2025 年 FRAG 价格预测:解析市场趋势与潜在增长动力

全面剖析 Fragmetric(FRAG)2025 年至 2030 年的市场增长前景。洞悉 FRAG 价格趋势、市场稳定性与影响未来价值的核心因素,并探索专业投资方案,引言:FRAG 的市场地位与投资价值

Fragmetric(FRAG)作为 Solana 首个原生流动性(再)质押协议,自成立以来已成为先进的资产管理标准。到 2025 年,FRAG 市值达到 $5,417,640,流通量约为 202,000,000 枚,价格稳定在 $0.02682 左右。该资产以“FRAG-22 标准”著称,在成熟的 DeFi 策略中发挥着日益重要的作用。

本文将系统分析 2025 至 2030 年 FRAG 的价格走势,融合历史规律、市场供需、生态构建及宏观环境,为投资者提供专业的价格展望与实操投资策略。

一、FRAG 价格历史回顾与当前市场概况

FRAG 历史价格变化

- 2025 年:7 月 1 日上线,价格创下历史最高 $0.189

- 2025 年:经历重大回调,10 月 10 日跌至历史最低 $0.01055

FRAG 当前市场状况

截至 2025 年 10 月 11 日,FRAG 当前报价为 $0.02682,24 小时跌幅 14.26%。代币市值为 $5,417,640,全球加密货币市值排名第 1673 位。近期 FRAG 波动剧烈,24 小时成交量达 $1,904,499.41。现价较历史高点下跌 85.81%,较历史低点上涨 154.22%。短期内价格动能均为负:1 小时跌幅 -2.12%,7 天跌幅 -18.70%,30 天跌幅 -33.78%。长期趋势仍偏空,年跌幅达 -57.30%。

点击查看 FRAG 实时价格

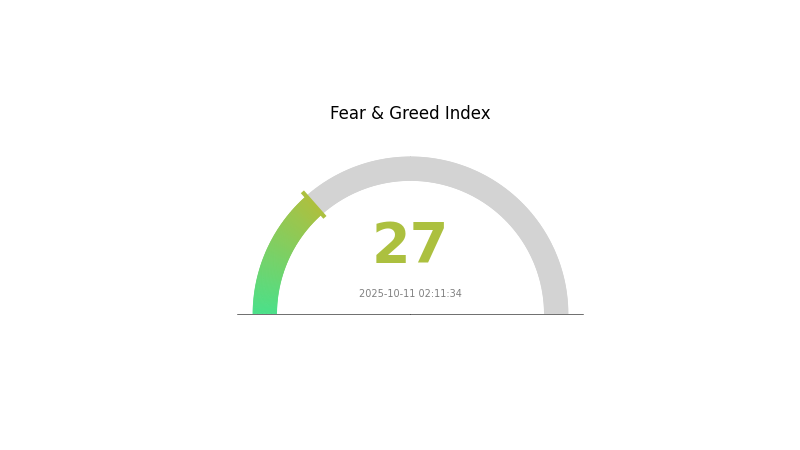

FRAG 市场情绪指数

2025-10-11 恐惧与贪婪指数:27(恐惧)

点击查看当前 恐惧与贪婪指数

加密市场情绪持续谨慎,恐惧与贪婪指数维持在 27,反映出投资者偏向避险。投资者对风险高度警惕,倾向于选择更安全的资产。但对逆势交易者而言,恐惧周期往往也是买入机会。建议投资者持续关注市场趋势,合理控制风险,并利用 Gate.com 等工具动态追踪情绪变化。

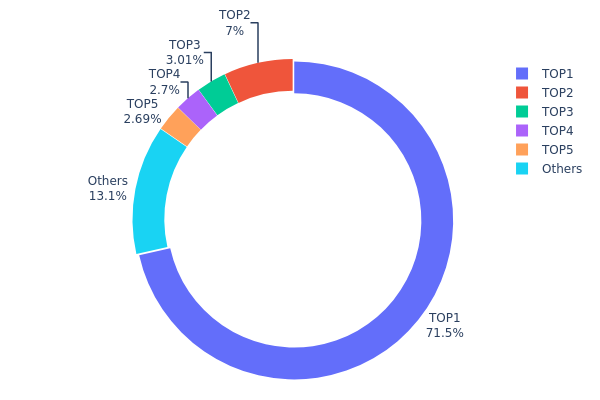

FRAG 持币分布

FRAG 地址持币分布显示,整体持有结构高度集中。最大地址持有总供应量的 71.48%,集中度极高。第二大持有者占 7%,其余前五大地址各持有 2.68% 至 3.01%。

如此高度集中引发市场稳定性及价格操控风险。单一地址持有超过七成代币,极易造成大额抛售或买盘对 FRAG 价格产生巨大影响。此外,持币集中度过高可能削弱项目的去中心化形象,影响公平分配认知,阻碍潜在投资者入场。

当前分布结构显示 FRAG 链上结构稳定性有限。虽然其他小型持有者(合计 13.13%)有一定补充,但最大地址主导地位依然是影响 FRAG 市场动态与长期前景的关键因素。

