# PreciousMetalsPullBack

23.05K

Risk assets fell overnight. Gold slid $300 to $5,155/oz, and silver dropped up to 8% to $108.23/oz. Are you buying the dip or cutting exposure? Share your Gate TradFi metals strategy!

MrFlower_

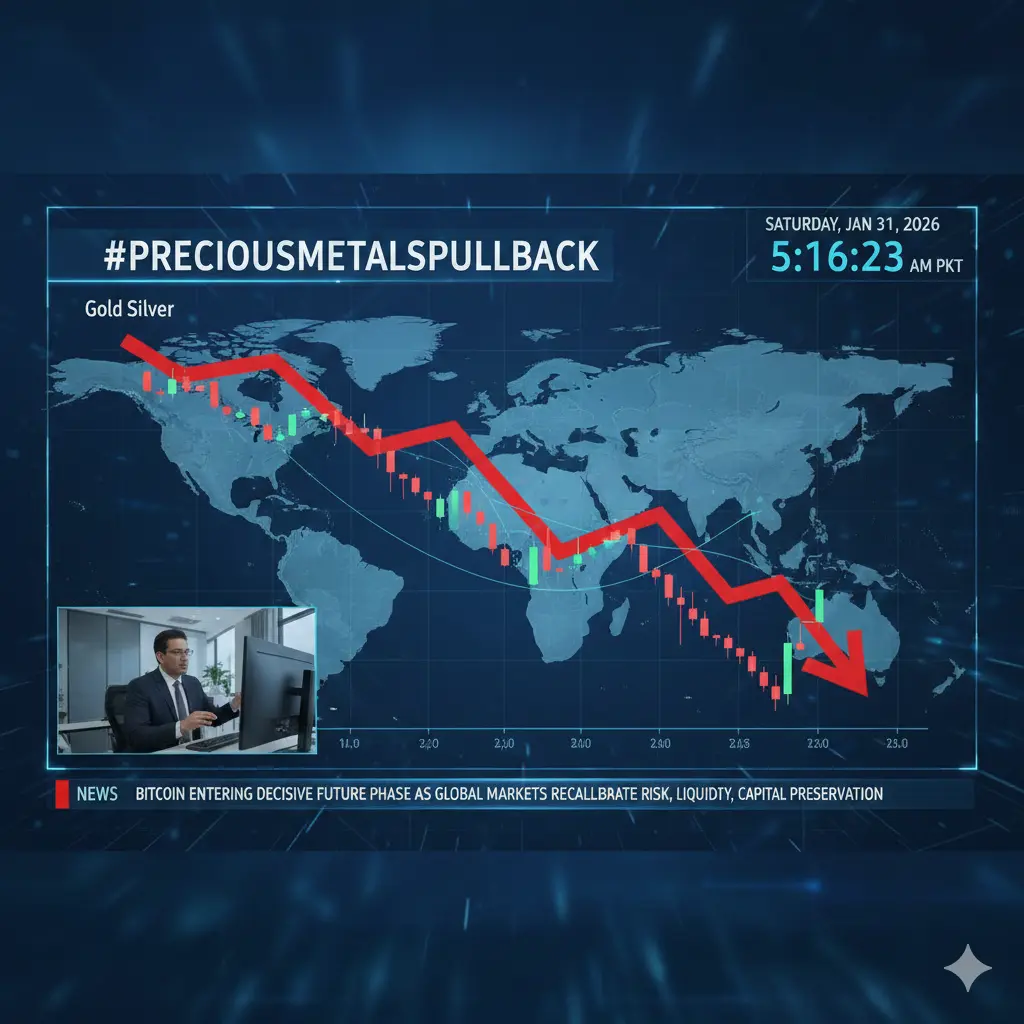

#PreciousMetalsPullBack Bitcoin is entering a decisive future phase as global markets continue to recalibrate around risk, liquidity, and capital preservation. While price action has stabilized compared to the violent January selloff, the market is still struggling to regain conviction. Buyers remain cautious, rallies are being sold into quickly, and overall participation feels selective rather than broad. This reflects a market that is no longer driven by hype, but by macro alignment — and that alignment has yet to fully materialize.

