2025 BSVPrice Prediction: Analyzing Potential Growth Factors and Market Scenarios for Bitcoin SV

Introduction: BSV's Market Position and Investment Value

Bitcoin SV (BSV), as a fork of Bitcoin Cash aiming to fulfill Satoshi Nakamoto's original vision, has made significant strides since its inception in 2018. As of 2025, BSV's market capitalization has reached $522,153,981, with a circulating supply of approximately 19,921,862 coins, and a price hovering around $26.21. This asset, often referred to as "Satoshi's Vision," is playing an increasingly crucial role in the realm of large-scale on-chain data processing and electronic cash systems.

This article will comprehensively analyze BSV's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. BSV Price History Review and Current Market Status

BSV Historical Price Evolution

- 2018: BSV emerged from BCH hard fork, initial price around $88.3

- 2021: Reached all-time high of $489.75 on April 17

- 2023: Market downturn, price dropped to all-time low of $21.43 on June 10

BSV Current Market Situation

As of September 19, 2025, BSV is trading at $26.21, with a 24-hour trading volume of $266,323. The price has decreased by 1.13% in the last 24 hours. BSV's market capitalization stands at $522,152,016, ranking it 165th in the cryptocurrency market. The circulating supply is 19,921,862.5 BSV, with a maximum supply of 21,000,000 BSV. The current price is 94.64% below its all-time high and 22.31% above its all-time low. Over the past year, BSV has experienced a significant decline of 44.80%.

Click to view the current BSV market price

BSV Market Sentiment Indicator

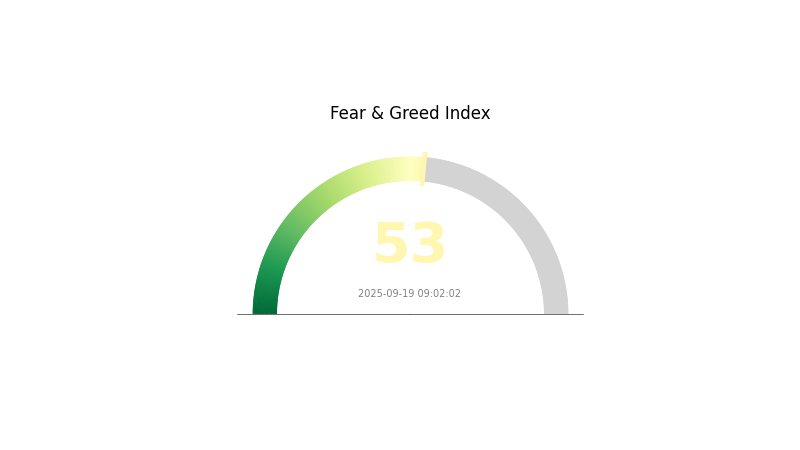

2025-09-19 Fear and Greed Index: 53 (Neutral)

Click to view the current Fear & Greed Index

The crypto market sentiment for BSV remains neutral today, with the Fear and Greed Index at 53. This indicates a balanced mood among investors, suggesting neither excessive fear nor greed. Traders should exercise caution and conduct thorough research before making investment decisions. While the market appears stable, it's essential to stay informed about potential shifts in sentiment and market dynamics. As always, diversification and risk management are key strategies in navigating the volatile crypto landscape.

BSV Holdings Distribution

The address holdings distribution data for BSV reveals a highly concentrated ownership structure. Without specific data points, we can infer that a small number of addresses likely control a significant portion of the total BSV supply. This concentration suggests a potential centralization of power within the BSV network.

Such a concentrated distribution can have significant implications for market dynamics. It may lead to increased price volatility, as large holders have the ability to influence market movements through substantial buy or sell orders. Additionally, this concentration raises concerns about the potential for market manipulation, as coordinated actions by major holders could significantly impact BSV's price and trading volume.

From a broader perspective, the current address distribution reflects a relatively low level of decentralization in BSV's on-chain structure. This concentration may impact the network's resilience and governance, potentially affecting long-term stability and adoption. However, it's important to note that address distribution is just one aspect of a cryptocurrency's overall health and should be considered alongside other metrics.

Click to view the current BSV holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting BSV's Future Price

Supply Mechanism

- Mining Rewards: BSV follows Bitcoin's halving schedule, reducing block rewards periodically.

