CALCIFY vs BAT: The Ultimate Showdown in Dental Health Technologies

Introduction: Investment Comparison of CALCIFY vs BAT

In the cryptocurrency market, the comparison between CALCIFY and BAT has always been a topic that investors cannot ignore. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency asset positioning.

CALCIFY (CALCIFY): Since its launch in 2025, it has gained market recognition for its decentralized compute marketplace.

BAT (BAT): Since its inception in 2017, it has been hailed as a digital asset for attention-based advertising, and is one of the most widely traded cryptocurrencies globally.

This article will comprehensively analyze the investment value comparison between CALCIFY and BAT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, and attempt to answer the question that investors are most concerned about:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

CALCIFY and BAT Historical Price Trends

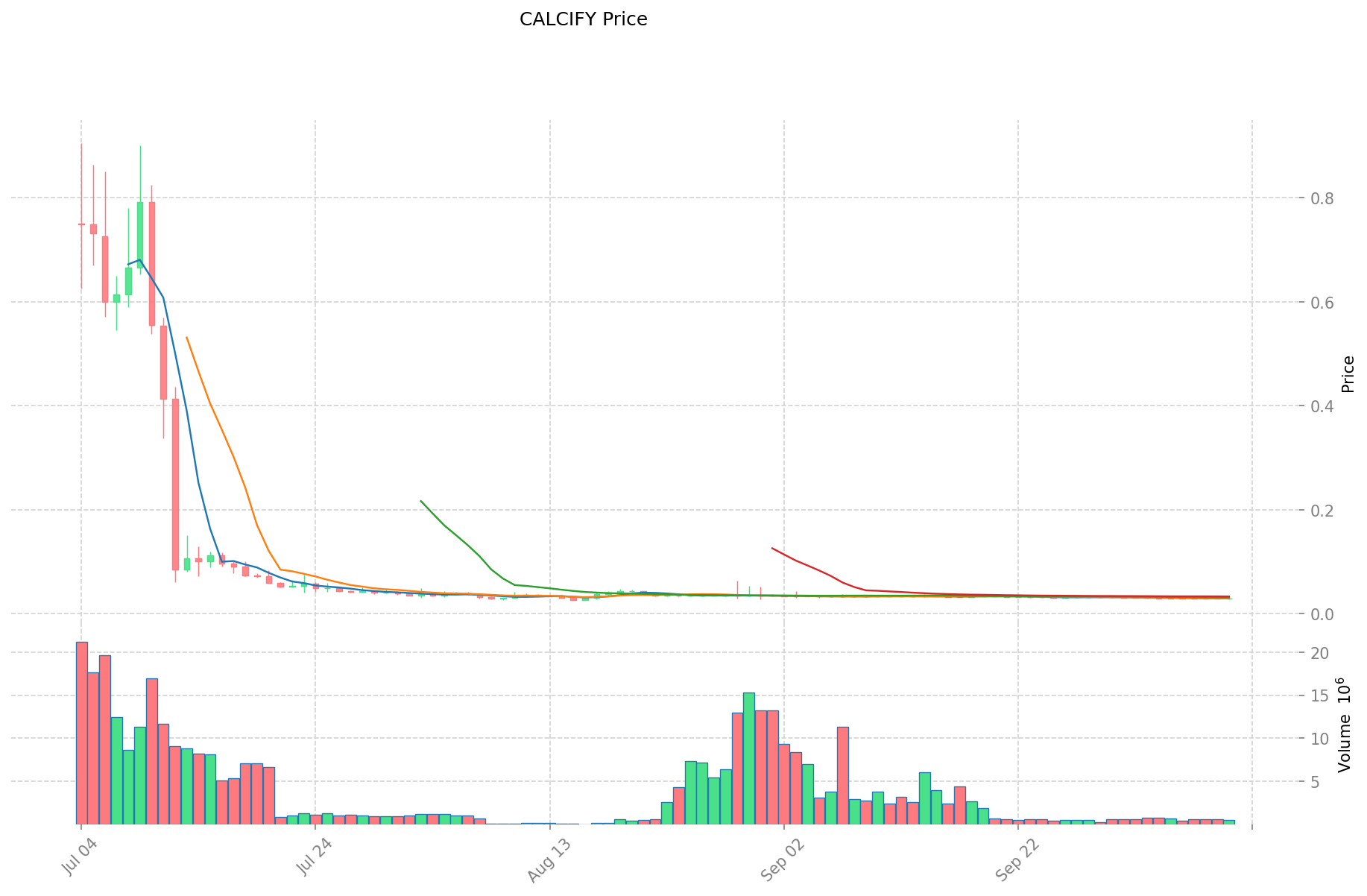

- 2025: CALCIFY reached its all-time high of $1.28546 on July 3rd, followed by a significant decline.

- 2021: BAT hit its all-time high of $1.92 on November 28th, amid a broader crypto market rally.

- Comparative analysis: In the recent market cycle, CALCIFY dropped from $1.28546 to a low of $0.002, while BAT declined from $1.92 to current levels around $0.13-$0.17.

Current Market Situation (2025-10-11)

- CALCIFY current price: $0.02967

- BAT current price: $0.1318

- 24-hour trading volume: CALCIFY $15,820.83 vs BAT $1,092,343.21

- Market Sentiment Index (Fear & Greed Index): 27 (Fear)

Click to view real-time prices:

- View CALCIFY current price Market Price

- View BAT current price Market Price

Key Factors Affecting CALCIFY vs BAT Investment Value

Supply Mechanisms Comparison (Tokenomics)

- Investment return considerations: Shorter investment recovery periods generally indicate lower risk

- Value demonstration: Value is the manifestation of capability, while valuation represents the estimation of capability and value

- Risk assessment: Different environmental factors influence investment risk profiles

Institutional Adoption and Market Applications