The broader macro backdrop continues to weigh heavily on Bi

The broader macro backdrop continues to weigh heavily on Bi

BTC-0,2%

- Reward

- like

- Comment

- Repost

- Share

#PreciousMetalsPullBack Bitcoin is entering a decisive future phase as global markets continue to recalibrate around risk, liquidity, and capital preservation. While price action has stabilized compared to the violent January selloff, the market is still struggling to regain conviction. Buyers remain cautious, rallies are being sold into quickly, and overall participation feels selective rather than broad. This reflects a market that is no longer driven by hype, but by macro alignment — and that alignment has yet to fully materialize.

The broader macro backdrop continues to weigh heavily on Bi

The broader macro backdrop continues to weigh heavily on Bi

BTC-0,2%

- Reward

- 1

- Comment

- Repost

- Share

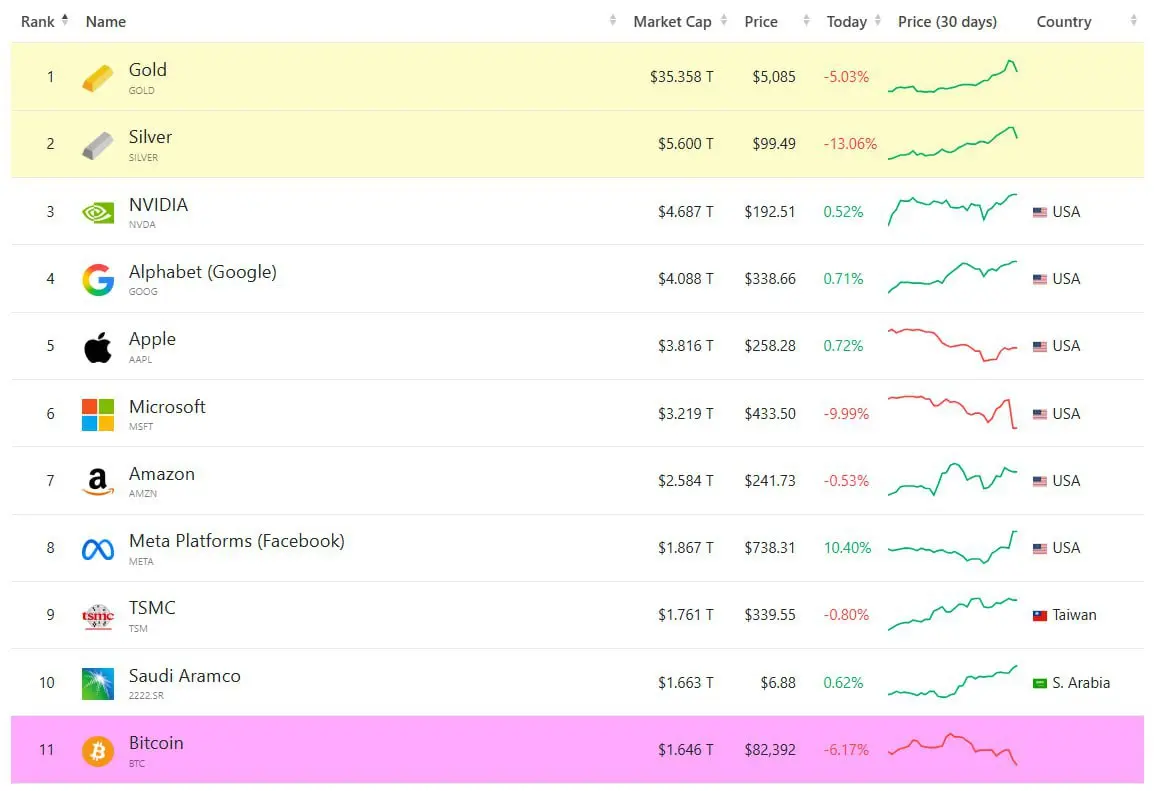

Insane volatility In the last 24 hours:

In the last 24 hours:

