Prévisions de prix GOMINING pour 2025 : analyse des tendances du marché et des facteurs potentiels de croissance

Introduction : Positionnement de GOMINING sur le marché et valeur d’investissement

GoMining (GOMINING) s’est affirmé comme une référence du minage numérique depuis sa création. En 2025, sa capitalisation atteint 168 602 971 $, avec une circulation d’environ 406 958 657 tokens et un prix autour de 0,4143 $. Désigné comme « token d’écosystème de minage numérique », il joue un rôle clé dans le minage de Bitcoin et le GameFi.

Cet article analyse en détail la trajectoire du prix de GOMINING entre 2025 et 2030, croisant tendances passées, offre et demande, évolution de l’écosystème et facteurs macroéconomiques pour fournir des prévisions professionnelles et des stratégies d’investissement concrètes.

I. Historique du prix de GOMINING et situation actuelle du marché

Évolution historique du prix de GOMINING

- 2023 : GOMINING enregistre son plus bas à 0,00263 $ le 29 avril 2023

- 2024 : Le token atteint son plus haut à 0,5649 $ le 16 décembre 2024

- 2025 : Les fluctuations persistent, avec un prix actuel à 0,4143 $

Situation actuelle du marché GOMINING

Au 19 octobre 2025, GOMINING s’échange à 0,4143 $, pour une capitalisation de 168 602 971 $. Le token affiche une baisse de 1,52 % sur 24 heures, avec un volume d’échange de 293 895 $, reflet d’une activité modérée. GOMINING occupe la 303e place sur le marché crypto, avec une domination de 0,0043 %. L’offre en circulation s’élève à 406 958 657 tokens, soit 93,14 % du maximum de 436 915 240 tokens. Malgré le repli récent, GOMINING montre une forte résilience et reste bien au-dessus de son plus bas historique.

Cliquez pour visualiser le cours actuel de GOMINING

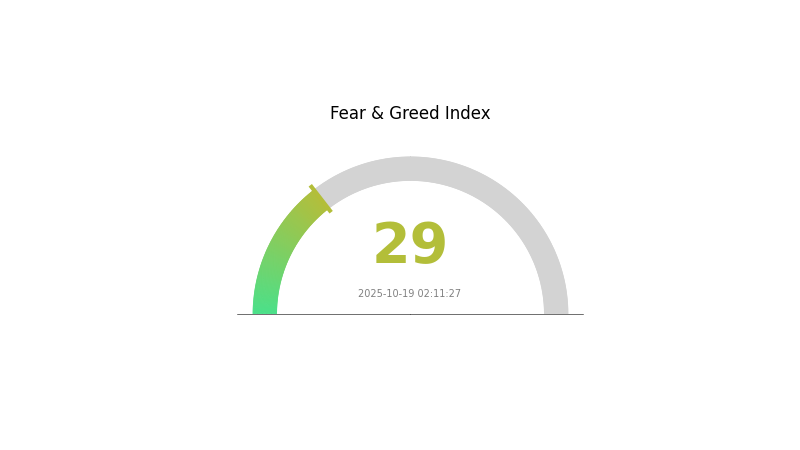

Indicateur de sentiment du marché GOMINING

19 octobre 2025, indice Fear & Greed : 29 (Peur)

Cliquez pour consulter l’indice Fear & Greed actuel

Le marché crypto traverse une phase de peur, l’indice Fear & Greed étant à 29. Les investisseurs se montrent plus prudents et averses au risque. Cette situation peut précéder des opportunités d’achat, les actifs pouvant être sous-évalués. Il est néanmoins essentiel d’effectuer des analyses approfondies et de bien évaluer votre tolérance au risque avant toute décision. Le sentiment de marché évolue vite et les performances passées ne préjugent pas des résultats futurs.

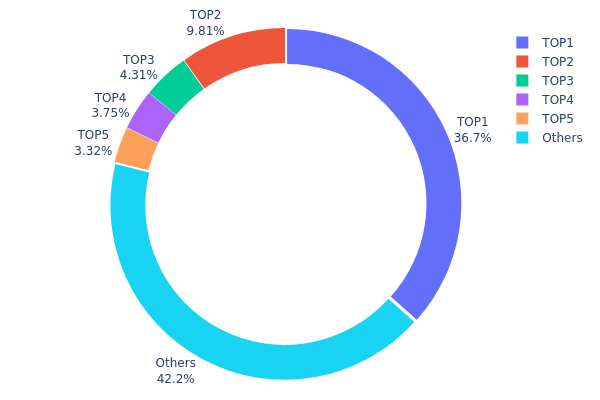

Répartition des détentions GOMINING

La distribution des adresses détentrices de GOMINING montre une forte concentration des tokens sur quelques grands portefeuilles. Le principal détenteur possède 36,65 % de l’offre totale, et les cinq plus grandes adresses en contrôlent 57,8 %. Ce degré de concentration soulève des risques de manipulation et de volatilité du marché.