- Developer tools: Investors have noted concerns about commoditization of developer tools and horizontal platforms

- Algorithm risks: Growing investor concerns regarding algorithmic risks and biases

- Deep learning interpretability: Current investor focus on the explainability of deep learning systems

Technical Development and Ecosystem Building

- Technical innovation: Important factor in determining long-term investment value

- Market demand: Essential consideration for sustainable investment returns

- Competitive landscape: Critical component in evaluating investment potential

Macroeconomic Factors and Market Cycles

- Business terminology impact: Value, impact, and return on investment are key business metrics to consider

- Environmental factors: External conditions can significantly influence investment outcomes

- Structural security: Timely detection of structural issues is crucial for maintaining asset value and operational lifetime

III. 2025-2030 Price Prediction: CALCIFY vs BAT

Short-term Prediction (2025)

- CALCIFY: Conservative $0.0197271 - $0.02859 | Optimistic $0.02859 - $0.0360234

- BAT: Conservative $0.124644 - $0.1326 | Optimistic $0.1326 - $0.175032

Mid-term Prediction (2027)

- CALCIFY may enter a growth phase, with estimated prices $0.0291406434 - $0.0401572281

- BAT may enter a bullish market, with estimated prices $0.1211301 - $0.20072988

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- CALCIFY: Base scenario $0.04683981730428 - $0.061828558841649 | Optimistic scenario $0.061828558841649+

- BAT: Base scenario $0.205005080358 - $0.28085696009046 | Optimistic scenario $0.28085696009046+

Disclaimer

CALCIFY:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0360234 | 0.02859 | 0.0197271 | -3 |

| 2026 | 0.03876804 | 0.0323067 | 0.020353221 | 8 |

| 2027 | 0.0401572281 | 0.03553737 | 0.0291406434 | 19 |

| 2028 | 0.0457952318505 | 0.03784729905 | 0.0283854742875 | 27 |

| 2029 | 0.05185836915831 | 0.04182126545025 | 0.02341990865214 | 40 |

| 2030 | 0.061828558841649 | 0.04683981730428 | 0.028103890382568 | 57 |

BAT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.175032 | 0.1326 | 0.124644 | 0 |

