2025 CORE Fiyat Tahmini: Kripto Para Ekosistemindeki Potansiyel Büyüme Faktörleri ve Piyasa Trendlerinin Analizi

Giriş: CORE’un Piyasadaki Konumu ve Yatırım Potansiyeli

Core DAO (CORE), EVM uyumlu bir L1 blokzinciri olarak, kuruluşundan bu yana önemli bir gelişim gösterdi. 2025 itibarıyla CORE’un piyasa değeri 463.397.531 $’a ulaştı; dolaşımdaki arz yaklaşık 1.012.005.964 token; fiyat ise 0,4579 $ seviyesinde. “Bitcoin-Ethereum hibriti” olarak anılan CORE, merkeziyetsiz finans ve blokzincirler arası birlikte çalışabilirlikte giderek daha kritik bir rol üstleniyor.

Bu yazıda 2025-2030 döneminde CORE’un fiyat hareketleri, tarihsel trendler, arz-talep dengesi, ekosistem büyümesi ve makroekonomik faktörler bir arada ele alınacak; yatırımcılar için profesyonel fiyat öngörüleri ve uygulamaya yönelik yatırım stratejileri sunulacaktır.

I. CORE Fiyat Geçmişi ve Güncel Piyasa Durumu

CORE Fiyatının Tarihsel Gelişimi

- 2023: CORE, 8 Şubat’ta 14,48 $ ile tüm zamanların en yüksek seviyesine ulaşarak dönüm noktası yaşadı

- 2023: Yılın ilerleyen aylarında sert düşüşle 3 Kasım’da 0,2995 $ ile en düşük seviyesini gördü

- 2025: Güncel piyasa döngüsüne bakıldığında fiyat 0,4579 $’a toparlanmış ve istikrar sinyali veriyor

CORE Güncel Piyasa Görünümü

19 Eylül 2025’te CORE 0,4579 $ seviyesinden işlem görüyor; piyasa değeri 463.397.531 $. Son 24 saatte %0,69 gerileyen CORE, işlem hacminde 880.419 $ ile orta düzeyde bir aktivite sergiledi. Dolaşımdaki miktar 1.012.005.964 CORE’dur. Bu, maksimum arzın %48,19’una karşılık gelir. Son bir yılda %52,23 aşağıda olsa da, CORE tüm zamanların en düşük seviyesinin üstünde istikrarını koruyor. Mevcut fiyat, en düşük noktadan %52,89 toparlanma göstererek orta vadede yukarı yönlü bir potansiyeli işaret ediyor.

Güncel CORE piyasa fiyatını görmek için tıklayın

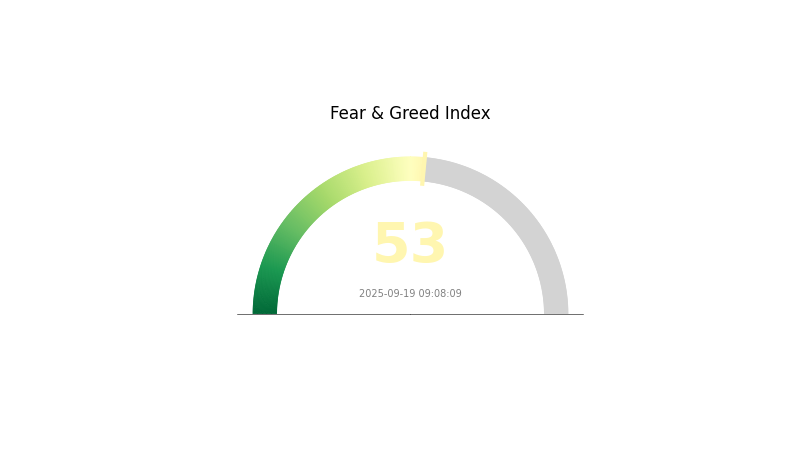

CORE Piyasa Duyarlılığı Göstergesi

19 Eylül 2025 Korku ve Açgözlülük Endeksi: 53 (Nötr)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Bugün kripto piyasasında duyarlılık dengelidir; Korku ve Açgözlülük Endeksi 53 ile nötr seviyede. Bu, yatırımcıların mevcut koşullara karşı aşırı bir iyimserlik veya pesimizm taşımadığını gösteriyor. Piyasada ani hareketi tetikleyecek bir korku ya da açgözlülük yok; yine de yatırımcıların dikkatli karar vermesi ve derinlemesine analiz yapması büyük önem taşıyor. Kripto piyasasında yatırım kararı alırken, yalnızca duyarlılık göstergesiyle yetinmemek ve çok yönlü değerlendirme yapmak şarttır.

