2025 TED Price Prediction: Unveiling the Future Value of Trust-Based Digital Currency

Introduction: TED's Market Position and Investment Value

Tezos Domains (TED), as an innovative decentralized naming system on the Tezos blockchain, has been playing a crucial role in translating user-friendly aliases to Tezos addresses since its inception. As of 2025, TED's market capitalization has reached $96,756, with a circulating supply of approximately 19,750,340 tokens, and a price hovering around $0.004899. This asset, dubbed the "Tezos Domain Resolver," is increasingly playing a vital role in enhancing user experience and accessibility within the Tezos ecosystem.

This article will comprehensively analyze TED's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. TED Price History Review and Current Market Status

TED Historical Price Evolution

- 2023: All-time high of $0.115496 reached on October 10, marking a significant milestone for TED

- 2024: Price experienced volatility, fluctuating between the all-time high and lower levels

- 2025: Market cycle shift, price declined from the peak to the current level of $0.004899

TED Current Market Situation

As of November 2, 2025, TED is trading at $0.004899, showing a 9.44% increase in the last 24 hours. The token has experienced positive momentum in the short term, with a 15.86% gain over the past week. However, the long-term trend remains bearish, as evidenced by the 52.41% decrease in price over the past year. TED's market capitalization currently stands at $96,756.92, ranking it at 5109 in the cryptocurrency market. The trading volume in the last 24 hours has reached $27,948.43, indicating moderate market activity. The circulating supply of TED is 19,750,340 tokens, which represents 21.51% of the total supply of 91,826,365 TED.

Click to view the current TED market price

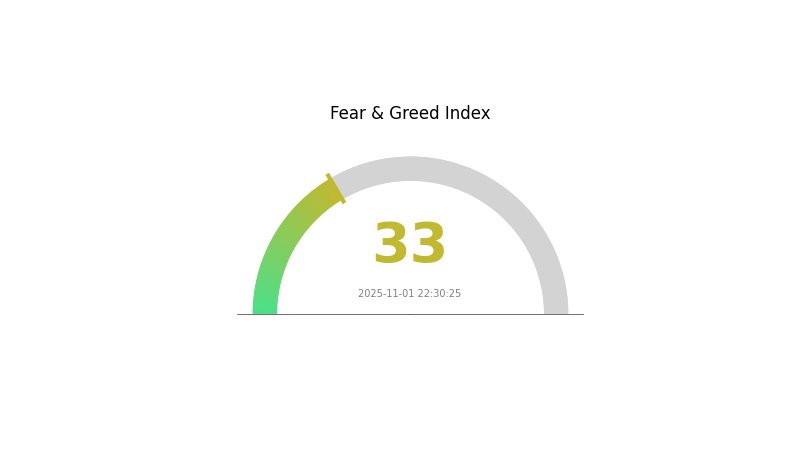

TED Market Sentiment Index

2025-11-01 Fear and Greed Index: 33 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 33, indicating a state of fear. This suggests investors are hesitant and may be looking for safer options. However, for contrarian traders, periods of fear often present potential buying opportunities. As always, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on market trends and stay informed with Gate.com's comprehensive market data.

TED Holdings Distribution

The address holdings distribution data for TED reveals a notably decentralized ownership structure. With no single address holding a significant percentage of the total supply, the risk of market manipulation or price volatility due to large holders is minimized. This distribution pattern suggests a healthy ecosystem where power and influence are not concentrated in the hands of a few large players.

The absence of dominant holders contributes to the overall stability of TED's market structure. It reduces the likelihood of sudden price swings caused by large sell-offs or accumulations by major holders. Furthermore, this balanced distribution aligns well with the principles of decentralization, potentially enhancing the token's appeal to investors who value equitable ownership structures in blockchain projects.

In summary, the current address distribution of TED reflects a robust on-chain structure with a high degree of decentralization. This characteristic may contribute to a more resilient and fair market environment, potentially fostering long-term stability and organic growth for the TED ecosystem.

Click to view the current TED Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting TED's Future Price

Technical Development and Ecosystem Building

-

Network Upgrade: Successful upgrades could potentially drive TED price to test higher levels. For instance, a successful upgrade might push the price towards the $10,000 mark. However, if there are delays in the upgrade process, the price could potentially fall back to the $3,600-$3,800 range in the short term.

-

Ecosystem Applications: The development and adoption of DApps and ecosystem projects built on TED's network could significantly influence its price. A thriving ecosystem with diverse applications tends to increase demand for the native token.

