2025 SOIL Price Prediction: Analyzing Growth Potential and Market Trends for the Emerging Crypto Asset

Introduction: SOIL's Market Position and Investment Value

Soil (SOIL), as a blockchain-based lending protocol bridging traditional finance and the crypto world, has been reshaping corporate debt and fixed-income investments since its inception. As of 2025, SOIL's market capitalization has reached $5,448,754, with a circulating supply of approximately 44,515,968 tokens, and a price hovering around $0.1224. This asset, known as a "regulated DeFi protocol," is playing an increasingly crucial role in providing safe returns for stablecoins backed by real-world assets.

This article will comprehensively analyze SOIL's price trends from 2025 to 2030, considering historical patterns, market supply and demand, ecosystem development, and macroeconomic conditions to provide professional price predictions and practical investment strategies for investors.

I. SOIL Price History Review and Current Market Status

SOIL Historical Price Evolution

- 2024: SOIL reached its all-time high of $4 on March 28, marking a significant milestone for the project.

- 2023: SOIL hit its all-time low of $0.04 on October 10, indicating a challenging period for the token.

SOIL Current Market Situation

As of October 11, 2025, SOIL is trading at $0.1224, representing a substantial decline of 80.28% over the past year. The token's market capitalization currently stands at $5,448,754.50, with a circulating supply of 44,515,968.17 SOIL tokens. The 24-hour trading volume is $31,765.61, showing moderate market activity.

SOIL has experienced significant volatility in recent periods:

- In the last 24 hours, the price has dropped by 10.08%

- Over the past 7 days, it has declined by 4.38%

- The 30-day performance shows a substantial decrease of 35.58%

The token is currently trading at 96.94% below its all-time high and 206% above its all-time low, indicating a challenging market environment for SOIL.

Click to view the current SOIL market price

SOIL Market Sentiment Indicator

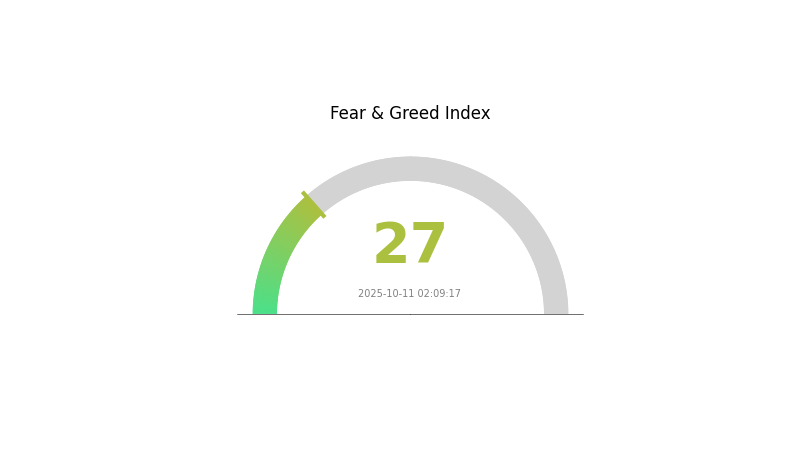

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains in the "Fear" zone, with the Fear and Greed Index at 27. This indicates a cautious attitude among investors, potentially driven by recent market volatility or negative news. During such periods, some traders view it as a potential buying opportunity, adhering to the contrarian investment strategy of "be fearful when others are greedy, and greedy when others are fearful." However, it's crucial to conduct thorough research and manage risks carefully before making any investment decisions.

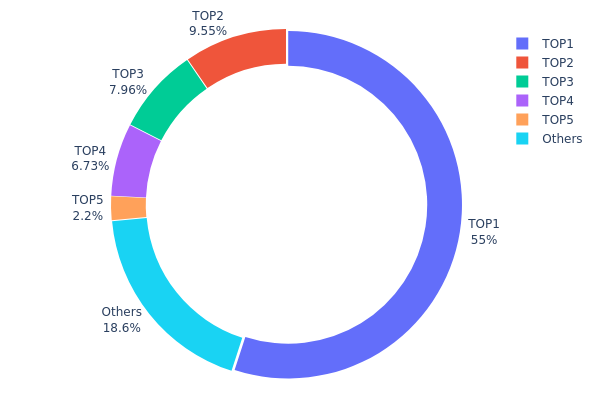

SOIL Holdings Distribution

The address holdings distribution data for SOIL reveals a highly concentrated ownership structure. The top address holds a dominant 54.99% of the total supply, with the subsequent four largest holders controlling an additional 26.42%. This concentration is further emphasized by the fact that the top five addresses collectively account for 81.41% of all SOIL tokens.

Such a concentrated distribution raises concerns about potential market manipulation and price volatility. With a single address controlling over half the supply, there is a significant risk of large-scale sell-offs or buying pressure that could dramatically impact SOIL's market price. Moreover, this level of concentration suggests a low degree of decentralization, which may undermine the token's resilience and overall market stability.

The current holdings structure indicates a relatively immature market for SOIL, with limited distribution among a broader base of investors or users. This centralization could pose challenges for the token's long-term sustainability and may deter potential investors concerned about undue influence from large holders. As the project develops, a more equitable distribution would be beneficial for fostering a healthier, more robust market ecosystem.

