2025 AIL Fiyat Tahmini: Hızla Gelişen Piyasada Yapay Zekâ Tokenlerinin Geleceğini Şekillendirmek

Giriş: AIL'in Piyasa Konumu ve Yatırım Değeri

AILayer (AIL), Bitcoin üzerinde AI uygulamalarının kitlesel benimsenmesini amaçlayan ilk Layer 2 olarak, Web3 ve yapay zekanın entegrasyonunu kuruluşundan itibaren derinleştirmiştir. 2025 itibarıyla AIL'in piyasa değeri $40.239,67'ye ulaşırken, dolaşımda yaklaşık 127.704.437 token ve fiyatı $0,0003151 seviyesindedir. "AI-Web3 köprüsü" olarak tanımlanan bu varlık, yapay zekâ ile blokzincir teknolojisinin birleşiminde kritik bir rol üstleniyor.

Bu makalede, AIL'in 2025-2030 fiyat trendleri; geçmiş hareketler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik unsurlar üzerinden kapsamlı şekilde analiz edilerek, yatırımcılara profesyonel fiyat tahminleri ve pratik stratejiler sunulacaktır.

I. AIL Fiyat Tarihi İncelemesi ve Güncel Piyasa Durumu

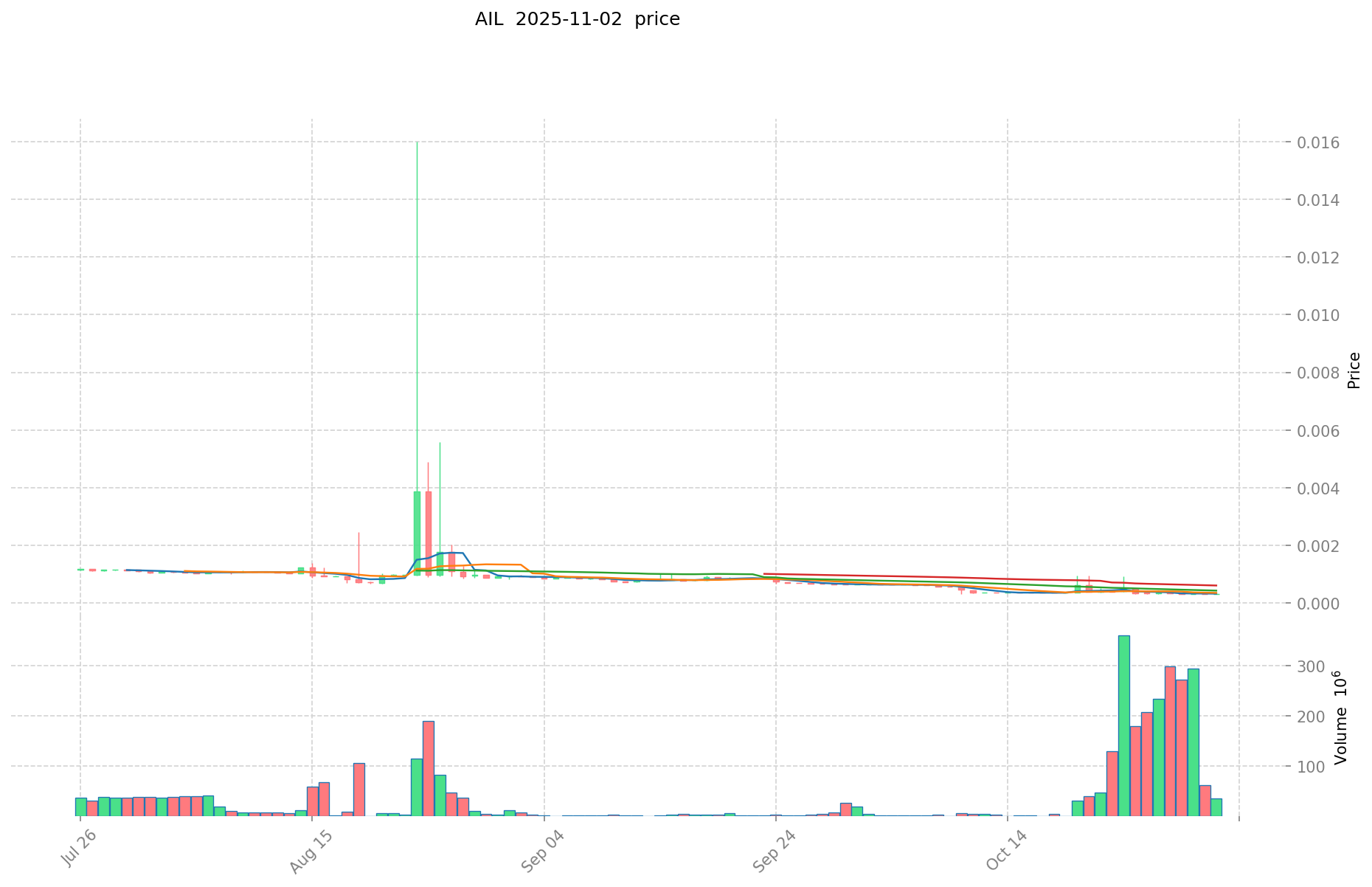

AIL Fiyatlarının Geçmişteki Değişimi

- 2025 (Mart): İlk lansman, fiyat tüm zamanların en yükseği $0,0999’a çıktı