Une telle concentration peut accroître l’instabilité, les gros détenteurs pouvant influencer significativement les prix. La faible décentralisation de l’écosystème GOMINING pèse sur la dynamique du marché et la gouvernance du projet.

À l’inverse, 42,2 % des tokens sont répartis sur d’autres adresses, témoignant d’une participation plus large. Ce schéma hybride combine contrôle centralisé et dispersion des tokens chez les petits détenteurs.

Cliquez pour consulter la répartition des détentions GOMINING

| Top | Adresse | Quantité détenue | Détention (%) |

|---|---|---|---|

| 1 | 0x2ccd...6e1fe4 | 122 268,25 K | 36,65 % |

| 2 | 0x4a58...3b4889 | 32 721,91 K | 9,80 % |

| 3 | 0x2923...5dc3a5 | 14 377,14 K | 4,30 % |

| 4 | 0xfb56...19e02c | 12 500,77 K | 3,74 % |

| 5 | 0xb786...9b3046 | 11 059,51 K | 3,31 % |

| - | Autres | 140 674,66 K | 42,2 % |

II. Principaux facteurs influençant le prix futur de GOMINING

Mécanisme d’offre

- Récompenses de minage : Les tokens GOMINING sont minés via l’écosystème GoMining, qui gère des infrastructures de minage Bitcoin.

- Modèle historique : L’offre de GOMINING est liée aux opérations de minage Bitcoin, influençant la disponibilité et le prix du token.

- Effet actuel : La difficulté et les récompenses du minage Bitcoin ont un impact direct sur l’offre et la valeur de GOMINING.

Dynamique institutionnelle et des whales

- Détentions institutionnelles : Certains fonds et groupes d’investissement crypto miniers incluent GOMINING pour diversifier leurs portefeuilles.

Environnement macroéconomique

- Couverture contre l’inflation : Adossé au minage Bitcoin, GOMINING peut être considéré comme une couverture contre l’inflation, à l’image du Bitcoin.

Développement technique et expansion de l’écosystème

- Amélioration de l’efficacité du minage : Les progrès techniques dans le minage Bitcoin bénéficient à la valeur de GOMINING.

- Applications dans l’écosystème : La plateforme GoMining peut élargir ses services ou s’intégrer à d’autres projets blockchain, renforçant l’utilité et la valeur du token.

III. Prévisions du prix GOMINING 2025-2030

Prévisions 2025

- Scénario conservateur : 0,27785 $ - 0,35000 $

- Scénario neutre : 0,35000 $ - 0,41470 $

- Scénario optimiste : 0,41470 $ - 0,47276 $ (dépend d’un sentiment de marché positif et d’une adoption accrue)

Prévisions 2027-2028

- Phase attendue : Croissance potentielle avec volatilité accrue

- Fourchette de prix prévue :

- 2027 : 0,28514 $ - 0,52955 $

- 2028 : 0,46161 $ - 0,69242 $

- Facteurs clés : Innovations technologiques, adoption sectorielle étendue, clarification réglementaire

Prévisions long terme 2029-2030

- Scénario de base : 0,59175 $ - 0,70714 $ (croissance et adoption constantes)

- Scénario optimiste : 0,70714 $ - 0,82253 $ (forte performance et utilité accrue)

- Scénario transformateur : 0,82253 $ - 1,03949 $ (applications de rupture et intégration massive)

- 31 décembre 2030 : GOMINING 1,03949 $ (pic potentiel selon les projections optimistes)

| Année | Prix max prévisionnel | Prix moyen prévisionnel | Prix min prévisionnel | Variation (%) |

|---|---|---|---|---|

| 2025 | 0,47276 | 0,4147 | 0,27785 | 0 |

| 2026 | 0,46148 | 0,44373 | 0,42154 | 7 |

| 2027 | 0,52955 | 0,4526 | 0,28514 | 9 |

| 2028 | 0,69242 | 0,49107 | 0,46161 | 18 |

| 2029 | 0,82253 | 0,59175 | 0,36688 | 42 |

| 2030 | 1,03949 | 0,70714 | 0,51621 | 70 |

IV. Stratégies d’investissement et gestion des risques pour GOMINING

Méthodologie d’investissement GOMINING

(1) Stratégie de détention long terme

- Pour : Investisseurs prudents souhaitant une exposition au minage Bitcoin

- Recommandations :

- Accumuler des tokens GOMINING lors des corrections de marché

- Participer au staking pour générer des récompenses

- Conserver les tokens dans un portefeuille sécurisé

(2) Stratégie de trading actif

- Outils techniques :

