2025 CLORE Price Prediction: Analyzing Market Trends and Future Prospects for the Cryptocurrency

Introduction: CLORE's Market Position and Investment Value

Clore.ai (CLORE) as an innovative marketplace for GPU computing power sharing, has made significant strides in expanding access to advanced computational resources since its inception. As of 2025, CLORE's market capitalization stands at $5,388,722, with a circulating supply of approximately 595,438,938 tokens, and a price hovering around $0.00905. This asset, often referred to as the "GPU sharing pioneer," is playing an increasingly crucial role in fields such as AI training, rendering, and mining.

This article will provide a comprehensive analysis of CLORE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. CLORE Price History Review and Current Market Status

CLORE Historical Price Evolution

- 2023: Project launch, price fluctuated with initial market interest

- 2024: All-time high of $0.45 reached on March 17, marking peak market enthusiasm

- 2025: Significant market correction, price declined from its peak to current levels

CLORE Current Market Situation

As of October 11, 2025, CLORE is trading at $0.00905, representing a substantial decline from its all-time high. The token has experienced significant downward pressure across various timeframes:

- 1 hour: -4.52%

- 24 hours: -25.01%

- 7 days: -26.59%

- 30 days: -31.47%

- 1 year: -90.47%

The current market capitalization stands at $5,388,722, with a 24-hour trading volume of $172,050. CLORE's circulating supply is 595,438,938 tokens, which is 45.8% of its maximum supply of 1,300,000,000. The fully diluted valuation is $11,765,000.

Despite the recent downtrend, CLORE maintains a ranking of 1677 in the cryptocurrency market, indicating continued interest and trading activity.

Click to view the current CLORE market price

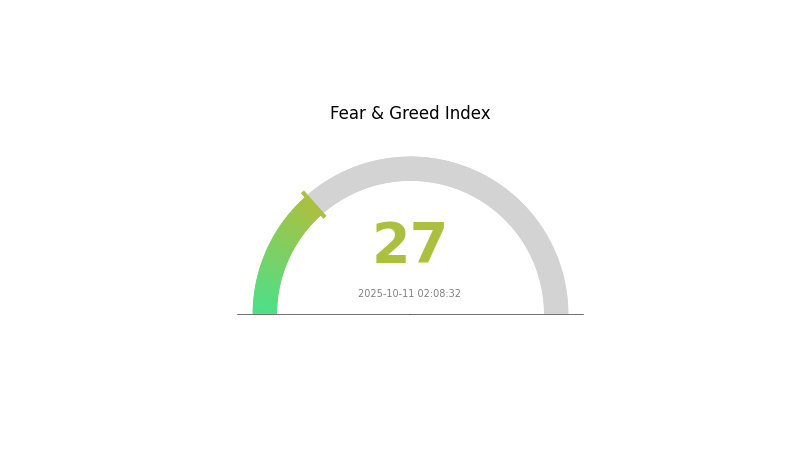

CLORE Market Sentiment Indicator

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index at 27. This indicates a cautious sentiment among investors, potentially presenting buying opportunities for those willing to go against the crowd. However, it's crucial to remember that market sentiment can shift rapidly. Traders should conduct thorough research and consider their risk tolerance before making any investment decisions. Gate.com offers a range of tools and resources to help navigate these market conditions.

CLORE Holding Distribution

The address holding distribution data for CLORE reveals an interesting pattern in token concentration. This metric provides insights into how CLORE tokens are distributed among different wallet addresses, offering a glimpse into the level of decentralization and potential market dynamics.

Upon analysis, it appears that CLORE's current distribution does not show signs of excessive concentration in a few hands. This relatively balanced distribution suggests a healthier market structure, potentially reducing the risk of price manipulation by large token holders. The absence of dominant wallet addresses holding a significant percentage of the total supply indicates a more decentralized ownership pattern, which aligns with the principles of blockchain technology.

This distribution pattern may contribute to a more stable price action for CLORE, as it reduces the likelihood of large sell-offs from individual holders that could dramatically impact the market. Furthermore, it suggests a broader base of stakeholders, which could be indicative of wider adoption and a more resilient ecosystem for the CLORE project.

