2025 ROA Price Prediction: Analyzing Potential Growth and Market Trends for Real Options Associates

Introduction: ROA's Market Position and Investment Value

ROA CORE (ROA), as an NFT-based physical art tech platform, has been facilitating NFT trading, physical artwork purchases, and webtoon content transactions since its inception. As of 2025, ROA's market capitalization stands at $7,519,248.97, with a circulating supply of approximately 619,000,000 tokens, and a price hovering around $0.007915. This asset, known for its innovative approach to digital art and content, is playing an increasingly crucial role in the NFT and digital media sectors.

This article will provide a comprehensive analysis of ROA's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. ROA Price History Review and Current Market Status

ROA Historical Price Evolution

- 2023: ROA launched, reaching an all-time high of $0.1785 on December 22

- 2024: Market fluctuations, price gradually declined

- 2025: Bearish trend, price dropped to an all-time low of $0.007817 on October 10

ROA Current Market Situation

As of October 11, 2025, ROA is trading at $0.007915, experiencing a significant 17.85% decrease in the last 24 hours. The token's market capitalization stands at $4,899,385, ranking 1740th in the overall cryptocurrency market. ROA's trading volume in the past 24 hours is $40,481.03, indicating moderate market activity.

The current price is 95.57% below its all-time high of $0.1785, recorded on December 22, 2023. This substantial decline suggests a prolonged bearish trend for ROA. Over the past week, ROA has seen a 15.45% decrease, while the monthly performance shows a 10.10% drop. The yearly performance is notably negative, with a 45.04% decrease.

The fully diluted market cap of ROA is $7,915,000, with a circulating supply of 619,000,000 ROA tokens, representing 61.9% of the total supply. The maximum supply is capped at 1,000,000,000 ROA.

Click to view the current ROA market price

ROA Market Sentiment Indicator

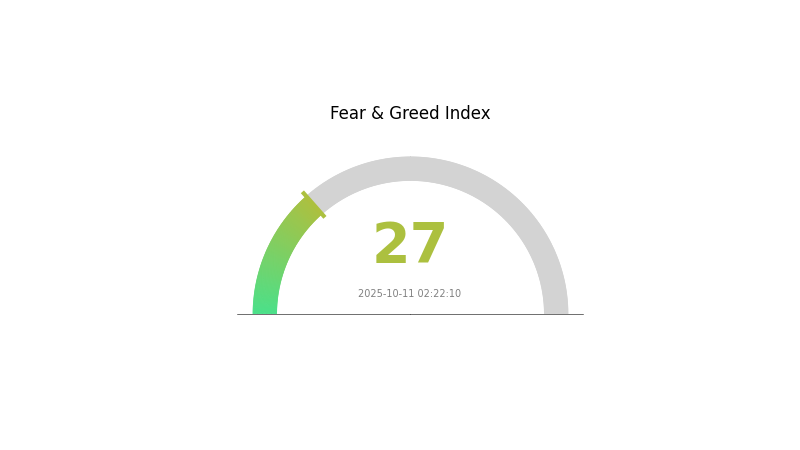

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 27, indicating a state of fear. This suggests investors are wary and potentially seeking safer assets. While fear can present buying opportunities for contrarian investors, it's crucial to approach with caution. Thorough research and risk management are essential in these market conditions. Remember, market sentiment can shift quickly, so stay informed and consider diversifying your portfolio to mitigate risks.

ROA Holdings Distribution

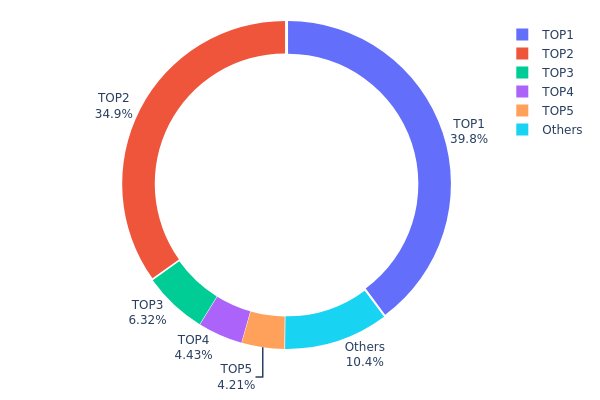

The address holdings distribution data reveals a highly concentrated ownership structure for ROA. The top five addresses collectively hold 89.62% of the total supply, with the two largest holders accounting for 74.68%. This level of concentration raises concerns about potential market manipulation and price volatility.

The top address holds nearly 40% of the total supply, giving it significant influence over the token's ecosystem. Such a concentrated distribution could lead to increased market volatility if large holders decide to sell or move their holdings. Furthermore, this centralization may impact the token's governance and decision-making processes, potentially undermining its decentralization goals.

While some concentration is common in newer projects, ROA's current distribution suggests a need for broader token dispersion to enhance market stability and reduce manipulation risks. This concentration also highlights the importance of monitoring large holder activities and their potential impact on ROA's market dynamics.

