2025 CBL Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: CBL's Market Position and Investment Value

Credbull (CBL), as an innovative and fastest-growing RWA project, has emerged as the first onchain private credit fund platform offering stable high yield and asset liquidity since its inception. As of 2025, Credbull's market capitalization has reached $19,270, with a circulating supply of approximately 100,000,000 tokens, and a price hovering around $0.0001927. This asset, hailed as the "democratizer of private credit lending," is playing an increasingly crucial role in providing access to the high-performing $2.0 Trillion private credit lending market.

This article will comprehensively analyze Credbull's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. CBL Price History Review and Current Market Status

CBL Historical Price Evolution

- 2024: Project launch, price peaked at $0.0704 on November 7th

- 2025: Market downturn, price dropped to an all-time low of $0.0001466 on October 10th

- 2025: Recent stabilization, price hovering around $0.0001927 as of November 3rd

CBL Current Market Situation

CBL is currently trading at $0.0001927, experiencing a slight decline of 0.05% in the past 24 hours. The token has seen a more significant drop of 25.14% over the last 30 days, indicating a bearish trend in the medium term. However, there's a minor uptick of 0.12% in the last hour, suggesting some short-term buying interest. The token's market capitalization stands at $19,270, with a fully diluted valuation of $192,700. With a circulating supply of 100,000,000 CBL, representing 10% of the total supply, the token's market dominance remains relatively small at 0.0000050%.

Click to view the current CBL market price

CBL Market Sentiment Indicator

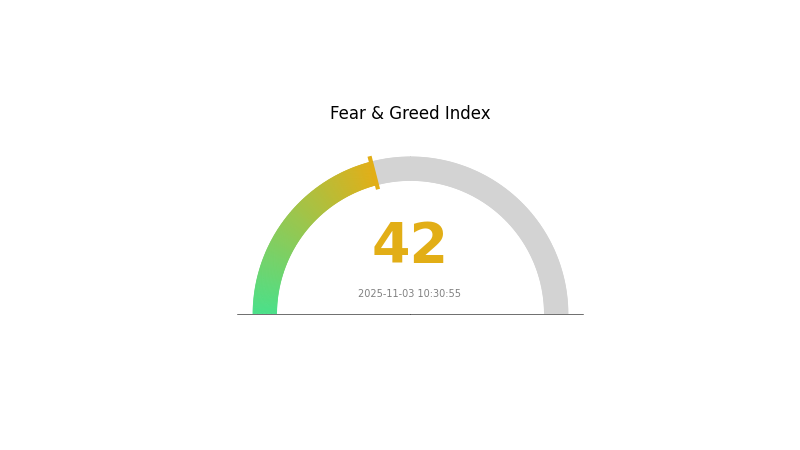

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index stands at 42, indicating a state of fear. This suggests investors are hesitant and potentially looking for buying opportunities. While fear can signal a good time to invest for contrarian traders, it's crucial to conduct thorough research and manage risks. Keep an eye on market trends and fundamental factors before making any investment decisions. As always, diversification and a long-term perspective are key in navigating volatile crypto markets.

CBL Holdings Distribution

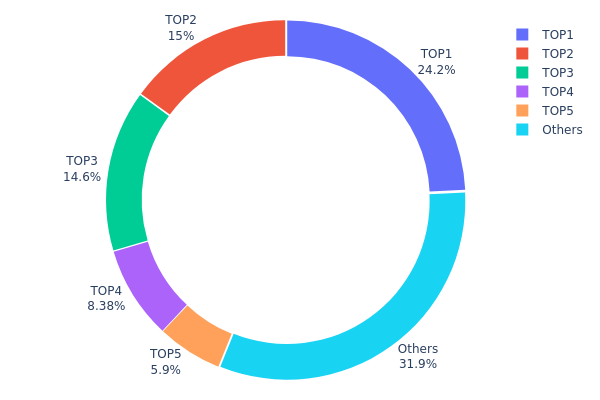

The address holdings distribution data reveals a significant concentration of CBL tokens among a few top addresses. The top holder possesses 24.19% of the total supply, while the top five addresses collectively control 68.07% of all CBL tokens. This high concentration raises concerns about potential market manipulation and price volatility.

Such a concentrated distribution structure could lead to increased market instability, as large holders have the capacity to significantly impact token prices through substantial buy or sell orders. Moreover, this centralization contradicts the principles of decentralization often sought in cryptocurrency projects. The presence of 31.93% holdings distributed among other addresses provides some balance, but the overall structure suggests a relatively low level of on-chain decentralization for CBL.

This concentration of holdings may impact CBL's market dynamics, potentially leading to increased price fluctuations and susceptibility to whale movements. Investors and traders should be aware of this distribution pattern when considering CBL's market behavior and long-term stability.