| 2026 | 0.19227 | 0.153816 | 0.08152248 | 16 |

| 2027 | 0.20072988 | 0.173043 | 0.1211301 | 31 |

| 2028 | 0.2111816772 | 0.18688644 | 0.112131864 | 41 |

| 2029 | 0.210976102116 | 0.1990340586 | 0.14927554395 | 51 |

| 2030 | 0.28085696009046 | 0.205005080358 | 0.14555360705418 | 55 |

IV. Investment Strategy Comparison: CALCIFY vs BAT

Long-term vs Short-term Investment Strategies

- CALCIFY: Suitable for investors focused on decentralized compute marketplaces and ecosystem potential

- BAT: Suitable for investors interested in attention-based advertising and established digital assets

Risk Management and Asset Allocation

- Conservative investors: CALCIFY: 20% vs BAT: 80%

- Aggressive investors: CALCIFY: 60% vs BAT: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- CALCIFY: Higher volatility due to lower market cap and trading volume

- BAT: Exposure to fluctuations in the broader cryptocurrency market

Technical Risk

- CALCIFY: Scalability, network stability

- BAT: Centralization of Brave browser, potential security vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both differently, with BAT potentially facing more scrutiny due to its connection with advertising

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- CALCIFY advantages: Emerging technology in decentralized compute marketplace, potential for high growth

- BAT advantages: Established ecosystem, wider adoption through Brave browser, more stable market position

✅ Investment Advice:

- New investors: Consider a smaller allocation to CALCIFY, with a larger portion in BAT for stability

- Experienced investors: Balanced approach, potentially equal allocation to both assets

- Institutional investors: Thorough due diligence on CALCIFY's technology and growth potential, while maintaining exposure to BAT's established market

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between CALCIFY and BAT? A: CALCIFY is a newer cryptocurrency focused on decentralized compute marketplaces, launched in 2025. BAT, launched in 2017, is an established digital asset for attention-based advertising. CALCIFY has a lower market cap and trading volume, while BAT has wider adoption through the Brave browser.

Q2: Which cryptocurrency has shown better price performance recently? A: Based on the current market data, BAT is trading at a higher price ($0.1318) compared to CALCIFY ($0.02967). However, it's important to note that CALCIFY is a newer asset and may have different growth potential.

Q3: What are the key factors affecting the investment value of CALCIFY and BAT? A: Key factors include supply mechanisms, institutional adoption, market applications, technical development, ecosystem building, and macroeconomic factors. For CALCIFY, its focus on decentralized compute marketplaces is a significant factor, while BAT's connection to the Brave browser ecosystem is crucial.

Q4: What are the price predictions for CALCIFY and BAT in 2030? A: For CALCIFY, the base scenario prediction for 2030 is $0.04683981730428 - $0.061828558841649, with an optimistic scenario above $0.061828558841649. For BAT, the base scenario is $0.205005080358 - $0.28085696009046, with an optimistic scenario above $0.28085696009046.

Q5: How should investors allocate their assets between CALCIFY and BAT? A: Conservative investors might consider allocating 20% to CALCIFY and 80% to BAT, while aggressive investors might opt for 60% CALCIFY and 40% BAT. New investors are advised to have a larger portion in BAT for stability, while experienced investors might consider a more balanced approach.

Q6: What are the potential risks associated with investing in CALCIFY and BAT? A: Both face market risks, with CALCIFY potentially having higher volatility due to its lower market cap. Technical risks include scalability issues for CALCIFY and centralization concerns for BAT. Regulatory risks may affect both, with BAT potentially facing more scrutiny due to its connection with advertising.

Q7: Which cryptocurrency is considered the better buy? A: The better buy depends on individual investment goals and risk tolerance. CALCIFY offers potential for high growth in the emerging decentralized compute marketplace, while BAT provides stability with its established ecosystem and wider adoption. New investors might lean towards BAT, while experienced investors could consider a balanced approach.

Share

Content