: Trong 24 giờ qua, có 138.316 nhà giao dịch bị thanh lý.

Tổng số thanh lý lên đến 574,66 triệu đô la.

Xem bản gốcTổng số thanh lý lên đến 574,66 triệu đô la.

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Bitcoin $BTC đang lặp lại cấu trúc đỉnh của năm 2022 dẫn đến một thị trường giảm giá kéo dài 100 ngày.

Một đợt điều chỉnh về mức $76,000 sẽ hoàn tất việc kiểm tra lại trước khi có bất kỳ xu hướng tiếp tục nào

Mức này cũng phù hợp gần với chi phí sản xuất (điện) ước tính của BTC, vốn chưa bao giờ giảm xuống dưới

Một đợt điều chỉnh về mức $76,000 sẽ hoàn tất việc kiểm tra lại trước khi có bất kỳ xu hướng tiếp tục nào

Mức này cũng phù hợp gần với chi phí sản xuất (điện) ước tính của BTC, vốn chưa bao giờ giảm xuống dưới

BTC-3,72%

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

BITCOIN GIẢM XUỐNG $90K

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Solana nằm dưới $130

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

ETH giảm xuống còn $3000

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

TIN NÓNG: $300 TỶ đã bị xóa khỏi vốn hóa thị trường tiền điện tử trong 6 ngày qua

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Chàng trai đã gửi báo cáo mất chó và khi được hỏi chó trông như thế nào, anh ấy đã gửi cái này 😂

Xem bản gốc

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Các hacker đã đánh cắp 610.000.000 USD vào năm 2021 chỉ để vui chơi rồi trả lại

Họ lợi dụng một lỗ hổng trong logic hợp đồng thông minh của nền tảng, cho phép họ chuyển hơn $610 triệu giá trị tiền điện tử vào ví mà họ kiểm soát

Họ nói rằng chúng tôi làm điều này “vì vui” và để phơi bày một lỗ hổng bảo mật trước khi ai đó tệ hơn có thể khai thác nó

Trong hai tuần sau vụ hack, gần như tất cả các tài sản bị đánh cắp đã được trả lại cho Poly Network hoặc bị phong tỏa bởi các bên thứ ba

Xem bản gốcHọ lợi dụng một lỗ hổng trong logic hợp đồng thông minh của nền tảng, cho phép họ chuyển hơn $610 triệu giá trị tiền điện tử vào ví mà họ kiểm soát

Họ nói rằng chúng tôi làm điều này “vì vui” và để phơi bày một lỗ hổng bảo mật trước khi ai đó tệ hơn có thể khai thác nó

Trong hai tuần sau vụ hack, gần như tất cả các tài sản bị đánh cắp đã được trả lại cho Poly Network hoặc bị phong tỏa bởi các bên thứ ba

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Gia đình này đã được đề nghị lên đến $50 TRIỆU đô la cho mảnh vườn 5 mẫu của họ ở Tây Sydney

Họ từ chối bán nên thành phố thực sự đã xây dựng xung quanh nó

Với 50.000.000 đô la, tôi sẽ đóng gói hành lý và chọn một biệt thự mới 😭

Xem bản gốcHọ từ chối bán nên thành phố thực sự đã xây dựng xung quanh nó

Với 50.000.000 đô la, tôi sẽ đóng gói hành lý và chọn một biệt thự mới 😭

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Lần cuối cùng NIFTY50 mất xu hướng tăng của mình thì một cuộc suy thoái lớn đã xảy ra

Lịch sử có thể lặp lại lần nữa

Xem bản gốcLịch sử có thể lặp lại lần nữa

- Phần thưởng

- Thích

- Bình luận

- Đăng lại

- Retweed

Chủ đề thịnh hành

Xem thêm17.2K Phổ biến

44.71K Phổ biến

54.46K Phổ biến

16.62K Phổ biến

11.09K Phổ biến

Ghim