2025 BP Price Prediction: Navigating the Energy Transition and Market Trends

Introduction: BP's Market Position and Investment Value

BunnyPark (BP), as a DeFi and NFT project based on BSC, has been providing a unique "SaaS" incubation platform and fund for NFT development since its inception. As of 2025, BunnyPark's market capitalization has reached $46,420.4, with a circulating supply of approximately 31,600,000 tokens, and a price hovering around $0.001469. This asset, often referred to as the "LEGO provider in the NFT space," is playing an increasingly crucial role in NFT and GameFi development.

This article will comprehensively analyze BunnyPark's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BP Price History Review and Current Market Status

BP Historical Price Evolution

- 2021: Project launch, price reached all-time high of $6.71 on May 15

- 2022-2024: Bearish market cycle, price declined significantly

- 2025: Price hit all-time low of $0.00105965 on April 7

BP Current Market Situation

The current price of BP is $0.001469, which is 99.98% below its all-time high. The token has experienced a slight decline of 0.2% in the past 24 hours. Over the past week, BP has seen a significant drop of 22.68%, indicating a strong downward trend in the short term. The 30-day performance shows an even more substantial decrease of 59.30%, suggesting a persistent bearish sentiment in the market.

BP's market capitalization stands at $46,420.4, ranking it at 5901 among all cryptocurrencies. The 24-hour trading volume is $9,745.32, which is relatively low, indicating limited liquidity and trading activity. The circulating supply is 31,600,000 BP tokens, representing 26.1% of the total supply.

Click to view the current BP market price

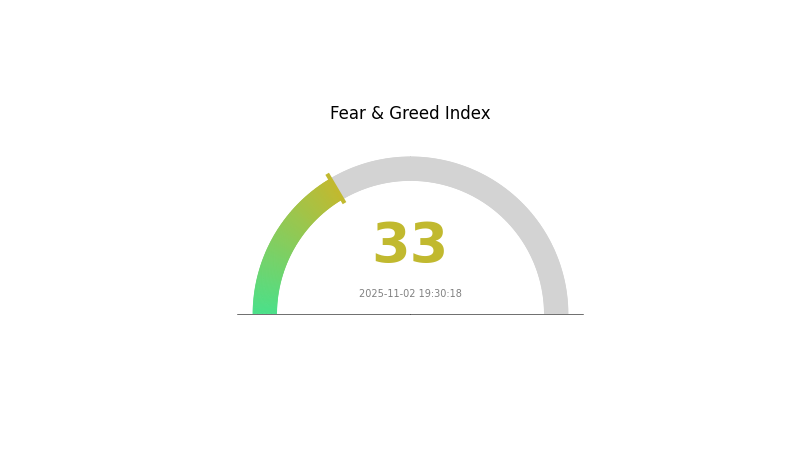

BP Market Sentiment Indicator

2025-11-02 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index registering at 33. This indicates a cautious attitude among investors, potentially signaling undervaluation of cryptocurrencies. During such periods, experienced traders often view it as a potential buying opportunity, adhering to the principle of "be fearful when others are greedy, and greedy when others are fearful." However, investors should always conduct thorough research and manage risks appropriately before making any investment decisions.

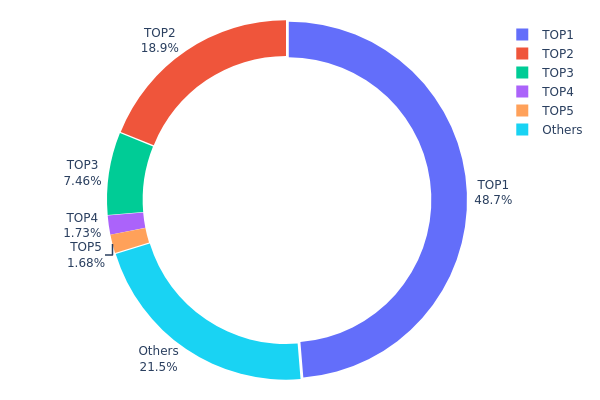

BP Holdings Distribution

The address holdings distribution data reveals significant concentration in BP token ownership. The top address, likely a burn address (0x0000...00dead), holds 48.70% of the total supply, effectively removing these tokens from circulation. The second largest holder controls 18.90%, while the third possesses 7.46%. Collectively, the top five addresses account for 78.46% of all BP tokens.

This high concentration of holdings suggests a relatively centralized token distribution, which could have implications for market dynamics. With nearly half the supply burned and another significant portion held by a few addresses, the circulating supply is effectively reduced. This concentration may lead to increased price volatility, as large holders have the potential to significantly impact the market with their trading activities.

The current distribution structure indicates a lower level of decentralization for BP, which could affect its resilience to market manipulation. However, the substantial burned supply may also create scarcity, potentially supporting long-term value. Investors should monitor these large holders' activities, as their actions could have outsized effects on BP's market performance and overall stability.

