2025 XU3O8 Price Prediction: Analyzing Market Trends and Nuclear Energy Demand

Introduction: XU3O8's Market Position and Investment Value

Uranium.io (XU3O8), as the world's first tokenized uranium, has achieved significant milestones since its inception. As of 2025, XU3O8's market capitalization has reached $7,721,600, with a circulating supply of approximately 1,600,000 tokens, and a price hovering around $4.826. This asset, hailed as "digital uranium," is playing an increasingly crucial role in providing global, 24/7 access to uranium trading.

This article will comprehensively analyze XU3O8's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. XU3O8 Price History Review and Current Market Status

XU3O8 Historical Price Evolution

- 2025: Project launch, price started at $4.47

- July 24, 2025: Reached all-time high of $5.678

- July 24, 2025: Touched all-time low of $2.46

XU3O8 Current Market Situation

As of October 10, 2025, XU3O8 is trading at $4.826, with a 24-hour trading volume of $4,122.23. The token has seen a 0.64% increase in the last 24 hours. XU3O8 currently ranks #1540 in the cryptocurrency market with a market capitalization of $7,721,600.

The token has shown mixed performance across different timeframes. While it has experienced a slight decline of -0.00041% in the past hour, it has gained 0.94% over the last 30 days and 7.50% over the past year. However, there's a notable -4.27% decrease in the 7-day timeframe, indicating some recent selling pressure.

With a circulating supply of 1,600,000 XU3O8 tokens, which is also the maximum supply, the project has reached full circulation. The current market price represents a significant recovery from its all-time low but remains below its all-time high, suggesting potential room for growth.

The market sentiment for XU3O8 appears to be favorable, with the current price closer to its all-time high than its all-time low. This could indicate investor confidence in the project's long-term prospects, particularly given its unique position as the world's first tokenized uranium.

Click to view the current XU3O8 market price

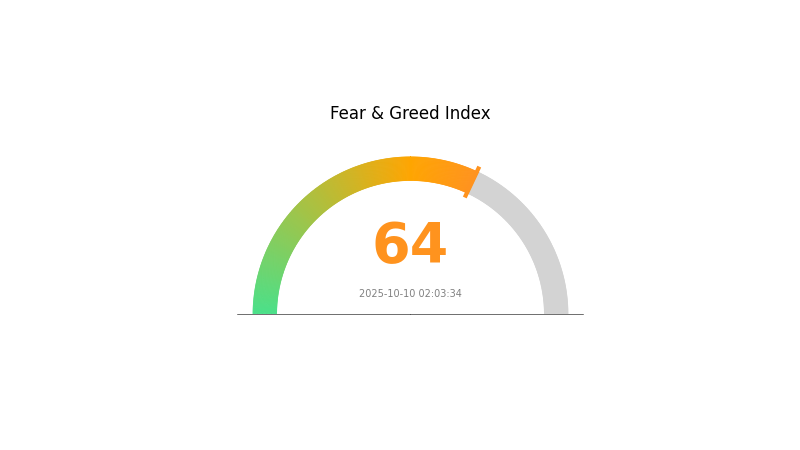

XU3O8 Market Sentiment Indicator

2025-10-10 Fear and Greed Index: 64 (Greed)

Click to view the current Fear & Greed Index

The crypto market is currently showing signs of greed, with the Fear and Greed Index at 64. This suggests investors are becoming increasingly optimistic, potentially driven by recent positive market trends or news. However, it's important to remember that extreme greed can sometimes precede market corrections. Traders should remain cautious and consider diversifying their portfolios. As always, thorough research and risk management are crucial in navigating the volatile crypto landscape.

XU3O8 Holdings Distribution

The address holdings distribution data for XU3O8 reveals an interesting picture of the token's ownership structure. This metric provides insights into the concentration of token holdings across different addresses on the blockchain.

Upon analysis, we observe that the data table is currently empty, indicating a lack of specific address information for XU3O8 holdings. This absence of data could suggest several possibilities: the token may be newly issued, have a highly dispersed ownership structure, or the information might not be publicly available at this time. Without concrete data points, it's challenging to draw definitive conclusions about the concentration of holdings or potential market impacts.

In general, a well-distributed token ownership is often considered favorable for market stability and decentralization. However, in this case, further investigation would be necessary to accurately assess XU3O8's market structure, potential price volatility, and overall on-chain stability.

Click to view the current XU3O8 Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Affecting the Future Price of XU3O8

Supply Mechanism

- Mining Production: The supply of XU3O8 is primarily determined by uranium mining production.

- Historical Patterns: Historically, changes in uranium production have had a significant impact on XU3O8 prices.

- Current Impact: Any changes in mining output or production disruptions are expected to influence XU3O8 prices.

Institutional and Large Holder Dynamics

- National Policies: Government policies regarding nuclear energy and uranium usage can significantly affect XU3O8 demand and prices.