- 2025 (Ekim): Piyasa düşüşüyle fiyat en düşük seviye olan $0,0003011’e geriledi

- 2025 (Kasım): Mevcut fiyat $0,0003151 civarında dengelendi

AIL Güncel Piyasa Durumu

3 Kasım 2025 itibarıyla AIL, $0,0003151 seviyesinden işlem görüyor ve 24 saatlik hacmi $10.293,47. Token son 24 saatte %0,25 artış gösterdi. Ancak, AIL uzun vadede ciddi değer kaybına uğradı; son bir haftada %15,82 ve son 30 günde %50,56 geriledi.

AIL'in piyasa değeri şu anda $40.239,67 ve kripto para piyasasında 6073. sırada. 127.704.437 dolaşımdaki AIL tokenı ve toplam 1.000.000.000 arz ile dolaşım oranı %12,77.

Tam seyreltilmiş piyasa değeri $315.100 olup, tüm tokenlar dolaşıma girerse büyüme potansiyeli sunmaktadır. AIL'in piyasa hakimiyeti %0,0000080 seviyesinde ve bu oran, ekosistemdeki yeni ve küçük konumunu yansıtıyor.

Güncel AIL piyasa fiyatını görmek için tıklayın

AIL Piyasa Duyarlılık Göstergesi

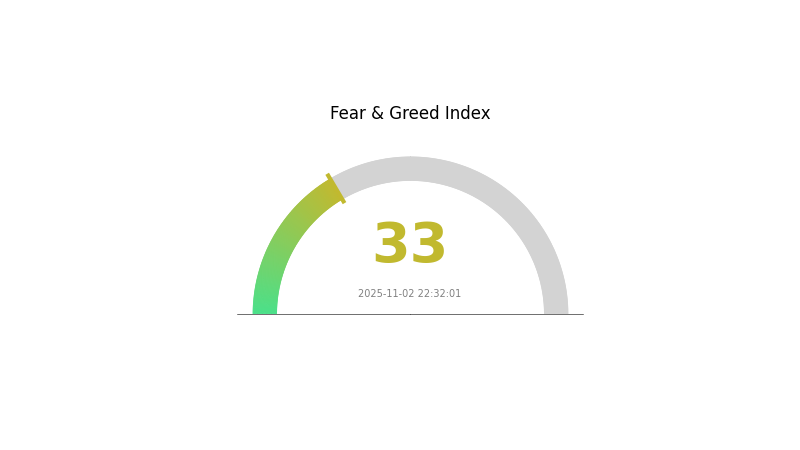

2025-11-02 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku & Açgözlülük Endeksi'ni görmek için tıklayın

