2025 SKATE Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

Introduction: SKATE's Market Position and Investment Value

Skate (SKATE), as a multi-VM infrastructure project for decentralized applications, has been enabling seamless cross-chain operations since its inception. As of 2025, SKATE's market capitalization has reached $5,421,600, with a circulating supply of approximately 180,000,000 tokens, and a price hovering around $0.03012. This asset, often referred to as a "cross-chain enabler," is playing an increasingly crucial role in facilitating interoperability across multiple blockchains, including EVM and alternative VMs.

This article will comprehensively analyze SKATE's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and the macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

I. SKATE Price History Review and Current Market Status

SKATE Historical Price Evolution

- 2025 June: SKATE reached its all-time high of $0.128, marking a significant milestone for the project.

- 2025 October: The price experienced a sharp decline, dropping to its all-time low of $0.00987.

SKATE Current Market Situation

As of October 11, 2025, SKATE is trading at $0.03012, representing a substantial 42.62% decrease in the last 24 hours. The token has seen significant volatility, with a 24-hour high of $0.05335 and a low of $0.00987. SKATE's market capitalization currently stands at $5,421,600, with a circulating supply of 180,000,000 tokens out of a total supply of 1,000,000,000. The token's trading volume in the past 24 hours has reached $3,737,906.73, indicating considerable market activity. SKATE's performance over different time frames shows consistent downward trends, with a 37.15% decrease over the past week and a 36.69% decline over the last 30 days. The long-term outlook appears challenging, with an 81.20% drop over the past year.

Click to view the current SKATE market price

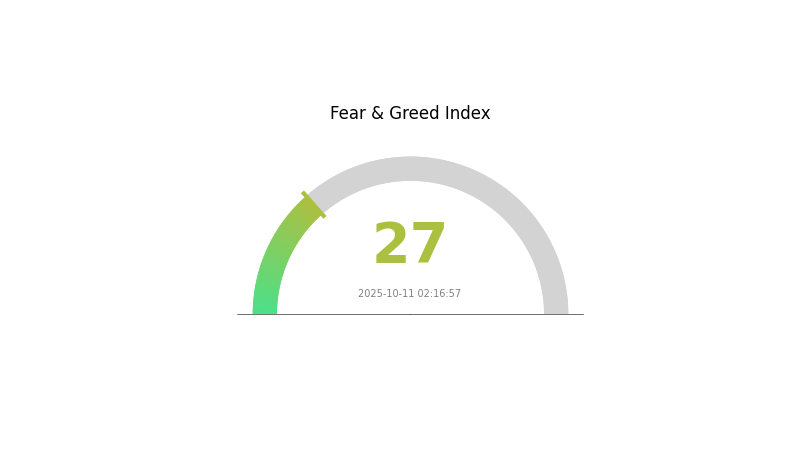

SKATE Market Sentiment Index

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing a period of fear, with the Fear and Greed Index registering at 27. This indicates a cautious sentiment among investors, potentially signaling a buying opportunity for those who follow contrarian strategies. However, it's crucial to conduct thorough research and risk assessment before making any investment decisions. Remember that market conditions can change rapidly, and past performance doesn't guarantee future results. Stay informed and trade wisely on Gate.com.

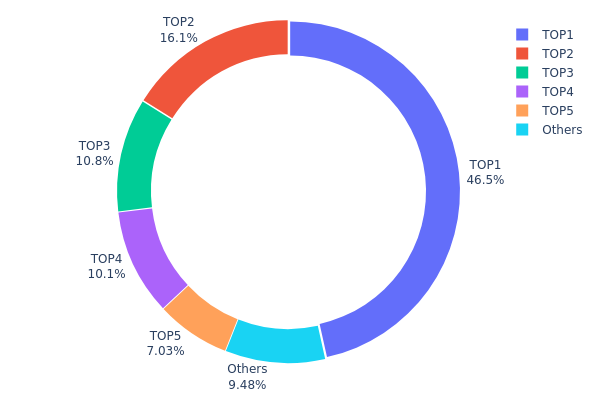

SKATE Holdings Distribution

The address holdings distribution data reveals a highly concentrated ownership structure for SKATE tokens. The top address holds a significant 46.52% of the total supply, while the top 5 addresses collectively control 90.51% of all tokens. This extreme concentration raises concerns about the token's decentralization and market stability.

Such a concentrated distribution can lead to increased volatility and susceptibility to price manipulation. With nearly half of the supply controlled by a single entity, any large-scale movement from this address could dramatically impact market dynamics. Furthermore, the high concentration in few hands may deter potential investors worried about centralized control and limited liquidity.

This distribution pattern suggests that SKATE's on-chain structure is currently unstable and potentially vulnerable. The high concentration contradicts principles of decentralization often associated with cryptocurrencies, and may indicate a need for broader token distribution to enhance market resilience and reduce manipulation risks.

Click to view the current SKATE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa8a1...481c3e | 432250.00K | 46.52% |

| 2 | 0x59ce...bd9ee2 | 150000.00K | 16.14% |

| 3 | 0x2c68...849ba2 | 100000.00K | 10.76% |

| 4 | 0x1c73...1c164d | 93499.32K | 10.06% |

| 5 | 0xf89d...5eaa40 | 65329.35K | 7.03% |

| - | Others | 88043.34K | 9.49% |

II. Key Factors Influencing SKATE's Future Price

Supply Mechanism

- Token Unlocks: Early token unlocks can create selling pressure on SKATE's price.

