2025 HOUSE Price Prediction: Navigating the Real Estate Landscape in a Post-Pandemic World

Introduction: HOUSE's Market Position and Investment Value

Housecoin (HOUSE), as a meme token themed on hedging the real estate market, has made significant strides since its inception. As of 2025, HOUSE's market capitalization has reached $4,968,835, with a circulating supply of approximately 998,760,897 tokens, and a price hovering around $0.004975. This asset, dubbed as "the house-value token," is playing an increasingly crucial role in the cryptocurrency meme sector.

This article will comprehensively analyze HOUSE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to provide investors with professional price predictions and practical investment strategies.

I. HOUSE Price History Review and Current Market Status

HOUSE Historical Price Evolution

- 2025 May: HOUSE reached its all-time high of $0.33

- 2025 October: HOUSE hit its all-time low of $0.004701, marking a significant price drop

HOUSE Current Market Situation

HOUSE is currently trading at $0.004975, experiencing a substantial decline of 26.11% in the last 24 hours. The token's market cap stands at $4,968,835, with a fully diluted valuation matching this figure. HOUSE has seen a significant downturn across various timeframes, with a 41.5% decrease over the past week and a 62.64% drop in the last 30 days. The current price is considerably lower than its all-time high of $0.33, recorded on May 1, 2025. The 24-hour trading volume is $591,881, indicating active market participation despite the price decline. With a circulating supply of 998,760,897 HOUSE tokens, which is also the total and maximum supply, the project has reached full circulation.

Click to view the current HOUSE market price

HOUSE Market Sentiment Indicator

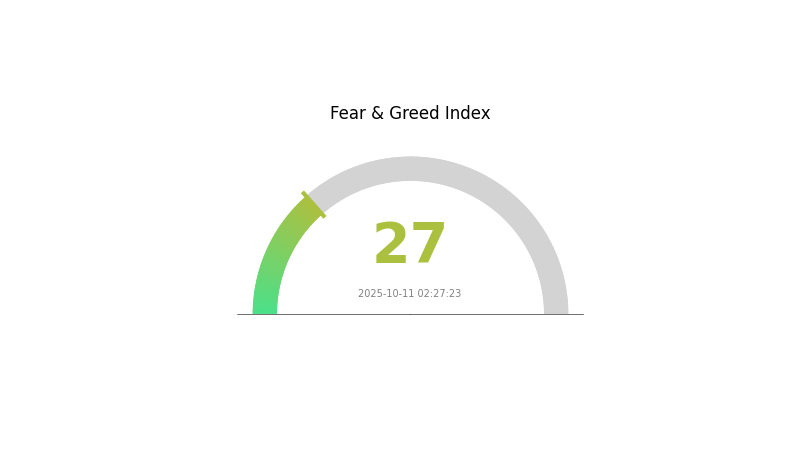

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index registering at 27. This indicates a cautious sentiment among investors, potentially signaling a buying opportunity for contrarian traders. However, it's crucial to conduct thorough research and consider multiple factors before making investment decisions. The market's fear could be attributed to various factors such as regulatory concerns, macroeconomic conditions, or recent market events. As always, diversification and risk management remain key strategies in navigating the volatile crypto landscape.

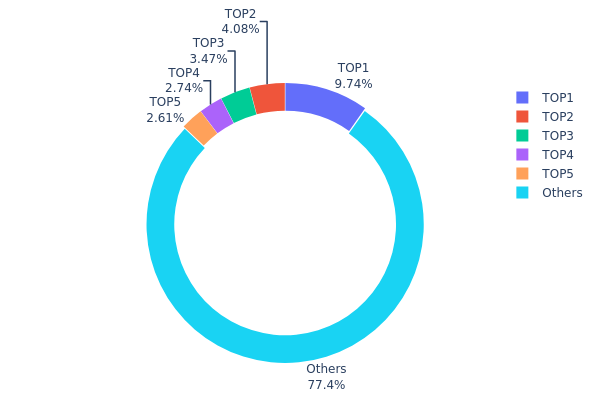

HOUSE Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of HOUSE tokens among various wallet addresses. Analysis of this data reveals a moderately concentrated distribution pattern. The top address holds 9.74% of the total supply, while the top 5 addresses collectively control 22.62% of HOUSE tokens. This level of concentration, while notable, does not indicate extreme centralization.

The distribution suggests a balanced market structure, with the majority of tokens (77.38%) held by addresses outside the top 5. This wider distribution among "Others" is a positive sign for market stability and reduced vulnerability to price manipulation by large holders. However, the presence of significant holdings in the top addresses could still influence short-term price movements if these holders decide to sell or accumulate.

Overall, the current HOUSE token distribution reflects a moderate level of decentralization. While there are some large holders with potential market influence, the substantial distribution among smaller holders contributes to a more resilient and potentially stable ecosystem for HOUSE.