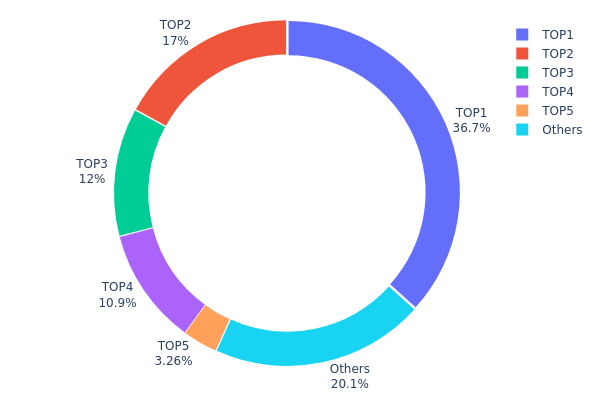

CORE Varlık Dağılımı

CORE adres dağılımı verileri, oldukça merkeziyetçi bir yapı ortaya koyuyor. En büyük adres toplam arzın %36,09’una sahipken, ilk beş adres CORE tokenlarının %78,60’ını kontrol ediyor. Bu yoğunlaşma, piyasa manipülasyonu ve fiyat oynaklığı açısından kritik riskler barındırıyor.

Böylesi merkezi bir dağılım piyasa dalgalanmalarına yol açabilir. “Balina” olarak bilinen büyük sahipler, önemli alım veya satım işlemleriyle fiyatları ciddi şekilde etkileyebilir. Bu yapı, CORE ekosisteminde düşük merkeziyetsizlik seviyesine işaret eder; temel blokzincir ilkeleriyle çelişebilir.

CORE’da mevcut dağılım, görece olgunlaşmamış bir piyasa yapısına işaret ediyor. Arzın beşte birinden fazlası küçük adreslerde bulunsa da, büyük sahiplerin baskınlığı zincir üzerindeki yapının ve piyasadaki istikrarın, bu aktörlerin radikal hareketlerinde riske girebileceğini düşündürüyor.

Güncel CORE Varlık Dağılımı için tıklayın

| Sıra | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...001000 | 757.792,39K | 36,09% |

| 2 | 0x8605...f94f52 | 351.500,00K | 16,74% |

| 3 | 0x0000...001011 | 247.846,43K | 11,80% |

| 4 | 0x3073...e21838 | 226.000,00K | 10,76% |

| 5 | 0xedd1...916de0 | 67.381,47K | 3,21% |

| - | Diğerleri | 413.968,57K | 21,4% |

II. Gelecekte CORE Fiyatını Belirleyecek Temel Faktörler

Arz Yapısı

- Toplam Arz: CORE’un arzı 2.100.000.000 token ile sınırlıdır.

- Dolaşımdaki Arz: 19 Eylül 2025’te dolaşımdaki CORE miktarı 1.012.006.150,28 token.

- Güncel Etki: Sınırlı arz ve kademeli dağıtım, nadirlik oluşturarak fiyatı destekleyebilir.

Kurumsal ve Balina Hareketleri

- Kurumsal Benimseme: CORE’u kabul eden işletme sayısı giderek artıyor, bu da talebi ve fiyatı yukarı çekebilir.

Makroekonomik Koşullar

- Enflasyona Karşı Koruma: Küresel kripto para talebindeki artış, CORE’un enflasyona karşı koruma aracı olarak değerlendirilebilmesini ve fiyatında artışı tetikleyebilir.

