2025 OVR Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: OVR's Market Position and Investment Value

OVR (OVR) as a decentralized network platform uniting the real and virtual worlds through augmented reality (AR), has made significant strides since its inception in 2020. As of 2025, OVR's market capitalization has reached $5,424,898, with a circulating supply of approximately 51,265,344 tokens, and a price hovering around $0.10582. This asset, hailed as the "AR-NFT innovator," is playing an increasingly crucial role in the fields of augmented reality and digital real estate.

This article will comprehensively analyze OVR's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. OVR Price History Review and Current Market Status

OVR Historical Price Evolution

- 2021: OVR reached its all-time high of $3.33 on December 2, 2021, marking a significant milestone in its price history.

- 2022: The crypto market entered a bearish phase, causing OVR's price to decline significantly from its peak.

- 2023-2024: OVR experienced price fluctuations as the broader crypto market showed signs of recovery.

OVR Current Market Situation

As of October 11, 2025, OVR is trading at $0.10582, representing a significant decline from its all-time high. The token has experienced a notable price drop in recent periods, with a 14.9% decrease in the last 24 hours and a 26.58% decline over the past week. The current market capitalization stands at $5,424,898.70, ranking OVR at 1672 in the global cryptocurrency market. The trading volume in the last 24 hours is $22,723.42, indicating moderate market activity. The current price is closer to its historical low of $0.02546331 than its all-time high, suggesting a challenging market environment for OVR.

Click to view the current OVR market price

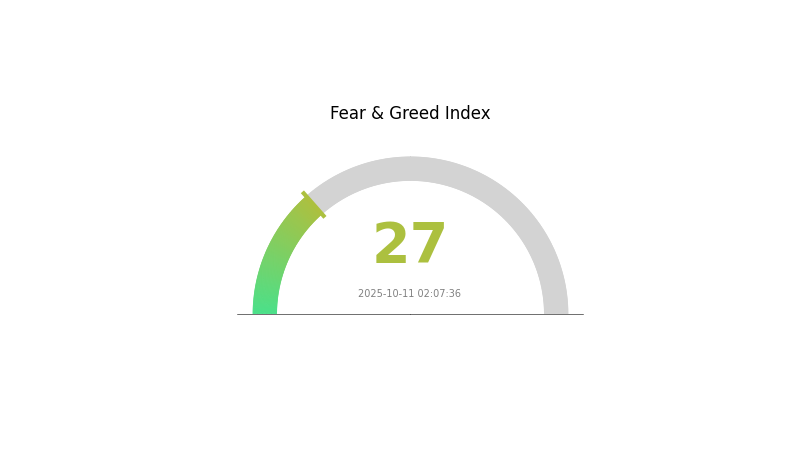

OVR Market Sentiment Indicator

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index standing at 27. This indicates a cautious sentiment among investors, possibly due to recent market volatility or uncertainties. During such times, it's crucial for traders to remain vigilant and conduct thorough research before making investment decisions. Remember, periods of fear can sometimes present buying opportunities for long-term investors, but always invest responsibly and within your risk tolerance.

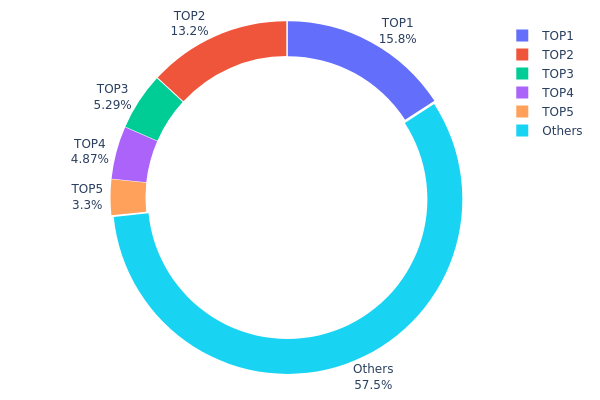

OVR Holdings Distribution

The address holdings distribution data for OVR reveals a relatively concentrated ownership structure. The top two addresses hold approximately 29% of the total supply, with 15.83% and 13.16% respectively. The next three largest holders account for an additional 13.44% combined. This concentration suggests a potential for significant market influence by a small number of large holders.

However, it's worth noting that 57.57% of OVR tokens are distributed among "Others," indicating a degree of wider distribution beyond the top holders. This balance between concentration and dispersion could impact market dynamics. While the large holders may have the ability to influence price movements, the substantial portion held by smaller addresses could provide some stability and resistance to manipulative actions.

The current distribution pattern reflects a moderate level of decentralization for OVR. While not ideal for a fully decentralized ecosystem, it's not uncommon for emerging blockchain projects. This structure may evolve as the project matures, potentially leading to a more dispersed ownership over time.

