StacyMuur

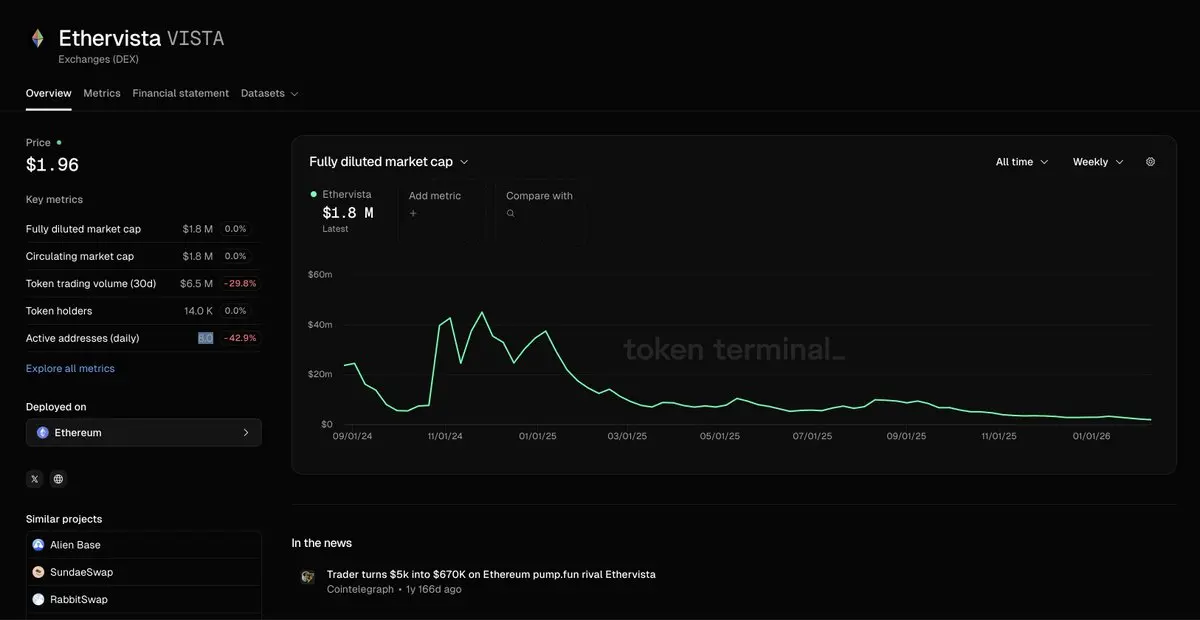

No content yet

StacyMuur

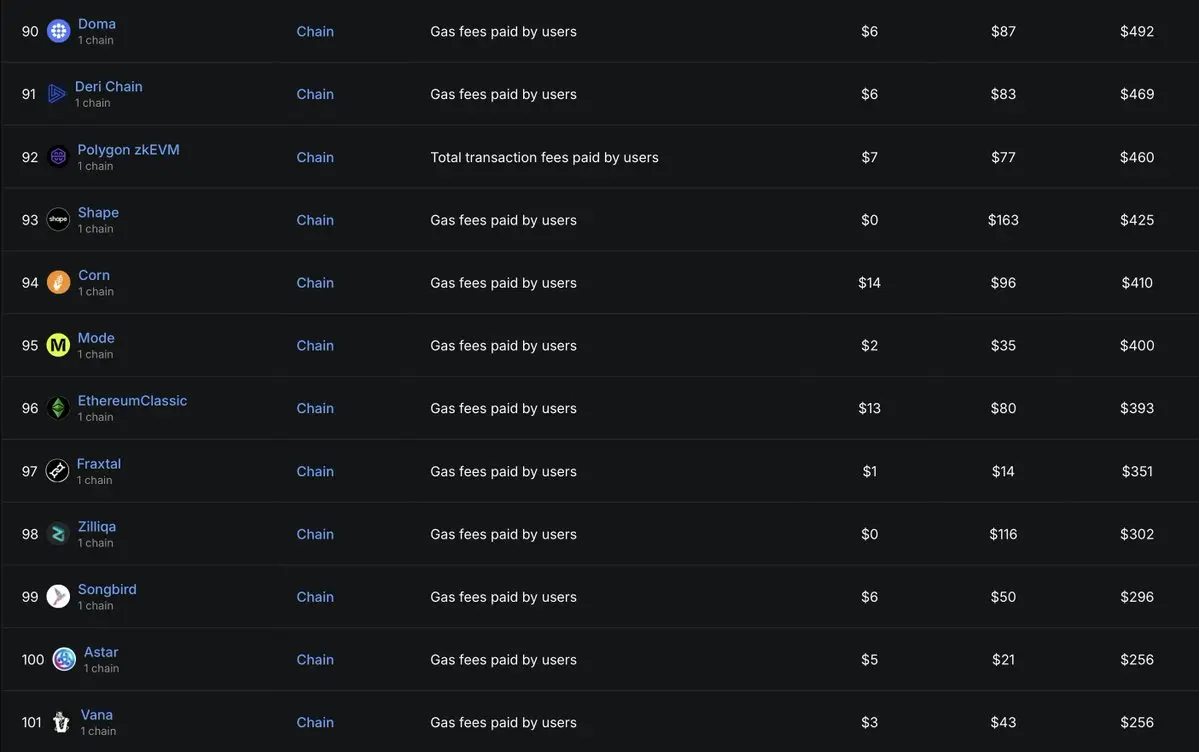

If you're seeking DeFi exposure, watch fees.

Top 10 lending protocols by 30d fees:

1/ Aave: $93.1M (+47.2%)

2/ Morpho: $11.3M (-16.7%)

3/ Maple Finance: $9.9M (+44.5%)

4/ Euler: $4.8M (-24.0%)

5/ Fluid: $4.9M (+2.8%)

6/ Spark: $4.0M (+0.3%)

7/ Venus: $3.3M (+95.4%)

8/ Jupiter Lend: $1.2M (+4.5%)

9/ Compound: $2.2M (-37.4%)

10/ Silo Finance: $542.6K (+25.3%)

The sector is doing $28.8B in active loans right now.

Down 22% from peak but fees are up 29.7% MoM.

Top 10 lending protocols by 30d fees:

1/ Aave: $93.1M (+47.2%)

2/ Morpho: $11.3M (-16.7%)

3/ Maple Finance: $9.9M (+44.5%)

4/ Euler: $4.8M (-24.0%)

5/ Fluid: $4.9M (+2.8%)

6/ Spark: $4.0M (+0.3%)

7/ Venus: $3.3M (+95.4%)

8/ Jupiter Lend: $1.2M (+4.5%)

9/ Compound: $2.2M (-37.4%)

10/ Silo Finance: $542.6K (+25.3%)

The sector is doing $28.8B in active loans right now.

Down 22% from peak but fees are up 29.7% MoM.

- Reward

- 2

- Comment

- Repost

- Share

Came across an interesting thing, pushing quantum-resistant crypto.

Yesterday, @HYLQstrategy acquired 18,333,334 $qONE in a strategic investment into @qlabsofficial.

Might be the first institutional bet on quantum-safe infrastructure on Hyperliquid.

Security is becoming the next narrative.

Yesterday, @HYLQstrategy acquired 18,333,334 $qONE in a strategic investment into @qlabsofficial.

Might be the first institutional bet on quantum-safe infrastructure on Hyperliquid.

Security is becoming the next narrative.

- Reward

- 1

- Comment

- Repost

- Share

Don't just reply with "rewrite" every time you don't like an AI answer.

Save these prompts for 10x productivity and accuracy.

Save these prompts for 10x productivity and accuracy.

