2025 WUSD Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: WUSD's Market Position and Investment Value

Worldwide USD (WUSD) as a fiat-collateralized stablecoin pegged to the U.S. Dollar at a 1:1 ratio, has been optimizing payment solutions for web3 industry enterprise users since its inception. As of 2025, WUSD's market cap has reached $4,704,769, with a circulating supply of approximately 4,705,240 tokens, maintaining a price around $0.9999. This asset, known as a "secure and compliant digital payment solution," is playing an increasingly crucial role in empowering the real economy through stablecoins, exchanges, and cards.

This article will comprehensively analyze WUSD's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price forecasts and practical investment strategies.

I. WUSD Price History Review and Current Market Status

WUSD Historical Price Evolution

- 2024: WUSD launched, price stabilized around $1

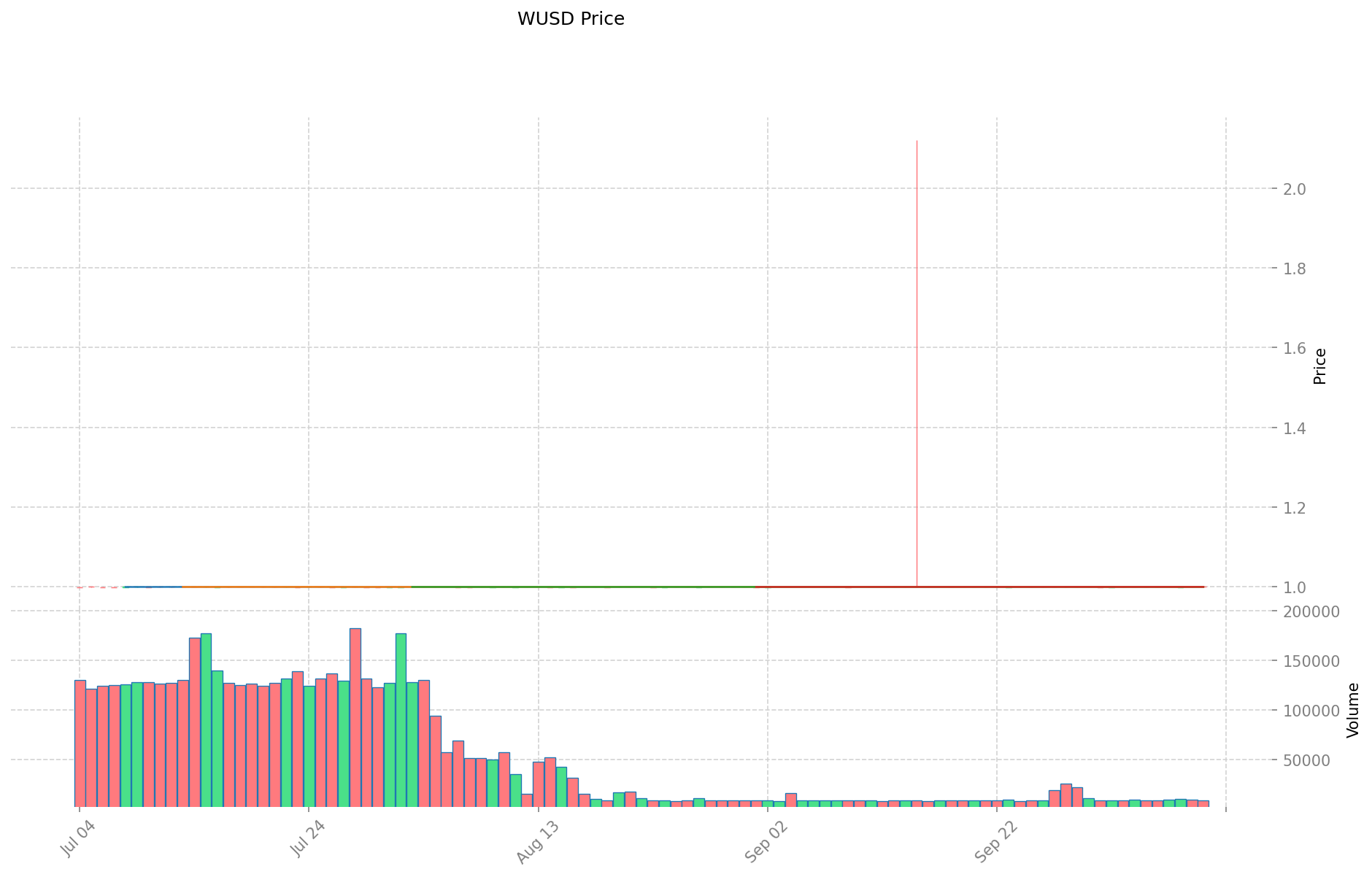

- 2025: Reached all-time high of $2.1209 on September 15

- 2025: Experienced volatility, dropping to all-time low of $0.9974 on November 23

WUSD Current Market Situation

As of October 11, 2025, WUSD is trading at $0.9999, maintaining its peg to the US dollar. The 24-hour trading volume stands at $9,565.88, indicating moderate market activity. WUSD's market cap is $4,704,769.51, ranking it 1762th in the cryptocurrency market. The circulating supply is 4,705,240.03 WUSD, which is also the total supply. Despite minor fluctuations, WUSD has shown resilience in maintaining its 1:1 ratio with the US dollar, demonstrating its stability as a stablecoin.

