2025 BLOCK Price Prediction: Analyzing Potential Growth Factors and Market Trends

Introduction: BLOCK's Market Position and Investment Value

BlockGames (BLOCK), as a pioneer in building a Player Network with Universal Player Profiles, has made significant strides since its inception in 2024. As of 2025, BLOCK's market capitalization stands at $50,732.2725, with a circulating supply of approximately 135,975,000 tokens, and a price hovering around $0.0003731. This asset, hailed as the "data economy enabler" in gaming, is playing an increasingly crucial role in revolutionizing the mobile gaming industry and player data management.

This article will provide a comprehensive analysis of BLOCK's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. BLOCK Price History and Current Market Status

BLOCK Historical Price Evolution

- 2024: BLOCK launched at $0.1, reaching an all-time high of $0.3414 on April 11

- 2025: Market downturn, price declined significantly to an all-time low of $0.0002682 on October 11

BLOCK Current Market Situation

As of November 3, 2025, BLOCK is trading at $0.0003731, representing a 98.11% decrease from its price one year ago. In the past 24 hours, the price has experienced a 2.16% decline, with a trading volume of $19,983.48. The current market capitalization stands at $50,732.27, ranking BLOCK at 5826 in the overall cryptocurrency market.

The circulating supply of BLOCK is 135,975,000 tokens, which is 13.6% of the total supply of 1,000,000,000 BLOCK. The fully diluted market cap is $373,100.00.

Recent price trends show mixed short-term performance: a 0.19% increase in the last hour, but declines of 2.65% over the past week and 23.28% over the last 30 days. This indicates ongoing volatility and a generally bearish sentiment in the short to medium term.

Click to view the current BLOCK market price

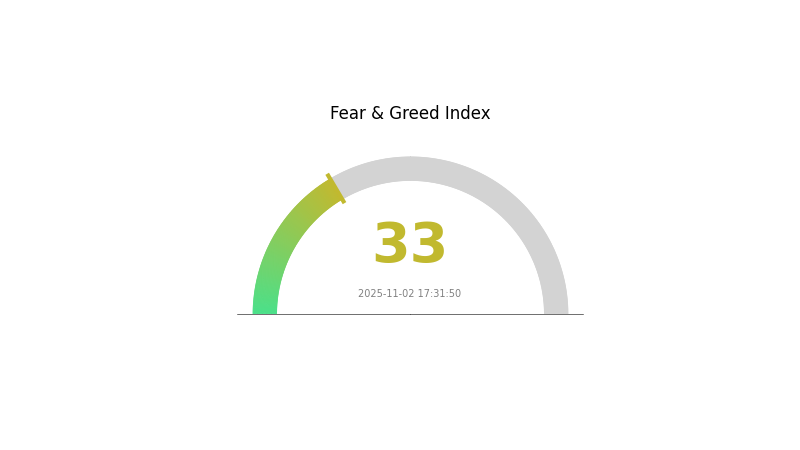

BLOCK Market Sentiment Indicator

2025-11-02 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a phase of fear, with the Fear and Greed Index registering at 33. This indicates a cautious sentiment among investors, potentially reflecting recent market uncertainties or negative news. During such periods, some seasoned investors may view this as an opportunity to accumulate assets at lower prices, adhering to the contrarian investment strategy of "being greedy when others are fearful." However, it's crucial for traders to conduct thorough research and exercise caution in their decision-making process.

BLOCK Holdings Distribution

The address holdings distribution data reveals a significant concentration of BLOCK tokens among a few top addresses. The top address holds 40% of the total supply, while the top 5 addresses collectively control 77.5% of all BLOCK tokens. This high level of concentration raises concerns about centralization and potential market manipulation.

Such a distribution pattern can have substantial implications for market dynamics. With a small number of addresses controlling a large portion of the supply, there's an increased risk of price volatility and market manipulation. These large holders, often referred to as "whales," have the potential to significantly impact the market through their trading activities. Furthermore, this concentration may undermine the principles of decentralization that many blockchain projects strive for.

The current distribution suggests a relatively low level of on-chain structural stability and a high degree of centralization. This could potentially deter some investors who prioritize decentralized ownership structures. However, it's important to note that the reasons behind this concentration (e.g., locked tokens, treasury holdings) would require further investigation to fully understand the implications for BLOCK's market structure and long-term prospects.

Click to view the current BLOCK Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9aff...2c950c | 400000.00K | 40.00% |

| 2 | 0xdeae...ea4e74 | 150000.00K | 15.00% |

| 3 | 0x2cde...48f00c | 114979.82K | 11.49% |

| 4 | 0x58ed...a36a51 | 73461.64K | 7.34% |

| 5 | 0x94e8...04b660 | 36744.24K | 3.67% |

| - | Others | 224814.30K | 22.5% |

II. Key Factors Influencing BLOCK's Future Price

Institutional and Whale Dynamics

-

Institutional Holdings: ETF inflows have significantly impacted Bitcoin's price. In October, Bitcoin spot ETFs saw a net inflow of $4.21 billion, reversing the outflow trend from September. The total assets under management reached $178.2 billion, accounting for 6.8% of Bitcoin's total market capitalization.