- Reward

- like

- Comment

- Repost

- Share

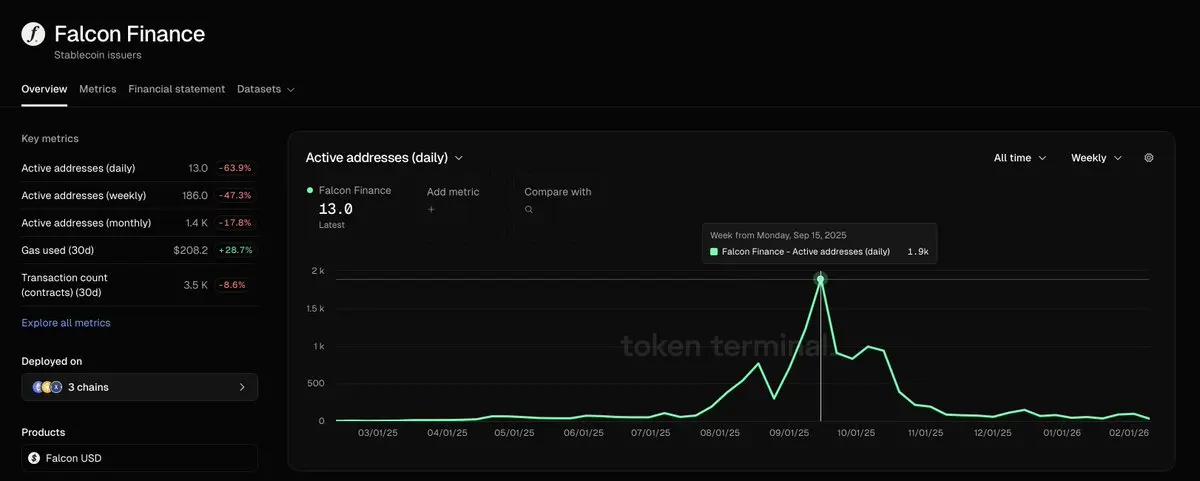

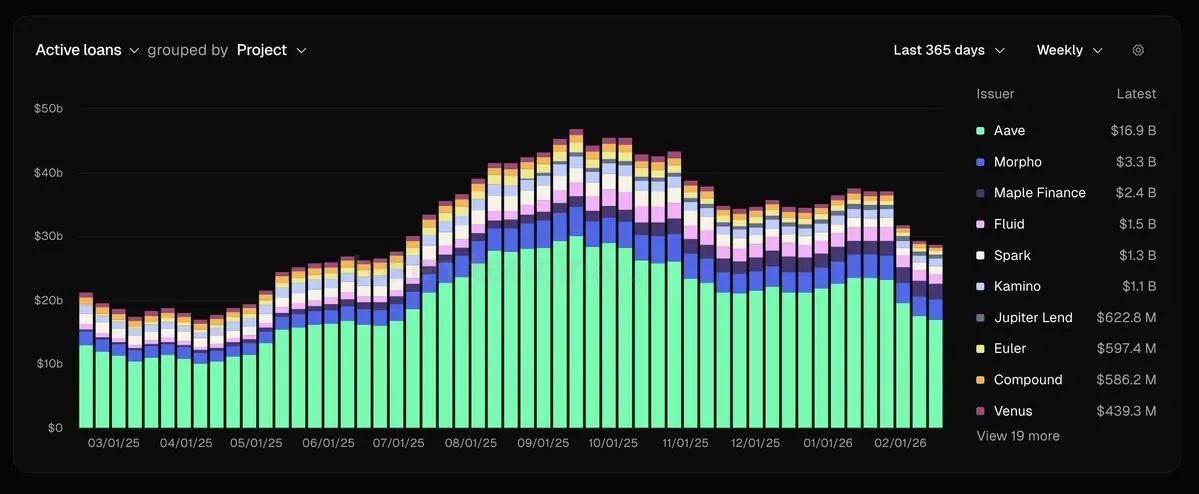

Oh wow

Your favorite @Aster_DEX:

• 6 daily active addresses

• 51 weekly

• 346 monthly

What went wrong, CZ?

Your favorite @Aster_DEX:

• 6 daily active addresses

• 51 weekly

• 346 monthly

What went wrong, CZ?

- Reward

- 1

- Comment

- Repost

- Share

Just saw the first LinkedIn post about OpenClaw.

We're cooked.

We're cooked.