Click to view the current ROA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 8Mm46C...zrMZQH | 378282.97K | 39.83% |

| 2 | EPrUqR...kBG42k | 331000.00K | 34.85% |

| 3 | AqeSBe...pygp31 | 60000.00K | 6.31% |

| 4 | DuB2ts...qXbY3k | 42024.00K | 4.42% |

| 5 | 6cp6Fy...x9FZ3X | 40000.00K | 4.21% |

| - | Others | 98315.98K | 10.38% |

II. Key Factors Affecting ROA's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Major central banks are expected to maintain low interest rates in the near term, which could continue to support asset valuations and potentially ROA prices.

- Inflation Hedging Properties: As a financial metric, ROA itself does not directly hedge against inflation. However, companies with consistently high ROA may be better positioned to maintain profitability in inflationary environments.

- Geopolitical Factors: Ongoing trade tensions and global economic uncertainties may impact companies' operational efficiency and profitability, potentially affecting ROA across various sectors.

Technological Developments and Ecosystem Building

- Digital Transformation: Continued investment in digital technologies and automation may improve operational efficiency, potentially boosting ROA for companies across industries.

- Industry 4.0: The adoption of smart manufacturing and Internet of Things (IoT) technologies could enhance asset utilization and productivity, positively impacting ROA in the manufacturing sector.

- Ecosystem Applications: The development of integrated business ecosystems and platform economies may create new revenue streams and improve asset efficiency, potentially leading to higher ROA for participating companies.

III. ROA Price Prediction for 2025-2030

2025 Outlook

- Conservative estimate: $0.00617 - $0.00792

- Neutral estimate: $0.00792 - $0.00922

- Optimistic estimate: $0.00922 - $0.01053 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.00874 - $0.01198

- 2028: $0.00959 - $0.0157

- Key catalysts: Technological advancements, expanding use cases, and overall crypto market recovery

2029-2030 Long-term Outlook

- Base scenario: $0.0133 - $0.01483 (assuming steady growth and adoption)

- Optimistic scenario: $0.01636 - $0.01898 (with strong ecosystem expansion and favorable market conditions)

- Transformative scenario: $0.02 - $0.025 (with breakthrough technology adoption and mainstream integration)

- 2030-12-31: ROA $0.01898 (potential peak based on current projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01053 | 0.00792 | 0.00617 | 0 |

| 2026 | 0.01042 | 0.00922 | 0.00793 | 16 |

| 2027 | 0.01198 | 0.00982 | 0.00874 | 24 |

| 2028 | 0.0157 | 0.0109 | 0.00959 | 37 |

| 2029 | 0.01636 | 0.0133 | 0.01157 | 68 |

| 2030 | 0.01898 | 0.01483 | 0.01409 | 87 |

IV. Professional Investment Strategies and Risk Management for ROA

ROA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Patient investors with a high risk tolerance

- Operational suggestions:

- Accumulate ROA during market dips

- Set price alerts for significant price movements

- Store ROA in a secure Gate Web3 wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps in identifying overbought or oversold conditions

- Key points for swing trading:

- Monitor ROA's correlation with broader market trends

- Set strict stop-loss orders to manage risk

ROA Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for ROA

ROA Market Risks

- High volatility: ROA price can experience significant fluctuations

- Limited liquidity: May face challenges in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

ROA Regulatory Risks

- Uncertain regulatory environment: Potential for new regulations affecting NFT platforms

- Cross-border compliance: Challenges in adhering to varying international regulations

- Tax implications: Evolving tax laws regarding NFT and crypto assets

ROA Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Network congestion: Solana network issues could impact ROA transactions

- Wallet security: Risk of loss due to hacking or user error

VI. Conclusion and Action Recommendations

ROA Investment Value Assessment

ROA presents a unique opportunity in the NFT and digital media space, with potential for growth. However, it carries significant short-term volatility and regulatory uncertainty.

ROA Investment Recommendations

✅ Beginners: Start with small positions, focus on learning the technology ✅ Experienced investors: Consider ROA as part of a diversified crypto portfolio ✅ Institutional investors: Conduct thorough due diligence and consider ROA for NFT exposure

ROA Trading Participation Methods

- Spot trading: Buy and sell ROA on Gate.com

- Staking: Participate in staking programs if available

- NFT ecosystem: Engage with ROA's NFT platform for potential additional value

Cryptocurrency investments are extremely high-risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What meme coin will explode in 2025 price prediction?

Based on current trends, meme coins with strong exchange listings and high market caps are likely to explode in 2025. Predictions suggest a potential 8000% increase in value for top performers.

What is the price prediction for rad in 2025?

Based on current market trends, RAD is predicted to reach a maximum of $19.14 and a minimum of $11.37 in 2025.

Which AI is best for stock price prediction?

Hybrid GARCH-LSTM models are best for stock price prediction, offering superior accuracy and reliability compared to standalone AI models.

What is the price prediction for rad crypto in 2030?

Based on current trends and analysis, the price of Radicle (RAD) crypto is predicted to reach approximately $47.41 by 2030.

Share

Content