2025 Y8U Price Prediction: Navigating the Future of Crypto Assets in a Volatile Market

Introduction: Y8U's Market Position and Investment Value

Y8U (Y8U) as a Web3 protocol for creating and decentralized storage of digital clones, has been revolutionizing media production in the age of AI automation since its inception. As of 2025, Y8U's market capitalization has reached $35,941.2, with a circulating supply of approximately 24,550,000 tokens, and a price hovering around $0.001464. This asset, hailed as the "AI-powered digital clone platform," is playing an increasingly crucial role in the field of content creation and user privacy.

This article will comprehensively analyze Y8U's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide investors with professional price predictions and practical investment strategies.

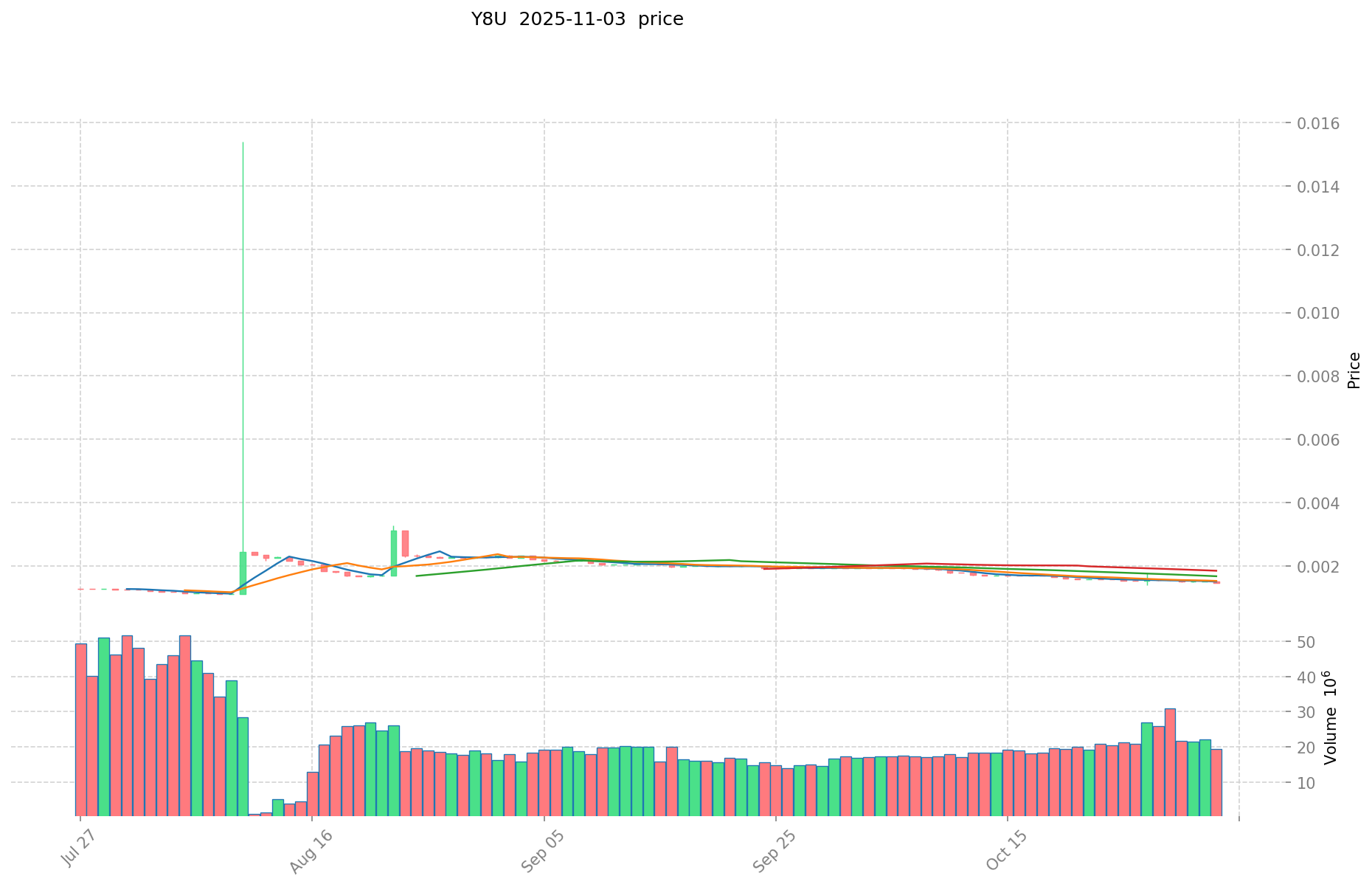

I. Y8U Price History Review and Current Market Status

Y8U Historical Price Evolution

- 2024: Y8U reached its all-time high of $0.157 on April 23, marking a significant milestone for the project.

- 2025: The market experienced a downturn, with Y8U hitting its all-time low of $0.001106 on August 9.