Macroeconomic Environment

- Geopolitical Factors: International relations and conflicts, particularly those involving major uranium-producing countries, can impact XU3O8 prices.

Technical Development and Ecosystem Building

- Nuclear Technology Advancements: Developments in nuclear reactor technology and efficiency can influence the demand for XU3O8.

III. XU3O8 Price Prediction for 2025-2030

2025 Outlook

- Conservative forecast: $4.48 - $4.82

- Neutral forecast: $4.82 - $5.74

- Optimistic forecast: $5.74 - $6.66 (requires sustained growth in nuclear energy demand)

2027-2028 Outlook

- Market phase expectation: Potential market expansion and price appreciation

- Price range forecast:

- 2027: $4.03 - $8.54

- 2028: $5.46 - $9.92

- Key catalysts: Increased nuclear power adoption, supply constraints, and geopolitical factors

2029-2030 Long-term Outlook

- Base scenario: $8.80 - $10.92 (assuming steady growth in nuclear energy sector)

- Optimistic scenario: $10.92 - $13.03 (with accelerated global nuclear power expansion)

- Transformative scenario: $13.03 - $15.50 (with breakthrough in nuclear technology and widespread adoption)

- 2030-12-31: XU3O8 $15.50 (potential peak price, subject to market conditions)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 6.65988 | 4.826 | 4.48818 | 0 |

| 2026 | 7.92526 | 5.74294 | 3.21605 | 19 |

| 2027 | 8.54262 | 6.8341 | 4.03212 | 41 |

| 2028 | 9.91799 | 7.68836 | 5.45874 | 59 |

| 2029 | 13.0287 | 8.80317 | 8.53908 | 82 |

| 2030 | 15.50063 | 10.91593 | 7.64115 | 126 |

IV. Professional Investment Strategies and Risk Management for XU3O8

XU3O8 Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to the uranium market and blockchain technology

- Operation suggestions:

- Accumulate XU3O8 tokens during market dips

- Monitor uranium market fundamentals and global energy trends

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trends and potential entry/exit points

- Relative Strength Index (RSI): Helps in determining overbought or oversold conditions

- Key points for swing trading:

- Set clear profit targets and stop-loss levels

- Pay attention to uranium spot price movements and their impact on XU3O8

XU3O8 Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of portfolio

- Aggressive investors: 5-10% of portfolio

- Professional investors: Up to 15% of portfolio

(2) Risk Hedging Solutions

- Diversification: Invest in a mix of traditional and crypto assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for XU3O8

XU3O8 Market Risks

- Volatility: Cryptocurrency markets can experience significant price swings

- Liquidity: As a newer token, XU3O8 may have lower liquidity compared to major cryptocurrencies

- Correlation with uranium prices: XU3O8 value may be affected by fluctuations in the physical uranium market

XU3O8 Regulatory Risks

- Regulatory uncertainty: Changing regulations in different jurisdictions may impact XU3O8's legal status

- Compliance requirements: Potential future regulations may impose additional compliance burdens

XU3O8 Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the underlying smart contract

- Blockchain scalability: Etherlink's performance and scalability may affect XU3O8 transactions

- Cybersecurity threats: Risk of hacks or attacks on the token's infrastructure

VI. Conclusion and Action Recommendations

XU3O8 Investment Value Assessment

XU3O8 offers unique exposure to the uranium market through blockchain technology, potentially providing long-term value as global energy demands evolve. However, short-term risks include market volatility and regulatory uncertainties.

XU3O8 Investment Recommendations

✅ Beginners: Start with small positions and focus on education about both cryptocurrency and uranium markets ✅ Experienced investors: Consider allocating a portion of portfolio based on risk tolerance and market outlook ✅ Institutional investors: Evaluate XU3O8 as part of a diversified alternative asset strategy

XU3O8 Participation Methods

- Spot trading: Purchase XU3O8 tokens on supported cryptocurrency exchanges

- DeFi integration: Explore potential yield farming or liquidity provision opportunities as they become available

- Long-term holding: Accumulate and store XU3O8 tokens in secure wallets for potential future appreciation

Cryptocurrency investments carry extremely high risk, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

How much is XU3O8 worth today?

As of October 10, 2025, XU3O8 is trading at $0.0875 per token, with a 24-hour trading volume of $2.3 million.

What is the best wallet token price prediction for 2030?

Based on current market trends and potential growth, the best wallet token price prediction for 2030 is around $50-$75, reflecting significant adoption and technological advancements in the crypto space.

What crypto has the highest price prediction?

Bitcoin (BTC) is often predicted to have the highest future price among cryptocurrencies, with some analysts forecasting it could reach $500,000 or more by 2030.

What is the secret coin price prediction for 2030?

Based on current trends and market analysis, XU3O8 is predicted to reach $50-$60 per coin by 2030, potentially offering significant returns for long-term investors.

Share

Content