Macroeconomic Environment

-

Inflation Hedging Properties: As with other cryptocurrencies, TED's performance in an inflationary environment could be a crucial factor. If it demonstrates strong inflation-hedging properties, it could attract more investors seeking to protect their wealth.

-

Geopolitical Factors: International geopolitical tensions and economic policy uncertainties can impact the broader cryptocurrency market, including TED. These factors can influence risk appetite and capital flows in the global financial markets.

Institutional and Whale Dynamics

-

Enterprise Adoption: The adoption of TED or its underlying technology by well-known enterprises could significantly boost its price and overall market perception.

-

National Policies: Government policies and regulations regarding cryptocurrencies can have a substantial impact on TED's price. Favorable policies could drive adoption and price growth, while restrictive measures might have the opposite effect.

III. TED Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00467 - $0.00497

- Neutral prediction: $0.00497 - $0.00535

- Optimistic prediction: $0.00535 - $0.00572 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00556 - $0.00713

- 2028: $0.00402 - $0.00757

- Key catalysts: Increased adoption and technological advancements

2030 Long-term Outlook

- Base scenario: $0.00733 - $0.00852 (assuming steady market growth)

- Optimistic scenario: $0.00852 - $0.00952 (assuming strong market performance)

- Transformative scenario: $0.00952 - $0.01000 (assuming breakthrough innovations)

- 2030-12-31: TED $0.00952 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00572 | 0.00497 | 0.00467 | 1 |

| 2026 | 0.00674 | 0.00535 | 0.00438 | 9 |

| 2027 | 0.00713 | 0.00604 | 0.00556 | 23 |

| 2028 | 0.00757 | 0.00658 | 0.00402 | 34 |

| 2029 | 0.00757 | 0.00708 | 0.00389 | 44 |

| 2030 | 0.00952 | 0.00733 | 0.00381 | 49 |

IV. TED Professional Investment Strategy and Risk Management

TED Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors and believers in Tezos ecosystem

- Operational suggestions:

- Accumulate TED tokens during market dips

- Stay updated with Tezos Domains project developments

- Store tokens in a secure Tezos-compatible wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversal points

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor trading volume for potential breakouts

- Set stop-loss orders to manage downside risk

TED Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple Tezos ecosystem projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet supporting Tezos blockchain

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for TED

TED Market Risks

- Price volatility: Significant price fluctuations common in small-cap tokens

- Limited liquidity: Potential difficulty in executing large trades

- Market sentiment: Susceptible to broader crypto market trends

TED Regulatory Risks

- Uncertain regulatory landscape: Potential for stricter regulations on crypto assets

- Cross-border compliance: Varying regulations across different jurisdictions

- Tax implications: Evolving tax treatment of crypto assets

TED Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the underlying code

- Scalability challenges: Possible limitations as the Tezos network grows

- Competitive pressure: Risk of other naming systems gaining more adoption

VI. Conclusion and Action Recommendations

TED Investment Value Assessment

TED presents a niche investment opportunity within the Tezos ecosystem. While it offers potential long-term value as Tezos adoption grows, it carries significant short-term risks due to its low market cap and limited trading volume.

TED Investment Recommendations

✅ Beginners: Consider small, experimental positions after thorough research ✅ Experienced investors: Allocate a small portion of portfolio, monitor project developments closely ✅ Institutional investors: Evaluate as part of a broader Tezos ecosystem investment strategy

TED Trading Participation Methods

- Spot trading: Available on Gate.com

- Dollar-cost averaging: Regular small purchases to mitigate volatility

- Staking: Explore any available staking options for passive income

Cryptocurrency investments carry extremely high risk. This article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the price prediction for TeslaCoin?

TeslaCoin is predicted to reach $0 by 2026, with an assumed 5% annual growth rate. This forecast extends to $0 in 2030, 2040, and 2050.

What will a tether be worth in 10 years?

Tether is expected to maintain its $1.00 value in 10 years, due to its strong reserve backing and stability as a stablecoin.

What is Tezos worth in 2025?

Based on current forecasts, Tezos (XTZ) is expected to reach an average price of $0.57 in 2025, with a minimum price of $0.55.

What will Tezos be worth in 2030?

Based on current projections, Tezos could potentially reach $0.74 by 2030, assuming a 5% price change. However, this is speculative and subject to market dynamics.

Share

Content