2025 EURT Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: EURT's Market Position and Investment Value

Euro Tether (EURT) as a euro-backed stablecoin has established itself as a significant player in the cryptocurrency market since its inception. As of 2025, EURT's market cap has reached $4,778,573, with a circulating supply of approximately 4,155,281 tokens, maintaining a price around $1.15. This asset, often referred to as a "digital euro equivalent," is playing an increasingly crucial role in providing a stable, euro-pegged option for crypto traders and investors.

This article will comprehensively analyze EURT's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. EURT Price History Review and Current Market Status

EURT Historical Price Evolution

- 2021: EURT reached its all-time high of $1.31 on September 2, marking a significant milestone for the stablecoin.

- 2022: The cryptocurrency market experienced a downturn, with EURT hitting its all-time low of $0.944541 on September 28.

- 2025: EURT has shown resilience, maintaining relative stability as a euro-pegged stablecoin.

EURT Current Market Situation

As of October 11, 2025, EURT is trading at $1.15, with a 24-hour trading volume of $15,390.88. The token has experienced a slight decrease of 0.49% in the past 24 hours. EURT's market capitalization stands at $4,778,573.99, ranking it at 1753 in the global cryptocurrency market. The circulating supply is 4,155,281.74 EURT, which represents 8.31% of the total supply of 50,000,050 EURT. Over the past year, EURT has shown a positive trend with a 5.96% increase in value, reflecting its stability as a euro-pegged stablecoin.

Click to view the current EURT market price

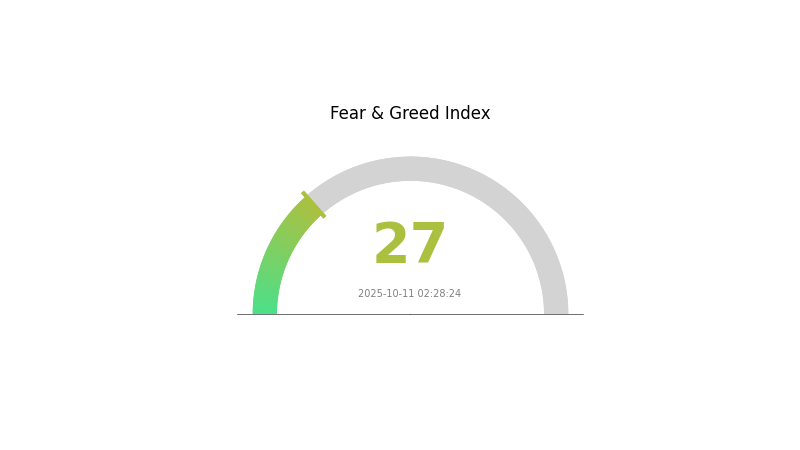

EURT Market Sentiment Indicator

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the sentiment index at a low 27. This suggests investors are cautious and potentially looking for buying opportunities. While fear can lead to further price declines, it often precedes market bottoms. Savvy traders might consider this a time to accumulate, but should remain vigilant. As always, thorough research and risk management are crucial in these uncertain market conditions.

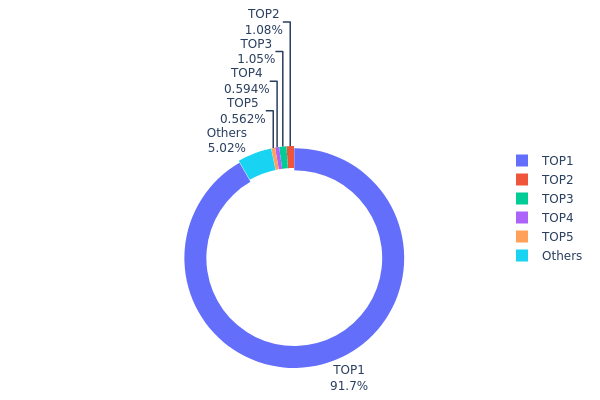

EURT Holdings Distribution

The address holdings distribution data for EURT reveals a highly concentrated ownership structure. The top address holds an overwhelming 91.69% of the total supply, equivalent to 45,846,150 EURT tokens. This extreme concentration raises significant concerns about centralization and potential market manipulation risks.

The subsequent top addresses hold considerably smaller portions, with the second and third largest wallets containing just over 1% each. This stark disparity between the largest holder and the rest of the market participants indicates a severely imbalanced distribution. Such a concentrated structure could lead to increased volatility and susceptibility to large price swings based on the actions of the dominant address.

From a market stability perspective, this level of concentration poses challenges to the token's liquidity and overall ecosystem health. It may deter potential investors due to concerns about price manipulation and could impede the development of a robust, decentralized market for EURT.

