2025 HQ Fiyat Tahmini: Piyasa Trendleri ve Gelecek Değeri Şekillendiren Faktörlerin Analizi

Giriş: HQ’nun Pazar Konumu ve Yatırım Potansiyeli

Metaverse HQ (HQ), oyun, DeFi ve merkeziyetsiz ekosistemler için yapay zeka destekli bir Questing protokolü olarak, 2021’den bu yana kullanıcılarına milyonlarca dolar değerinde ödül dağıttı. 2025 itibarıyla HQ’nun piyasa değeri $46.079,8 seviyesinde; dolaşımdaki arz yaklaşık 74.000.000 token, fiyatı ise $0,0006227 civarında bulunuyor. “Zincir içi ve zincir dışı ödüller için evrensel bağlantı noktası” olarak nitelendirilen bu varlık, çeşitli blokzinciri platformlarında sürdürülebilir ve uzun vadeli kullanıcı katılımını teşvik etmede giderek daha önemli bir rol üstleniyor.

Bu makalede, HQ’nun 2025-2030 yılları arasındaki fiyat trendleri; geçmiş performanslar, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler göz önünde bulundurularak kapsamlı bir şekilde değerlendirilecek; yatırımcılara profesyonel fiyat öngörüleri ve uygulanabilir yatırım stratejileri sunulacaktır.

I. HQ Fiyat Geçmişi ve Güncel Piyasa Durumu

HQ Tarihsel Fiyat Seyri

- 2021: MVHQ, ilk NFT tabanlı topluluk olarak kuruldu, ilk fiyatı $0,05

- 2025 Ocak: Tüm zamanların en yüksek seviyesi olan $2’ye ulaştı, güçlü bir büyüme yaşandı

- 2025 Ekim: Tüm zamanların en düşük seviyesi olan $0,0005335’e geriledi, belirgin bir piyasa düzeltmesi gerçekleşti

HQ Güncel Piyasa Görünümü

HQ, şu anda $0,0006227 seviyesinden işlem görüyor ve son 24 saatte %2,58 değer kaybetti. Son 7 günde %7,04 artış ve son 30 günde %25,31 düşüş ile ciddi volatilite gösterdi. Şu anki fiyat, tüm zamanların en yüksek seviyesinden %94,95 oranında düşük ve zorlu piyasa koşullarını yansıtıyor. HQ’nun piyasa değeri $46.079,8, tam seyreltilmiş piyasa değeri ise $622.700; kripto para piyasasında 5918. sırada yer alıyor. Dolaşımdaki arz 74.000.000 HQ ve bu, toplam 1.000.000.000 tokenın %7,4’üne karşılık geliyor.

Güncel HQ piyasa fiyatını görüntülemek için tıklayın

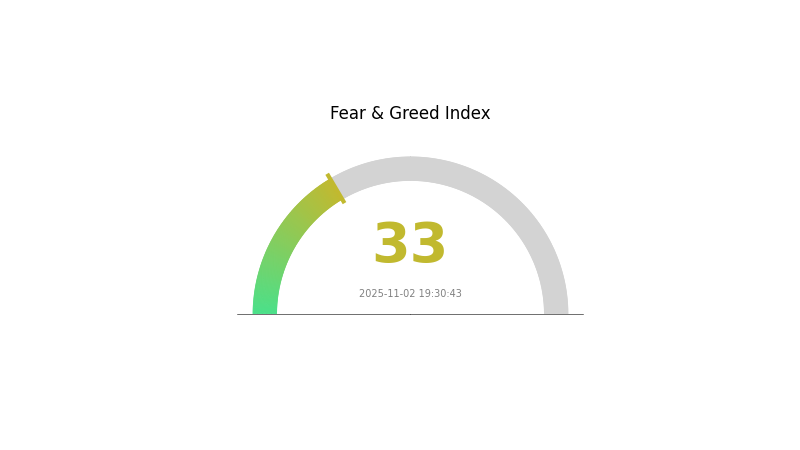

HQ Piyasa Duyarlılığı Endeksi

2025-11-02 Korku ve Açgözlülük Endeksi: 33 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntülemek için tıklayın