Y8U Current Market Situation

As of November 3, 2025, Y8U is trading at $0.001464, representing a significant decline of 90.7% from its price one year ago. The token has experienced negative price movements across various timeframes, with a 24-hour decrease of 3.43% and a 30-day drop of 24.79%. The current market capitalization stands at $35,941.2, with a circulating supply of 24,550,000 Y8U tokens. The trading volume in the last 24 hours amounts to $28,150.74, indicating moderate market activity. The fully diluted valuation is $1,464,000, with Y8U having a market dominance of 0.000037%.

Click to view the current Y8U market price

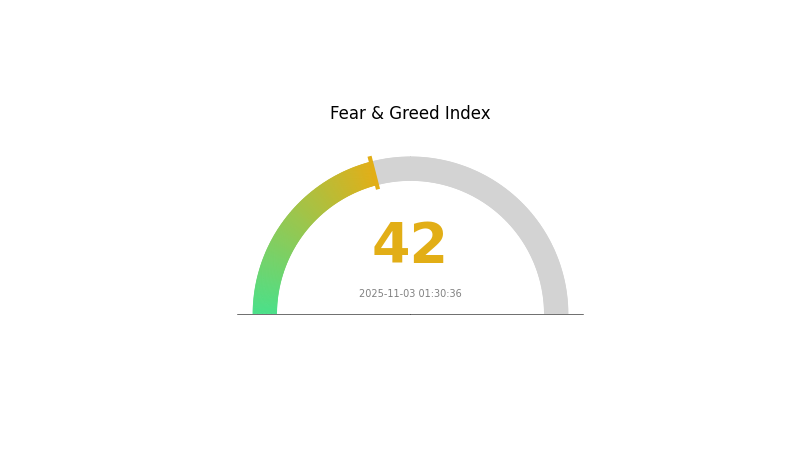

Y8U Market Sentiment Indicator

2025-11-03 Fear and Greed Index: 42 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious as the Fear and Greed Index hovers at 42, indicating a fearful atmosphere. This suggests investors are adopting a more conservative approach, potentially creating buying opportunities for those with a higher risk tolerance. However, it's crucial to remain vigilant and conduct thorough research before making any investment decisions. As always, diversification and risk management are key in navigating the volatile crypto landscape.

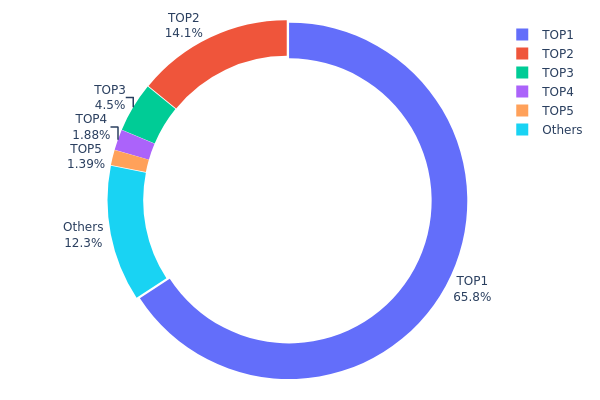

Y8U Holdings Distribution

The address holdings distribution data for Y8U reveals a highly concentrated ownership structure. The top address holds a staggering 65.78% of the total supply, while the second-largest holder accounts for 14.12%. This concentration is further emphasized by the fact that the top five addresses collectively control 87.66% of Y8U tokens.

Such a high level of concentration raises concerns about market stability and potential price manipulation. With a single address holding nearly two-thirds of the supply, there's a significant risk of large-scale market movements if this holder decides to sell or transfer their tokens. Furthermore, the top two addresses combined control almost 80% of the supply, which could lead to coordinated actions that dramatically impact Y8U's market dynamics.

This distribution pattern suggests a low level of decentralization for Y8U, potentially compromising its resilience to market shocks and limiting broader participation in its ecosystem. Investors and market participants should be aware of these concentration risks when considering Y8U, as they may lead to increased volatility and susceptibility to whale-driven price movements.

Click to view the current Y8U Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe870...dc355c | 192820.73K | 65.78% |

| 2 | 0x0d07...b492fe | 41406.57K | 14.12% |

| 3 | 0x741b...7b48cd | 13197.97K | 4.50% |

| 4 | 0x5fc1...6fdfa2 | 5497.53K | 1.87% |

| 5 | 0x3c70...b91952 | 4087.90K | 1.39% |

| - | Others | 36086.97K | 12.34% |

II. Key Factors Affecting Y8U's Future Price

Market Sentiment

- Investor Confidence: Investor sentiment and confidence have a direct impact on Y8U's price movements. Market optimism or pessimism can significantly influence price trends.

- Economic Trends: Overall economic conditions and trends play a crucial role in shaping Y8U's future price trajectory.

Technological Developments

- Blockchain Advancements: Continuous improvements in blockchain technology, optimization of scaling solutions, and enhanced security measures can drive Y8U's price upward.

