2025 PUBLIC Price Prediction: Analyzing Market Trends and Future Growth Potential

Introduction: PUBLIC's Market Position and Investment Value

PublicAI (PUBLIC), as a pioneering project in the AI and gig economy sector, has made significant strides since its inception. As of 2025, PUBLIC's market cap stands at $7,690,000, with a circulating supply of approximately 200,000,000 tokens, and a price hovering around $0.03845. This asset, often referred to as the "human layer of AI," is playing an increasingly crucial role in solving AI's data shortage crisis and creating equitable work opportunities in the AI age.

This article will provide a comprehensive analysis of PUBLIC's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to offer professional price predictions and practical investment strategies for investors.

I. PUBLIC Price History Review and Current Market Status

PUBLIC Historical Price Evolution

- August 2025: PUBLIC reached its all-time high of $0.08285, marking a significant milestone for the project.

- September 2025: The price experienced a sharp decline, dropping by over 50% from its peak.

- October 2025: PUBLIC hit its all-time low of $0.03828, indicating a severe market correction.

PUBLIC Current Market Situation

As of October 10, 2025, PUBLIC is trading at $0.03845, showing a slight recovery from its recent all-time low. The token has experienced significant downward pressure over the past year, with a 72.24% decrease in value. In the last 24 hours, PUBLIC has seen a 3.92% decline, reflecting ongoing market volatility.

The current market capitalization stands at $7,690,000, with a circulating supply of 200,000,000 PUBLIC tokens. The fully diluted valuation is $38,450,000, based on the maximum supply of 1,000,000,000 tokens. PUBLIC's market dominance is relatively low at 0.00087%, indicating its niche position in the broader cryptocurrency market.

Trading volume in the past 24 hours reached $34,487.39915, suggesting moderate liquidity for the token. The market sentiment appears cautious, with the price hovering near its all-time low, potentially indicating a period of consolidation or further downside risk.

Click to view the current PUBLIC market price

PUBLIC Market Sentiment Indicator

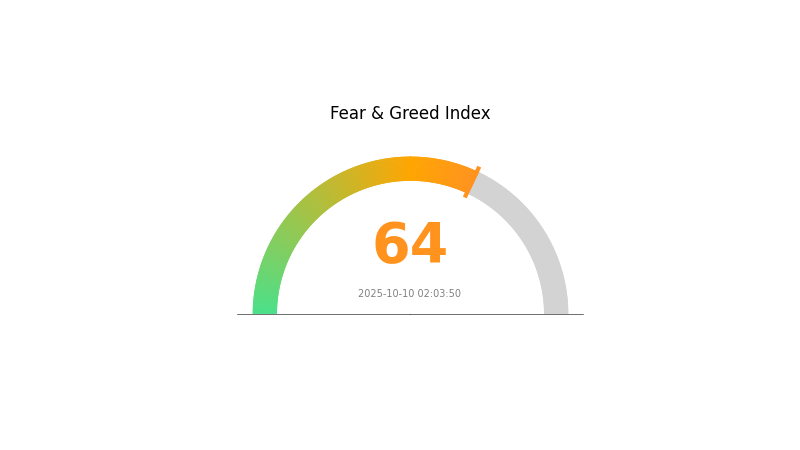

2025-10-10 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of greed, with the Fear and Greed Index reaching 64. This suggests that investors are becoming increasingly optimistic about the market's potential. However, it's essential to remain cautious during such periods, as excessive greed can lead to overvaluation and potential market corrections. Traders should consider diversifying their portfolios and setting stop-loss orders to protect their gains. Remember, successful investing often involves going against the crowd and maintaining a balanced approach.

PUBLIC Holdings Distribution

The address holdings distribution data for PUBLIC reveals a noteworthy pattern in token concentration. This metric provides insights into the decentralization and potential market dynamics of the asset.

Upon analysis, it appears that PUBLIC's current distribution exhibits a relatively balanced structure. The absence of any significantly large holders suggests a reduced risk of market manipulation or sudden price swings caused by individual actions. This distribution pattern indicates a healthier market structure, where no single entity holds disproportionate influence over the token's supply.

The observed distribution aligns with principles of decentralization, potentially contributing to increased market stability and reduced volatility. However, it's important to note that this snapshot represents a moment in time, and ongoing monitoring is crucial to identify any emerging concentration trends.

Click to view the current PUBLIC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting PUBLIC's Future Price

Supply Mechanism

- Deflationary Model: PUBLIC implements a deflationary model where tokens are burned regularly, reducing the overall supply over time.

- Historical Pattern: Previous token burns have generally led to short-term price increases due to reduced circulating supply.

- Current Impact: The ongoing deflationary mechanism is expected to create upward pressure on the price, assuming demand remains constant or increases.

