Prediksi Harga SLAY 2025: Apakah Token Gaming Ini Akan Mencapai Level Tertinggi di Ekonomi Metaverse?

Pendahuluan: Posisi Pasar dan Nilai Investasi SLAY

SatLayer (SLAY) telah menempatkan dirinya sebagai lapisan ekonomi utama untuk Bitcoin sejak awal peluncurannya. Pada tahun 2025, kapitalisasi pasar SLAY telah mencapai $11.720.940 dengan jumlah token beredar sekitar 462.000.000 dan harga di kisaran $0,02537. Aset ini, yang dijuluki sebagai Bitcoin's programmable collateral, berperan semakin penting dalam mengubah BTC menjadi aset produktif untuk AI, DeFi, RWA, stablecoin, hingga keuangan tradisional.

Artikel ini menyajikan analisis mendalam terhadap tren harga SLAY dari 2025 hingga 2030, menggabungkan data historis, dinamika suplai dan permintaan, perkembangan ekosistem, serta faktor makroekonomi untuk memberikan prediksi harga profesional dan strategi investasi yang aplikatif bagi investor.

I. Tinjauan Sejarah Harga dan Status Pasar Terkini SLAY

Perkembangan Harga Historis SLAY

- 11 Agustus 2025: SLAY menembus harga tertinggi sepanjang masa di $0,13933, menjadi pencapaian penting bagi proyek ini

- 4 September 2025: Harga jatuh ke titik terendah sepanjang masa di $0,01491, menandakan koreksi pasar yang besar

- Oktober 2025: SLAY mengalami volatilitas tinggi, dengan harga bergerak di antara titik tertinggi dan terendah historis

Kondisi Pasar SLAY Terkini

Pada 8 Oktober 2025, SLAY diperdagangkan pada harga $0,02537, turun tajam 11,29% dalam 24 jam terakhir. Kapitalisasi pasar token ini sebesar $11.720.940, menempatkannya di peringkat 1.340 di pasar kripto global. Jumlah token beredar mencapai 462.000.000, setara dengan 21% dari total pasokan sebesar 2.100.000.000. Kapitalisasi pasar terdilusi penuh berada di $53.277.000.

SLAY mencatat tren harga negatif di berbagai periode waktu:

- 1 jam: -0,38%

- 24 jam: -11,29%

- 7 hari: -0,94%

- 30 hari: -16,24%

- 1 tahun: -76,32%

Data ini menunjukkan sentimen bearish baik jangka pendek maupun panjang. SLAY saat ini diperdagangkan 81,78% di bawah harga tertinggi sepanjang masa, mengindikasikan penurunan performa pasar yang signifikan.

Klik untuk melihat harga pasar SLAY terkini

Indikator Sentimen Pasar SLAY

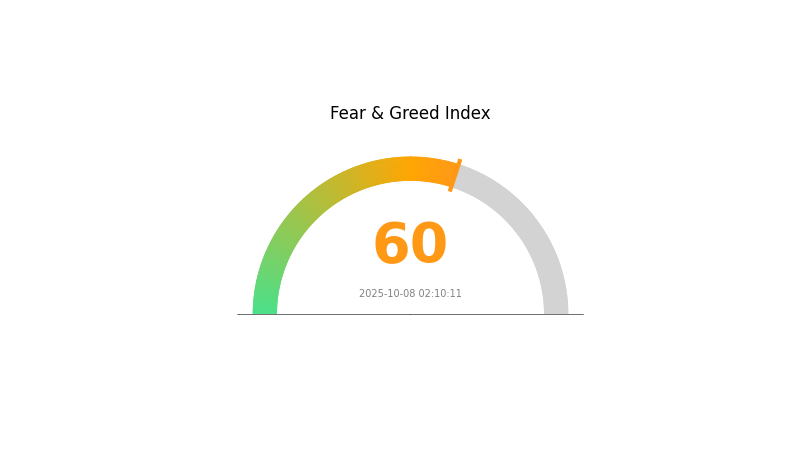

08-10-2025 Indeks Ketakutan dan Keserakahan: 60 (Keserakahan)

Klik untuk melihat Indeks Ketakutan & Keserakahan saat ini

Pasar kripto menunjukkan gejala keserakahan, dengan Indeks Ketakutan dan Keserakahan di angka 60. Hal ini menggambarkan optimisme investor, kemungkinan dipicu oleh perkembangan positif atau sentimen bullish. Namun, investor harus tetap berhati-hati karena tingkat keserakahan yang tinggi bisa memicu overvaluasi dan volatilitas. Diversifikasikan portofolio dan tetapkan stop-loss untuk mengelola risiko. Lakukan riset mendalam dan pastikan batas risiko sebelum mengambil keputusan investasi di pasar yang dinamis ini.

