CGPU vs SOL: The Battle for Dominance in the Next-Gen Blockchain Ecosystem

Introduction: CGPU vs SOL Investment Comparison

In the cryptocurrency market, the comparison between ChainGPU (CGPU) vs Solana (SOL) has always been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

ChainGPU (CGPU): Since its launch, it has gained market recognition for its focus on democratizing GPU and AI resources.

Solana (SOL): Established in late 2017, it has been hailed as a high-performance blockchain protocol designed for scalability without compromising decentralization or security.

This article will comprehensively analyze the investment value comparison between CGPU and SOL, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

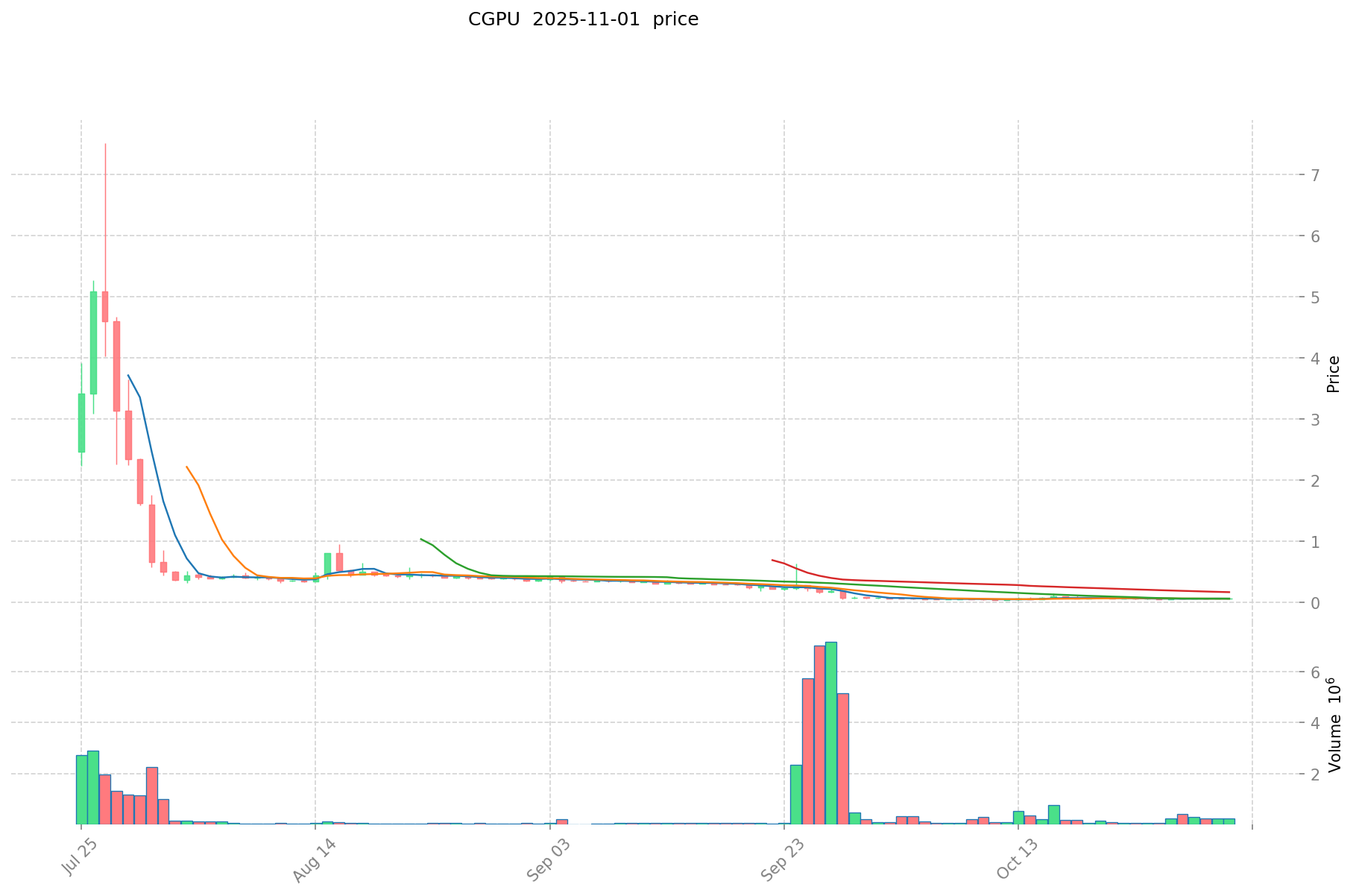

ChainGPU (CGPU) and Solana (SOL) Historical Price Trends

- 2024: CGPU reached its all-time high of $75 on October 22, 2024.

- 2025: SOL hit its historical peak of $293.31 on January 19, 2025.

- Comparative analysis: In the recent market cycle, CGPU dropped from its high of $75 to a low of $0.02879, while SOL demonstrated more resilience, maintaining a higher price level.

Current Market Situation (2025-11-02)

- CGPU current price: $0.05801

- SOL current price: $185.95

- 24-hour trading volume: CGPU $11,772.09659 vs SOL $71,487,428.85466

- Market Sentiment Index (Fear & Greed Index): 33 (Fear)

Click to view real-time prices:

- View CGPU current price Market Price

- View SOL current price Market Price

II. Core Factors Influencing Solana's Investment Value

Supply Mechanism (Tokenomics)

- SOL: Inflationary model with controlled parameters - initial inflation rate of 8%, disinflationary rate of -15%, targeting long-term inflation rate of 1.5%. Current inflation rate is 5.07%.

- Value sources: Primarily through Staking rewards and Miner Extractable Value (MEV)

- 📌 Historical pattern: SOL token supply is managed through creation (Genesis Block and inflation rewards) and reduction (transaction fee burning)

Institutional Adoption and Market Applications

- Institutional holdings: Solana's market capitalization has reached approximately $63 billion, positioning it as one of the leading blockchain platforms