Click to view the current WUSD market price

WUSD Market Sentiment Indicator

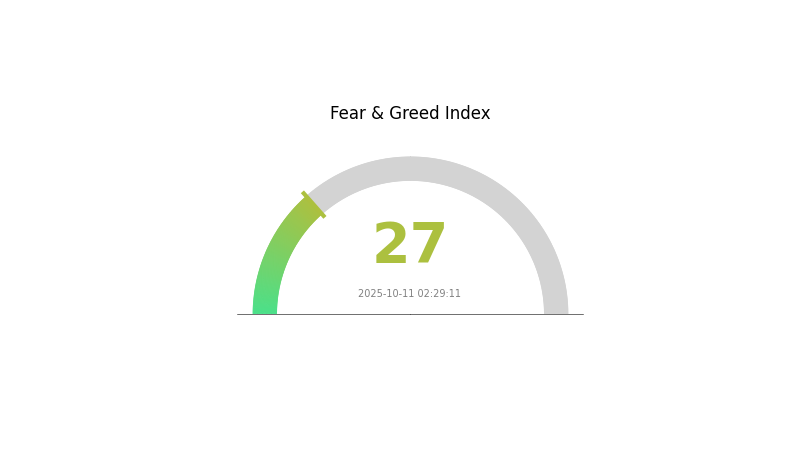

2025-10-11 Fear and Greed Index: 27 (Fear)

Click to view the current Fear & Greed Index

The crypto market is currently in a state of fear, with the Fear and Greed Index registering at 27. This suggests investors are becoming increasingly cautious and risk-averse. Such sentiment often precedes potential buying opportunities, as assets may be undervalued. However, it's crucial to conduct thorough research and consider your risk tolerance before making any investment decisions. Remember, market sentiment can shift rapidly, and past performance doesn't guarantee future results.

WUSD Holdings Distribution

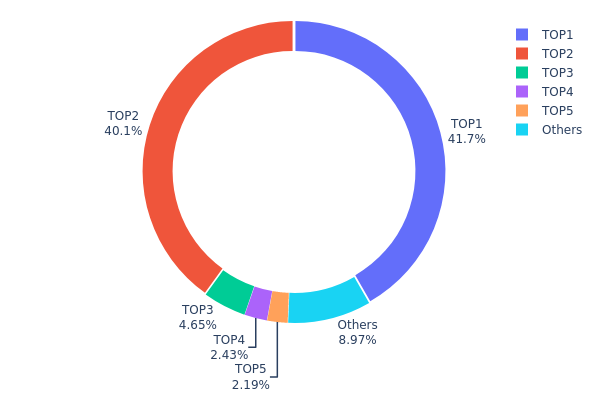

The address holdings distribution data reveals a highly concentrated ownership structure for WUSD. The top two addresses collectively hold 81.76% of the total supply, with 41.69% and 40.07% respectively. This extreme concentration raises concerns about centralization and potential market manipulation.

The third-largest holder possesses 4.64% of the supply, while the remaining addresses in the top 5 each control around 2%. Notably, all other addresses combined account for only 8.98% of WUSD holdings. This skewed distribution suggests a significant imbalance in token ownership, potentially impacting market dynamics and price stability.

Such a concentrated holdings structure could lead to increased volatility and vulnerability to large-scale sell-offs or buy-ins initiated by major holders. It also raises questions about the true decentralization and on-chain structural stability of WUSD, as a small number of entities wield disproportionate influence over the token's circulating supply.

Click to view the current WUSD Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xffa8...44cd54 | 1165.35K | 41.69% |

| 2 | 0xa9e6...026580 | 1120.06K | 40.07% |

| 3 | 0x6d0d...d9062d | 129.87K | 4.64% |

| 4 | 0x8e40...db2360 | 67.96K | 2.43% |

| 5 | 0x1ab4...8f8f23 | 61.34K | 2.19% |

| - | Others | 250.61K | 8.98% |

II. Core Factors Affecting WUSD's Future Price

Supply Mechanism

- Fiat Collateralization: WUSD is a fiat-collateralized stablecoin pegged to the US dollar at a 1:1 ratio.

- Current Impact: WSPN aims to expand WUSD adoption and utility, which could potentially impact its supply and demand dynamics.