Click to view the current OVR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x3154...0f2c35 | 14235.73K | 15.83% |

| 2 | 0xe372...d26d73 | 11834.38K | 13.16% |

| 3 | 0x0965...4ce600 | 4758.15K | 5.29% |

| 4 | 0xc3f6...94c0b0 | 4375.06K | 4.86% |

| 5 | 0xe07f...148072 | 2962.26K | 3.29% |

| - | Others | 51728.17K | 57.57% |

II. Key Factors Influencing OVR's Future Price

Technical Development and Ecosystem Building

- Product Cost: The cost of producing OVR devices and content will significantly impact its market price and performance.

- Consumer Demand: Changes in consumer demand for VR products will play a crucial role in determining OVR's price trajectory.

- Competitive Landscape: The pricing strategies of competitors in the VR market will influence OVR's pricing and market position.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly interest rate decisions, may affect OVR's price as part of the broader technology sector.

- Geopolitical Factors: International situations, such as the Russia-Ukraine conflict, could impact commodity prices and global liquidity, potentially affecting OVR's market.

III. OVR Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.09298 - $0.10566

- Neutral prediction: $0.10566 - $0.11094

- Optimistic prediction: $0.11094 - $0.11623 (requires positive market sentiment and project developments)

2027 Mid-term Outlook

- Market stage expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2026: $0.05769 - $0.15199

- 2027: $0.07888 - $0.16302

- Key catalysts: Technological advancements, partnerships, and wider integration of OVR technology

2030 Long-term Outlook

- Base scenario: $0.16772 - $0.17655 (assuming steady market growth and project development)

- Optimistic scenario: $0.17655 - $0.19259 (assuming strong market performance and widespread adoption)

- Transformative scenario: $0.19259 - $0.20303 (assuming breakthrough innovations and mass market integration)

- 2030-12-31: OVR $0.20303 (potential peak based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.11623 | 0.10566 | 0.09298 | 0 |

| 2026 | 0.15199 | 0.11094 | 0.05769 | 4 |

| 2027 | 0.16302 | 0.13147 | 0.07888 | 23 |

| 2028 | 0.17375 | 0.14724 | 0.13105 | 38 |

| 2029 | 0.19259 | 0.1605 | 0.1284 | 50 |

| 2030 | 0.20303 | 0.17655 | 0.16772 | 65 |

IV. OVR Professional Investment Strategy and Risk Management

OVR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors with high risk tolerance

- Operational suggestions:

- Accumulate OVR tokens during market dips

- Set price targets and stick to them

- Store tokens in secure cold wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions

- RSI (Relative Strength Index): Determine overbought/oversold conditions

- Key points for swing trading:

- Monitor AR industry news and OVR project updates

- Set stop-loss orders to limit potential losses

OVR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Invest in a mix of AR/VR projects

- Dollar-Cost Averaging: Spread investments over time

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable 2FA, use strong passwords, regular security audits

V. Potential Risks and Challenges for OVR

OVR Market Risks

- High volatility: OVR price can fluctuate dramatically

- Competition: Other AR projects may gain market share

- Adoption challenges: Slow user uptake of AR technology

OVR Regulatory Risks

- Unclear regulations: AR and crypto regulations may change

- Token classification: OVR may face scrutiny as a security

- Cross-border issues: International AR usage may face legal hurdles

OVR Technical Risks

- Smart contract vulnerabilities: Potential for hacks or exploits

- Scalability challenges: AR platform may struggle with high user load

- Integration issues: Difficulties in real-world AR implementation

VI. Conclusion and Action Recommendations

OVR Investment Value Assessment

OVR presents a unique opportunity in the AR crypto space but carries significant risks. Long-term potential is high if AR adoption grows, but short-term volatility and regulatory uncertainties pose challenges.

OVR Investment Recommendations

✅ Beginners: Start with small positions, focus on education ✅ Experienced investors: Consider dollar-cost averaging, set clear exit strategies ✅ Institutional investors: Conduct thorough due diligence, consider OTC options

OVR Trading Participation Methods

- Spot trading: Buy and hold OVR tokens on Gate.com

- Staking: Participate in OVR staking programs if available

- OTC trading: Large volume trades through Gate.com OTC services

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance. It is recommended to consult a professional financial advisor. Never invest more than you can afford to lose.

FAQ

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, with forecasts reaching $139,249. Chainlink follows with a high prediction of $59.67.

What meme coin will explode in 2025 price prediction?

Meme coins listed on major exchanges with high market caps are likely to explode in 2025. Look for coins with strong exchange presence and rapid price growth.

Would hamster kombat coin reach $1?

Based on current predictions, Hamster Kombat coin is unlikely to reach $1 in the near future. Forecasts for 2024 and 2025 suggest prices well below $1, with no indications of reaching this milestone soon.

What is OVR crypto?

OVR is a decentralized AR platform on Ethereum, enabling interactive augmented reality experiences via mobile devices or smart glasses.

Share

Content