- Innovation: Ongoing technological innovations in the cryptocurrency space can potentially impact Y8U's value and adoption.

Regulatory Environment

- Policy Changes: Regulatory decisions and policy changes in various countries can have substantial effects on Y8U's price and overall market perception.

- Global Financial Openness: Increasing financial openness and integration of cryptocurrencies into traditional financial systems may influence Y8U's adoption and value.

Macroeconomic Factors

- Inflation Hedging: In high-inflation environments, cryptocurrencies like Y8U may be sought after as potential hedging tools, potentially driving up their prices.

- Currency Dynamics: Changes in fiat currency strengths, particularly in relation to major global currencies, can impact Y8U's relative value and appeal as an alternative asset.

III. Y8U Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.00094 - $0.00130

- Neutral prediction: $0.00130 - $0.00160

- Optimistic prediction: $0.00160 - $0.00175 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase

- Price range forecast:

- 2027: $0.00132 - $0.00250

- 2028: $0.00204 - $0.00284

- Key catalysts: Market adoption, technological advancements

2029-2030 Long-term Outlook

- Base scenario: $0.00250 - $0.00300 (assuming steady market growth)

- Optimistic scenario: $0.00300 - $0.00350 (assuming strong market performance)

- Transformative scenario: $0.00350 - $0.00396 (assuming exceptional market conditions)

- 2030-12-31: Y8U $0.00396 (potential peak price)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00175 | 0.00146 | 0.00094 | 0 |

| 2026 | 0.00201 | 0.00161 | 0.00129 | 9 |

| 2027 | 0.0025 | 0.00181 | 0.00132 | 23 |

| 2028 | 0.00284 | 0.00215 | 0.00204 | 46 |

| 2029 | 0.00324 | 0.0025 | 0.0018 | 70 |

| 2030 | 0.00396 | 0.00287 | 0.00235 | 96 |

IV. Professional Investment Strategies and Risk Management for Y8U

Y8U Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operation suggestions:

- Accumulate Y8U tokens during market dips

- Set price targets and regularly reassess the project's fundamentals

- Store tokens in a secure hardware wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use to identify trend directions and potential reversals

- Relative Strength Index (RSI): Monitor overbought and oversold conditions

- Key points for swing trading:

- Monitor Y8U's correlation with broader market trends

- Set strict stop-loss and take-profit levels

Y8U Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3%

- Aggressive investors: 5-10%

- Professional investors: 10-15%

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple cryptocurrencies and traditional assets

- Stop-loss orders: Implement to limit potential losses

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Use hardware wallets for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords, and regularly update software

V. Potential Risks and Challenges for Y8U

Y8U Market Risks

- High volatility: Y8U's price can experience significant fluctuations

- Limited liquidity: Low trading volume may lead to slippage and difficulty in executing large trades

- Market sentiment: Y8U's price may be influenced by overall crypto market trends

Y8U Regulatory Risks

- Uncertain regulatory environment: Potential changes in cryptocurrency regulations could impact Y8U's adoption and value

- Cross-border compliance: Varying regulations across different jurisdictions may affect Y8U's global accessibility

Y8U Technical Risks

- Smart contract vulnerabilities: Potential bugs or exploits in the Y8U smart contract

- Blockchain congestion: Network issues on the BSC chain could affect transaction speeds and costs

- Integration challenges: Potential difficulties in integrating Y8U with other platforms or services

VI. Conclusion and Action Recommendations

Y8U Investment Value Assessment

Y8U presents an innovative approach to digital content creation and monetization in the AI era. However, it faces significant short-term risks due to market volatility and regulatory uncertainties. Long-term value depends on widespread adoption and successful implementation of its technology.

Y8U Investment Recommendations

✅ Beginners: Start with small investments and focus on learning about the project and its technology ✅ Experienced investors: Consider a balanced approach, allocating a small portion of your portfolio to Y8U ✅ Institutional investors: Conduct thorough due diligence and consider Y8U as part of a diversified crypto portfolio

Y8U Trading Participation Methods

- Spot trading: Buy and sell Y8U tokens on Gate.com

- Staking: Participate in staking programs if available to earn passive income

- DeFi integration: Explore decentralized finance options involving Y8U tokens

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What will yearn finance be worth in 2030?

Based on current trends, Yearn Finance could potentially reach around €10,836.61 by 2030 in a neutral scenario. This projection is speculative and subject to market dynamics.

Which coin will reach 1 rupee prediction?

Shiba Inu (SHIB) is predicted to reach 1 rupee by the end of 2030, based on current market trends and projections.

What is the price prediction for Dogelon in 2050?

By 2050, Dogelon could reach a high of $0.25, with an average price of $0.19. This prediction is based on current market analysis.

How much will USDC be worth in 2025?

USDC is expected to maintain its $1 peg in 2025, with minimal fluctuations. As a stablecoin, its value should remain closely tied to the US dollar.

Share

Content