Kripto piyasasında duyarlılık temkinli seyrediyor; Korku ve Açgözlülük Endeksi 33 seviyesinde ve bu korku ortamına işaret ediyor. Bu durum, yatırımcıların işlem kararlarında dikkatli ve ölçülü hareket ettiğini gösteriyor. Korku, ters pozisyonda olan yatırımcılar için fırsat yaratabilse de, detaylı araştırma yapmak ve riskleri etkin şekilde yönetmek büyük önem taşıyor. Piyasa koşulları değiştikçe güncel kalmak ve portföyü çeşitlendirmek, olası volatiliteye karşı koruma sağlayacaktır.

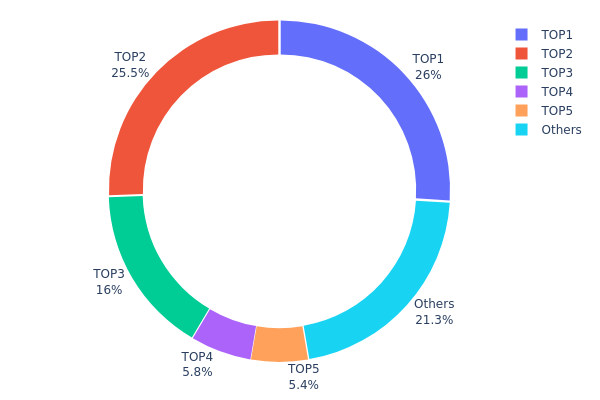

HQ Varlık Dağılımı

Adres varlık dağılımı incelendiğinde, HQ’da sahipliğin oldukça yoğun olduğu görülüyor. İlk 5 adres, toplam arzın %78,69’unu elinde tutuyor; en büyük iki adres ise tokenların her birinde %25’ten fazlasını kontrol ediyor. Bu yoğunlaşma, merkezileşme ve olası piyasa manipülasyonu riskleri açısından endişe verici.

İlk üç adres, toplam arzın %67,5’ini oluşturuyor; bu da tokenın dolaşımdaki arzı ile fiyat hareketleri üzerinde kayda değer bir etki anlamına geliyor. Bu düzeyde konsantrasyon, büyük sahiplerin satış yapması durumunda ciddi dalgalanma ve hızlı fiyat düşüşlerine yol açabilir. Aynı zamanda, dengesiz dağılım, HQ zincir üstü oylama mekanizmalarını kullanırsa token yönetimi ve karar süreçlerini de etkileyebilir.

Yeni kripto projelerinde belli bir düzeyde yoğunlaşma yaygın olsa da HQ’nun mevcut dağılımı, piyasa istikrarı ve manipülasyon riskinin azaltılması için daha fazla merkeziyetsizliğin gerekliliğine işaret ediyor. Proje ilerlerken, bu dağılımdaki değişimleri takip etmek, tokenın uzun vadeli sürdürülebilirliği ve piyasa dinamikleri açısından kritik önemde olacak.

Güncel HQ Varlık Dağılımını görüntülemek için tıklayın

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xbc23...cd3f4a | 260.000,00K | 26,00% |

| 2 | 0x6dbd...9a8b53 | 255.000,00K | 25,50% |

| 3 | 0xa3f8...91430e | 160.024,01K | 16,00% |

| 4 | 0x122d...bd0329 | 58.018,83K | 5,80% |

| 5 | 0xde4e...433cc8 | 53.973,25K | 5,39% |

| - | Diğerleri | 212.983,91K | 21,31% |

II. HQ’nun Gelecekteki Fiyatını Etkileyen Temel Unsurlar

Makroekonomik Ortam

- Para Politikası Etkisi: Başlıca merkez bankalarının politikaları HQ fiyatını etkileyebilir

- Enflasyon Karşıtı Özellikler: HQ’nun enflasyonist dönemlerdeki performansı değerini belirleyebilir