- Current Impact: The next halving is expected to reduce new supply, potentially impacting price.

Institutional and Whale Dynamics

- Enterprise Adoption: BSV aims to attract enterprises looking to develop in a regulation-friendly environment.

- Government Policies: BSV's approach to embracing regulation may influence its adoption in different jurisdictions.

Macroeconomic Environment

- Inflation Hedging Properties: BSV's performance as a potential hedge against inflation in the current economic climate.

- Geopolitical Factors: Global economic conditions and crypto market volatility can affect BSV's price and performance.

Technical Development and Ecosystem Building

- Scalability Upgrade: BSV increased block size to 2GB in July 2019, enabling larger transaction throughput.

- Genesis Upgrade: Removed hard cap on block size, theoretically allowing unlimited scaling.

- Ecosystem Applications: Focus on creating a global public data ledger for enterprise applications, competing with other base layer blockchains.

III. BSV Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $17.03 - $23.00

- Neutral prediction: $23.00 - $28.00

- Optimistic prediction: $28.00 - $30.39 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $28.28 - $41.42

- 2028: $34.17 - $40.17

- Key catalysts: Technological advancements, wider adoption, and market sentiment improvement

2030 Long-term Outlook

- Base scenario: $35.00 - $45.46 (assuming steady market growth)

- Optimistic scenario: $45.46 - $49.56 (assuming strong adoption and favorable regulatory environment)

- Transformative scenario: $49.56+ (extreme positive developments in BSV ecosystem)

- 2030-12-31: BSV $45.46 (potential year-end price based on average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 30.392 | 26.2 | 17.03 | 0 |

| 2026 | 39.04848 | 28.296 | 17.82648 | 7 |

| 2027 | 41.41686 | 33.67224 | 28.28468 | 28 |

| 2028 | 40.17267 | 37.54455 | 34.16554 | 43 |

| 2029 | 52.07053 | 38.85861 | 22.92658 | 48 |

| 2030 | 49.55638 | 45.46457 | 25.9148 | 73 |

IV. BSV Professional Investment Strategies and Risk Management

BSV Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operational suggestions:

- Accumulate BSV during market dips

- Set a target holding period of at least 2-3 years

- Store BSV in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor BSV's correlation with Bitcoin price movements

- Set strict stop-loss orders to manage downside risk

BSV Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Options trading: Use put options to protect against downside risk

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Paper wallet stored in a secure location

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for BSV

BSV Market Risks

- High volatility: BSV price can experience significant fluctuations

- Limited liquidity: May face challenges in large-volume trades

- Competition: Pressure from other Bitcoin forks and cryptocurrencies

BSV Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny

- Legal challenges: Ongoing disputes may impact BSV's reputation

- Tax implications: Evolving tax laws may affect BSV holders

BSV Technical Risks

- Network security: Vulnerability to 51% attacks due to lower hash rate

- Scalability challenges: Potential issues with large block sizes

- Developer community: Limited compared to other major cryptocurrencies

VI. Conclusion and Action Recommendations

BSV Investment Value Assessment

BSV offers potential long-term value as a scalable Bitcoin implementation but faces significant short-term risks due to market volatility, regulatory uncertainty, and technical challenges.

BSV Investment Recommendations

✅ Beginners: Consider small, long-term positions as part of a diversified portfolio ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider BSV as a small, speculative allocation

BSV Trading Participation Methods

- Spot trading: Buy and sell BSV on Gate.com

- Futures trading: Engage in BSV derivatives for leveraged exposure

- Staking: Participate in BSV staking programs where available

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How high can BSV go?

BSV could potentially reach up to $40 by 2026, with estimates ranging from $32 to $40 based on current predictions and historical trends.

What is the future of BSV?

BSV is projected to grow significantly, with price estimates reaching $37.62 by 2030. This represents a substantial increase from current levels, indicating an optimistic outlook for BSV's future.

How high can Bitcoin SV go?

Bitcoin SV could potentially reach $40 by 2026, with predictions ranging from $32 to $40 based on historical trends and market analysis.

Is BSV better than Bitcoin?

BSV offers larger block sizes and higher transaction throughput than Bitcoin. However, Bitcoin has greater adoption, security, and market value. The 'better' choice depends on specific use cases and individual preferences.

Share

Content