2025 RHEA Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: RHEA's Market Position and Investment Value

Rhea Finance (RHEA), as a pivotal liquidity hub and chain-abstracted liquidity layer in the NEAR ecosystem, has achieved significant milestones since its inception through the strategic merger of Ref Finance and Burrow Finance. As of 2025, RHEA's market capitalization stands at $4,762,000, with a circulating supply of approximately 200,000,000 tokens, and a price hovering around $0.02381. This asset, often referred to as the "DeFi Powerhouse on NEAR," is playing an increasingly crucial role in decentralized finance and protocol-level integrations.

This article will provide a comprehensive analysis of RHEA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. RHEA Price History Review and Current Market Status

RHEA Historical Price Evolution

- 2025 August: RHEA reached its all-time high of $0.35778, marking a significant milestone for the project

- 2025 September: The price experienced a notable decline, reflecting broader market trends

- 2025 October: RHEA hit its all-time low of $0.022, indicating a substantial market correction

RHEA Current Market Situation

As of October 11, 2025, RHEA is trading at $0.02381, experiencing a 14.58% decrease in the last 24 hours. The current price represents a significant drop from its all-time high, with a total market capitalization of $23,810,000. The circulating supply stands at 200,000,000 RHEA tokens, which is 20% of the total supply of 1,000,000,000. The 24-hour trading volume is $378,248.85, indicating moderate market activity. RHEA's market dominance is currently at 0.00060%, suggesting it's a relatively small player in the overall cryptocurrency market.

Click to view the current RHEA market price

RHEA Market Sentiment Indicator

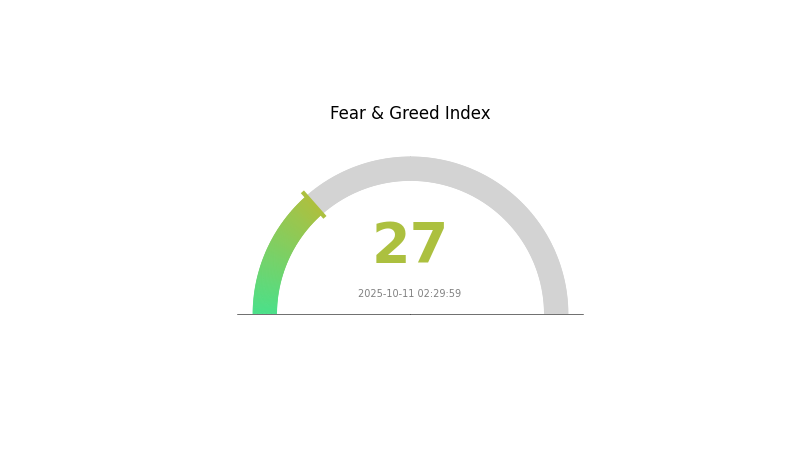

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing a period of fear, with the Fear and Greed Index standing at 27. This suggests that investors are cautious and uncertain about the market's direction. During such times, it's crucial to remain level-headed and avoid making impulsive decisions. While fear may present buying opportunities for some, it's essential to conduct thorough research and consider your risk tolerance before making any investment choices. Stay informed and monitor market trends closely to navigate these challenging conditions effectively.

RHEA Holdings Distribution

The address holdings distribution chart for RHEA reveals an unusual situation where no top holders are currently listed. This absence of data could indicate several potential scenarios for the token's distribution.

Without visible large holders, RHEA's ownership structure appears to be highly decentralized at first glance. However, this lack of information also raises questions about the transparency and accessibility of RHEA's on-chain data. It could suggest that the token's holdings are widely dispersed among numerous small holders, or that there are technical limitations in tracking the token's distribution.

This unique distribution pattern, or lack thereof, may contribute to increased market volatility for RHEA. The absence of significant holders could mean there are no major players to stabilize prices during market fluctuations. Conversely, it might also reduce the risk of market manipulation by large individual stakeholders.

Click to view the current RHEA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting RHEA's Future Price

Supply Mechanism

- Market Dynamics: The supply and demand factors are reflected in the average price of RHEA.

- Historical Patterns: Price movements, in terms of magnitude and duration, tend to fall within a limited range based on historical median data.

- Current Impact: Future events' influence (excluding force majeure factors) is typically priced into current market valuations.

Macroeconomic Environment

- Market Psychology: Investor sentiment, including hopes, disappointments, and knowledge, plays a significant role in price fluctuations.