Gold: −10.9%, erased $4.1 Trillion

Silver: −21.5%, erased $1.4 Trillion

Copper: −10.3%, erased $40 Billion

Palladium: –20%, erased 65 Billion

Platinum: –23%, erased 143 Billion

S&P 500: −0.6%, erased $380 Billion

Nasdaq: −1.2%, erased $480 Billion

Russell 2000: −0.76%, erased $25 Billion

Bitcoin: −6.6%, erased $108 Billion

Ethereum: −7.5%, erased $25 Billion

Over $6.5 TRILLION erased across metals, equities, and crypto in a single day.#BTC #PreciousMetalsPullBack

In the last 24 hours:

Gold: −10.9%, erased $4.1 Trillion

Silver: −21.5%, erased $1.4 Trillion

Copper: −10.3%, erased $40 Billion

Palladium: –20%, erased 65 Billion

Platinum: –23%, erased 143 Billion

S&P 500: −0.6%, erased $380 Billion

Nasdaq: −1.2%, erased $480 Billion

Russell 2000: −0.76%, erased $25 Billion

Bitcoin: −6.6%, erased $108 Billion

Ethereum: −7.5%, erased $25 Billion

Over $6.5 TRILLION erased across metals, equities, and crypto in a single day.#BTC #PreciousMetalsPullBack

- Reward

- like

- 1

- Repost

- Share

GateUser-7f8f5af5 :

:

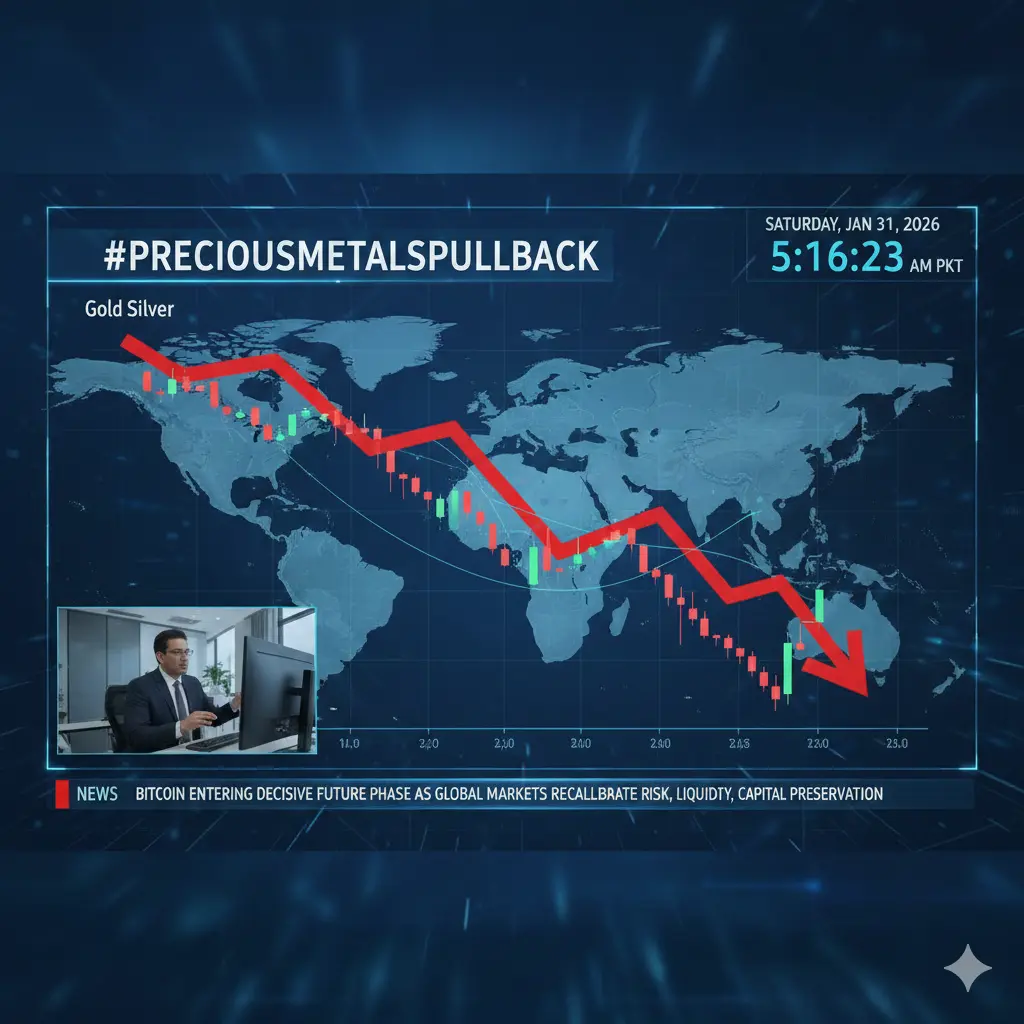

whether the United Kingdom Rushanara Ali Ahmed Palak placedGlobal Central Bank Reserves Are Quietly Shifting — and Bitcoin Has Entered the Conversation