- Airdrops: Distribution of tokens through airdrops can impact the market supply and price.

- Current Impact: The price has declined 68.8% from its all-time high of $0.13, partly due to early unlocks and airdrop selling pressure.

Institutional and Whale Dynamics

- Current Market Cap: SKATE's market capitalization stands at $7.34 million.

- Circulating Supply: There are currently 180 million SKATE tokens in circulation.

Macroeconomic Environment

- Regulatory Changes: Regulatory developments in the cryptocurrency space can significantly influence SKATE's price.

Technical Development and Ecosystem Building

- Skate Hub Chain: As the core processing unit for the Stateless application model, Skate Hub Chain has been launched. It operates as an Ethereum L2 network, utilizing dual data availability solutions through Avail and EigenDA.

- Preconfirmation AVS: Skate's preconfirmation AVS is built on EigenLayer, aiming to achieve efficient pre-confirmations without changing the core protocol, thus promoting sustainable growth of the Ethereum ecosystem.

- Ecosystem Applications: The project aims to drive the sustainable growth of the Ethereum ecosystem through its technological implementations.

III. SKATE Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01963 - $0.03

- Neutral prediction: $0.03 - $0.0327

- Optimistic prediction: $0.0327 - $0.0337 (requires positive market sentiment)

2026-2027 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2026: $0.02923 - $0.04948

- 2027: $0.0368 - $0.05417

- Key catalysts: Increased adoption and technological advancements

2028-2030 Long-term Outlook

- Base scenario: $0.04776 - $0.07165 (assuming steady market growth)

- Optimistic scenario: $0.07165 - $0.08383 (assuming favorable market conditions)

- Transformative scenario: $0.08383+ (extremely favorable market conditions)

- 2030-12-31: SKATE $0.07379 (potential peak before year-end)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0337 | 0.03272 | 0.01963 | 8 |

| 2026 | 0.04948 | 0.03321 | 0.02923 | 10 |

| 2027 | 0.05417 | 0.04135 | 0.0368 | 37 |

| 2028 | 0.07116 | 0.04776 | 0.04489 | 58 |

| 2029 | 0.08383 | 0.05946 | 0.03805 | 97 |

| 2030 | 0.07379 | 0.07165 | 0.0695 | 137 |

IV. SKATE Professional Investment Strategy and Risk Management

SKATE Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Value investors with a high risk tolerance

- Operation suggestions:

- Accumulate SKATE tokens during market dips

- Set price targets for partial profit-taking

- Store tokens in secure non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Monitor overbought/oversold conditions

- Key points for swing trading:

- Set stop-loss orders to limit potential losses

- Take profits at predetermined resistance levels

SKATE Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple crypto assets

- Options strategies: Use put options for downside protection

(3) Secure Storage Solutions

- Hardware wallet recommendation: Gate web3 wallet

- Cold storage solution: Use air-gapped devices for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. SKATE Potential Risks and Challenges

SKATE Market Risks

- High volatility: Significant price swings can lead to substantial losses

- Liquidity risk: Limited trading volume may impact entry/exit execution

- Correlation risk: SKATE may be affected by overall crypto market trends

SKATE Regulatory Risks

- Uncertain regulatory environment: Potential for stricter regulations on DeFi projects

- Cross-chain compliance: Challenges in adhering to regulations across multiple blockchains

- Token classification risk: Possibility of SKATE being classified as a security

SKATE Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the multi-VM infrastructure

- Interoperability challenges: Risks associated with cross-chain transactions

- Scalability issues: Potential performance bottlenecks as network usage grows

VI. Conclusion and Action Recommendations

SKATE Investment Value Assessment

SKATE offers innovative multi-VM infrastructure but faces significant short-term risks due to market volatility and regulatory uncertainties. Long-term potential exists if the project successfully addresses technical challenges and gains wider adoption.

SKATE Investment Recommendations

✅ Beginners: Consider small allocations as part of a diversified crypto portfolio ✅ Experienced investors: Implement dollar-cost averaging strategy with strict risk management ✅ Institutional investors: Conduct thorough due diligence and consider OTC trading for large positions

SKATE Trading Participation Methods

- Spot trading: Buy and sell SKATE tokens on Gate.com

- Staking: Participate in liquidity provision through Skate AMM if available

- DeFi integration: Explore cross-chain DeFi opportunities using SKATE's multi-VM capabilities

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will be the price of ice in 2025?

Based on market forecasts, the price of ICE is expected to reach a minimum of $0.0049624153 and an average of $0.0050856402 per token in 2025.

What crypto has the highest price prediction?

Bitcoin has the highest price prediction at $139,249, followed by Chainlink at $59.67.

What is the price of skate chain coin?

As of 2025-10-11, the price of Skate coin is $0.0499, with a market cap of $10.7 million and a trading volume of $6.1 million.

What is the price prediction for crypto in 2025?

Based on current trends, crypto prices are expected to see significant growth by 2025. Many analysts predict major coins could reach new all-time highs, potentially increasing 5-10x from current levels.

Share

Content