Click to view the current CBL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9b64...cf77e5 | 241920.97K | 24.19% |

| 2 | 0xfaea...834482 | 150000.00K | 15.00% |

| 3 | 0x61a9...13c780 | 146089.81K | 14.60% |

| 4 | 0x0d07...b492fe | 83831.44K | 8.38% |

| 5 | 0xecf3...36c998 | 59002.52K | 5.90% |

| - | Others | 319155.25K | 31.93% |

II. Key Factors Affecting CBL's Future Price

Institutional and Major Holder Dynamics

- Institutional Holdings: Foreign investors made significant purchases of 1,697 shares on November 11th, becoming the top buyers that day.

- Corporate Adoption: CBL-514, the company's weight loss drug candidate, has shown promising results in animal studies when combined with Tirzepatide.

- National Policies: Regulatory changes and FDA recommendations have impacted the clinical trial timeline for CBL-514.

Macroeconomic Environment

- Monetary Policy Impact: High interest rates are expected to continue negatively affecting commodity prices.

- Geopolitical Factors: Domestic and international business environments, as well as geopolitical events, can cause significant fluctuations in CBL's stock price.

Technological Developments and Ecosystem Building

- Clinical Trial Progress: CBL-514's Phase III clinical trial enrollment has been delayed to Q2 or Q3 2026, pushing potential market entry to 2029.

- Patent Protection: CBL-514 has patent protection until 2045, covering product composition, formulation, and dosage forms. The company has filed 146 patent applications with 98 approvals, achieving a 67.1% approval rate.

- Ecosystem Applications: CBL-514/CBL-514D's main indications include reducing abdominal subcutaneous fat, treating Dercum's disease, cellulite, and combining with GLP-1 agonists for weight loss and improved weight maintenance.

III. CBL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00015 - $0.00017

- Neutral prediction: $0.00018 - $0.00020

- Optimistic prediction: $0.00021 - $0.00022 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00018 - $0.00036

- 2028: $0.00022 - $0.00035

- Key catalysts: Increased adoption and positive market sentiment

2030 Long-term Outlook

- Base scenario: $0.00037 - $0.00040 (assuming steady market growth)

- Optimistic scenario: $0.00045 - $0.00048 (with strong market performance)

- Transformative scenario: $0.00049 - $0.00051 (with exceptional market conditions)

- 2030-12-31: CBL $0.00051 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00022 | 0.00019 | 0.00015 | 0 |

| 2026 | 0.0003 | 0.0002 | 0.00014 | 6 |

| 2027 | 0.00036 | 0.00025 | 0.00018 | 30 |

| 2028 | 0.00035 | 0.0003 | 0.00022 | 57 |

| 2029 | 0.00048 | 0.00033 | 0.00031 | 70 |

| 2030 | 0.00051 | 0.0004 | 0.00037 | 108 |

IV. CBL Professional Investment Strategies and Risk Management

CBL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term outlook

- Operation suggestions:

- Accumulate CBL tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure cold storage solutions

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to RWA projects

- Set strict stop-loss orders to manage downside risk

CBL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple RWA projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use unique passwords

V. Potential Risks and Challenges for CBL

CBL Market Risks

- Volatility: CBL price may experience significant fluctuations

- Liquidity: Limited trading volume may impact ability to enter/exit positions

- Competition: Emergence of other RWA projects could affect market share

CBL Regulatory Risks

- Uncertain regulations: Potential changes in crypto regulations may impact CBL

- Cross-border restrictions: Varying international laws could limit accessibility

- Compliance requirements: Increased KYC/AML measures may affect user base

CBL Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the protocol

- Scalability issues: Possible network congestion on the Arbitrum network

- Integration challenges: Difficulties in expanding to new platforms or services

VI. Conclusion and Action Recommendations

CBL Investment Value Assessment

CBL offers exposure to the growing RWA sector with potential for high yields, but faces significant short-term volatility and regulatory uncertainties.

CBL Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about RWA projects ✅ Experienced investors: Consider allocating a portion of portfolio to CBL, actively manage positions ✅ Institutional investors: Conduct thorough due diligence, potentially engage in yield farming strategies

CBL Trading Participation Methods

- Spot trading: Purchase CBL tokens on Gate.com

- Yield farming: Explore liquidity provision opportunities if available

- Dollar-cost averaging: Regular small purchases to mitigate volatility risk

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

What is the future outlook for CBL?

CBL's future outlook is positive, with projections indicating an average price target of $36.72 by 2026, ranging from $36.36 to $37.00. This forecast suggests potential growth based on current market trends.

Can BCH reach $1000?

While BCH's current price is $199, reaching $1000 is possible but challenging. It depends on market conditions, adoption, and technological advancements in the crypto space.

Can CKB reach 1 dollar?

CKB has potential to reach $1, but timing is uncertain. Market conditions and adoption will be key factors. Predictions vary, but many analysts see it as possible long-term.

How high could Cybin go?

Based on current forecasts, Cybin could potentially reach as high as $150. The average price target suggests a significant increase from its last closing price.

Share

Content