Click to view the current EURT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5754...07b949 | 45846.15K | 91.69% |

| 2 | 0x5c4b...553aef | 540.85K | 1.08% |

| 3 | 0x6916...7733a5 | 526.58K | 1.05% |

| 4 | 0x6ab5...070770 | 297.18K | 0.59% |

| 5 | 0x4fb3...a83128 | 281.18K | 0.56% |

| - | Others | 2508.11K | 5.03% |

II. Key Factors Affecting Future EURT Prices

Macroeconomic Environment

-

Impact of Monetary Policy: The Federal Reserve is expected to cut interest rates 2 to 3 times this year, while the European Central Bank's (ECB) policy decisions will be crucial. The interest rate differential between the Eurozone and the US remains a core factor influencing the EUR/USD exchange rate.

-

Inflation Hedging Properties: Inflation rates are a key indicator of economic stability, affecting EURT's value as a potential hedge against inflation.

-

Geopolitical Factors: Political stability is a cornerstone of currency confidence. International situations and geopolitical events can significantly impact EURT's price movements.

Institutional and Major Player Dynamics

- National Policies: Government policies at the national level, particularly those related to fiscal measures and economic reforms, can influence EURT's attractiveness and stability.

Technical Development and Ecosystem Building

- Ecosystem Applications: The development of major DApps and ecosystem projects within the EURT network could potentially drive adoption and value.

III. EURT Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.805 - $1.15

- Neutral prediction: $1.15 - $1.30

- Optimistic prediction: $1.30 - $1.449 (requires increased adoption and market stability)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with fluctuations

- Price range forecast:

- 2027: $0.70914 - $1.61294

- 2028: $0.93106 - $1.77201

- Key catalysts: Technological advancements, regulatory clarity, and broader market trends

2029-2030 Long-term Outlook

- Base scenario: $1.63686 - $1.78417 (assuming steady market growth)

- Optimistic scenario: $1.93149 - $2.06964 (assuming increased adoption and favorable market conditions)

- Transformative scenario: $2.06964+ (assuming significant breakthroughs and widespread acceptance)

- 2030-12-31: EURT $1.78417 (potential average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.449 | 1.15 | 0.805 | 0 |

| 2026 | 1.48143 | 1.2995 | 1.07859 | 13 |

| 2027 | 1.61294 | 1.39047 | 0.70914 | 20 |

| 2028 | 1.77201 | 1.5017 | 0.93106 | 30 |

| 2029 | 1.93149 | 1.63686 | 1.08032 | 42 |

| 2030 | 2.06964 | 1.78417 | 0.98129 | 55 |

IV. EURT Professional Investment Strategies and Risk Management

EURT Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking euro-pegged stability

- Operation suggestions:

- Accumulate EURT during market dips

- Hold as a hedge against euro volatility

- Store in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Monitor EUR/USD forex movements

- Track European economic indicators

EURT Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10%

- Moderate investors: 10-20%

- Aggressive investors: 20-30%

(2) Risk Hedging Solutions

- Diversification: Balance EURT with other stablecoins and assets

- Stop-loss orders: Set predetermined exit points to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for EURT

EURT Market Risks

- Euro volatility: Fluctuations in the euro may affect EURT's stability

- Limited liquidity: Lower trading volumes compared to USD-pegged stablecoins

- Market sentiment: Changes in stablecoin perception could impact adoption

EURT Regulatory Risks

- European regulatory scrutiny: Potential new regulations on stablecoins

- Cross-border restrictions: Varying legal status in different jurisdictions

- Compliance requirements: Evolving KYC/AML standards for stablecoin issuers

EURT Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token contract

- Centralization risks: Reliance on Tether's management and reserves

- Blockchain congestion: High gas fees on Ethereum during peak times

VI. Conclusion and Action Recommendations

EURT Investment Value Assessment

EURT offers a stable, euro-pegged digital asset with potential for growth in the European crypto market. However, it faces challenges in adoption and regulatory uncertainty.

EURT Investment Recommendations

✅ Beginners: Start with small allocations to understand EURT's behavior

✅ Experienced investors: Use EURT for euro-based crypto trading pairs

✅ Institutional investors: Consider EURT for treasury management and euro exposure

EURT Participation Methods

- Spot trading: Buy and sell EURT on Gate.com

- Savings: Explore EURT staking or lending options if available

- Payments: Use EURT for euro-denominated crypto transactions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance, and it is recommended to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the euro price prediction for 2025?

Based on forecasts, the euro is expected to trade around 1.17-1.20 against the US dollar by the end of 2025. Some investment banks project EUR/USD levels between 1.19 and 1.25, citing potential dollar weakness and euro resilience.

What will tether be worth in 2030?

Based on current predictions, Tether could potentially reach €1.09 by 2030, assuming a 5% price change. However, cryptocurrency values are highly speculative and subject to market fluctuations.

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach a price range of $90 to $120, based on current market trends and growth projections for the cryptocurrency.

What is tether eurt?

Euro Tether (EURT) is a stablecoin pegged to the Euro at a 1:1 ratio. It's part of the Tether family, used for stable cryptocurrency transactions.

Share

Content