- Jeopolitik Faktörler: Uluslararası gelişmeler HQ fiyat hareketlerini etkileyebilir

Teknik Gelişim ve Ekosistem İnşası

- Ekosistem Uygulamaları: Önde gelen DApp’ler ve ekosistem projeleri HQ’nun kullanımını ve değerini artırabilir

III. 2025-2030 HQ Fiyat Öngörüsü

2025 Öngörüsü

- Temkinli senaryo: $0,00052 - $0,00062

- Tarafsız senaryo: $0,00062 - $0,00064

- İyimser senaryo: $0,00064 - $0,00066 (olumlu piyasa koşulları gerektirir)

2027-2028 Öngörüsü

- Piyasa aşaması beklentisi: Olası büyüme dönemi

- Fiyat aralığı tahmini:

- 2027: $0,0007 - $0,00102

- 2028: $0,00082 - $0,00131

- Temel tetikleyiciler: Artan benimseme ve piyasa ivmesi

2030 Uzun Vadeli Öngörü

- Temel senaryo: $0,00084 - $0,00124 (istikrarlı piyasa büyümesi varsayımıyla)

- İyimser senaryo: $0,00124 - $0,00135 (güçlü piyasa performansı ile)

- Dönüştürücü senaryo: $0,00135+ (son derece olumlu koşullarda)

- 2030-12-31: HQ $0,00135 (iyimser öngörüye göre potansiyel zirve)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,00066 | 0,00062 | 0,00052 | 0 |

| 2026 | 0,00093 | 0,00064 | 0,00055 | 3 |

| 2027 | 0,00102 | 0,00079 | 0,0007 | 26 |

| 2028 | 0,00131 | 0,0009 | 0,00082 | 44 |

| 2029 | 0,00137 | 0,0011 | 0,00082 | 77 |

| 2030 | 0,00135 | 0,00124 | 0,00084 | 98 |

IV. HQ Profesyonel Yatırım Stratejileri ve Risk Yönetimi

HQ Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı türü: Metaverse ekosistemine inanan ve uzun vadeli yatırımcılar

- Uygulama önerileri:

- Piyasa düşüşlerinde HQ token biriktirin

- Ödül kazanmak ve yönetime katılmak için tokenları stake edin

- Tokenları güvenli, saklama dışı cüzdanlarda muhafaza edin

(2) Aktif Alım Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası dönüş noktalarını tespit etmek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım veya aşırı satım durumlarını belirlemeye yardımcı olur

- Dalgalı alım satımda dikkat edilmesi gerekenler:

- HQ’nun genel kripto piyasasıyla korelasyonunu takip edin

- Aşağı yönlü riski kontrol etmek için kesin stop-loss emirleri uygulayın

HQ Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Orta seviye yatırımcılar: %3-5’i

- Agresif yatırımcılar: %5-10’u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: Yatırımları farklı kripto varlık ve sektörlerine yaymak

- Stabilcoin kullanımı: Portföyün bir kısmını stabilcoinlerde tutarak istikrar sağlamak

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan: Gate web3 cüzdan

- Soğuk saklama: Uzun vadeli varlıklar için donanım cüzdanları

- Güvenlik tedbirleri: İki faktörlü kimlik doğrulama etkinleştirin, güçlü şifreler kullanın, yazılımları düzenli güncelleyin

V. HQ için Potansiyel Riskler ve Zorluklar

HQ Piyasa Riskleri

- Yüksek volatilite: Fiyatlar kısa sürede ciddi değişimler gösterebilir

- Sınırlı likidite: Büyük işlemlerde önemli fiyat kaymaları yaşanabilir

- Korelasyon riski: Performans genel kripto piyasa duyarlılığına bağlı olarak değişebilir

HQ Düzenleyici Riskler

- Belirsiz düzenleyici ortam: Temel pazarlarda olumsuz düzenlemelerle karşılaşma olasılığı

- Uyum zorlukları: Değişen regülasyonlar operasyonel maliyetleri ve kullanıcı sayısını etkileyebilir

