2025 GME Price Prediction: Analyzing Market Trends and Potential Catalysts for GameStop's Future Valuation

Introduction: GME's Market Position and Investment Value

GameStop (GME), as a community coin on the Solana network parodying GameStop, has been attracting attention since its inception. As of 2025, GME's market capitalization has reached $7,588,798, with a circulating supply of approximately 6,885,137,498 tokens, and a price hovering around $0.0011022. This asset, known as a "meme coin," is playing an increasingly significant role in the realm of community-driven cryptocurrencies.

This article will provide a comprehensive analysis of GME's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to offer professional price predictions and practical investment strategies for investors.

I. GME Price History Review and Current Market Status

GME Historical Price Evolution

- 2024: GME reached its all-time high of $0.03248 on June 7, marking a significant milestone in its price history.

- 2025: The market experienced a downturn, with GME hitting its all-time low of $0.0009397 on September 25.

GME Current Market Situation

As of October 10, 2025, GME is trading at $0.0011022, representing a 2.75% decrease in the last 24 hours. The token's market capitalization stands at $7,588,798, ranking it 1554th in the global cryptocurrency market. GME has seen a significant decline from its all-time high, currently trading 96.61% below that peak.

The trading volume in the past 24 hours is $74,047, indicating moderate market activity. GME's price has shown volatility across different timeframes, with a 2.05% increase in the last hour, but a 9.45% decrease over the past week and an 11.82% drop in the last 30 days. The most substantial decline is observed in the yearly performance, with a 64.8% decrease.

The current market sentiment for GME appears to be cautious, with the token struggling to maintain its value in the face of broader market trends. Despite the recent hourly gains, the overall trajectory remains bearish in the short to medium term.

Click to view the current GME market price

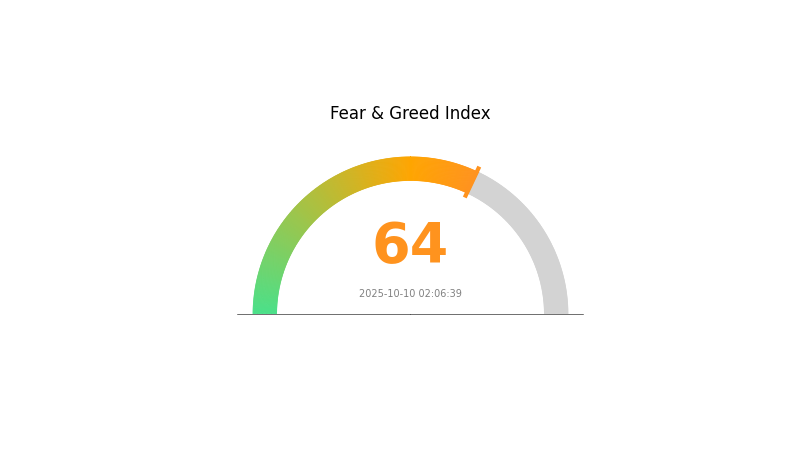

GME Market Sentiment Indicator

2025-10-10 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index at 64. This suggests that investors are becoming increasingly optimistic about the market's potential. However, it's important to remember that excessive greed can lead to overvaluation and potential corrections. As always, it's crucial to conduct thorough research and maintain a balanced investment strategy. Consider using Gate.com's advanced trading tools to make informed decisions in this dynamic market environment.

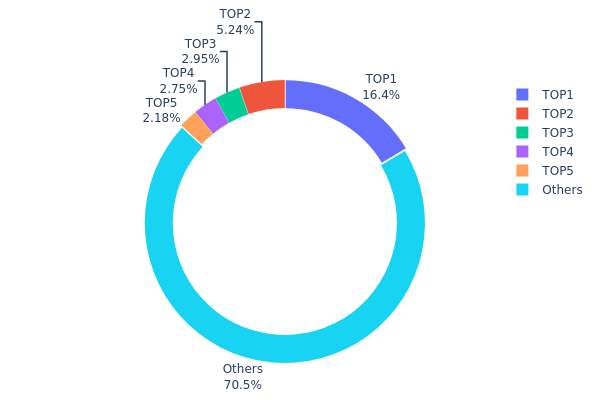

GME Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of GME tokens across different wallet addresses. Analysis of this data reveals a moderate level of centralization within the GME ecosystem. The top address holds a significant 16.40% of the total supply, while the top five addresses collectively control 29.49% of GME tokens.

This concentration pattern suggests a potential for market influence by large holders, commonly known as "whales." Such a distribution could impact price volatility, as substantial movements from these addresses might trigger market reactions. However, the fact that 70.51% of tokens are distributed among other addresses indicates a reasonable level of decentralization, which may help mitigate the risk of market manipulation by a single entity.

The current holdings distribution reflects a balanced market structure for GME, with a mix of significant stakeholders and a broad base of smaller holders. This distribution contributes to the token's on-chain stability while maintaining a degree of decentralization that aligns with the ethos of many blockchain projects. Investors and analysts should monitor any significant changes in this distribution, as shifts could signal evolving market dynamics or potential upcoming events affecting GME's ecosystem.

