2025 SOLS Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

Introduction: SOLS Market Position and Investment Value

SOLS (SOLS), as a pioneer in Solana Inscriptions, has paved the way for the adoption of the LibrePlex Fair Launch protocol since its inception in 2023. By 2025, SOLS has achieved a market capitalization of $323,610, with a circulating supply of 21,000,000 tokens, and a price hovering around $0.01541. This asset, hailed as the "SPL-20 trailblazer," is playing an increasingly crucial role in bridging the gap between the Degen and DeFi sectors within the Solana ecosystem.

This article will provide a comprehensive analysis of SOLS' price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to offer professional price predictions and practical investment strategies for investors.

I. SOLS Price History Review and Current Market Status

SOLS Historical Price Evolution

- 2023: Launch on November 22, price reached $0.9

- 2023: All-time high of $8.3301 on December 15

- 2025: Market cycle, price dropped from the all-time high to the current $0.01541

SOLS Current Market Situation

As of October 31, 2025, SOLS is trading at $0.01541. The token has experienced significant volatility since its launch, with a 24-hour trading volume of $10,540.97. SOLS has seen a 7.8% decrease in the last 24 hours and a 17.58% decline over the past week. The current market capitalization stands at $323,610, with a circulating supply of 21,000,000 SOLS tokens, which is also the total and maximum supply. The token is currently 99.81% down from its all-time high of $8.3301 reached on December 15, 2023. The market sentiment appears bearish in the short term, with negative price trends across various timeframes.

Click to view the current SOLS market price

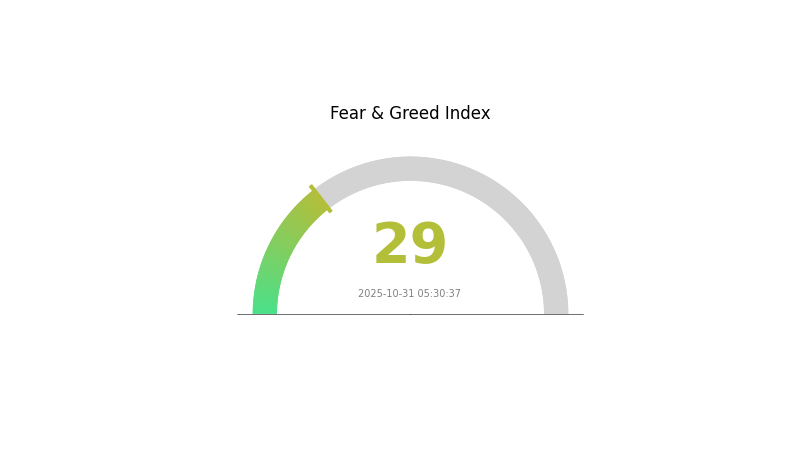

SOLS Market Sentiment Index

2025-10-31 Fear and Greed Index: 29 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by fear, with the sentiment index at 29. This indicates a cautious atmosphere among investors. During such periods, some traders see opportunities for potential bargains, while others remain wary of further downturns. It's crucial to remember that market sentiment can shift rapidly. Traders on Gate.com should stay informed, manage risks wisely, and consider diverse strategies to navigate this uncertain terrain.

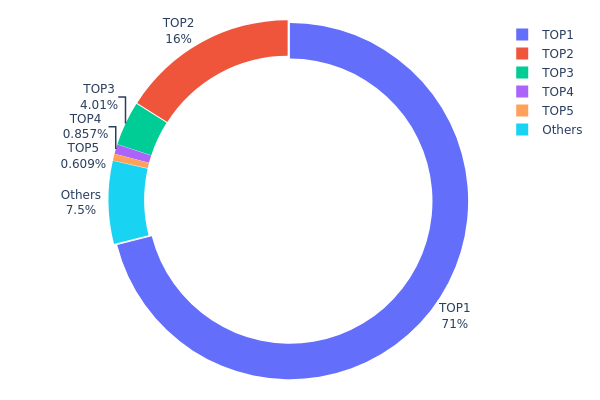

SOLS Holdings Distribution

The address holdings distribution data for SOLS reveals a highly concentrated ownership structure. The top address holds an overwhelming 71.02% of the total supply, equivalent to 14,915.70K SOLS. This is followed by the second-largest holder with 15.99% (3,359.00K SOLS), creating a combined ownership of 87.01% between just two addresses. The third-largest holder possesses 4.01% of the supply, while the remaining addresses in the top 5 hold less than 1% each.

This extreme concentration raises significant concerns about the decentralization and market dynamics of SOLS. With over 70% of the supply controlled by a single entity, there's a substantial risk of market manipulation and price volatility. Such a distribution pattern could potentially deter new investors and impact the token's liquidity. Furthermore, this centralization contradicts the principles of decentralization often associated with blockchain projects, potentially affecting the overall stability and fairness of the SOLS ecosystem.

Click to view the current SOLS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | u6PJ8D...ynXq2w | 14915.70K | 71.02% |

| 2 | DGn2nH...4eezQF | 3359.00K | 15.99% |

| 3 | A77HEr...oZ4RiR | 842.76K | 4.01% |

| 4 | 3J5JCJ...3uSEnb | 179.95K | 0.85% |

| 5 | ASTyfS...g7iaJZ | 127.91K | 0.60% |

| - | Others | 1574.59K | 7.53% |

II. Key Factors Affecting SOLS Future Price

Supply Mechanism

- Inflation Rate: SOL has a decreasing inflation rate, which could impact its price over time.