- Fundamental Factors: Long-term price trends are influenced by the operational performance of related enterprises or projects.

Technical Development and Ecosystem Building

- Short-term Trends: Daily news and market sentiment affect short-term price movements, typically lasting a few days.

- Market Indicators: Divergences between different market indicators or price trends, as well as inconsistencies between trading volume and price trends, can signal potential market shifts.

III. RHEA Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01217 - $0.0234

- Neutral prediction: $0.0234 - $0.03

- Optimistic prediction: $0.03 - $0.03276 (requires significant market recovery)

2026-2028 Outlook

- Market phase expectation: Gradual recovery and growth

- Price range forecast:

- 2026: $0.02303 - $0.04072

- 2027: $0.01961 - $0.03646

- 2028: $0.01984 - $0.05066

- Key catalysts: Increasing adoption, technological advancements, and overall crypto market growth

2029-2030 Long-term Outlook

- Base scenario: $0.03659 - $0.05144 (assuming steady market growth)

- Optimistic scenario: $0.05984 - $0.07253 (assuming strong market performance)

- Transformative scenario: Above $0.07253 (under extremely favorable market conditions)

- 2030-12-31: RHEA $0.05144 (potential average price by end of 2030)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.03276 | 0.0234 | 0.01217 | -1 |

| 2026 | 0.04072 | 0.02808 | 0.02303 | 17 |

| 2027 | 0.03646 | 0.0344 | 0.01961 | 44 |

| 2028 | 0.05066 | 0.03543 | 0.01984 | 48 |

| 2029 | 0.05984 | 0.04305 | 0.03659 | 80 |

| 2030 | 0.07253 | 0.05144 | 0.03395 | 116 |

IV. RHEA Professional Investment Strategies and Risk Management

RHEA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and NEAR ecosystem supporters

- Operational advice:

- Accumulate RHEA tokens during market dips

- Participate in Rhea Finance's DeFi activities to earn additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Monitor NEAR ecosystem developments for potential price catalysts

- Set stop-loss orders to manage downside risk

RHEA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi projects on NEAR

- Staking: Participate in RHEA staking to earn passive income and reduce volatility exposure

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and keep private keys offline

V. RHEA Potential Risks and Challenges

RHEA Market Risks

- High volatility: RHEA price may experience significant fluctuations

- Liquidity risk: Limited trading volume may impact ability to enter/exit positions

- Competition: Other DeFi projects on NEAR may capture market share

RHEA Regulatory Risks

- Uncertain regulatory landscape: Potential for increased DeFi regulation

- Compliance challenges: Evolving KYC/AML requirements may impact Rhea Finance operations

- Cross-border restrictions: Varying regulations across jurisdictions may limit accessibility

RHEA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in Rhea Finance protocols

- Network congestion: NEAR blockchain performance issues could affect Rhea Finance operations

- Integration risks: Challenges in implementing chain abstraction and AI-powered features

VI. Conclusion and Action Recommendations

RHEA Investment Value Assessment

RHEA represents a high-risk, high-potential investment in the NEAR ecosystem's DeFi sector. Long-term value is tied to Rhea Finance's success in becoming the primary liquidity hub for NEAR, while short-term risks include market volatility and technical challenges.

RHEA Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about NEAR and DeFi

✅ Experienced investors: Consider allocating a portion of NEAR ecosystem investments to RHEA

✅ Institutional investors: Evaluate RHEA as part of a broader NEAR ecosystem strategy

RHEA Trading Participation Methods

- Spot trading: Purchase RHEA tokens on Gate.com and other supported exchanges

- DeFi participation: Engage with Rhea Finance protocols for liquidity provision and yield farming

- Staking: Participate in RHEA staking programs for passive income generation

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What meme coin will explode in 2025 price prediction?

Meme coins listed on major exchanges with high market caps are likely to explode in 2025. Look for coins with strong exchange presence and significant price increases.

What price will Shiba Inu reach in 2030?

Based on current market trends, analysts predict Shiba Inu could reach $0.00010 by 2030. However, this forecast is speculative and subject to change.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction, forecasted to reach $122,937. Chainlink follows with a peak prediction of $59.67.

What is the price prediction for XRP in 2030?

By 2030, XRP is predicted to reach a price range of $90 to $120, based on current market trends and growth projections for the cryptocurrency.

Share

Content