2025 HAI Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: HAI's Market Position and Investment Value

Hacken Token (HAI), as a leading cryptocurrency in the network security consulting sector, has made significant strides since its inception. As of 2025, HAI's market capitalization has reached $5,512,526, with a circulating supply of approximately 833,337,375 tokens, and a price hovering around $0.006615. This asset, known as the "Cybersecurity Guardian," is playing an increasingly crucial role in protecting cryptocurrency transactions and blockchain security.

This article will comprehensively analyze HAI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. HAI Price History Review and Current Market Status

HAI Historical Price Evolution

- 2021: ATH reached, price peaked at $0.465884 on April 12

- 2025: Market downturn, price dropped to ATL of $0.0015677 on June 21

- 2025: Recent recovery, price currently at $0.006615 as of October 11

HAI Current Market Situation

HAI is currently trading at $0.006615, showing a significant decline of 24.8% in the past 24 hours. The token has experienced negative price movements across various timeframes, with a 6.94% decrease over the past week and a 20.77% drop in the last 30 days. The current price represents a substantial 82.56% decline from a year ago. HAI's market capitalization stands at $5,512,526, ranking it at 1660 in the cryptocurrency market. The trading volume in the last 24 hours is $106,905, indicating moderate market activity. Despite the recent downtrend, HAI is still trading well above its all-time low, suggesting some level of market support.

Click to view the current HAI market price

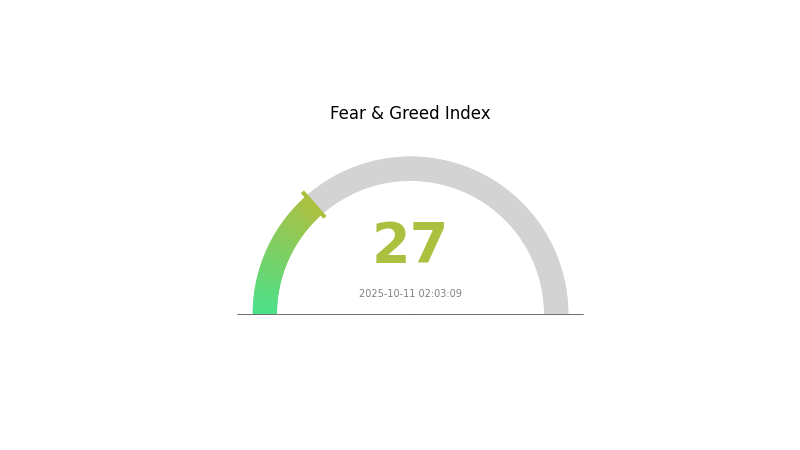

HAI Market Sentiment Indicator

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 27. This suggests investors are cautious and potentially bearish. During such periods, some traders view it as a buying opportunity, adhering to the contrarian strategy of "be greedy when others are fearful." However, it's crucial to conduct thorough research and risk assessment before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results.

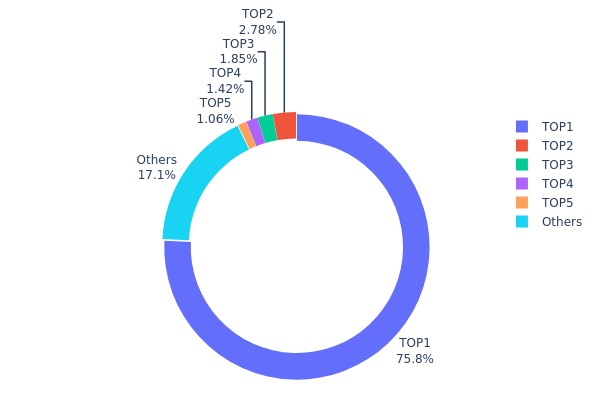

HAI Holdings Distribution

The address holdings distribution data for HAI reveals a highly concentrated ownership structure. The top address holds a staggering 75.75% of the total supply, equivalent to 26,576.93K HAI tokens. This extreme concentration raises significant concerns about centralization and potential market manipulation risks.

The subsequent top holders possess considerably smaller stakes, with the second-largest address holding 2.78% and the third 1.85%. Collectively, the top five addresses control 82.85% of HAI tokens, while the remaining 17.15% is distributed among other addresses. This skewed distribution suggests a lack of widespread adoption and could lead to increased price volatility, as large holders have the potential to significantly impact market dynamics through their trading activities.

Such a concentrated ownership structure may undermine the project's decentralization efforts and could deter potential investors concerned about fair market practices. It also highlights the importance of monitoring large address movements for potential market-moving events.

Click to view the current HAI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 26576.93K | 75.75% |

| 2 | 0x72f3...c3b3ef | 976.97K | 2.78% |

| 3 | 0x5509...68a383 | 649.30K | 1.85% |

| 4 | 0xa719...539541 | 499.75K | 1.42% |

| 5 | 0xb395...fa76cc | 370.30K | 1.05% |

| - | Others | 6011.18K | 17.15% |

II. Core Factors Influencing HAI's Future Price

Supply Mechanism

- Central Bank Gold Purchases: Central banks, especially from developing countries, have become major buyers in the gold market, directly increasing physical demand and boosting investor confidence.