For decades, central bank reserves were effectively a two-asset system.

Gold served as the long-term store of value.

The U.S. dollar functioned as the global liquidity anchor.

The chart above shows how that balance evolved over time. Gold’s dominance declined after the 1970s, while dollar reserves expanded as global trade and financial markets became dollar-centric. That structure held for years, even through multiple crises.

What is changing now is not the size of Bitcoin in reserves, but its existenc

For decades, central bank reserves were effectively a two-asset system.

Gold served as the long-term store of value.

The U.S. dollar functioned as the global liquidity anchor.

The chart above shows how that balance evolved over time. Gold’s dominance declined after the 1970s, while dollar reserves expanded as global trade and financial markets became dollar-centric. That structure held for years, even through multiple crises.

What is changing now is not the size of Bitcoin in reserves, but its existenc

BTC-0,2%

- Reward

- 2

- Comment

- Repost

- Share

🚨 Crypto Market Wiped Out Overnight! 🚨

💥 Total crypto market cap crashes below $3 TRILLION

📉 Crypto-related stocks dump nearly 10% in one session

This wasn’t noise — it was a liquidity shock.

Leverage flushed. Weak hands shaken. Fear activated.

But here’s the truth traders miss 👇

🔥 Extreme fear = future opportunity forming

🧠 Smart money watches, waits, and prepares

Markets don’t end in panic —

They reset before the next big move 💣

Follow for real market structure, not hype 💎

The next trend rewards the prepared, not the emotional ❤️#PreciousMetalsPullBack $BTC

💥 Total crypto market cap crashes below $3 TRILLION

📉 Crypto-related stocks dump nearly 10% in one session

This wasn’t noise — it was a liquidity shock.

Leverage flushed. Weak hands shaken. Fear activated.

But here’s the truth traders miss 👇

🔥 Extreme fear = future opportunity forming

🧠 Smart money watches, waits, and prepares

Markets don’t end in panic —

They reset before the next big move 💣

Follow for real market structure, not hype 💎

The next trend rewards the prepared, not the emotional ❤️#PreciousMetalsPullBack $BTC

BTC-0,2%

- Reward

- 2

- Comment

- Repost

- Share

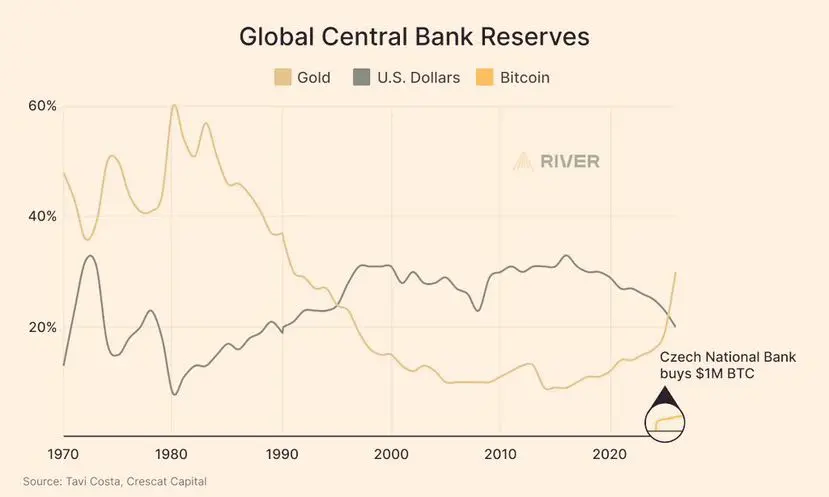

$BTC Bitcoin is no longer in the top 10 global assets by market cap, currently ranked 11th.