Kripto piyasasında şu anda korku hakim; Korku ve Açgözlülük Endeksi 33 seviyesinde. Bu, yatırımcılarda temkinli bir hava olduğunu ve son dalgalanma veya olumsuz haberlerin etkili olabileceğini gösteriyor. Böyle zamanlarda, yatırımcıların dikkatli olması ve aceleci kararlar vermemesi gerekir. Korku bazıları için alım fırsatı sunabilir; yine de kapsamlı araştırma ve etkin risk yönetimi şarttır. Her koşulda, portföy çeşitlendirmesi ve uzun vadeli bakış açısı, belirsiz piyasalarda temel stratejilerdir.

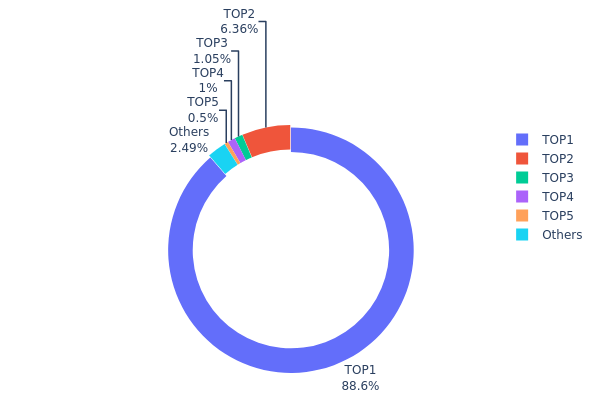

AIL Token Dağılımı

AIL için adres dağılımı verileri, çok yoğunlaşmış bir sahiplik yapısını gösteriyor. En büyük adres toplam arzın %88,59’unu elinde bulunduruyor ve merkezileşme düzeyi oldukça yüksek. İkinci en büyük sahip ise %6,36’lık oranla takip ediyor. Diğer üst adresler ise %1,05 ile %0,50 arasında değişen daha küçük oranlara sahip.

Bu kadar yoğun bir dağılım, piyasa istikrarı ve olası fiyat manipülasyonu açısından risk oluşturuyor. Tek bir adres neredeyse %90’lık arzı kontrol ettiğinde, büyük işlemler piyasada ciddi oynaklığa neden olabilir. Merkezileşme, kripto projelerinde sıkça vurgulanan merkeziyetsizlik ilkesiyle çelişiyor ve yatırımcı güvenini zedeleyebilir, uzun vadeli sürdürülebilirliği tehdit edebilir.

Piyasa yapısı açısından, bu dağılım bir varlığın orantısız etki sahibi olduğu kırılgan bir ekosistemi işaret ediyor. Adil piyasa uygulamaları endişesi olan yatırımcıları caydırabilir ve düzenleyici otoritelerin denetimini artırabilir. Sonuç olarak, mevcut AIL sahiplik dağılımı piyasa dinamikleri ve proje yönetimi açısından ciddi merkeziyet riski taşımaktadır.

Güncel AIL Token Dağılımı'nı görmek için tıklayın

| En Üst | Adres | Sahiplik Miktarı | Sahiplik (%) |

|---|---|---|---|

| 1 | 0x99cf...aaef66 | 885.968,42K | 88,59% |

| 2 | 0x0d07...b492fe | 63.610,45K | 6,36% |

| 3 | 0x4982...6e89cb | 10.503,13K | 1,05% |

| 4 | 0xeacb...2b3f10 | 9.998,06K | 0,99% |

| 5 | 0x99f6...fdb197 | 5.000,00K | 0,50% |

| - | Diğerleri | 24.919,95K | 2,51% |

II. AIL'in Gelecekteki Fiyatını Etkileyecek Temel Faktörler

Makroekonomik Ortam

- Parasal Politika Etkisi: ABD Merkez Bankası'nın para politikası ana belirleyicidir. Sıkı para politikası genellikle AIL fiyatlarını aşağı yönlü etkiler.

