2025 AMC Price Prediction: Analyzing Potential Growth and Market Trends for the Entertainment Giant

Introduction: AMC's Market Position and Investment Value

AI Meta Club (AMC), as a platform that brings together AI and Metaverse enthusiasts, has been making waves since its inception. As of 2025, AMC's market capitalization stands at $375,600.0, with a circulating supply of approximately 6,000,000 tokens and a price hovering around $0.0626. This asset, often referred to as the "AI and Metaverse connector," is playing an increasingly crucial role in fostering community engagement and knowledge sharing in the fields of artificial intelligence and metaverse technologies.

This article will provide a comprehensive analysis of AMC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. AMC Price History Review and Current Market Status

AMC Historical Price Evolution

- 2024: Project launch, price reached ATL of $0.0357 on July 1st

- 2025: Significant growth, price hit ATH of $5 on March 13th

- 2025: Market correction, price declined to current $0.0626

AMC Current Market Situation

As of October 31, 2025, AMC is trading at $0.0626, experiencing a slight 24-hour decrease of 0.04%. The token's market cap stands at $375,600, with a circulating supply of 6,000,000 AMC. The fully diluted valuation is $62,600,000, indicating a significant potential for growth if the total supply enters circulation. AMC's trading volume in the past 24 hours is $14,420.16, suggesting moderate market activity. The token is currently down 98.75% from its all-time high of $5, presenting a challenging market environment for investors.

Click to view the current AMC market price

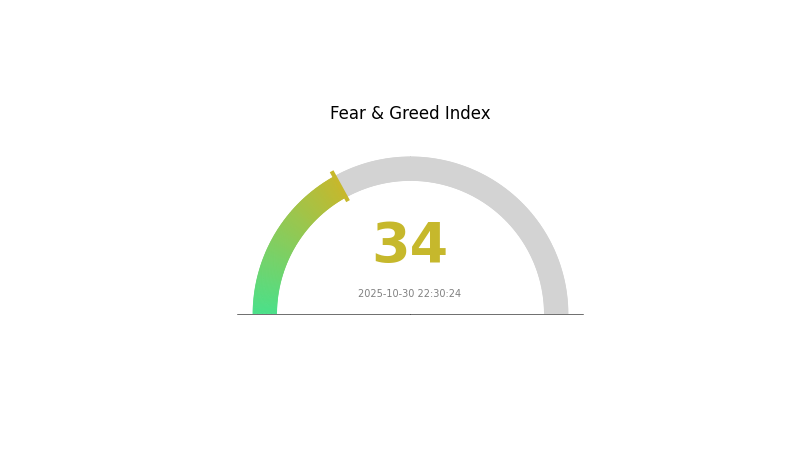

AMC Market Sentiment Indicator

2025-10-30 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 34, indicating a state of Fear. This suggests investors are hesitant and risk-averse. Such periods often present potential buying opportunities for long-term investors, as assets may be undervalued. However, it's crucial to conduct thorough research and consider your risk tolerance before making investment decisions. Remember, market sentiment can shift quickly, and diversification is key in volatile markets.

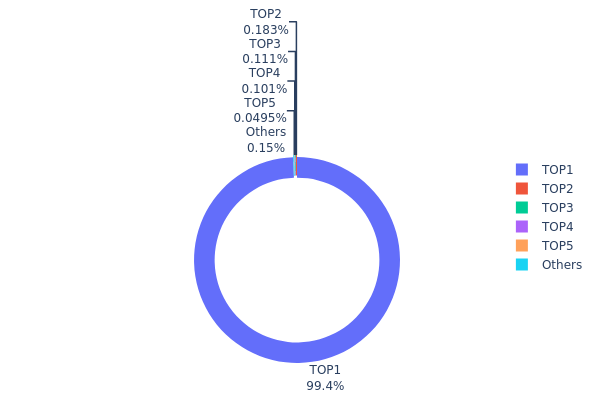

AMC Holdings Distribution

The address holdings distribution data for AMC reveals a highly concentrated ownership structure. The top address holds an overwhelming 99.40% of the total supply, amounting to 994,000,000 AMC tokens. This extreme concentration raises significant concerns about the token's decentralization and market stability.

Such a high concentration in a single address could potentially lead to increased market volatility and susceptibility to price manipulation. The top holder has the ability to significantly influence the market price through large-scale buying or selling actions. Additionally, this concentration may deter potential investors due to concerns about liquidity and fair market practices.

The remaining top addresses hold relatively small percentages, with the second largest holding only 0.18% of the supply. This skewed distribution suggests a lack of widespread adoption and could potentially impact the token's long-term viability and its ability to achieve true decentralization in governance and ecosystem development.

