2025 RAI Price Prediction: Analyzing Potential Growth and Market Factors for the Reflexer Stablecoin

Introduction: RAI's Market Position and Investment Value

Rai Reflex Index (RAI), as a non-pegged, ETH-backed stable asset, has emerged as a unique player in the decentralized finance (DeFi) space since its inception in 2021. As of 2025, RAI's market capitalization stands at $1,921,370, with a circulating supply of approximately 600,803 tokens and a price hovering around $3.198. This asset, often referred to as the "reflexive stablecoin," is playing an increasingly crucial role in providing stability and yield opportunities within the DeFi ecosystem.

This article will provide a comprehensive analysis of RAI's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. RAI Price History Review and Current Market Status

RAI Historical Price Evolution

- 2021: RAI launched at $3.38, price fluctuated between $2.44 and $5.8

- 2023: Reached all-time low of $2.44 on October 8th

- 2025: Hit all-time high of $5.8 on August 25th

RAI Current Market Situation

As of November 24, 2025, RAI is trading at $3.198. The token has experienced a significant decline over the past month, with a 25.24% decrease in value. The 24-hour trading volume stands at $9,753.25, indicating moderate market activity. RAI's market capitalization is currently $1,921,370, ranking it 2177th in the cryptocurrency market.

The token is showing bearish momentum across multiple timeframes. In the past 24 hours, RAI has dropped by 3.33%, while the 7-day performance shows a substantial decrease of 17.99%. Despite these short-term setbacks, RAI has managed to maintain a positive yearly performance, with a 6.92% increase over the past year.

RAI's current price is well below its all-time high of $5.8, suggesting potential room for growth if market conditions improve. However, the token is also trading above its all-time low of $2.44, indicating some level of price support.

Click to view the current RAI market price

RAI Market Sentiment Indicator

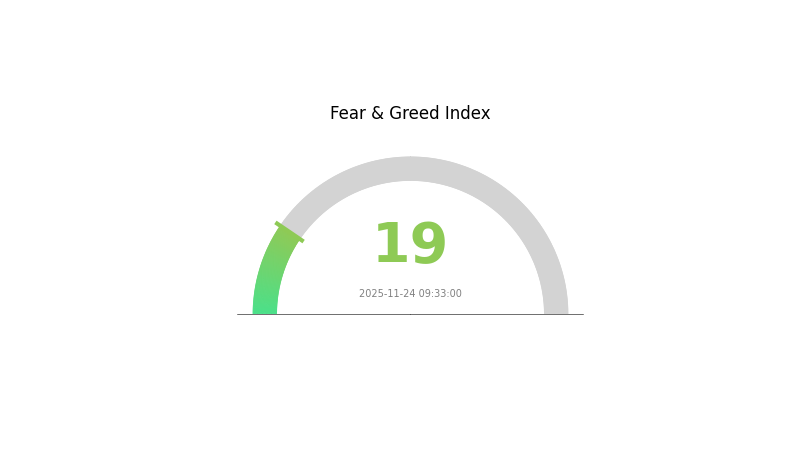

2025-11-24 Fear and Greed Index: 19 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is experiencing extreme fear, with the sentiment index plummeting to 19. This indicates a highly pessimistic mood among investors, potentially creating oversold conditions. Historically, such extreme fear levels have often preceded market rebounds. However, caution is advised as the underlying reasons for this sentiment should be carefully analyzed. Savvy traders might view this as an opportunity to "be greedy when others are fearful," but always within the bounds of prudent risk management.

RAI Holdings Distribution

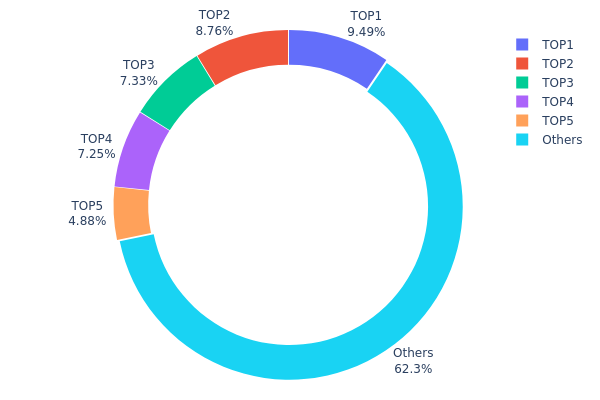

The address holdings distribution data for RAI reveals a moderately concentrated ownership structure. The top 5 addresses collectively hold 37.7% of the total RAI supply, with the largest holder possessing 9.49%. This concentration level suggests a relatively balanced distribution, as no single address controls an overwhelming majority of tokens.

While the top holders have significant stakes, the fact that 62.3% of RAI is distributed among other addresses indicates a reasonable level of decentralization. This distribution pattern may contribute to market stability, as it reduces the risk of price manipulation by a single large holder. However, coordinated actions by the top holders could still potentially impact market dynamics.

The current distribution reflects a maturing market structure for RAI, balancing between institutional involvement and wider retail participation. This equilibrium generally supports liquidity and may contribute to more orderly price movements, though vigilance is warranted regarding potential shifts in large holder behaviors.