Click to view the current GME Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 1129019.76K | 16.40% |

| 2 | u6PJ8D...ynXq2w | 360503.60K | 5.23% |

| 3 | 5PAhQi...cnPRj5 | 202726.00K | 2.94% |

| 4 | 4gXs8o...Dat8tH | 189106.96K | 2.74% |

| 5 | Cw32Ny...YLwZeh | 150233.00K | 2.18% |

| - | Others | 4849454.58K | 70.51% |

II. Key Factors Affecting GME's Future Price

Macroeconomic Environment

-

Inflation Hedging Properties: As a meme stock, GME may not have strong inflation hedging properties traditionally associated with some cryptocurrencies or precious metals. Its price movements are more likely influenced by market sentiment and specific company factors rather than broader economic indicators like inflation.

-

Geopolitical Factors: International tensions or economic uncertainties could impact overall market sentiment, potentially affecting GME's price along with other stocks. However, as a US-based retail company, GME may be less directly affected by global geopolitical events compared to multinational corporations or commodities.

Technical Development and Ecosystem Building

-

NFT Marketplace: GameStop has launched an NFT marketplace, expanding its presence in the digital asset space. This development could potentially impact GME's price as it represents a new revenue stream and aligns the company with emerging blockchain technologies.

-

Ecosystem Applications: GameStop's foray into NFTs and potential blockchain-based gaming initiatives could lead to the development of new applications within its ecosystem. These might include digital collectibles, in-game assets, or loyalty programs leveraging blockchain technology.

III. GME Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.00105 - $0.00110

- Neutral forecast: $0.00110 - $0.00115

- Optimistic forecast: $0.00115 - $0.00119 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range prediction:

- 2027: $0.00082 - $0.00167

- 2028: $0.00098 - $0.00190

- Key catalysts: Technological advancements, increased utility, and broader market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.00171 - $0.00189 (assuming steady growth and adoption)

- Optimistic scenario: $0.00207 - $0.00222 (with significant project milestones and market expansion)

- Transformative scenario: $0.00222+ (with groundbreaking innovations and mainstream acceptance)

- 2030-12-31: GME $0.00222 (potentially reaching new all-time highs)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00119 | 0.0011 | 0.00105 | 0 |

| 2026 | 0.00164 | 0.00115 | 0.0008 | 3 |

| 2027 | 0.00167 | 0.00139 | 0.00082 | 26 |

| 2028 | 0.0019 | 0.00153 | 0.00098 | 38 |

| 2029 | 0.00207 | 0.00171 | 0.00096 | 55 |

| 2030 | 0.00222 | 0.00189 | 0.00121 | 71 |

IV. Professional Investment Strategies and Risk Management for GME

GME Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a high-risk appetite

- Operational suggestions:

- Accumulate GME during market dips

- Set long-term price targets and stick to them

- Store GME in a secure Solana-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps determine overbought/oversold conditions

- Key points for swing trading:

- Monitor SOL ecosystem developments closely

- Set strict stop-loss orders to manage downside risk

GME Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Aggressive investors: 3-5% of crypto portfolio

- Professional investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Solana ecosystem tokens

- Options strategies: Consider using options to hedge against potential downside

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting Solana tokens

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for GME

GME Market Risks

- High volatility: GME price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Dependency on Solana: GME's performance is tied to the Solana ecosystem

GME Regulatory Risks

- Uncertain regulatory landscape: Potential for increased scrutiny of meme coins

- Legal status: Risk of being classified as a security in some jurisdictions

- Compliance issues: Possible challenges in meeting future regulatory requirements

GME Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the token contract

- Solana network congestion: Transaction delays or increased fees during high network load

- Wallet compatibility: Limited support from some crypto wallets

VI. Conclusion and Action Recommendations

GME Investment Value Assessment

GME presents a high-risk, speculative investment within the Solana ecosystem. While it may offer short-term trading opportunities, its long-term value proposition remains uncertain due to its meme coin nature and reliance on community sentiment.

GME Investment Recommendations

✅ Beginners: Avoid or limit exposure to a very small portion of your portfolio ✅ Experienced investors: Consider small allocations for short-term trading opportunities ✅ Institutional investors: Approach with caution, potentially as part of a diversified Solana ecosystem portfolio

GME Trading Participation Methods

- Spot trading: Buy and sell GME on Gate.com

- Limit orders: Use to enter or exit positions at specific price points

- Dollar-cost averaging: Gradually accumulate GME over time to mitigate price volatility

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Is GME expected to rise?

Yes, GME is expected to rise. Market analysts predict a bullish trend for GME in the coming months, driven by positive developments in the gaming industry and potential partnerships.

What is the AI prediction for GME stock?

AI predicts GME stock to reach $150 by end of 2025, driven by strong e-commerce growth and strategic partnerships.

What is GameStop Target price?

Based on current market trends and analyst projections, GameStop's target price for 2025 is estimated to be around $150-$200 per share.

Is GME heavily shorted?

As of 2025, GME is no longer heavily shorted. Short interest has significantly decreased since the 2021 short squeeze event, with current levels considered normal for most stocks.

Share

Content