Crypto Market Update:

The market is still moving slowly, and honestly, it feels a bit dull right now. BTC is stuck around the $88k–$89k zone and continues to struggle with momentum. No strong breakout, no major breakdown — just a lot of sideways movement.

ETH and most altcoins are also following the same pattern, holding key levels but lacking volume and conviction. Right now, traders are being cautious, waiting for a clear trigger before making bigger moves.

This phase can test patience, but these q

Crypto Market Update:

The market is still moving slowly, and honestly, it feels a bit dull right now. BTC is stuck around the $88k–$89k zone and continues to struggle with momentum. No strong breakout, no major breakdown — just a lot of sideways movement.

ETH and most altcoins are also following the same pattern, holding key levels but lacking volume and conviction. Right now, traders are being cautious, waiting for a clear trigger before making bigger moves.

This phase can test patience, but these q

BTC-0,2%

- Reward

- 2

- 1

- Repost

- Share

Apollo123 :

:

☺️😅😜😅😚😚😚😚😅😅😜😅😜☺️☺️☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️😜☺️☺️😜☺️☺️😜☺️😜☺️☺️😜☺️😜☺️☺️#PreciousMetalsPullBack Bitcoin continues to face heavy pressure as global markets move deeper into a risk-off phase. After dropping sharply on January 29, BTC fell to an intraday low near $83,383, marking its weakest level since November. Although a minor bounce followed, Bitcoin remains trapped in the $84,000–$85,000 range, representing a 33% decline from the October peak near $126,000.

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

The recent downturn is not driven by crypto alone but by a broader shift in global capital flows. Over the past week, Bitcoin spot ETFs recorded five consecutive days of outflows totaling more than $1.1 billi