Teknoloji ve Ekosistem Gelişimi

- Altyapı Geliştirme: CORE ekosistemi, geniş çaplı uygulamalar için altyapı iyileştirmelerine odaklanıyor ve bu durum değer algısını artırabilir.

- Ekosistem Uygulamaları: CORE ağında DApp ve projelerdeki büyüme, token talebini ve kullanılabilirliğini yükseltebilir.

III. CORE Fiyat Tahmini (2025-2030)

2025 Görünümü

- Temkinli: 0,31533 $ - 0,40000 $

- Nötr: 0,40000 $ - 0,50000 $

- İyimser: 0,50000 $ - 0,56668 $ (güçlü piyasa duyarlılığı ve yüksek benimseme koşuluyla)

2027-2028 Görünümü

- Piyasa aşaması: Artan benimsemeyle büyüme olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,49679 $ - 0,57239 $

- 2028: 0,48389 $ - 0,62293 $

- Belirleyici etkenler: Teknik ilerleme, artan kullanım, genel piyasa eğilimi

2029-2030 Uzun Vadeli Tahmin

- Temel senaryo: 0,58956 $ - 0,68389 $ (istikrarlı büyüme varsayımıyla)

- İyimser senaryo: 0,68389 $ - 0,77822 $ (hızlı benimseme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: 0,77822 $ - 0,80000 $ (çığır açıcı kullanım alanları ve yaygın entegrasyon ile)

- 2030-12-31: CORE 0,7386 $ (yılın tahmini zirvesi)

| Yıl | Tahmini En Yüksek | Tahmini Ortalama | Tahmini En Düşük | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,56668 | 0,457 | 0,31533 | 0 |

| 2026 | 0,56814 | 0,51184 | 0,31222 | 11 |

| 2027 | 0,57239 | 0,53999 | 0,49679 | 17 |

| 2028 | 0,62293 | 0,55619 | 0,48389 | 21 |

| 2029 | 0,77822 | 0,58956 | 0,51292 | 28 |

| 2030 | 0,7386 | 0,68389 | 0,54027 | 49 |

IV. CORE Profesyonel Yatırım Stratejisi ve Risk Yönetimi

CORE Yatırım Yaklaşımları

(1) Uzun Vadeli Tutma Stratejisi

- Hedef yatırımcı profili: Uzun vadeli değer yatırımcıları

- Operasyon notları:

- Piyasa gerilemelerinde CORE birikimi yapın

- Kısmi kar alımı için net fiyat hedefleri belirleyin

- Token’ları kendi kontrolünüzde ve güvenli bir cüzdanda tutun

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalama: Destek/direnç ve trend belirlemek için

- RSI: Aşırı alım/satım noktalarını takip edin

- Swing işlem için kritik noktalar:

- Piyasa duyarlılığını ve proje gelişmelerini izleyin

- Zarar durdur emri ile riski yönetin

CORE Risk Yönetimi

(1) Varlık Dağılımı Prensipleri

- Temkinli yatırımcı: Kripto portföyünün %1-3’ü

- Orta riskli yatırımcı: Kripto portföyünün %3-5’i

- Agresif yatırımcı: Kripto portföyünün %5-10’u

(2) Riskten Korunma Stratejileri

- Çeşitlendirme: Farklı kripto varlıklara dağılım

- Zarar durdur emri: Kaybı sınırlamak için

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli varlıklar için donanım cüzdanı

- Güvenlik önlemleri: İki faktörlü doğrulama ve güçlü şifreler kullanın

V. CORE için Potansiyel Riskler ve Zorluklar

CORE Piyasa Riskleri

- Fiyat oynaklığı: Kripto piyasalarında ciddi dalgalanmalar

- Rekabet: Yeni rakip L1 blokzincirlerin etkisi

- Likidite: Küçük borsalarda olası likidite sıkıntıları

CORE Düzenleyici Riskler

- Düzenleyici belirsizlik: Küresel düzenlemelerin belirsiz ve değişken yapısı

- Uyum güçlükleri: Yeni regülasyonlara adaptasyonda yaşanabilecek sıkıntılar

- Yasal durum: Bazı ülkelerde net olmayan mevzuat

CORE Teknik Riskler

- Akıllı kontrat açıkları: Blokzincir kodundaki potansiyel zafiyetler

- Ölçeklenebilirlik sorunları: Ağ trafiği artışında performans riskleri

- Mutabakat mekanizmasının istikrarı: “Satoshi Plus” konsensüsünün olası sorunları

