2025 XCV Price Prediction: Analyzing Market Trends and Potential Growth Factors

Introduction: XCV's Market Position and Investment Value

XCarnival (XCV), as a mortgage lending platform for metaverse assets, has been providing effective value release for illiquid assets since its inception in 2021. As of 2025, XCV's market capitalization has reached $401,012, with a circulating supply of approximately 790,640,622 tokens, and a price hovering around $0.0005072. This asset, dubbed the "Metaverse Mortgage Innovator," is playing an increasingly crucial role in NFT lending and long-tail asset liquidity.

This article will comprehensively analyze XCV's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. XCV Price History Review and Current Market Status

XCV Historical Price Evolution

- 2021: Project launch, price reached all-time high of $1.95

- 2022-2024: Prolonged bear market, price declined significantly

- 2025: Market bottomed out, price hit all-time low of $0.00026481

XCV Current Market Situation

XCV is currently trading at $0.0005072, down 0.11% in the past 24 hours. The token has experienced significant declines over longer time frames, dropping 9.78% in the past week, 31.65% in the past month, and 38.01% over the past year. With a circulating supply of 790,640,622 XCV, the current market cap stands at $401,012.92. The fully diluted valuation is $507,200, based on the max supply of 1 billion tokens. Trading volume in the last 24 hours is $12,039.11, indicating relatively low liquidity. XCV is currently ranked #3461 in the cryptocurrency market, with a market dominance of 0.000015%.

Click to view the current XCV market price

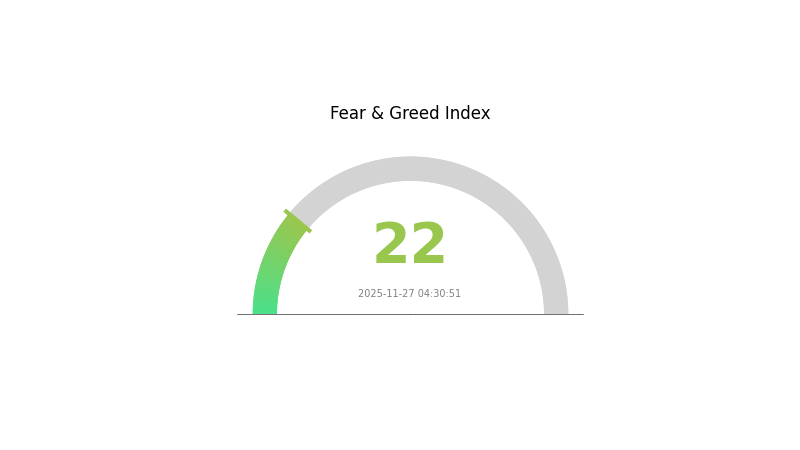

XCV Market Sentiment Indicator

2025-11-27 Fear and Greed Index: 22 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment index plummeting to 22. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. While fear may indicate oversold conditions, it can also precede further market declines. Traders should consider diversifying their portfolios and implementing risk management strategies. As always, staying informed and monitoring market trends is essential in these volatile times.

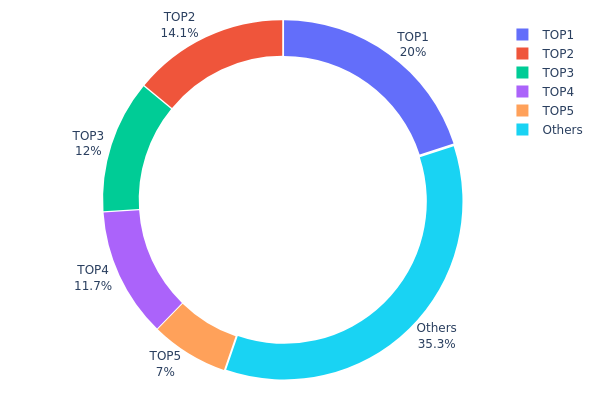

XCV Holdings Distribution

The address holdings distribution data provides crucial insights into the concentration of XCV tokens among different wallet addresses. Analysis of this data reveals a significant concentration of XCV tokens in a few top addresses. The top address holds 20% of the total supply, while the top five addresses collectively control 64.7% of XCV tokens. This high concentration suggests a potentially centralized ownership structure, which could have implications for market dynamics.

Such a concentrated distribution may lead to increased volatility in XCV's market price, as large holders have the capacity to significantly impact supply and demand through their trading activities. Moreover, this concentration raises concerns about the potential for market manipulation, as coordinated actions by top holders could disproportionately influence price movements.

From a broader perspective, the current holdings distribution indicates a relatively low level of decentralization for XCV. While 35.3% of tokens are distributed among "Others," suggesting some level of wider adoption, the dominance of top addresses highlights potential vulnerabilities in the token's ecosystem stability and may impact its perceived fairness among smaller participants in the market.

Click to view the current XCV Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf037...841f0d | 200000.00K | 20.00% |

| 2 | 0x53f7...f3fa23 | 140589.38K | 14.05% |

| 3 | 0x4edf...dc65e4 | 120000.00K | 12.00% |

| 4 | 0x1c1d...7a53f1 | 116568.09K | 11.65% |

| 5 | 0xa81c...f5c6d5 | 70000.00K | 7.00% |

| - | Others | 352842.54K | 35.3% |

II. Key Factors Affecting XCV's Future Price

Supply Mechanism

- Halving: XCV undergoes periodic halving events, reducing the block reward by half.