Click to view the current HOUSE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | Gj5t6K...f96HNH | 97271.23K | 9.74% |

| 2 | 9ZPsRW...ZgE4Y4 | 40744.35K | 4.08% |

| 3 | A77HEr...oZ4RiR | 34630.89K | 3.46% |

| 4 | ASTyfS...g7iaJZ | 27397.45K | 2.74% |

| 5 | u6PJ8D...ynXq2w | 26023.09K | 2.60% |

| - | Others | 772543.98K | 77.38% |

II. Core Factors Influencing Future HOUSE Prices

Supply Mechanism

- Inventory Management: The current housing market inventory is a crucial factor in determining future price trends.

- Historical Patterns: Past supply changes have significantly impacted housing prices, with low inventory typically leading to price increases.

- Current Impact: The current inventory levels are expected to influence price movements in the coming years.

Macroeconomic Environment

- Monetary Policy Impact: Interest rate changes and overall economic growth rates will affect housing affordability and demand.

- Inflation Hedging Properties: Real estate is often viewed as a hedge against inflation, potentially supporting prices in inflationary environments.

- Geopolitical Factors: International economic trends and capital market movements can influence real estate investment flows and pricing.

Technical Development and Ecosystem Building

- Construction Costs: Rising global raw material prices and increasing construction costs are significant factors in housing price trends.

- Environmental Regulations: Stricter environmental regulations and building standards are leading to increased housing construction costs.

- Urbanization: The accelerating pace of urbanization is creating additional demand pressure in certain areas, potentially driving up prices.

III. HOUSE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00261 - $0.00395

- Neutral prediction: $0.00395 - $0.00502

- Optimistic prediction: $0.00502 - $0.00627 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth and consolidation phase

- Price range forecast:

- 2027: $0.00601 - $0.00892

- 2028: $0.00669 - $0.00816

- Key catalysts: Project milestones, market adoption, and overall crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.00792 - $0.00975 (assuming steady market growth)

- Optimistic scenario: $0.00975 - $0.01072 (assuming strong project performance and favorable market conditions)

- Transformative scenario: $0.01072 - $0.01157 (assuming breakthrough innovations and widespread adoption)

- 2030-12-31: HOUSE $0.00975 (potential average price by end of 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00627 | 0.00502 | 0.00261 | 0 |

| 2026 | 0.00728 | 0.00565 | 0.00395 | 13 |

| 2027 | 0.00892 | 0.00647 | 0.00601 | 29 |

| 2028 | 0.00816 | 0.00769 | 0.00669 | 54 |

| 2029 | 0.01157 | 0.00792 | 0.00547 | 59 |

| 2030 | 0.01072 | 0.00975 | 0.00575 | 95 |

IV. HOUSE Professional Investment Strategies and Risk Management

HOUSE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational advice:

- Accumulate HOUSE tokens during market dips

- Set a target holding period of at least 1-2 years

- Store tokens in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor for overbought/oversold conditions

- Key points for swing trading:

- Set strict stop-loss orders to limit potential losses

- Take profits at predetermined price targets

HOUSE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement automatic sell orders to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term storage

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update security settings

V. HOUSE Potential Risks and Challenges

HOUSE Market Risks

- High volatility: HOUSE price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades without impacting price

- Market sentiment: Meme coin status may lead to unpredictable price movements

HOUSE Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of meme coins

- Cross-border restrictions: Possible limitations on trading or ownership in certain jurisdictions

- Tax implications: Evolving tax regulations may impact investment returns

HOUSE Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the underlying code

- Network congestion: Solana network issues could affect transaction speed and costs

- Wallet security: Risk of hacks or unauthorized access to digital wallets

VI. Conclusion and Action Recommendations

HOUSE Investment Value Assessment

HOUSE presents a high-risk, high-potential-reward investment opportunity. Its meme coin status and real estate market theme offer speculative appeal, but investors should be prepared for extreme volatility and potential losses.

HOUSE Investment Recommendations

✅ Beginners: Limit exposure to a small percentage of portfolio, focus on education and understanding the market ✅ Experienced investors: Consider short-term trading opportunities while maintaining strict risk management ✅ Institutional investors: Approach with caution, potentially as part of a diversified crypto portfolio

HOUSE Trading Participation Methods

- Spot trading: Buy and sell HOUSE tokens directly on Gate.com

- Limit orders: Set specific buy or sell prices to automate trades

- Dollar-cost averaging: Regularly purchase small amounts to average out price fluctuations

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the next 5 year forecast for real estate in Canada?

Canada's real estate market is projected to grow steadily, with prices rising 15-20% over the next 5 years. Major cities like Toronto and Vancouver will lead this trend, driven by population growth and economic stability.

Will 2025 be a good year to buy a house in Canada?

Yes, 2025 could be a good year to buy a house in Canada. Housing prices are expected to stabilize, with lower price increases compared to recent years.

How much will houses cost in 2030 in Canada?

By 2030, average house prices in Canada are expected to rise significantly. A typical 1-bedroom condo in Toronto may cost between $1.2 million and $1.5 million, reflecting broader market trends across the country.

Will house prices stay the same in 2025?

No, house prices are unlikely to stay the same in 2025. Moderate price growth is expected due to tight supply and pent-up demand, despite high interest rates.

Share

Content