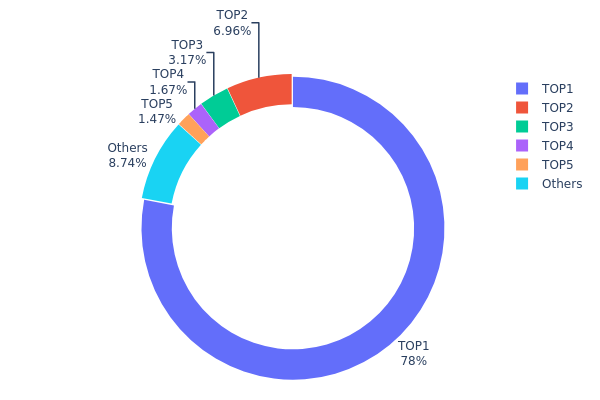

Distribusi Kepemilikan SLAY

Distribusi kepemilikan alamat SLAY sangat terpusat. Alamat utama menguasai 78% dari total pasokan, menunjukkan dominasi kontrol yang besar. Empat pemegang terbesar berikutnya secara kolektif menguasai 13,24% tambahan, sehingga total kepemilikan lima alamat teratas mencapai 91,24% dari seluruh token SLAY.

Konsentrasi kepemilikan yang ekstrem meningkatkan risiko manipulasi pasar dan volatilitas harga. Dengan sebagian besar token dikuasai oleh segelintir pihak, potensi terjadinya penjualan besar-besaran atau tekanan beli tiba-tiba makin tinggi, sehingga harga bisa bergerak dramatis. Sentralisasi semacam ini juga berpotensi menurunkan prinsip desentralisasi yang biasa diusung proyek kripto.

Struktur distribusi saat ini mengindikasikan stabilitas on-chain yang rendah dan risiko dominasi pasar oleh entitas terbatas cukup tinggi. Konsentrasi kepemilikan dapat menurunkan minat investor yang mengutamakan prinsip keadilan pasar dan bisa memengaruhi keberlanjutan serta adopsi ekosistem SLAY ke depan.

Klik untuk melihat Distribusi Kepemilikan SLAY terkini

| Top | Alamat | Jumlah Kepemilikan | Kepemilikan (%) |

|---|---|---|---|

| 1 | 0xb2bd...6379ec | 1.638.000,00K | 78,00% |

| 2 | 0x89da...f99edb | 146.063,45K | 6,95% |

| 3 | 0x96a2...d53d18 | 66.575,23K | 3,17% |

| 4 | 0x7391...38a2a6 | 35.000,01K | 1,66% |

| 5 | 0x6054...59b36f | 30.789,26K | 1,46% |

| - | Lainnya | 183.572,05K | 8,76% |

II. Faktor-Faktor Utama yang Mempengaruhi Harga SLAY di Masa Depan

Lingkungan Makroekonomi

- Dampak Kebijakan Moneter: Kebijakan bank sentral dan penentuan suku bunga akan sangat memengaruhi pergerakan harga SLAY.

- Peran Lindung Nilai Inflasi: Performa SLAY sebagai aset pelindung nilai inflasi menjadi perhatian utama di ekonomi saat ini.

- Faktor Geopolitik: Ketegangan internasional dan peristiwa global dapat memengaruhi persepsi nilai SLAY sebagai aset pelindung nilai.

Pengembangan Teknologi dan Ekosistem

- Aplikasi Ekosistem: Perkembangan dan adopsi DApp serta proyek jaringan di SLAY menjadi penentu utama nilai jangka panjangnya.

III. Prediksi Harga SLAY 2025-2030

Proyeksi 2025

- Prediksi konservatif: $0,02183 - $0,02509

- Prediksi netral: $0,02509 - $0,02948

- Prediksi optimis: $0,02948 - $0,03387 (memerlukan pemulihan pasar signifikan)

Proyeksi 2027-2028

- Ekspektasi fase pasar: Potensi fase pertumbuhan dan peningkatan adopsi

- Rentang harga yang diperkirakan:

- 2027: $0,02245 - $0,0407

- 2028: $0,03372 - $0,0557

- Pemicu utama: Kemajuan teknologi dan pemulihan pasar kripto secara global

Proyeksi Jangka Panjang 2029-2030

- Skenario dasar: $0,04679 - $0,05147 (asumsi pertumbuhan pasar stabil)

- Skenario optimis: $0,05615 - $0,07463 (dengan adopsi yang dipercepat dan kondisi pasar mendukung)

- Skenario transformatif: $0,07463+ (jika terjadi terobosan use case dan integrasi mainstream)

