2025 BEAM Price Prediction: Will This Privacy-Focused Cryptocurrency Reach New Heights?

Introduction: BEAM's Market Position and Investment Value

Beam (BEAM), as a privacy-focused cryptocurrency based on the MimbleWimble protocol, has made significant strides since its inception in 2019. As of 2025, BEAM's market capitalization has reached $7,244,019, with a circulating supply of approximately 188,548,150 coins, and a price hovering around $0.03842. This asset, known as the "privacy coin," is playing an increasingly crucial role in the field of confidential transactions and scalable blockchain solutions.

This article will comprehensively analyze BEAM's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. BEAM Price History Review and Current Market Status

BEAM Historical Price Evolution

- 2019: BEAM launched, price reached all-time high of $4.28 on January 5

- 2020-2024: Price fluctuated but generally trended downward

- 2025: Price hit all-time low of $0.01941531 on October 1, then rebounded

BEAM Current Market Situation

As of October 10, 2025, BEAM is trading at $0.03842, with a 24-hour trading volume of $94,750.99. The price has increased by 10.16% in the last 24 hours, showing significant short-term momentum. Over the past week, BEAM has surged by 50.9%, indicating strong bullish sentiment in the short to medium term. The 30-day price change is +42.88%, further confirming the positive trend. However, the 1-year performance remains slightly negative at -3.23%.

BEAM's market capitalization stands at $7,244,019.92, ranking it 1575th in the overall cryptocurrency market. The circulating supply is 188,548,150 BEAM, which is 71.75% of the total supply of 262,800,000 BEAM. The fully diluted market cap is $10,096,776.00.

The current price is still significantly below the all-time high of $4.28, suggesting potential room for growth if the project gains more adoption and market interest. However, the recent price surge may also indicate a need for caution as short-term corrections are possible after such rapid gains.

Click to view the current BEAM market price

BEAM Market Sentiment Indicator

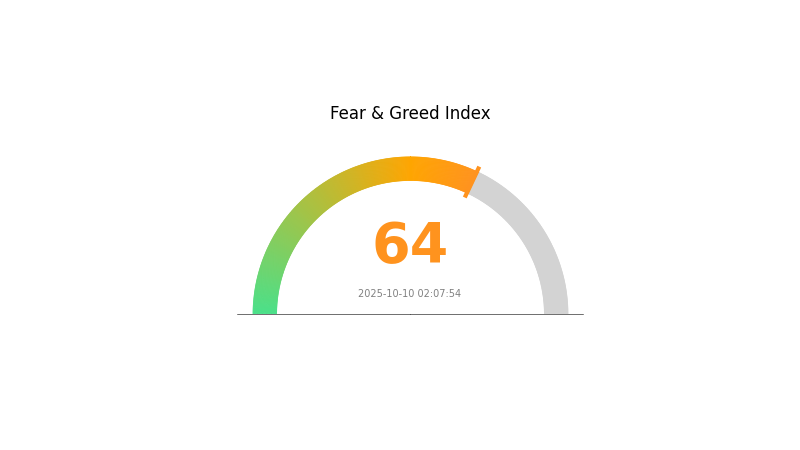

2025-10-10 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently showing signs of greed, with the Fear and Greed Index standing at 64. This suggests that investors are becoming increasingly optimistic about BEAM's future prospects. However, it's important to remember that extreme greed can sometimes precede market corrections. Traders should exercise caution and consider diversifying their portfolios to mitigate potential risks. As always, conducting thorough research and staying informed about market trends is crucial for making sound investment decisions.

BEAM Holdings Distribution

The address holdings distribution data for BEAM is currently unavailable, which limits our ability to conduct a comprehensive analysis of its concentration characteristics. This lack of information prevents us from assessing the level of decentralization, potential market manipulation risks, or the overall stability of BEAM's on-chain structure.

In the absence of specific data, it's important to note that a healthy distribution of token holdings typically indicates a more decentralized and robust network. A well-distributed token supply can contribute to reduced volatility and lower risks of market manipulation. However, without concrete figures, we cannot make definitive statements about BEAM's current market structure or its implications for price movements.