点击查看 FRAG 持币分布详情

| 排名 | 地址 | 持有数量 | 持有比例 (%) |

|---|---|---|---|

| 1 | F8ngMX...CXAse4 | 714842.88K | 71.48% |

| 2 | BTj8Pn...JZbzRu | 70000.00K | 7.00% |

| 3 | AC5RDf...CWjtW2 | 30116.65K | 3.01% |

| 4 | 71hPbt...p4ehgi | 27035.40K | 2.70% |

| 5 | 5MQGiz...3Vm7iC | 26898.12K | 2.68% |

| - | 其他 | 131106.10K | 13.13% |

二、影响 FRAG 未来价格的核心因素

供应机制

- 供需关系:供需平衡直接影响 FRAG 价格走势。

- 当前影响:供需结构变化将对 FRAG 市场波动产生显著作用。

机构与巨鲸行为

- 企业采用:知名企业采纳 FRAG 或将成为价格推动力。

宏观经济环境

- 抗通胀属性:FRAG 在通胀环境下的表现会影响其市场价格。

技术进步与生态构建

- 项目进展:FRAG 项目持续发展将显著影响未来价格。

- 技术创新:FRAG 生态技术升级与创新有望驱动价格变动。

- 生态应用:基于 FRAG 的核心 DApp 或生态项目成长,亦可提升其市场价值。

三、2025-2030 年 FRAG 价格预测

2025 年展望

- 保守预测:$0.01555 - $0.02728

- 中性预测:$0.02728 - $0.0311

- 乐观预测:$0.0311 - $0.04(需强市场动能)

2026-2027 年展望

- 市场阶段:或将进入成长周期

- 价格区间预测:

- 2026 年:$0.02102 - $0.04116

- 2027 年:$0.02744 - $0.04186

- 核心驱动力:采用率提升与技术创新突破

2028-2030 年长期展望

- 基础情景:$0.03851 - $0.05024(假设市场平稳增长)

- 乐观情景:$0.05024 - $0.06733(市场环境有利)

- 变革性情景:$0.06733 - $0.08(技术突破及大规模采用)

- 2030 年 12 月 31 日:FRAG $0.06733(潜在最高价)

| 年份 | 预测最高价 | 预测均价 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0311 | 0.02728 | 0.01555 | 1 |

| 2026 | 0.04116 | 0.02919 | 0.02102 | 8 |

| 2027 | 0.04186 | 0.03517 | 0.02744 | 31 |

| 2028 | 0.04737 | 0.03851 | 0.03351 | 43 |

| 2029 | 0.05755 | 0.04294 | 0.03994 | 60 |

| 2030 | 0.06733 | 0.05024 | 0.04371 | 87 |

四、FRAG 专业投资策略与风险管控

FRAG 投资方法论

(1)长期持有策略

- 适合对象:关注 Solana 生态与 DeFi 创新的投资者

- 操作建议:

- 市场回调时分批买入 FRAG

- 参与 FRAG 质押获取额外收益

- 存储于安全的 Solana 兼容钱包

(2)主动交易策略

- 技术分析工具:

- 均线:辅助判断趋势与反转点

- RSI:监测超买与超卖状态

- 波段交易要点:

- 密切关注 Solana 生态动态

- 跟踪整体 DeFi 市场情绪

FRAG 风险管理框架

(1)资产配置原则

- 保守型:加密资产配置 1-3%

- 激进型:加密资产配置 5-10%

- 专业型:加密配置最高至 15%

(2)风险对冲措施

- 资产分散:FRAG 与其他 Solana 项目代币均衡配置

- 止损单:及时止损,控制风险

(3)安全存储方案

- 热钱包推荐:Gate Web3 钱包

- 冷存储:支持 Solana 代币的硬件钱包

- 安全措施:启用双重验证,设置强密码

五、FRAG 潜在风险及挑战

FRAG 市场风险

- 高波动性:价格易剧烈波动

- 流动性风险:成交量不足影响价格稳定

- 竞争压力:Solana 新兴 DeFi 协议冲击 Fragmetric 市场地位

FRAG 合规风险

- 监管不确定性:全球 DeFi 政策变数

- 合规挑战:协议需应对法律合规变更

- 地缘政治影响:国际局势波动影响加密市场

FRAG 技术风险

- 智能合约漏洞:协议易遭代码攻击

- 可扩展性压力:Solana 网络增长或遇瓶颈

- 兼容性问题:与其他链互操作性风险

六、结论与操作建议

FRAG 投资价值评估

FRAG 作为 Solana 资产管理创新,为 DeFi 用户带来长期潜力,但短期波动及监管不确定性风险显著。

FRAG 投资建议

✅ 新手:以小仓位入场,侧重学习 DeFi 与 Solana 生态 ✅ 有经验者:可将部分 Solana 生态配置分配给 FRAG ✅ 机构投资者:将 FRAG 纳入多元化 DeFi 投资组合

FRAG 参与方式

- 现货交易:在 Gate.com 购买 FRAG

- 质押挖矿:参与 Fragmetric 质押项目,获取额外收益

- 收益农场:探索 Fragmetric 生态内流动性挖矿机会

加密货币投资风险极高,本文不构成投资建议。请根据自身风险承受力慎重决策,并建议咨询专业财务顾问。切勿投资超过可承受损失。

常见问题 FAQ

2025 年 Pi 价格预测是多少?

据市场分析,2025 年 Pi Network 均价预计约为 $2.3,区间为 $0.57 至 $6.7。

2030 年 XRP 价格预测是多少?

预计到 2030 年,XRP 价格区间为 $90 到 $120,基于当前市场趋势与加密行业增长预期。

哪种加密资产价格预测最高?

比特币预测最高,预计可达 $122,937。Chainlink 预测峰值为 $59.67。

AI 能预测加密货币价格吗?

AI 可用高级模型进行加密资产价格预测,但因市场波动性,结果仅供参考。虽无法做到完全精准,AI 在趋势分析和预测方面仍具有实用价值。

分享

目录