- Reward

- like

- Comment

- Repost

- Share

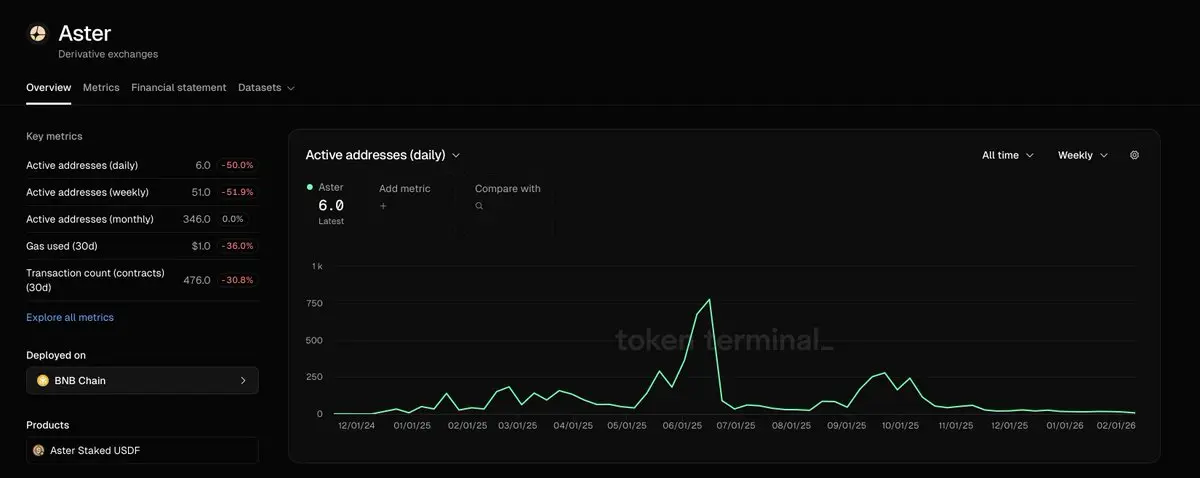

Lmao.

Ethervista (top-1 pump fun rival at some point) = 8 active addresses.

Ethervista (top-1 pump fun rival at some point) = 8 active addresses.

- Reward

- 2

- Comment

- Repost

- Share

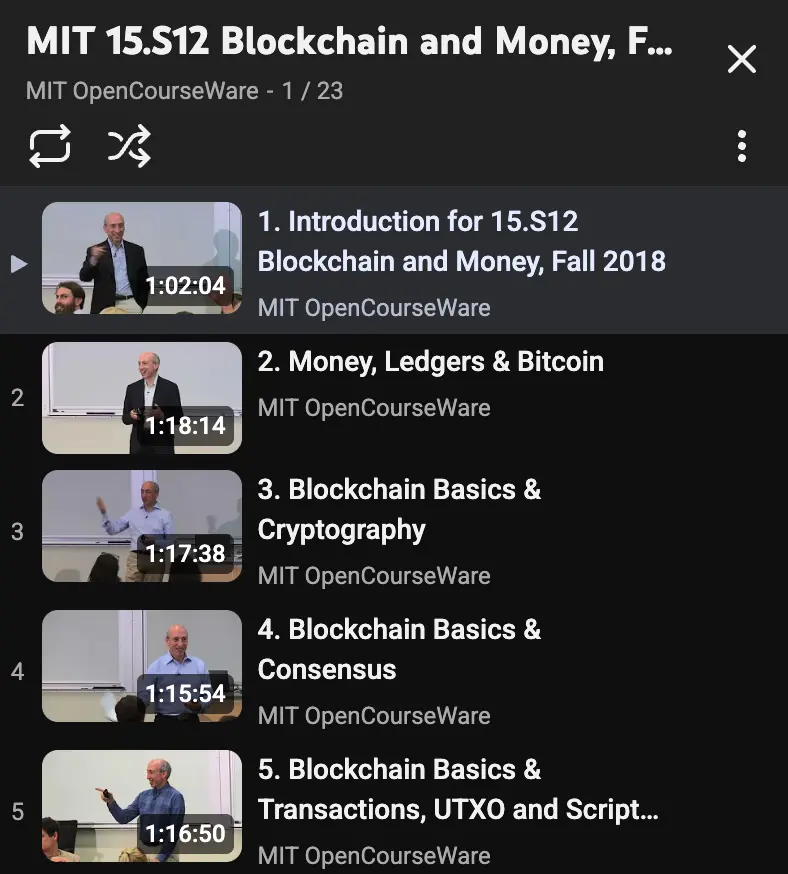

I still refuse to believe that Gary Gensler did a full 23-lesson course on blockchain for MIT

Was he really the bad guy?