- Enflasyon Koruma Özellikleri: Enflasyonist ortamlarda AIL'in performansı önemli bir faktördür. Yüksek enflasyon fiyat üzerinde etkili olur.

- Jeopolitik Faktörler: Uluslararası gelişmeler ve jeopolitik olaylar AIL fiyat trendini etkileyebilir.

Teknolojik Gelişim ve Ekosistem Kurulumu

- Ekosistem Uygulamaları: AIL'e bağlı büyük DApp’ler ve ekosistem projelerinin gelişimi, gelecekteki fiyatı etkileyebilir.

III. 2025-2030 AIL Fiyat Tahmini

2025 Görünümü

- İhtiyatlı tahmin: $0,00022 - $0,00030

- Tarafsız tahmin: $0,00030 - $0,00034

- İyimser tahmin: $0,00034 - $0,00036 (olumlu piyasa duyarlılığıyla)

2026-2028 Görünümü

- Piyasa fazı beklentisi: Kademeli büyüme ve olası dalgalanmalar

- Fiyat aralığı tahmini:

- 2026: $0,00032 - $0,00036

- 2027: $0,00024 - $0,00043

- 2028: $0,00021 - $0,00042

- Ana katalizörler: Artan benimseme, teknolojik ilerleme, piyasa trendleri

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: $0,00036 - $0,00042 (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: $0,00042 - $0,00044 (güçlü piyasa performansında)

- Dönüştürücü senaryo: $0,00044+ (çok elverişli koşullar ve yaygın benimsenme)

- 2030-12-31: AIL $0,00044 (iyimser tahminlere göre olası zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00036 | 0,00032 | 0,00022 | 0 |

| 2026 | 0,00036 | 0,00034 | 0,00032 | 7 |

| 2027 | 0,00043 | 0,00035 | 0,00024 | 11 |

| 2028 | 0,00042 | 0,00039 | 0,00021 | 24 |

| 2029 | 0,00044 | 0,00041 | 0,00026 | 28 |

| 2030 | 0,00044 | 0,00042 | 0,00036 | 34 |

IV. AIL İçin Profesyonel Yatırım Stratejileri ve Risk Yönetimi

AIL Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısı ve yüksek risk toleransı olanlar

- İşlem önerileri:

- Piyasa düşüşlerinde AIL biriktirmek

- Kısmi kâr alımı için fiyat hedefleri belirlemek

- AIL’i güvenli, kendi saklamalı cüzdanlarda tutmak

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trend ve olası dönüş noktalarını tespit etmek için kullanılır

- RSI: Aşırı alım ve aşırı satım durumlarını izlemek için kullanılır

- Salınım ticareti için ana noktalar:

- AILayer proje gelişmelerini ve iş birliklerini takip etmek

- Genel Bitcoin ve AI piyasa trendlerine dikkat etmek

AIL Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcılar: %1-3

- Agresif yatırımcılar: %5-10

- Profesyonel yatırımcılar: En fazla %15

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Yatırımları birden fazla kripto para ve geleneksel varlığa yaymak

- Zarar durdur emirleri: Olası kayıpları sınırlamak için uygulamak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama, güçlü şifreler ve oltalama saldırılarına karşı dikkatli olmak

V. AIL İçin Potansiyel Riskler ve Zorluklar

AIL Piyasa Riskleri

- Yüksek oynaklık: AIL fiyatında ciddi dalgalanmalar görülebilir

- Düşük likidite: Sınırlı işlem hacmi, pozisyon açma ve kapama işlemlerini etkileyebilir

- Piyasa duyarlılığı: AIL’in performansı genel kripto piyasası trendlerinden etkilenebilir

AIL Düzenleyici Riskler

- Belirsiz düzenlemeler: AIL’i etkileyebilecek yeni kripto para düzenlemeleri ihtimali