- Enterprise adoption: Preferred platform for onboarding off-chain users, especially in decentralized physical infrastructure networks (DePIN), mobile applications, and payments

- National policies: Solana Foundation is strategically focusing on the Asia-Pacific market, with major events like Breakpoint 2024 being held in Singapore

Technical Development and Ecosystem Building

- Solana technical upgrades: Firedancer and Alpenglow aim to enhance stability, decentralization, and sub-second finality for real-time applications

- Ecosystem development: Robust development in DeFi protocols, NFT marketplaces (like Mad Lads), and gaming platforms (Star Atlas, Aurory)

- Ecosystem comparison: High transaction throughput and low fees have attracted numerous decentralized applications, with daily transaction volumes consistently outperforming other blockchains

Macroeconomic Factors and Market Cycles

- Performance in inflationary environments: Solana's economic model includes stake-based inflation rewards, with validators earning SOL through consensus participation and block production

- Liquidity factors: Liquid staking allows SOL holders to stake in pools and earn Liquid Staking Tokens (LSTs) that can be traded or used in applications

- Growth indicators: Significant increase in Total Value Locked (TVL) and DeFi Velocity showing high utilization rate of liquidity despite previous challenges from events like the FTX collapse

III. 2025-2030 Price Prediction: CGPU vs SOL

Short-term Prediction (2025)

- CGPU: Conservative $0.0389 - $0.0581 | Optimistic $0.0581 - $0.0755

- SOL: Conservative $143.30 - $186.11 | Optimistic $186.11 - $249.39

Mid-term Prediction (2027)

- CGPU may enter a growth phase, with estimated prices ranging from $0.0381 to $0.0898

- SOL may enter a bullish market, with estimated prices ranging from $248.18 to $319.82

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- CGPU: Base scenario $0.0574 - $0.1082 | Optimistic scenario $0.1082 - $0.1180

- SOL: Base scenario $221.46 - $335.55 | Optimistic scenario $335.55 - $483.20

Disclaimer: The above predictions are based on historical data and market analysis. Cryptocurrency markets are highly volatile and subject to rapid changes. These projections should not be considered as financial advice. Always conduct your own research before making investment decisions.