- Historical Pattern: Increased central bank gold purchases have historically supported higher gold prices.

- Current Impact: 95% of surveyed central banks expect global official gold reserves to increase further in the next 12 months, potentially driving prices higher.

Institutional and Major Player Dynamics

- Institutional Holdings: Central banks are expected to continue increasing their gold holdings, with 43% planning to buy more gold next year, a record high.

- National Policies: Many countries are diversifying away from the US dollar, with the dollar's share in global foreign exchange reserves declining from 72% in 2001 to 57.74% in Q1 2025.

Macroeconomic Environment

- Monetary Policy Impact: Low interest rates globally, including in the US and China, are reducing the attractiveness of fixed-income assets and driving investors towards gold.

- Inflation Hedging Properties: Gold is seen as a traditional safe-haven asset and inflation hedge, with its price typically rising during periods of high inflation or economic uncertainty.

- Geopolitical Factors: Ongoing geopolitical conflicts and tensions are increasing gold's appeal as a safe-haven asset.

Technical Developments and Ecosystem Building

- US Debt Situation: The US debt-to-GDP ratio has surged to 124% in 2024, raising concerns about fiscal sustainability and potentially boosting gold's appeal as a stable store of value.

- Market Expansion: The global smart medical equipment market is growing rapidly, with China's digital healthcare market also expanding annually, presenting significant development potential.

III. HAI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00584 - $0.00649

- Neutral prediction: $0.00649 - $0.00746

- Optimistic prediction: $0.00746 - $0.00843 (requires favorable market conditions)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase

- Price range forecast:

- 2026: $0.00552 - $0.00776

- 2027: $0.00632 - $0.00807

- Key catalysts: Increasing adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00874 - $0.01023 (assuming steady market growth)

- Optimistic scenario: $0.01023 - $0.01324 (assuming strong market performance)

- Transformative scenario: $0.01324 - $0.01524 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: HAI $0.01524 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00843 | 0.00649 | 0.00584 | -1 |

| 2026 | 0.00776 | 0.00746 | 0.00552 | 12 |

| 2027 | 0.00807 | 0.00761 | 0.00632 | 15 |

| 2028 | 0.00964 | 0.00784 | 0.0047 | 18 |

| 2029 | 0.01171 | 0.00874 | 0.00533 | 32 |

| 2030 | 0.01524 | 0.01023 | 0.00522 | 54 |

IV. Professional Investment Strategies and Risk Management for HAI

HAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in cybersecurity technology

- Operation suggestions:

- Accumulate HAI tokens during market dips

- Monitor Hacken's product development and adoption rates

- Store tokens in secure wallets with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to manage downside risk

- Take profit at predetermined levels based on technical indicators

HAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across different cybersecurity tokens

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate web3 wallet

- Cold storage solution: Hardware wallets for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. Potential Risks and Challenges for HAI

HAI Market Risks

- Volatility: Cryptocurrency markets are highly volatile

- Competition: Increasing competition in the cybersecurity token space

- Adoption: Slow adoption of Hacken's products could impact token value

HAI Regulatory Risks

- Regulatory uncertainty: Changing cryptocurrency regulations globally

- Compliance issues: Potential challenges in meeting evolving cybersecurity standards

- Cross-border restrictions: Limitations on token usage in certain jurisdictions

HAI Technical Risks

- Smart contract vulnerabilities: Potential security flaws in the token contract

- Network congestion: VeChain network issues could affect token transfers

- Scalability challenges: Limitations in handling increased transaction volume

VI. Conclusion and Action Recommendations

HAI Investment Value Assessment

HAI presents a unique investment opportunity in the cybersecurity token space, with long-term potential tied to Hacken's product suite. However, short-term volatility and regulatory uncertainties pose significant risks.

HAI Investment Recommendations

✅ Beginners: Consider small, long-term positions after thorough research ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct comprehensive due diligence and consider HAI as part of a diversified crypto portfolio

HAI Trading Participation Methods

- Spot trading: Buy and sell HAI on Gate.com

- Staking: Participate in available staking programs for passive income

- DeFi integration: Explore decentralized finance options involving HAI tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Would Hamster Kombat coin reach $1?

It's highly improbable for Hamster Kombat coin to reach $1. Such a massive price increase would require unprecedented growth, which is unlikely given current market conditions.

What is the price prediction for HBAR 2025?

HBAR is expected to trade between $0.124 and $0.200 in 2025, with an average forecast of $0.151. This outlook reflects moderate optimism for the token.

Is a hamster expected to rise?

Yes, a hamster is expected to rise. Projections suggest a potential 204.9% increase by 2035, possibly reaching $0.008311 under optimal conditions.

What is the price prediction for $hyper coin?

The price of $hyper coin is predicted to range between $0.00007681 and $0.00007792 in the coming year, based on current market trends.

Share

Content