Click to view the current SOIL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa5f7...4d1d59 | 54441.46K | 54.99% |

| 2 | 0x8c5e...a75154 | 9456.29K | 9.55% |

| 3 | 0xbd91...5c8e7f | 7876.93K | 7.95% |

| 4 | 0xe516...08a6e8 | 6666.67K | 6.73% |

| 5 | 0xeabc...09fd41 | 2173.29K | 2.19% |

| - | Others | 18385.36K | 18.59% |

II. Key Factors Affecting SOIL's Future Price

Supply Mechanism

- Agricultural Technology Progress: Rapid technological advancements in the agricultural sector are driving the growth of the soil monitoring systems market.

- Historical Pattern: Increased demand for improving agricultural productivity to feed a rapidly growing population has historically influenced soil-related markets.

- Current Impact: The rising popularity of precision agriculture and fertility management services is expected to boost market growth.

Institutional and Whale Dynamics

- Enterprise Adoption: Businesses are increasingly recognizing the potential to improve supply chains and meet growing food demands through soil-related technologies.

Macroeconomic Environment

- Geopolitical Factors: The Russia-Ukraine conflict has significant implications for global food security and agricultural product markets, potentially impacting soil-related investments.

Technical Development and Ecosystem Building

- Infrastructure Development: The lack of necessary infrastructure and technical skills, especially in underdeveloped economies, is currently limiting market expansion.

- Ecosystem Applications: There's a growing focus on improving soil carbon, soil health, and soil fertility in grasslands and croplands, as well as integrated systems including water management.

III. SOIL Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $0.10404 - $0.11322

- Neutral forecast: $0.11322 - $0.12240

- Optimistic forecast: $0.12240 - $0.13954 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.15181 - $0.16277

- 2028: $0.12611 - $0.16602

- Key catalysts: Project developments and broader crypto market trends

2029-2030 Long-term Outlook

- Base scenario: $0.16283 - $0.19295 (assuming steady market growth)

- Optimistic scenario: $0.19295 - $0.22308 (with favorable market conditions)

- Transformative scenario: $0.22308 - $0.27206 (with extremely positive developments)

- 2030-12-31: SOIL $0.19295 (56% increase from 2025)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.13954 | 0.1224 | 0.10404 | 0 |

| 2026 | 0.18205 | 0.13097 | 0.08775 | 6 |

| 2027 | 0.16277 | 0.15651 | 0.15181 | 26 |

| 2028 | 0.16602 | 0.15964 | 0.12611 | 29 |

| 2029 | 0.22308 | 0.16283 | 0.11398 | 31 |

| 2030 | 0.27206 | 0.19295 | 0.18138 | 56 |

IV. Professional Investment Strategies and Risk Management for SOIL

SOIL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable returns

- Operational advice:

- Accumulate SOIL tokens during market dips

- Set up automated regular purchases (dollar-cost averaging)

- Store tokens in secure hardware wallets for long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential reversal points

- Relative Strength Index (RSI): Helps detect overbought or oversold conditions

- Key points for swing trading:

- Monitor SOIL's correlation with broader crypto market trends

- Set clear entry and exit points based on technical indicators

SOIL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi protocols

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update security settings

V. Potential Risks and Challenges for SOIL

SOIL Market Risks

- Volatility: SOIL's price may experience significant fluctuations

- Liquidity risk: Limited trading volume could impact ability to enter or exit positions

- Correlation risk: SOIL may be affected by broader crypto market trends

SOIL Regulatory Risks

- Regulatory uncertainty: Changing regulations may impact SOIL's operations

- Compliance challenges: Adapting to evolving regulatory requirements in different jurisdictions

- Legal risks: Potential legal actions against DeFi protocols

SOIL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or bugs in the protocol

- Scalability issues: Challenges in handling increased transaction volumes

- Interoperability concerns: Compatibility issues with other blockchain networks or protocols

VI. Conclusion and Action Recommendations

SOIL Investment Value Assessment

SOIL presents a unique opportunity in the DeFi space, bridging traditional finance with crypto. While it offers potential for attractive yields, investors should be aware of the high volatility and regulatory uncertainties in the crypto market.

SOIL Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about DeFi and SOIL's mechanics ✅ Experienced investors: Consider allocating a portion of your DeFi portfolio to SOIL, while maintaining diversification ✅ Institutional investors: Conduct thorough due diligence and consider SOIL as part of a broader DeFi strategy

SOIL Participation Methods

- Spot trading: Buy and hold SOIL tokens on Gate.com

- Yield farming: Participate in SOIL's liquidity pools or lending protocols

- Staking: Explore staking options if available to earn additional rewards

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the share price prediction for Santana Minerals in 2025?

Based on analyst consensus, the share price prediction for Santana Minerals in 2025 is AU$1.40.

What is the seed premarket price prediction for 2025?

Based on current market analysis, the seed premarket price for 2025 is predicted to range between $0.7195 and $810.40.

What is the future oil price prediction?

The future oil price is predicted to be around $72.40 per barrel. Market conditions and global factors will influence actual prices.

What is the future price of grass token?

The future price of Grass token is projected to reach ₹147.09 by 2040, with potential for further growth to ₹239.59 in subsequent years.

Share

Content