CGPU:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.075517 | 0.05809 | 0.0389203 | 0 |

| 2026 | 0.076824025 | 0.0668035 | 0.06279529 | 15 |

| 2027 | 0.089767203125 | 0.0718137625 | 0.038061294125 | 23 |

| 2028 | 0.1066434373125 | 0.0807904828125 | 0.070287720046875 | 39 |

| 2029 | 0.122769217681875 | 0.0937169600625 | 0.0712248896475 | 61 |

| 2030 | 0.117984966870684 | 0.108243088872187 | 0.057368837102259 | 86 |

SOL:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 249.3874 | 186.11 | 143.3047 | 0 |

| 2026 | 293.960745 | 217.7487 | 132.826707 | 17 |

| 2027 | 319.818403125 | 255.8547225 | 248.179080825 | 37 |

| 2028 | 319.498584721875 | 287.8365628125 | 267.688003415625 | 54 |

| 2029 | 367.437764258296875 | 303.6675737671875 | 294.557546554171875 | 63 |

| 2030 | 483.19584337834875 | 335.552669012742187 | 221.464761548409843 | 80 |

IV. Investment Strategy Comparison: CGPU vs SOL

Long-term vs Short-term Investment Strategies

- CGPU: Suitable for investors focused on AI and GPU resource democratization

- SOL: Suitable for investors seeking ecosystem growth and scalability potential

Risk Management and Asset Allocation

- Conservative investors: CGPU: 20% vs SOL: 80%

- Aggressive investors: CGPU: 40% vs SOL: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- CGPU: Higher volatility, lower liquidity

- SOL: Susceptible to broader crypto market trends

Technical Risks

- CGPU: Scalability, network stability

- SOL: Network outages, centralization concerns

Regulatory Risks

- Global regulatory policies may affect both, with SOL potentially facing more scrutiny due to its larger market presence

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- CGPU advantages: Focus on AI and GPU resources, potential for growth in niche market

- SOL advantages: Established ecosystem, high transaction speed, institutional adoption

✅ Investment Advice:

- New investors: Consider allocating a larger portion to SOL due to its established market position

- Experienced investors: Diversify between both, with a bias towards SOL

- Institutional investors: Focus on SOL for its liquidity and ecosystem development

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between CGPU and SOL? A: CGPU focuses on democratizing GPU and AI resources, while SOL is a high-performance blockchain protocol designed for scalability. SOL has a larger market cap, higher trading volume, and a more established ecosystem compared to CGPU.

Q2: How do the price trends of CGPU and SOL compare? A: CGPU reached its all-time high of $75 in October 2024 but has since dropped significantly. SOL hit its peak of $293.31 in January 2025 and has shown more resilience, maintaining a higher price level.

Q3: What are the key factors influencing Solana's investment value? A: Key factors include its inflationary tokenomics model, institutional adoption, robust ecosystem development, technical upgrades like Firedancer and Alpenglow, and its performance in various market conditions.

Q4: How do the future price predictions for CGPU and SOL compare? A: By 2030, CGPU is predicted to reach $0.0574 - $0.1180 in optimistic scenarios, while SOL is projected to reach $221.46 - $483.20. SOL generally shows higher growth potential in these predictions.

Q5: What are the main risks associated with investing in CGPU and SOL? A: CGPU faces higher volatility and liquidity risks, while SOL is more susceptible to broader crypto market trends. Both face technical risks, with CGPU concerned about scalability and SOL about network outages. Regulatory risks apply to both, with SOL potentially facing more scrutiny due to its larger market presence.

Q6: How should investors allocate their assets between CGPU and SOL? A: Conservative investors might consider allocating 20% to CGPU and 80% to SOL, while more aggressive investors could opt for a 40% CGPU and 60% SOL split. New investors may want to allocate more to SOL due to its established market position.

Q7: Which cryptocurrency is considered the better buy? A: While both have potential, SOL is generally considered the better buy due to its established ecosystem, high transaction speed, and institutional adoption. However, the choice depends on individual investment goals and risk tolerance.

Share

Content