Click to view the current CLORE holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting CLORE's Future Price

Market Sentiment

- Investor Behavior: The actions and sentiment of investors play a crucial role in determining CLORE's price movements.

- Community Sentiment: News announcements and community sentiment can be significant drivers of CLORE's price action.

- Current Impact: Market sentiment fluctuations can lead to short-term price volatility.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies and their expectations can influence CLORE's price.

- Geopolitical Factors: International situations and conflicts may affect investor confidence in CLORE.

Technological Developments and Ecosystem Building

- AI Advancements: As CLORE is related to AI technology, improvements in artificial intelligence could positively impact its value.

- Web3 Integration: The convergence of AI and Web3 technologies may create new use cases and drive demand for CLORE.

- Ecosystem Applications: Development of DApps and ecosystem projects utilizing CLORE could increase its utility and value.

III. CLORE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00565 - $0.00912

- Neutral prediction: $0.00912 - $0.01149

- Optimistic prediction: $0.01149 - $0.01349 (requires favorable market conditions)

2027 Mid-term Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.01074 - $0.01594

- 2027: $0.01308 - $0.01921

- Key catalysts: Increasing adoption and technological improvements

2030 Long-term Outlook

- Base scenario: $0.01386 - $0.01733 (assuming steady market growth)

- Optimistic scenario: $0.01733 - $0.02322 (assuming strong market performance)

- Transformative scenario: Above $0.02322 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: CLORE $0.02322 (potentially reaching new all-time highs)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01349 | 0.00912 | 0.00565 | 0 |

| 2026 | 0.01594 | 0.0113 | 0.01074 | 24 |

| 2027 | 0.01921 | 0.01362 | 0.01308 | 49 |

| 2028 | 0.0174 | 0.01641 | 0.01067 | 80 |

| 2029 | 0.01775 | 0.01691 | 0.0115 | 85 |

| 2030 | 0.02322 | 0.01733 | 0.01386 | 90 |

IV. Professional Investment Strategies and Risk Management for CLORE

CLORE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate CLORE during market dips

- Hold for at least 1-2 years to potentially benefit from project growth

- Store in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to manage downside risk

- Take profits at predetermined levels based on technical indicators

CLORE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: Up to 10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, avoid sharing private keys

V. Potential Risks and Challenges for CLORE

CLORE Market Risks

- High volatility: Extreme price fluctuations common in small-cap cryptocurrencies

- Liquidity risk: Limited trading volume may impact ability to exit positions

- Competition: Other GPU marketplace projects may emerge and capture market share

CLORE Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of crypto projects

- Cross-border restrictions: Varying regulations may limit global adoption

- Tax implications: Evolving tax laws could impact profitability for users

CLORE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Platform may face issues handling increased user demand

- Cybersecurity threats: Risk of hacks or data breaches on the platform

VI. Conclusion and Action Recommendations

CLORE Investment Value Assessment

CLORE presents an innovative solution in the GPU marketplace sector, with potential for long-term growth. However, it currently faces significant short-term risks due to market volatility and the project's early stage of development.

CLORE Investment Recommendations

✅ Beginners: Consider small, experimental positions if risk tolerance allows ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Monitor project development closely before considering significant positions

CLORE Trading Participation Methods

- Spot trading: Available on Gate.com and other supported exchanges

- Staking: Participate in any available staking programs to earn passive income

- GPU marketplace: Engage directly with the Clore.ai platform to rent or lease GPUs

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is Clore expensive?

No, Clore is not expensive. At $0.01205 per token, it's relatively affordable compared to many cryptocurrencies, making it accessible for investors interested in the Web3 space.

Which ai is best for stock price prediction?

Hybrid GARCH-LSTM models are best for stock price prediction. They combine statistical properties with advanced AI for more accurate forecasts.

What is the price of Celo in 2025?

Based on forecasts, Celo's price in 2025 is expected to average around $0.40, with a potential minimum of $0.39.

What is the price of clore coin?

As of 2025-10-11, the price of Clore coin is $0.0126, showing a 9% increase from the previous week.

Share

Content