VI. Sonuç ve Eylem Önerileri

CORE Yatırım Değeri Analizi

CORE, EVM uyumlu bir L1 zinciri olarak Bitcoin düzeyinde güvenlik sağlıyor ve özgün bir değer sunuyor. Ancak, kısa vadeli oynaklık ve teknik zorluklar yatırımcılar tarafından dikkate alınmalıdır.

CORE Yatırım Önerileri

✅ Yeni başlayanlar: Ufak yatırımlarla başlayıp projeyi öğrenmeye odaklanmalı ✅ Tecrübeli yatırımcılar: Ortalama maliyetleme (düzenli alım) stratejisi ile dengeli ilerlemeli ✅ Kurumsal yatırımcılar: Ayrıntılı inceleme ve OTC opsiyonlarını gözden geçirmeli

CORE İşlem Yöntemleri

- Spot piyasada CORE alım-satımı Gate.com üzerinde yapılabilir

- Staking programları varsa katılım sağlanabilir

- Core blokzincirinde DeFi fırsatları değerlendirilebilir

Kripto para yatırımları yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Her yatırımcı, kendi risk toleransına göre dikkatli davranmalı ve profesyonel finansal danışmanlardan destek almalıdır. Yatırım tutarınız, kaybetmeyi göze alabileceğinizden fazla olmamalıdır.

SSS

2025’te Core fiyatı ne olur?

Mevcut piyasa tahminlerine göre, Eylül 2025’te Core fiyatının 0,4707 $ seviyesine ulaşması bekleniyor.

2030’da Core fiyatı ne olur?

Yıllık %5 artış öngörüsüne göre, Core fiyatı 2030’da 0,6145 $’a ulaşabilir.

Bir Core Coin’in değeri ne kadar olur?

Core Coin, 2030 yılında 0,028 - 0,115 $ aralığına ulaşabilir; güncel değerine göre %170’e varan artış beklentisi vardır.

2025 için CoreWeave hisse tahmini nedir?

2025’te CoreWeave hisse fiyatının ortalama 425,05 $’a ulaşması öngörülüyor; kısa vadede %0,19’luk hafif bir gerileme beklense de genel trend yükseliş yönünde.

2025 CKB Fiyat Tahmini: Benimseme ve Gelişim Hızlanırken Yükseliş Eğilimi

2025 HEI Fiyat Tahmini: HEI Token’ın Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

2025 SUI Fiyat Tahmini: Blockchain’in Yeni Gözdesinin Gelecekteki Gelişimi ve Yatırım Değeri Analizi

2025 LUNC Fiyat Tahmini: Terra Luna Classic’in Çöküş Sonrası Dönemde Potansiyel Toparlanma ve Piyasa Görünümünün Analizi

2025 APT Fiyat Tahmini: Aptos Token’ı Yeni Zirvelere Taşıyabilecek Temel Dinamikler

ICP Kripto: Neden Internet Computer 30 AUD'a Yükselebilir

Bitcoin %26 Düştü: Çoğu Kripto Varlığın Performansını Geride Bırakmasının Ardındaki Gizli Sinyaller ve Yatırım İçgörüleri

BTC Volatilite Geri Mi Dönüyor? Bitcoin Fiyat Yapısı ve $50,000 Etrafındaki Yeniden Başlayan Tartışma

Bitcoin Fiyat Görünümü: 80,000 $'ın Altına Düşmek Bir Risk mi Yoksa Bir Fırsat mı?

ETH Teknik Analiz: ABCD Düzeltme Modeli Altındaki $2,500 Destek Seviyesinin İncelenmesi

Dogecoin İşlem Hacmindeki Artışın Derinlemesine Analizi: %61'lik İşlem Çılgınlığını ve 14.8B$ Vadeli İşlem Aktivitesini Açıklamak