- 31 Desember 2030: SLAY $0,07463 (potensi puncak berdasarkan proyeksi optimis)

| Tahun | Prediksi Harga Tertinggi | Prediksi Harga Rata-rata | Prediksi Harga Terendah | Perubahan (%) |

|---|---|---|---|---|

| 2025 | 0,03387 | 0,02509 | 0,02183 | -1 |

| 2026 | 0,04068 | 0,02948 | 0,02771 | 16 |

| 2027 | 0,0407 | 0,03508 | 0,02245 | 38 |

| 2028 | 0,0557 | 0,03789 | 0,03372 | 49 |

| 2029 | 0,05615 | 0,04679 | 0,03463 | 84 |

| 2030 | 0,07463 | 0,05147 | 0,04941 | 102 |

IV. Strategi Investasi dan Manajemen Risiko Profesional untuk SLAY

Metodologi Investasi SLAY

(1) Strategi Kepemilikan Jangka Panjang

- Cocok untuk: Investor dengan toleransi risiko tinggi dan keyakinan terhadap potensi jangka panjang Bitcoin

- Saran:

- Akumulasi token SLAY saat harga turun

- Tetapkan jangka waktu investasi panjang (minimal 3-5 tahun)

- Simpan token di dompet perangkat keras yang aman

(2) Strategi Trading Aktif

- Alat analisis teknikal:

- Moving Average: Untuk identifikasi tren dan titik masuk/keluar potensial

- Relative Strength Index (RSI): Memantau kondisi jenuh beli/jenuh jual

- Poin penting swing trading:

- Pantau pergerakan harga Bitcoin karena dapat berpengaruh ke SLAY

- Set stop-loss ketat untuk membatasi risiko penurunan

Kerangka Manajemen Risiko SLAY

(1) Prinsip Alokasi Aset

- Investor konservatif: 1-3% dari portofolio kripto

- Investor agresif: 5-10% dari portofolio kripto

- Investor profesional: Hingga 15% dari portofolio kripto

(2) Solusi Hedging Risiko

- Diversifikasi: Investasi di berbagai aset kripto

- Stop-loss order: Implementasi untuk membatasi kerugian

(3) Solusi Penyimpanan Aman

- Rekomendasi dompet panas: Gate Web3 Wallet

- Penyimpanan dingin: Gunakan dompet perangkat keras untuk penyimpanan jangka panjang

- Keamanan: Aktifkan autentikasi dua faktor, gunakan password kuat, dan rutin memperbarui perangkat lunak

V. Potensi Risiko dan Tantangan SLAY

Risiko Pasar SLAY

- Volatilitas tinggi: Harga SLAY cenderung fluktuatif

- Risiko likuiditas: Volume perdagangan terbatas bisa memengaruhi likuiditas posisi

- Korelasi dengan Bitcoin: Kinerja SLAY sangat dipengaruhi harga Bitcoin

Risiko Regulasi SLAY

- Regulasi tidak pasti: Potensi peningkatan pengawasan proyek berbasis Bitcoin

- Tantangan kepatuhan: Perubahan regulasi dapat memengaruhi operasional atau status token SLAY

- Pembatasan lintas negara: Regulasi berbeda di tiap yurisdiksi dapat membatasi adopsi global

Risiko Teknis SLAY

- Kerentanan smart contract: Potensi eksploitasi di kode inti

- Tantangan skalabilitas: Keterbatasan dalam menangani volume transaksi tinggi

- Kompleksitas integrasi: Kesulitan menghubungkan ke berbagai protokol DeFi dan sistem keuangan tradisional

VI. Kesimpulan dan Rekomendasi Tindakan

Penilaian Nilai Investasi SLAY

SLAY menawarkan peluang unik memanfaatkan potensi Bitcoin di sektor DeFi. Meski memiliki prospek pertumbuhan jangka panjang, volatilitas jangka pendek dan ketidakpastian regulasi masih menjadi tantangan utama.

Rekomendasi Investasi SLAY

- Pemula: Mulai dari nominal kecil dan fokus pada edukasi Bitcoin dan DeFi

- Investor berpengalaman: Alokasikan sebagian portofolio kripto ke SLAY, tetap prioritaskan diversifikasi

- Investor institusi: Lakukan uji kelayakan menyeluruh dan pertimbangkan SLAY sebagai bagian dari strategi Bitcoin-focused

Metode Partisipasi SLAY

- Spot trading: Beli SLAY di Gate.com

- Partisipasi DeFi: Eksplorasi peluang staking atau penyediaan likuiditas yang tersedia

- Akumulasi jangka panjang: Atur rencana pembelian berkala untuk mengakumulasi SLAY

Investasi kripto sangat berisiko tinggi, dan artikel ini bukan merupakan saran investasi. Investor harus mengambil keputusan secara cermat sesuai batas risiko masing-masing dan disarankan untuk berkonsultasi dengan penasihat keuangan profesional. Jangan pernah berinvestasi lebih dari yang mampu Anda tanggung kehilangannya.

Bagikan

Konten