- Sınır ötesi kısıtlamalar: Uluslararası düzenlemeler küresel erişimi kısıtlayabilir

HQ Teknik Riskler

- Akıllı kontrat açıkları: Protokoldeki güvenlik açıklarından faydalanma ihtimali

- Ölçeklenebilirlik sorunları: Artan ağ yoğunluğunda işlem yönetiminde zorluklar yaşanabilir

- Uyumluluk sorunları: Diğer blokzinciri ağları veya protokollerle teknik uyumsuzluklar oluşabilir

VI. Sonuç ve Eylem Önerileri

HQ Yatırım Değeri Analizi

HQ, Metaverse ve yapay zeka tabanlı questing alanında uzun vadeli büyüme potansiyeliyle benzersiz bir fırsat sunuyor. Ancak kısa vadede yüksek volatilite ve düzenleyici belirsizliklerle karşı karşıya.

HQ Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Portföyünüzü çeşitlendirmek için küçük, uzun vadeli HQ pozisyonları alın ✅ Deneyimli yatırımcılar: Alım maliyeti ortalaması stratejisi uygulayın ve ekosisteme aktif katılım sağlayın ✅ Kurumsal yatırımcılar: Kapsamlı inceleme yapın ve projeyle stratejik ortaklıkları değerlendirin

HQ Alım-Satım Katılım Yöntemleri

- Spot alım satım: HQ tokenlarını Gate.com üzerinden alıp satın

- Stake etme: Ek ödüller kazanmak için stake programlarına katılın

- Ekosistem katılımı: Metaverse HQ’nun questing ve ödül programlarına dahil olun

Kripto para yatırımları son derece yüksek risk taşır, bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarını dikkate alarak dikkatli karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırım yapmayın.

SSS

Hamster Kombat $1’a ulaşır mı?

Evet, Hamster Kombat 2024’te $1 seviyesine ulaştı. Analistlerin önemli fiyat artışı öngörüleri mevcut piyasa eğilimleriyle doğrulandı.

Dogwifhat $10’a ulaşabilir mi?

Bu olasılık mevcut piyasa koşulları ve temel göstergeler göz önüne alındığında oldukça düşük; yakın zamanda $10 seviyesine çıkması beklenmiyor.

2030’da hangi kripto 1000x yapar?

Bitcoin Bull Token, Fantasy PEPE, Solaxy, SpacePay, SUBBD, Best Wallet Token ve Snorter Bot, 2030 yılına kadar 1000x büyüme potansiyeline sahip görünüyor.

Gravity kriptonun geleceği var mı?

Gravity’nin geleceği büyüme potansiyeli gösteriyor. Tahminler olası fiyat artışına işaret etse de piyasa volatilitesi yüksek. Uzun vadeli başarı, benimsenme oranı ve piyasa eğilimlerine bağlı olacak.

ZTX (ZTX) iyi bir yatırım mı?: Bu gelişmekte olan kripto paranın potansiyelini ve risklerini değerlendirme

Metahero (HERO) İyi Bir Yatırım mı?: 2023 yılında bu Metaverse token’ının potansiyeli ve riskleri üzerine analiz

2025 BAG Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

OXT ve MANA: Dijital Varlık Ekosisteminde İki Kripto Paranın Karşılaştırılması

2025 ZTX Fiyat Tahmini: Yükselen kripto para birimi için piyasa trendleri ve uzman öngörülerinin analizi

Hedera (HBAR) 2025 Fiyat Analizi ve Yatırım Olanakları

Vethereum (VETH) ile Tanışın: Solana'nın Kendine Özgü Meme Coin'ine Dair Analizler

2025 Yılında İdeal Dijital Varlık Cüzdanı Seçimi için Başlangıç Rehberi

2025 yılında en güncel Kripto Cüzdan uzantısını mobil ve masaüstü cihazlara indirip kurma rehberi

2025 yılında Kripto Cüzdan Eklentisini İndirme, Kurulum ve Kullanma Konusunda Kapsamlı Rehber