BTC-0,2%

- Reward

- 8

- 5

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

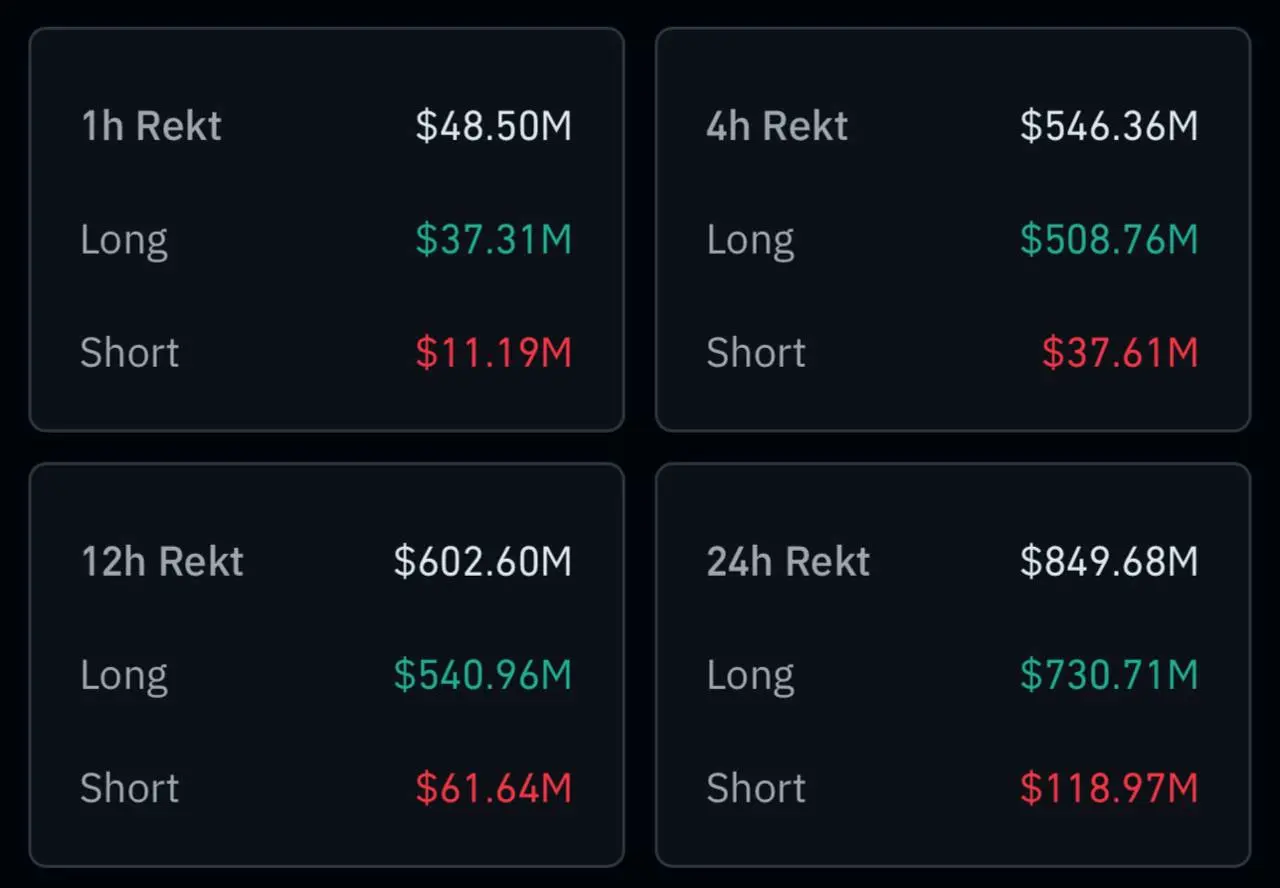

According to Coinglass data, $508,760,000 in LONG positions were liquidated in 4 hours.

BTC below $84,000.

#PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta

BTC below $84,000.

#PreciousMetalsPullBack #GateLiveMiningProgramPublicBeta

BTC-0,2%

- Reward

- 1

- 1

- Repost

- Share

DragonFlyOfficial :

:

Happy New Year! 🤑#PreciousMetalsPullBack 1. The "Dual Engine" Demand

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

Unlike gold, which is primarily a monetary hedge, silver’s value in 2026 is being driven by a powerful "dual engine":

Industrial Scarcity: With silver prices breaking past $100/oz earlier this year, the demand from green tech (solar PVs alone consume ~125 Moz annually) and AI data centers has created a persistent supply deficit.

Monetary Hedge: As gold nears $5,000/oz, tokenized silver has become the "high-beta" alternative for investors looking for safe-haven protection with more aggressive upside.

2. Tokenization as a De-correlator

Traditio

DEFI-3,85%

- Reward

- 6

- 11

- Repost

- Share

AngelEye :

:

Buy To Earn 💎View More

#PreciousMetalsPullBack #贵金属行情下跌 #贵金属巨震 Markets reminded everyone of a brutal truth today: there is no such thing as a one-way trade.

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

BTC and ETH collapsed hard.

Altcoins didn’t “correct” — they bled.

US equities slid in unison, risk appetite vanished overnight.

And while crypto traders panicked, gold did something far more dangerous — it shook out weak hands.

Gold plunged nearly $300 to $5,155/oz, silver dropped up to 8% to $108.23/oz.

This wasn’t a random dip. This was forced liquidation + leverage unwind after weeks of crowded long positioning.

Let’s be clear:

If you think this move means “

- Reward

- 5

- 2

- Repost

- Share

ybaser :

:

very good information to readView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

23.05K Popularity

36.8K Popularity

357.12K Popularity

34.84K Popularity

52.27K Popularity

6.58K Popularity

20.98K Popularity

11.19K Popularity

85.31K Popularity

31.13K Popularity

24.1K Popularity

25.15K Popularity

11.61K Popularity

17.94K Popularity

207.46K Popularity

News

View MoreBitwise Chief Investment Officer: Bitcoin will trade sideways between $75,000 and $100,000 in the first half of the year, with a long-term bullish target of $6.5 million

1 m

Data: If BTC drops below $79,995, the total long liquidation strength of mainstream CEXs will reach $1.834 billion.

6 m

Data: If ETH breaks through $2,842, the total liquidation strength of long positions on mainstream CEXs will reach $1.605 billion.

6 m

Today, the Fear & Greed Index rose to 20, indicating the market is in a "severely fearful state."

7 m

Tether's net profit in 2025 exceeds $10 billion, with gold reserves reaching $17.4 billion

14 m

Pin