-

Corporate Adoption: Companies like Iris Energy, TeraWulf, and Bitdeer are transitioning from Bitcoin mining to AI-driven high-performance computing centers, potentially affecting Bitcoin's network security and decentralization.

-

National Policies: The White House's nomination of Michael Selig as CFTC chairman and the SEC's update on ETP creation mechanisms, allowing in-kind redemptions for crypto ETFs, signal a more crypto-friendly regulatory environment.

Macroeconomic Environment

-

Monetary Policy Impact: Interest rate cut expectations are rising, which could potentially benefit crypto markets.

-

Inflation Hedging Properties: Bitcoin is increasingly viewed as a hedge against inflation, similar to digital gold.

-

Geopolitical Factors: Global economic uncertainties continue to influence Bitcoin's appeal as a potential safe-haven asset.

Technical Development and Ecosystem Building

-

Altcoin ETFs: The launch of the first batch of altcoin ETFs in the US, covering projects like Solana, Litecoin, and Hedera, is expanding the crypto investment landscape.

-

Ecosystem Applications: ProShares is preparing to launch the CoinDesk 20 ETF, tracking 20 assets including BTC, ETH, SOL, and XRP. REX-Osprey's 21-Asset ETF will allow holders to earn staking rewards from tokens like ADA, AVAX, NEAR, SEI, and TAO.

III. BLOCK Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00023 - $0.00030

- Neutral prediction: $0.00030 - $0.00040

- Optimistic prediction: $0.00040 - $0.00047 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.00026 - $0.00054

- 2028: $0.00026 - $0.00070

- Key catalysts: Technological advancements, wider market acceptance, and potential partnerships

2029-2030 Long-term Outlook

- Base scenario: $0.00061 - $0.00074 (assuming steady market growth and adoption)

- Optimistic scenario: $0.00074 - $0.00088 (assuming strong market performance and increased utility)

- Transformative scenario: $0.00088 - $0.00100 (assuming breakthrough developments and mainstream adoption)

- 2030-12-31: BLOCK $0.00100 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00047 | 0.00037 | 0.00023 | 0 |

| 2026 | 0.00055 | 0.00042 | 0.0003 | 13 |

| 2027 | 0.00054 | 0.00049 | 0.00026 | 30 |

| 2028 | 0.0007 | 0.00051 | 0.00026 | 37 |

| 2029 | 0.00088 | 0.00061 | 0.00034 | 63 |

| 2030 | 0.001 | 0.00074 | 0.00039 | 99 |

IV. BLOCK Professional Investment Strategies and Risk Management

BLOCK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operation suggestions:

- Accumulate BLOCK tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure hardware wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- RSI: Identify overbought and oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

BLOCK Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Portfolio diversification: Spread investments across different cryptocurrencies

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords

V. BLOCK Potential Risks and Challenges

BLOCK Market Risks

- High volatility: Significant price fluctuations common in the cryptocurrency market

- Limited liquidity: Potential difficulties in executing large trades

- Market sentiment: Susceptible to rapid changes based on news and trends

BLOCK Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting BLOCK

- Cross-border restrictions: Varying legal status in different jurisdictions

- Tax implications: Evolving tax laws related to cryptocurrency transactions

BLOCK Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Possible transaction delays during high network activity

- Technological obsolescence: Risk of being surpassed by more advanced blockchain solutions

VI. Conclusion and Action Recommendations

BLOCK Investment Value Assessment

BLOCK presents a high-risk, high-potential investment opportunity in the gaming and data economy sector. While it offers innovative solutions for player data ownership and rewards, investors should be cautious due to its current low market cap and high volatility.

BLOCK Investment Recommendations

✅ Beginners: Allocate only a small portion of portfolio, focus on learning ✅ Experienced investors: Consider a moderate position with strict risk management ✅ Institutional investors: Conduct thorough due diligence, consider as part of a diversified crypto portfolio

BLOCK Trading Participation Methods

- Spot trading: Purchase BLOCK tokens on Gate.com

- DeFi staking: Participate in yield farming programs if available

- Dollar-cost averaging: Regularly invest small amounts to mitigate price volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high will Block stock go?

Block stock could potentially double in the next five years, outpacing market growth. Analysts project significant gains based on strong future profit forecasts, despite current modest performance.

Is Block a good investment?

Yes, Block appears to be a good investment. Its Cash App shows strong growth, financial performance is solid, and efficiency initiatives are promising. Recent metrics and market position are favorable for potential investors.

Why did Block stock crash?

Block stock crashed due to the 2008 financial crisis, causing market volatility and reduced investor confidence. The global economic downturn significantly impacted many companies, including Block.

Is Blok a buy or sell?

Based on current market analysis, BLOK is showing a neutral trend. Neither a strong buy nor sell signal at this time.

Share

Content