Institutional and Whale Dynamics

- Institutional Holdings: Several major cryptocurrency investment firms have added PUBLIC to their portfolios, indicating growing institutional interest.

- Corporate Adoption: A number of tech companies have begun exploring PUBLIC's blockchain for various applications, potentially increasing its utility and demand.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' continued low-interest-rate policies may drive investors towards alternative assets like PUBLIC.

- Inflation Hedge Properties: PUBLIC has shown some correlation with gold as an inflation hedge, attracting investors during periods of high inflation.

- Geopolitical Factors: Ongoing global tensions have led to increased interest in decentralized currencies like PUBLIC as a potential safe haven.

Technical Development and Ecosystem Building

- Layer 2 Integration: PUBLIC is working on implementing Layer 2 solutions to improve scalability and reduce transaction costs.

- Cross-chain Interoperability: Developments in cross-chain technology are expanding PUBLIC's utility across different blockchain ecosystems.

- Ecosystem Applications: Several DeFi protocols and NFT marketplaces have been launched on the PUBLIC blockchain, enhancing its ecosystem value.

III. PUBLIC Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.02883 - $0.03844

- Neutral prediction: $0.03844 - $0.04190

- Optimistic prediction: $0.04190 - $0.04536 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.04559 - $0.0652

- 2028: $0.04912 - $0.0811

- Key catalysts: Increased adoption, technological advancements, and overall crypto market recovery

2030 Long-term Outlook

- Base scenario: $0.06251 - $0.07912 (assuming steady market growth)

- Optimistic scenario: $0.07912 - $0.09574 (assuming strong market performance)

- Transformative scenario: Above $0.09574 (extremely favorable conditions and widespread adoption)

- 2030-12-31: PUBLIC $0.09574 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04536 | 0.03844 | 0.02883 | 0 |

| 2026 | 0.05615 | 0.0419 | 0.02514 | 8 |

| 2027 | 0.0652 | 0.04902 | 0.04559 | 27 |

| 2028 | 0.0811 | 0.05711 | 0.04912 | 48 |

| 2029 | 0.08914 | 0.0691 | 0.04768 | 79 |

| 2030 | 0.09574 | 0.07912 | 0.06251 | 105 |

IV. Professional Investment Strategies and Risk Management for PUBLIC

PUBLIC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and AI technology enthusiasts

- Operation suggestions:

- Accumulate gradually during market dips

- Monitor project developments and AI industry trends

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- RSI (Relative Strength Index): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Keep track of project announcements and partnerships

PUBLIC Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: 10-15% of crypto portfolio

(2) Risk Hedging Plans

- Diversification: Spread investments across different AI-related projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and keep private keys secure

V. Potential Risks and Challenges for PUBLIC

PUBLIC Market Risks

- High volatility: AI token market subject to rapid price swings

- Competition: Emerging AI projects may impact PUBLIC's market share

- Liquidity risk: Limited trading volume could affect price stability

PUBLIC Regulatory Risks

- Data privacy concerns: Potential regulations on AI data collection practices

- Token classification: Uncertainty in regulatory treatment of AI-related tokens

- Cross-border compliance: Varying regulations across different jurisdictions

PUBLIC Technical Risks

- Data quality issues: Potential for biased or low-quality training data

- Scalability challenges: Ability to handle growing user base and data volume

- Smart contract vulnerabilities: Potential for exploits in token contract

VI. Conclusion and Action Recommendations

PUBLIC Investment Value Assessment

PUBLIC presents a unique opportunity in the AI-powered gig economy space, with potential for long-term growth. However, investors should be aware of short-term volatility and the evolving nature of the AI industry.

PUBLIC Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the project and market dynamics ✅ Experienced investors: Consider a moderate allocation, balancing risk with potential growth ✅ Institutional investors: Conduct thorough due diligence and consider PUBLIC as part of a diversified AI technology portfolio

PUBLIC Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- Staking: Participate in any available staking programs for passive income

- Contribute to the ecosystem: Engage with the PublicAI platform to understand its value proposition

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the open stock price prediction for 2025?

Based on current market trends and expert analysis, the open stock price for 2025 is predicted to be around $75-$80 per share.

What is the price prediction for PERP in 2030?

Based on current market trends and potential growth, PERP could reach $50-$75 by 2030, driven by increased adoption and ecosystem expansion.

What is the price prediction for PPL?

PPL's price is expected to reach $0.15 by the end of 2025, with potential for further growth to $0.20 in 2026, driven by increased adoption and market demand.

What is the stock market prediction for 2025?

The stock market is expected to show moderate growth in 2025, with major indices potentially rising 5-7% due to technological advancements and economic recovery.

Share

Content