Click to view the current AMC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9908...23032d | 994000.00K | 99.40% |

| 2 | 0x0d07...b492fe | 1828.79K | 0.18% |

| 3 | 0xc882...84f071 | 1107.72K | 0.11% |

| 4 | 0xac6a...b94102 | 1008.63K | 0.10% |

| 5 | 0x26a2...4d1e8b | 494.71K | 0.04% |

| - | Others | 1498.51K | 0.16999999999999% |

II. Key Factors Affecting AMC's Future Price

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their holdings in AMC. For example, in 2024, Pudong Development Bank reported a net profit attributable to the parent company of 45.257 billion yuan, a year-on-year increase of 23.31%, which led to increased AMC holdings.

Macroeconomic Environment

- Monetary Policy Impact: The challenging economic environment, uncertainties in tariffs and China's economic outlook, coupled with increased differentiation in the real estate market, are putting pressure on the core business of national AMCs.

- Inflation Hedging Properties: AMC's performance in an inflationary environment is closely tied to economic growth and consumer spending patterns.

- Geopolitical Factors: International geopolitical tensions and monetary conditions have marginal impacts on AMC's market direction, although these are not considered significantly influential compared to domestic economic recovery.

Technical Development and Ecosystem Building

- Financing Cost: Local AMCs' bank loan comprehensive financing costs are affected by various factors including regional financial environment, company shareholder background and business positioning, term structure, fund usage, and local bank preferences.

- Asset Quality: The quality of financial assets, as the core assets of AMC companies, plays a crucial role in the survival and development of these enterprises. Fair value measurement of these assets is becoming increasingly important in the changing market and competitive environment.

III. AMC Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.04883 - $0.0626

- Neutral forecast: $0.0626 - $0.06573

- Optimistic forecast: $0.06573 - $0.07 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range predictions:

- 2027: $0.03932 - $0.08139

- 2028: $0.06767 - $0.11052

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.07335 - $0.09982 (assuming steady market growth)

- Optimistic scenario: $0.09982 - $0.13875 (assuming strong market performance)

- Transformative scenario: $0.13875 - $0.15 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: AMC $0.13875 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.06573 | 0.0626 | 0.04883 | 0 |

| 2026 | 0.07379 | 0.06417 | 0.04235 | 2 |

| 2027 | 0.08139 | 0.06898 | 0.03932 | 10 |

| 2028 | 0.11052 | 0.07519 | 0.06767 | 20 |

| 2029 | 0.10678 | 0.09285 | 0.07335 | 48 |

| 2030 | 0.13875 | 0.09982 | 0.07187 | 59 |

IV. AMC Professional Investment Strategies and Risk Management

AMC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate AMC tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor AI and metaverse sector news for potential catalysts

- Set stop-loss orders to manage downside risk

AMC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple AI and metaverse projects

- Options strategies: Consider using options to hedge downside risk

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for AMC

AMC Market Risks

- High volatility: AMC price may experience significant fluctuations

- Competition: Increasing number of AI and metaverse projects may impact market share

- Market sentiment: Shifts in overall crypto market sentiment can affect AMC's performance

AMC Regulatory Risks

- Uncertain regulations: Evolving global crypto regulations may impact AMC's operations

- Compliance challenges: Potential difficulties in adhering to varying international standards

- Legal status: Ambiguity in the legal classification of utility tokens like AMC

AMC Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability issues: Challenges in handling increased network activity as the project grows

- Interoperability concerns: Potential difficulties in integrating with other blockchain networks

VI. Conclusion and Action Recommendations

AMC Investment Value Assessment

AMC presents a speculative opportunity in the growing AI and metaverse sector. While it offers potential for high returns, it also carries significant risks due to market volatility and regulatory uncertainties.

AMC Investment Recommendations

✅ Beginners: Consider small, experimental positions to gain exposure to the AI and metaverse sector ✅ Experienced investors: Implement a dollar-cost averaging strategy and set clear profit-taking targets ✅ Institutional investors: Conduct thorough due diligence and consider AMC as part of a diversified crypto portfolio

AMC Trading Participation Methods

- Spot trading: Buy and sell AMC tokens on Gate.com

- Staking: Participate in staking programs if available to earn additional rewards

- Community engagement: Join AI Meta Club's community to stay informed about project developments

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will AMC ever go back up in 2025?

Yes, AMC has potential to rise in 2025. Market trends and debt management could drive growth. Investors remain optimistic about its recovery.

What is the prediction for AMC stock price in 2040?

In 2040, AMC stock is predicted to range between $0.000000125 and $0.000000832, based on current market analysis.

What will AMC stock be worth in 2030?

Based on current trends and market analysis, AMC stock could potentially reach $50-$80 per share by 2030, driven by industry recovery and strategic growth initiatives.

Why are AMC stocks falling?

AMC stocks are falling due to analyst revisions and mixed pre-earnings commentary. The recent drop is attributed to lowered expectations.

Share

Content