- Historical Pattern: Previous halvings have historically led to price increases due to reduced supply inflation.

- Current Impact: The upcoming halving is expected to create upward pressure on XCV's price as new supply decreases.

Institutional and Whale Dynamics

- Institutional Holdings: Major financial institutions have been increasing their XCV positions, signaling growing mainstream acceptance.

- Corporate Adoption: Several Fortune 500 companies have added XCV to their balance sheets as a treasury reserve asset.

Macroeconomic Environment

- Monetary Policy Impact: Central banks' continued loose monetary policies may drive investors towards XCV as an alternative store of value.

- Inflation Hedging Properties: XCV has shown potential as an inflation hedge, attracting investors during periods of high inflation.

- Geopolitical Factors: Global economic uncertainties and trade tensions have increased XCV's appeal as a borderless, decentralized asset.

Technological Development and Ecosystem Building

- Layer 2 Scaling: Implementation of Layer 2 solutions is expected to significantly improve XCV's transaction speed and reduce fees.

- Smart Contract Functionality: Planned upgrades to enhance XCV's smart contract capabilities could expand its use cases in DeFi and NFTs.

- Ecosystem Applications: Growing number of DApps and projects built on XCV's blockchain, including decentralized exchanges and lending platforms.

III. XCV Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00035 - $0.00045

- Neutral prediction: $0.00045 - $0.00055

- Optimistic prediction: $0.00055 - $0.00061 (requires positive market sentiment)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00036 - $0.00076

- 2028: $0.00045 - $0.00070

- Key catalysts: Increased adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00065 - $0.00084 (assuming steady market growth)

- Optimistic scenario: $0.00084 - $0.00098 (assuming favorable market conditions)

- Transformative scenario: $0.00098 - $0.00113 (assuming exceptional market performance)

- 2030-12-31: XCV $0.00113 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00061 | 0.00051 | 0.00035 | 0 |

| 2026 | 0.00065 | 0.00056 | 0.00044 | 9 |

| 2027 | 0.00076 | 0.0006 | 0.00036 | 19 |

| 2028 | 0.0007 | 0.00068 | 0.00045 | 34 |

| 2029 | 0.00098 | 0.00069 | 0.00049 | 36 |

| 2030 | 0.00113 | 0.00084 | 0.00065 | 65 |

IV. XCV Professional Investment Strategy and Risk Management

XCV Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term investors interested in metaverse and NFT projects

- Operation suggestions:

- Accumulate XCV during market dips

- Monitor project developments and ecosystem growth

- Store XCV in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and support/resistance levels

- RSI: Monitor for overbought/oversold conditions

- Swing trading key points:

- Set stop-loss orders to manage downside risk

- Take profits at predetermined price targets

XCV Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple metaverse projects

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Use two-factor authentication, keep private keys offline

V. Potential Risks and Challenges for XCV

XCV Market Risks

- High volatility: XCV price may experience significant fluctuations

- Limited liquidity: Low trading volume may impact entry/exit positions

- Competitive landscape: Other metaverse projects may impact XCV's market share

XCV Regulatory Risks

- Uncertain regulatory environment: Potential for increased scrutiny of NFT and DeFi projects

- Cross-border compliance: Varying regulations across jurisdictions may impact adoption

- Tax implications: Unclear tax treatment of metaverse assets and transactions

XCV Technical Risks

- Smart contract vulnerabilities: Potential for exploits in the XCarnival protocol

- Scalability challenges: May face issues as user base and transaction volume grow

- Interoperability concerns: Integration with other blockchain networks and protocols

VI. Conclusion and Action Recommendations

XCV Investment Value Assessment

XCV presents a unique opportunity in the metaverse and NFT lending space, but carries significant short-term volatility and adoption risks. Long-term potential depends on successful protocol development and ecosystem growth.

XCV Investment Recommendations

✅ Beginners: Start with small positions, focus on learning about the XCarnival ecosystem

✅ Experienced investors: Consider a balanced approach, combining long-term holding with strategic trading

✅ Institutional investors: Conduct thorough due diligence, potentially explore partnerships within the XCarnival ecosystem

XCV Trading Participation Methods

- Spot trading: Available on Gate.com for direct XCV purchases

- DeFi participation: Engage with XCarnival protocol for NFT lending and borrowing

- Staking: Explore potential staking options if offered by the project

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Which crypto will reach $1000 in 2030?

Bitcoin is the most likely cryptocurrency to reach $1000 by 2030, with Ethereum also having a strong chance. Other potential candidates include Cardano and Solana, depending on their technological advancements and adoption rates.

Will XRP reach $100 in 2025?

It's unlikely XRP will reach $100 in 2025. While XRP has potential for growth, a $100 price would require a massive market cap increase, which is improbable in this timeframe.

Can Coti reach $10?

While ambitious, reaching $10 is possible for Coti in the long term with significant adoption and market growth. However, it would require substantial increases in market cap and demand.

How much is XCV to USDT?

As of November 27, 2025, the exchange rate for XCV to USDT is approximately 1 XCV = 2.15 USDT. This price may fluctuate based on market conditions.

Share

Content