Click to view the current RAI holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa9d1...1d3e43 | 57.04K | 9.49% |

| 2 | 0xc9bc...2a46af | 52.65K | 8.76% |

| 3 | 0x535d...115270 | 44.06K | 7.33% |

| 4 | 0x8ae7...48a3b1 | 43.54K | 7.24% |

| 5 | 0x752f...c7cafe | 29.34K | 4.88% |

| - | Others | 374.18K | 62.3% |

II. Key Factors Affecting RAI's Future Price

Supply Mechanism

- Algorithmic Stability: RAI employs an algorithmic mechanism to maintain price stability relative to its redemption price.

- Historical Pattern: Supply changes have historically had minimal direct impact on RAI's price due to its stabilization mechanism.

- Current Impact: The current supply dynamics are expected to continue supporting RAI's stability against market volatility.

Institutional and Whale Dynamics

- Institutional Holdings: Some decentralized finance (DeFi) protocols and DAOs have adopted RAI as a stable asset in their treasuries.

Macroeconomic Environment

- Inflation Hedging Properties: RAI's design aims to provide stability against inflation, potentially making it attractive in high-inflation environments.

Technical Development and Ecosystem Building

- Protocol Upgrades: Ongoing improvements to the RAI protocol focus on enhancing stability and efficiency.

- Ecosystem Applications: RAI is integrated into various DeFi platforms for lending, borrowing, and as a stable collateral option.

III. RAI Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $2.13 - $3.00

- Neutral prediction: $3.00 - $3.50

- Optimistic prediction: $3.50 - $4.30 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $3.29 - $5.00

- 2028: $4.30 - $4.71

- Key catalysts: Increased adoption, technological improvements

2030 Long-term Outlook

- Base scenario: $5.00 - $6.00 (assuming steady market growth)

- Optimistic scenario: $6.00 - $7.00 (assuming strong market performance)

- Transformative scenario: $7.00 - $8.13 (assuming breakthrough innovations and mass adoption)

- 2030-12-31: RAI $8.13 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.30245 | 3.187 | 2.13529 | 0 |

| 2026 | 4.38133 | 3.74473 | 2.58386 | 17 |

| 2027 | 4.99752 | 4.06303 | 3.29105 | 27 |

| 2028 | 4.71149 | 4.53027 | 4.30376 | 41 |

| 2029 | 6.74649 | 4.62088 | 2.54148 | 44 |

| 2030 | 8.12767 | 5.68368 | 5.00164 | 77 |

IV. Professional Investment Strategies and Risk Management for RAI

RAI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable assets

- Operation suggestions:

- Accumulate RAI during market dips

- Set up automated periodic investments

- Store in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term and long-term trends

- Relative Strength Index (RSI): Identify overbought/oversold conditions

- Key points for swing trading:

- Watch for price divergences from ETH

- Monitor supply/demand dynamics in the Reflexer protocol

RAI Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Moderate investors: 3-5% of portfolio

- Aggressive investors: 5-10% of portfolio

(2) Risk Hedging Solutions

- Diversification: Balance RAI with other stable assets

- Stop-loss orders: Set predetermined exit points

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallets for large holdings

- Security precautions: Enable 2FA, use unique passwords, verify transactions

V. Potential Risks and Challenges for RAI

RAI Market Risks

- Volatility: Price fluctuations despite stability mechanisms

- Liquidity: Limited trading pairs and market depth

- Adoption: Uncertainty in long-term user acceptance

RAI Regulatory Risks

- Stablecoin regulations: Potential impact from new policies

- DeFi oversight: Increased scrutiny on decentralized protocols

- Cross-border restrictions: Varying legal status in different jurisdictions

RAI Technical Risks

- Smart contract vulnerabilities: Potential exploits in the Reflexer protocol

- Oracle failures: Inaccurate price feeds affecting stability

- Scalability issues: Network congestion on Ethereum impacting transactions

VI. Conclusion and Action Recommendations

RAI Investment Value Assessment

RAI offers a unique non-pegged stable asset with potential for stability and yield. However, it faces adoption challenges and regulatory uncertainties in the evolving DeFi landscape.

RAI Investment Recommendations

✅ Beginners: Start with small allocations, focus on understanding the protocol ✅ Experienced investors: Consider RAI for portfolio diversification, monitor closely ✅ Institutional investors: Evaluate RAI as part of a broader DeFi strategy, conduct thorough risk assessment

RAI Participation Methods

- Direct purchase: Buy RAI on Gate.com

- Yield farming: Participate in liquidity pools involving RAI

- Collateralized debt: Use ETH as collateral to mint RAI through the Reflexer protocol

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What crypto will 1000x prediction?

While it's impossible to predict with certainty, emerging projects in AI, DeFi, or metaverse sectors could potentially see massive growth. Always research thoroughly before investing.

What is the future of Raydium?

Raydium's future looks promising, with potential for growth in DeFi on Solana. It may expand features, improve liquidity, and increase adoption, solidifying its position as a leading DEX.

What is the price prediction for RARI in 2030?

Based on market trends and potential growth, RARI could reach $50-$75 by 2030. However, cryptocurrency prices are highly volatile and unpredictable.

Does Rarible have a future?

Yes, Rarible has a promising future. As a leading NFT marketplace, it continues to innovate and adapt to the evolving Web3 landscape, attracting creators and collectors alike.

Share

Content