Was he really the bad guy?

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 2

- Comment

- Repost

- Share

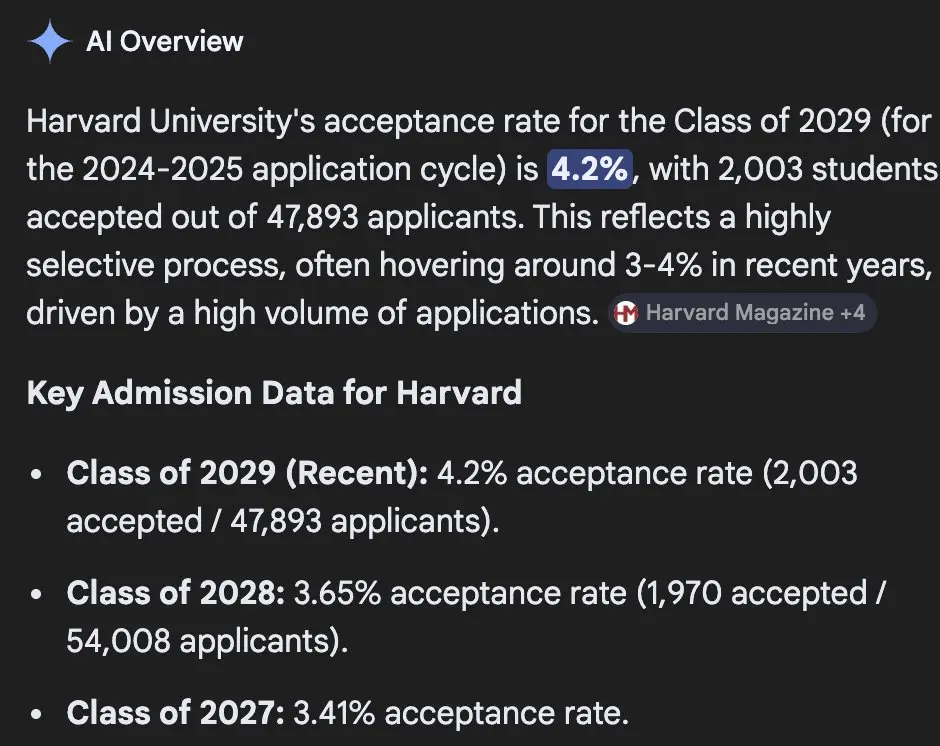

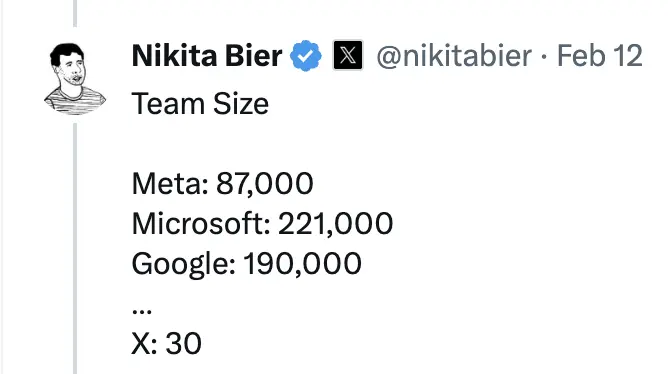

Not the flex you think it is

- Reward

- like

- Comment

- Repost

- Share

r/clawdbot

r/ClaudeAI

r/ClaudeCode

r/Futurology

r/AgentsOfAI

r/ArtificialInteligence

r/artificial

r/OpenAI

Don't thank me.

r/ClaudeAI

r/ClaudeCode

r/Futurology

r/AgentsOfAI

r/ArtificialInteligence

r/artificial

r/OpenAI

Don't thank me.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More287.09K Popularity

90.29K Popularity

412.3K Popularity

108.93K Popularity

16.04K Popularity

Pin