- Moyennes mobiles : Détecter la tendance et les possibles retournements

- Relative Strength Index (RSI) : Suivre les zones de surachat/survente

- Points-clés pour le swing trading :

- Définir précisément les points d’entrée et de sortie selon les indicateurs

- Surveiller le cours du Bitcoin, qui influence la valeur du token GOMINING

Cadre de gestion des risques GOMINING

(1) Principes d’allocation d’actifs

- Investisseur prudent : 1-3 % du portefeuille crypto

- Investisseur dynamique : 5-10 % du portefeuille crypto

- Investisseur professionnel : jusqu’à 15 % du portefeuille crypto

(2) Solutions de couverture

- Diversification : Répartir les investissements sur plusieurs projets de minage crypto

- Ordres stop-loss : Limiter les pertes potentielles

(3) Solutions de stockage sécurisé

- Hot wallet recommandé : Gate Web3 Wallet

- Stockage à froid : portefeuille matériel pour la conservation longue durée

- Sécurité : Activer l’authentification à deux facteurs, choisir des mots de passe robustes

V. Risques et défis potentiels pour GOMINING

Risques de marché GOMINING

- Volatilité du Bitcoin : impact direct sur la rentabilité du minage

- Concurrence : difficulté croissante du minage Bitcoin

- Coûts énergétiques : fluctuations influant sur la rentabilité

Risques réglementaires GOMINING

- Restrictions : potentielle répression gouvernementale du minage crypto

- Environnement : surveillance renforcée de la consommation énergétique

- Classification du token : incertitudes réglementaires sur le statut utilitaire

Risques techniques GOMINING

- Vulnérabilité des smart contracts : risques de bugs ou d’exploits

- Congestion du réseau : difficultés sur le réseau Ethereum affectant les transactions

- Obsolescence matérielle : besoin de mises à niveau fréquentes avec les progrès technologiques

VI. Conclusion et recommandations

Évaluation de la valeur d’investissement GOMINING

GOMINING permet d’accéder au minage Bitcoin via un token utilitaire, offrant un potentiel de valorisation à long terme, lié à la croissance du secteur. Les risques à court terme demeurent : volatilité du marché et incertitudes réglementaires.

Recommandations d’investissement GOMINING

✅ Débutants : Optez pour une allocation modérée dans un portefeuille crypto diversifié ✅ Investisseurs expérimentés : Profitez du staking et suivez les tendances du minage ✅ Institutionnels : Intégrez GOMINING dans une stratégie globale d’exposition au minage crypto

Modalités de participation à GOMINING

- Achat de tokens : disponible sur Gate.com

- Staking : accès à des programmes de récompenses

- Objets NFT : découvrez les mineurs numériques liés à la puissance réelle de minage Bitcoin

L’investissement en cryptomonnaies comporte des risques élevés. Cet article ne constitue pas un conseil financier. Prenez vos décisions selon votre propre tolérance au risque et consultez un professionnel. N’investissez jamais plus que ce que vous pouvez perdre.

FAQ

Quelle est la valeur du token GOMINING ?

En octobre 2025, le token GOMINING vaut environ 0,85 $. Ce prix reflète les tendances du marché et l’adoption croissante dans l’écosystème Web3.

DOGE atteindra-t-il 10 $ ?

À court terme, cela reste peu probable. DOGE pourrait atteindre 10 $ à long terme en cas d’adoption massive et de croissance du marché, sous réserve d’une forte expansion de la capitalisation et d’un intérêt soutenu des investisseurs.

Peut-on vendre des tokens GOMINING ?

Oui, les tokens GOMINING sont négociables sur plusieurs plateformes d’échange crypto. Vous pouvez les échanger contre d’autres cryptos ou des monnaies fiduciaires.

Quelle cryptomonnaie présente la plus forte prévision de prix ?

Le Bitcoin (BTC) reste la cryptomonnaie avec les prévisions de prix les plus élevées, certains analystes anticipant une valorisation à six chiffres d’ici 2030.

Qu'est-ce que le BTC : Guide complet de la toute première cryptomonnaie

Comment l’analyse des données on-chain permet-elle de prévoir l’évolution du cours du Bitcoin en 2025 ?

Les meilleurs ASIC Miners pour une rentabilité optimale

Dispositifs ASIC pour optimiser le minage de cryptomonnaies

pBTC35A (PBTC35A) est-il un investissement pertinent ? Analyse des risques et des perspectives de rendement de ce token adossé au Bitcoin

Découvrez le prix initial du Bitcoin en 2009 : un voyage à travers l’histoire de la crypto

Guide essentiel des Initial Coin Offerings (ICO)

Guide de participation à l’Airdrop et de réclamation des récompenses