- Sınır ötesi kısıtlamalar: Kripto paraların farklı ülkelerdeki yasal durumu

- Uyum zorlukları: Kripto para işlemlerinde gelişen AML/KYC gereklilikleri

AIL Teknik Riskleri

- Akıllı sözleşme açıkları: Temel kodda güvenlik zaafları olma ihtimali

- Ölçeklenebilirlik sorunları: Artan işlem hacmini yönetmede zorluklar

- Entegrasyon karmaşıklığı: AI ve blokzincir teknolojisinin etkin biçimde birleştirilmesi zorlukları

VI. Sonuç ve Eylem Önerileri

AIL Yatırım Değeri Değerlendirmesi

AIL, AI-blokzincir entegrasyonunda yüksek riskli ve yüksek potansiyelli bir fırsattır. Yenilikçi teknolojiye sahip olsa da kısa vadede piyasa performansı ve benimsenmesi belirsizliğini korumaktadır.

AIL Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Piyasayı gözlemlemek için küçük miktarda, deneme amaçlı yatırım yapın ✅ Deneyimli yatırımcılar: Sıkı risk yönetimiyle ortalama maliyetli alım stratejisi uygulayın ✅ Kurumsal yatırımcılar: Detaylı analiz yapın ve AIL’i çeşitlendirilmiş bir kripto portföyünün parçası olarak değerlendirin

AIL İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com spot piyasasında AIL alım-satımı

- Staking: Uygunsa AIL staking programlarına katılım

- DeFi entegrasyonu: AIL tokenlarını içeren merkeziyetsiz finans uygulamalarını değerlendirin

Kripto para yatırımları yüksek risklidir; bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli karar vermeli ve profesyonel finansal danışmanlardan destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

Ali Coin’in geleceği var mı?

Ali Coin’in geleceği belirsizdir. AI odaklı kripto piyasasında potansiyel sunsa da, mevcut piyasa trendleri temkinli olmayı gerektiriyor. Başarı; teknolojik ilerleme ve Web3 ekosisteminde yaygın benimsenmeye bağlıdır.

Illuvium $1000’a ulaşabilir mi?

Teorik olarak mümkün olsa da, yakın vadede olası değildir. Analist projeksiyonlarına göre Illuvium (ILV) 2027’de yaklaşık $16,78, 2033’te ise $379,07 seviyelerine ulaşabilir; bu tahminler mevcut piyasa trendlerine dayanmaktadır.

Fetch.ai $100’a ulaşabilir mi?

Mevcut öngörülere göre, Fetch.ai’nin 2028’e kadar $100’a ulaşması beklenmiyor. Tahminler, 2028’de en yüksek olası fiyatın $67,20 ve ortalama fiyatın $46,81 olacağını gösteriyor.

2030 yılında AI piyasası için beklenti nedir?

2030’a kadar Amazon ve Alphabet’in toplam piyasa değerinin $5,5 trilyona ulaşarak mevcut AI liderleri Nvidia ve Palantir’i geride bırakacağı öngörülüyor.

2025 ASM Fiyat Tahmini: Gelecek Eğilim Analizi ve Piyasa Değerini Belirleyen Ana Unsurlar

2025 HGPT Fiyat Tahmini: Dalgalı Piyasalarda Yapay Zeka Dil Modellerinin Geleceğine Yön Vermek

2025 AA Fiyat Tahmini: Piyasa Trendleri ve Olası Büyüme Faktörlerinin Analizi

Kuantum Finansal Sistemi: 2025 Lansman Tarihi ve Pazar Etkisi

COAI Kripto: Nedir ve Nasıl Çalışır

2025 AIC Fiyat Tahmini: Gelişen Dijital Varlık Ekosisteminde Piyasa Trendleri ile Teknolojik Yeniliklerde Yön Bulma

Tomarket Daily Combo 23 Aralık 2025

Marina Protokol Günlük Quiz Cevabı 23 Aralık 2025

Spur Protocol Günlük Quiz Cevabı Bugün 23 Aralık 2025

MAVIA nedir: Mobil Artırılmış Görsel Zekâ Mimarisi Hakkında Kapsamlı Bir Rehber

TRADE Nedir: Uluslararası Ticaret ve Ekonomik Değişimi Anlama Kapsamlı Rehberi