Investors and analysts should seek updated and verifiable data to make informed decisions about BEAM's market dynamics and potential risks or opportunities associated with its token distribution.

Click to view the current BEAM Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting BEAM's Future Price

Technical Development and Ecosystem Building

-

MimbleWimble Protocol: BEAM is built on the MimbleWimble protocol, which offers enhanced privacy and scalability features. This technology could potentially attract users who prioritize transaction privacy.

-

Ecosystem Applications: BEAM is working on developing its ecosystem, including DeFi applications and privacy-focused solutions. The growth of these applications could increase BEAM's utility and demand.

III. BEAM Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.0375 - $0.0390

- Neutral prediction: $0.0390 - $0.0450

- Optimistic prediction: $0.0450 - $0.05429 (requires favorable market conditions and increased adoption)

2026-2027 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecasts:

- 2026: $0.04061 - $0.06255

- 2027: $0.04533 - $0.077

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2028-2030 Long-term Outlook

- Base scenario: $0.06581 - $0.08552 (assuming steady market growth and continued development)

- Optimistic scenario: $0.08552 - $0.1069 (assuming accelerated adoption and favorable market conditions)

- Transformative scenario: $0.1069 - $0.12 (assuming breakthrough technology implementation and mainstream acceptance)

- 2030-12-31: BEAM $0.1069 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.05429 | 0.03906 | 0.0375 | 1 |

| 2026 | 0.06255 | 0.04668 | 0.04061 | 21 |

| 2027 | 0.077 | 0.05461 | 0.04533 | 42 |

| 2028 | 0.08358 | 0.06581 | 0.04409 | 71 |

| 2029 | 0.09635 | 0.07469 | 0.04855 | 94 |

| 2030 | 0.1069 | 0.08552 | 0.07611 | 122 |

IV. BEAM Professional Investment Strategies and Risk Management

BEAM Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Privacy-focused investors and blockchain technology enthusiasts

- Operation suggestions:

- Accumulate BEAM tokens during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure cold wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined price targets

BEAM Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple privacy coins

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet for long-term holdings

- Security precautions: Never share private keys, use two-factor authentication

V. Potential Risks and Challenges for BEAM

BEAM Market Risks

- High volatility: Price swings can be extreme in the short term

- Limited liquidity: May affect ability to enter/exit positions quickly

- Competition: Other privacy coins may gain market share

BEAM Regulatory Risks

- Increased scrutiny: Privacy coins may face additional regulatory challenges

- Potential bans: Some countries may restrict use of privacy-focused cryptocurrencies

- Exchange delisting: Risk of removal from trading platforms due to regulatory pressure

BEAM Technical Risks

- Protocol vulnerabilities: Potential for undiscovered security flaws

- Scalability challenges: May face issues with network growth

- Upgrade failures: Risk of contentious hard forks or failed implementations

VI. Conclusion and Action Recommendations

BEAM Investment Value Assessment

BEAM offers strong privacy features and potential for long-term growth, but faces significant short-term volatility and regulatory uncertainty.

BEAM Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research

✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management

✅ Institutional investors: Evaluate as part of a diversified privacy coin portfolio

BEAM Trading Participation Methods

- Spot trading: Buy and hold BEAM tokens on Gate.com

- Staking: Participate in available staking programs for passive income

- Mining: Consider mining BEAM to support the network and earn rewards

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will Beam crypto go?

Beam crypto could potentially reach $5 by 2026, driven by increased adoption and technological advancements in privacy-focused cryptocurrencies.

Can BeamX reach 1 dollar?

Yes, BeamX has the potential to reach $1. With ongoing development and growing adoption in the Web3 space, BeamX could achieve this milestone in the coming years, especially if market conditions remain favorable.

Is Beam a good buy?

Yes, Beam could be a good buy. Its privacy features and scalability make it promising for long-term growth in the crypto market.

What is the price prediction for beam coin in 2050?

Based on current trends and potential technological advancements, BEAM coin could reach $500-$1000 by 2050, assuming continued adoption and development in the privacy-focused cryptocurrency sector.

Share

Content