Click to view the current BP holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...00dead | 57921.39K | 48.70% |

| 2 | 0x2bf2...a5fd2d | 22480.43K | 18.90% |

| 3 | 0x0d07...b492fe | 8875.28K | 7.46% |

| 4 | 0x871f...8e97d4 | 2052.62K | 1.72% |

| 5 | 0x8a83...f11896 | 2000.99K | 1.68% |

| - | Others | 25603.95K | 21.54% |

II. Key Factors Affecting BP's Future Price

Supply Mechanism

- Long-term Demand Decline: BP predicts that global oil demand will gradually decrease to about 50% of current demand over the next 30 years.

- Historical Pattern: Past supply changes have significantly impacted oil prices.

- Current Impact: The expected long-term decline in oil demand is likely to put downward pressure on BP's future price.

Macroeconomic Environment

- Monetary Policy Impact: Major central banks' policies are expected to continue influencing oil prices.

- Inflation Hedging Properties: Oil has historically been seen as an inflation hedge, but its effectiveness may change in the future energy landscape.

- Geopolitical Factors: Ongoing conflicts, such as Russia-Ukraine and Israel-Palestine, as well as strategic competition between major powers, could cause oil supply disruptions or export reductions, leading to price volatility.

Technological Development and Ecosystem Building

- Energy Transition: BP is actively investing in renewable energy sources such as wind, solar, hydrogen, biofuels, and CCUS technologies.

- LNG Business Expansion: BP plans to increase its LNG annual sales volume to 25 million tons by 2025 and 30 million tons by 2030.

- Ecosystem Applications: BP is focusing on expanding its natural gas production and trading capabilities globally, particularly strengthening cooperation with regions like Asia.

III. BP Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00122 - $0.00147

- Neutral forecast: $0.00147 - $0.00182

- Optimistic forecast: $0.00182 - $0.00217 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00175 - $0.00292

- 2028: $0.00194 - $0.00331

- Key catalysts: Increased adoption and technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00295 - $0.00335 (assuming steady market growth)

- Optimistic scenario: $0.00335 - $0.00489 (assuming strong market performance)

- Transformative scenario: Above $0.00489 (under extremely favorable conditions)

- 2030-12-31: BP $0.00335 (potential stabilization point)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00217 | 0.00147 | 0.00122 | 0 |

| 2026 | 0.00268 | 0.00182 | 0.00155 | 24 |

| 2027 | 0.00292 | 0.00225 | 0.00175 | 53 |

| 2028 | 0.00331 | 0.00259 | 0.00194 | 76 |

| 2029 | 0.00375 | 0.00295 | 0.00283 | 100 |

| 2030 | 0.00489 | 0.00335 | 0.00318 | 127 |

IV. Professional Investment Strategies and Risk Management for BP

BP Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and belief in the project's long-term potential

- Operation suggestions:

- Accumulate BP tokens during market dips

- Regularly review project developments and adjust holdings accordingly

- Store tokens in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps determine overbought or oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set strict stop-loss and take-profit levels

BP Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Software wallet option: Official BunnyPark wallet (if available)

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. Potential Risks and Challenges for BP

BP Market Risks

- High volatility: BP price may experience significant fluctuations

- Limited liquidity: Low trading volume may lead to price slippage

- Market sentiment: Overall crypto market trends can heavily influence BP's price

BP Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on DeFi and NFT projects

- Compliance issues: Possible challenges in adhering to evolving regulatory requirements

- Cross-border restrictions: Varying regulations across jurisdictions may limit global adoption

BP Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the project's code

- Scalability challenges: Possible limitations in handling increased user activity

- Blockchain congestion: Network issues on BSC could impact BunnyPark's performance

VI. Conclusion and Action Recommendations

BP Investment Value Assessment

BunnyPark (BP) presents a high-risk, high-potential investment in the DeFi and NFT sectors. While it offers innovative features and growth potential, investors should be aware of the significant volatility and risks associated with early-stage crypto projects.

BP Investment Recommendations

✅ Beginners: Limit exposure to a small portion of portfolio, focus on learning about the project ✅ Experienced investors: Consider allocating a moderate portion based on risk tolerance, actively monitor project developments ✅ Institutional investors: Conduct thorough due diligence, potentially engage with the project team for deeper insights

BP Trading Participation Methods

- Spot trading: Buy and sell BP tokens on Gate.com

- Staking: Participate in staking programs if offered by BunnyPark

- NFT interactions: Engage with BunnyPark's NFT ecosystem for potential value accrual

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is BP stock a good buy now?

BP stock shows potential with analysts' 12-month price targets between $35-$40, above current $31.31. Consider market trends and your investment goals.

How high will BP shares go?

BP shares are projected to reach up to $66.00, with an average target 18.9% above the current price, indicating significant potential for growth.

What is the target price for BP in 2025?

The target price for BP in 2025 is $43, based on the latest forecast from Scotiabank. This represents an increase from their previous target of $42.

Is BP share price up 7 in a month but still considered good value?

Yes, BP's 7% price increase still offers good value, with a low P/E ratio of 5.73 and an attractive 5.67% dividend yield.

Share

Content