- Historical Patterns: Previous supply changes have influenced SOL's price volatility.

- Current Impact: The current supply mechanism is expected to maintain a balance between growth and scarcity.

Institutional and Whale Dynamics

- Institutional Holdings: Major institutions have shown increasing interest in SOL, potentially driving price growth.

- Corporate Adoption: Several companies are exploring Solana's blockchain for various applications.

- Government Policies: Regulatory developments in major economies could significantly impact SOL's price.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, especially regarding interest rates, may affect SOL's attractiveness as an investment.

- Inflation Hedging Properties: SOL's performance during inflationary periods could influence its adoption as a store of value.

- Geopolitical Factors: International tensions and economic uncertainties may drive investors towards or away from cryptocurrencies like SOL.

Technical Development and Ecosystem Growth

- Network Upgrades: Solana's continuous technical improvements enhance its performance and security, potentially boosting SOL's value.

- Scalability Solutions: Implementation of Layer 2 solutions could improve Solana's efficiency and user experience.

- Ecosystem Applications: The growth of DeFi, NFTs, and other applications on Solana contributes to SOL's demand and utility.

III. SOLS Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.01222 - $0.01547

- Neutral prediction: $0.01547 - $0.01686

- Optimistic prediction: $0.01686 - $0.02000 (requires positive market sentiment and increased adoption)

2027-2028 Outlook

- Market stage expectation: Potential growth phase with increasing adoption

- Price range forecast:

- 2027: $0.01807 - $0.02632

- 2028: $0.01793 - $0.02988

- Key catalysts: Technological advancements, wider industry partnerships, and improved market conditions

2029-2030 Long-term Outlook

- Base scenario: $0.02643 - $0.03264 (assuming steady market growth and adoption)

- Optimistic scenario: $0.03885 - $0.04569 (assuming strong market performance and increased utility)

- Transformative scenario: $0.05000 - $0.06000 (assuming breakthrough innovations and mainstream adoption)

- 2030-12-31: SOLS $0.04569 (potential peak price based on optimistic projections)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01686 | 0.01547 | 0.01222 | 0 |

| 2026 | 0.02312 | 0.01617 | 0.0152 | 4 |

| 2027 | 0.02632 | 0.01964 | 0.01807 | 26 |

| 2028 | 0.02988 | 0.02298 | 0.01793 | 48 |

| 2029 | 0.03885 | 0.02643 | 0.02458 | 70 |

| 2030 | 0.04569 | 0.03264 | 0.02644 | 110 |

IV. SOLS Professional Investment Strategies and Risk Management

SOLS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Accumulate SOLS during market dips

- Hold for at least 1-2 years to ride out market volatility

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- RSI (Relative Strength Index): Monitor for overbought/oversold conditions

- Key points for swing trading:

- Set clear stop-loss and take-profit levels

- Monitor Solana ecosystem developments for potential price catalysts

SOLS Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Solana ecosystem projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting Solana tokens

- Security precautions: Enable two-factor authentication, use unique strong passwords

V. Potential Risks and Challenges for SOLS

SOLS Market Risks

- High volatility: SOLS price may experience significant fluctuations

- Limited liquidity: Trading volume may be low, impacting ease of entry/exit

- Competitive landscape: Other Solana-based projects may impact SOLS adoption

SOLS Regulatory Risks

- Uncertain regulations: Future crypto regulations may impact SOLS trading/usage

- Cross-border restrictions: International regulatory differences may limit access

- Tax implications: Evolving tax laws may affect SOLS transactions/holdings

SOLS Technical Risks

- Smart contract vulnerabilities: Potential bugs in SOLS token contract

- Scalability challenges: Solana network congestion could impact SOLS transactions

- Bridge security: Risks associated with SPL to SPL-20 token conversion process

VI. Conclusion and Action Recommendations

SOLS Investment Value Assessment

SOLS presents a high-risk, high-potential opportunity within the Solana ecosystem. Long-term value proposition lies in its pioneering role in Solana inscriptions and fair launch protocols. Short-term risks include market volatility and technical uncertainties.

SOLS Investment Recommendations

✅ Beginners: Limited exposure (1-2% of crypto portfolio) with a long-term horizon

✅ Experienced investors: Consider swing trading opportunities with strict risk management

✅ Institutional investors: Strategic allocation as part of a diversified Solana ecosystem portfolio

SOLS Trading Participation Methods

- Spot trading: Available on Gate.com and Solana-based DEXs

- NFT markets: Trade SOLS tokens on major Solana NFT platforms

- DeFi participation: Provide liquidity or stake SOLS tokens in compatible protocols

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is Sol worth in 2025?

Based on market trends, Sol could be worth around $250-$300 in 2025, potentially reaching new all-time highs due to increased adoption and ecosystem growth.

Will Sol hit $1000?

Solana (SOL) has potential to reach $1,000 by 2030. Current market trends suggest it may be difficult in the short to medium term. Long-term projections remain optimistic.

Is Sol worth buying in 2025?

Yes, Sol is worth buying in 2025. Its strong ecosystem growth and technological advancements make it a promising investment.

How much will Sol cost in 2030?

Based on expert predictions, Sol could potentially reach $2500-$3000 by 2030, representing a 10x growth from 2026 estimates. This projection assumes favorable market conditions and continued technological advancements.

Share

Content