Macroeconomic Environment

- Inflation Hedging Properties: As a stablecoin pegged to the US dollar, WUSD may serve as a hedge against inflation in certain economies, particularly in regions like Africa where digital economies are rapidly growing.

Technical Development and Ecosystem Building

- Blockchain Technology Advancements: Ongoing progress in blockchain technology may introduce innovative features to WUSD, such as cross-chain transactions and enhanced privacy protection.

- Ecosystem Applications: WUSD plays a crucial role in the WSPN ecosystem, which is focused on maximizing user experience value. The growth of this ecosystem could significantly impact WUSD's adoption and price stability.

III. WUSD Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.85991 - $0.9999

- Neutral prediction: $0.9999 - $1.2

- Optimistic prediction: $1.2 - $1.45985 (requires sustained market stability)

2027-2028 Outlook

- Market phase expectation: Gradual growth and increased adoption

- Price range forecast:

- 2027: $1.17392 - $1.64066

- 2028: $1.42058 - $2.15379

- Key catalysts: Expanding use cases, improved blockchain infrastructure

2029-2030 Long-term Outlook

- Base scenario: $1.84065 - $2.13515 (assuming steady market growth)

- Optimistic scenario: $2.13515 - $2.49813 (assuming widespread adoption)

- Transformative scenario: $2.49813+ (exceptional market conditions and technological breakthroughs)

- 2030-12-31: WUSD $2.13515 (projected average price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.45985 | 0.9999 | 0.85991 | 0 |

| 2026 | 1.59884 | 1.22988 | 0.93471 | 23 |

| 2027 | 1.64066 | 1.41436 | 1.17392 | 41 |

| 2028 | 2.15379 | 1.52751 | 1.42058 | 52 |

| 2029 | 2.42965 | 1.84065 | 1.36208 | 84 |

| 2030 | 2.49813 | 2.13515 | 1.87893 | 113 |

IV. WUSD Professional Investment Strategies and Risk Management

WUSD Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stability

- Operation suggestions:

- Allocate a small portion of portfolio to WUSD as a stable asset

- Use dollar-cost averaging to accumulate WUSD over time

- Store WUSD in secure, non-custodial wallets

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Monitor short-term price movements

- RSI (Relative Strength Index): Identify overbought/oversold conditions

- Key points for swing trading:

- Focus on small price fluctuations around the $1 peg

- Set tight stop-loss orders to manage risk

WUSD Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 5-10% of portfolio

- Moderate investors: 10-20% of portfolio

- Aggressive investors: 20-30% of portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple stablecoins

- Collateral monitoring: Regularly check WUSD's backing and reserves

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for large holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for WUSD

WUSD Market Risks

- Depegging: Potential loss of 1:1 USD peg

- Liquidity risk: Limited trading volume may affect price stability

- Counterparty risk: Dependence on the issuer's financial stability

WUSD Regulatory Risks

- Stablecoin regulations: Potential new laws affecting WUSD's operations

- Cross-border restrictions: Limitations on international use

- Compliance challenges: Adapting to evolving AML/KYC requirements

WUSD Technical Risks

- Smart contract vulnerabilities: Potential bugs in the token's code

- Blockchain congestion: High network fees during peak times

- Integration issues: Compatibility problems with some platforms

VI. Conclusion and Action Recommendations

WUSD Investment Value Assessment

WUSD offers stability in the volatile crypto market but carries inherent risks associated with stablecoins. Its long-term value proposition lies in its potential for seamless payments and store of value, while short-term risks include regulatory uncertainties and market adoption challenges.

WUSD Investment Recommendations

✅ Beginners: Start with small allocations to understand stablecoin dynamics ✅ Experienced investors: Use WUSD for portfolio stabilization and as a trading pair ✅ Institutional investors: Consider WUSD for treasury management and efficient cross-border transactions

WUSD Participation Methods

- Spot trading: Buy and sell WUSD on Gate.com

- Yield farming: Explore DeFi platforms that support WUSD for passive income

- Payment solution: Utilize WUSD for business transactions and remittances

Cryptocurrency investments are extremely risky, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is WUSD coin?

WUSD is a stablecoin pegged 1:1 to the U.S. Dollar. It's fiat-collateralized and aims to bridge traditional finance and crypto markets, operating on blockchain technology.

What is the price prediction for WIF coin in 2040?

Based on long-term forecasts, WIF coin's price is predicted to range between $13.12 and $34.77 by 2040. However, exact price predictions are uncertain.

Which AI can predict crypto prices?

Incite AI is a leading tool for predicting crypto prices. It uses advanced algorithms to analyze market trends and provide precise insights. Its user-friendly interface and predictive capabilities are highly regarded in the crypto community.

Will dogwifhat go up in 2025?

Based on current trends, dogwifhat is likely to see price appreciation in 2025. Market sentiment and growing adoption could drive its value higher.

Share

Content