FOREST vs QNT: A Comparative Analysis of Two Innovative Blockchain Protocols

Introduction: FOREST vs QNT Investment Comparison

In the cryptocurrency market, the comparison between FOREST and QNT has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance but also represent different positions in the crypto asset landscape.

Forest Protocol (FOREST): Launched in 2025, it has gained market recognition for its innovative launchpad and AMM mechanism enabling creators to launch Playable Tokens.

Quant (QNT): Since its inception in 2018, it has been recognized for solving interoperability through the creation of a global blockchain operating system, Overledger.

This article will provide a comprehensive analysis of the investment value comparison between FOREST and QNT, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

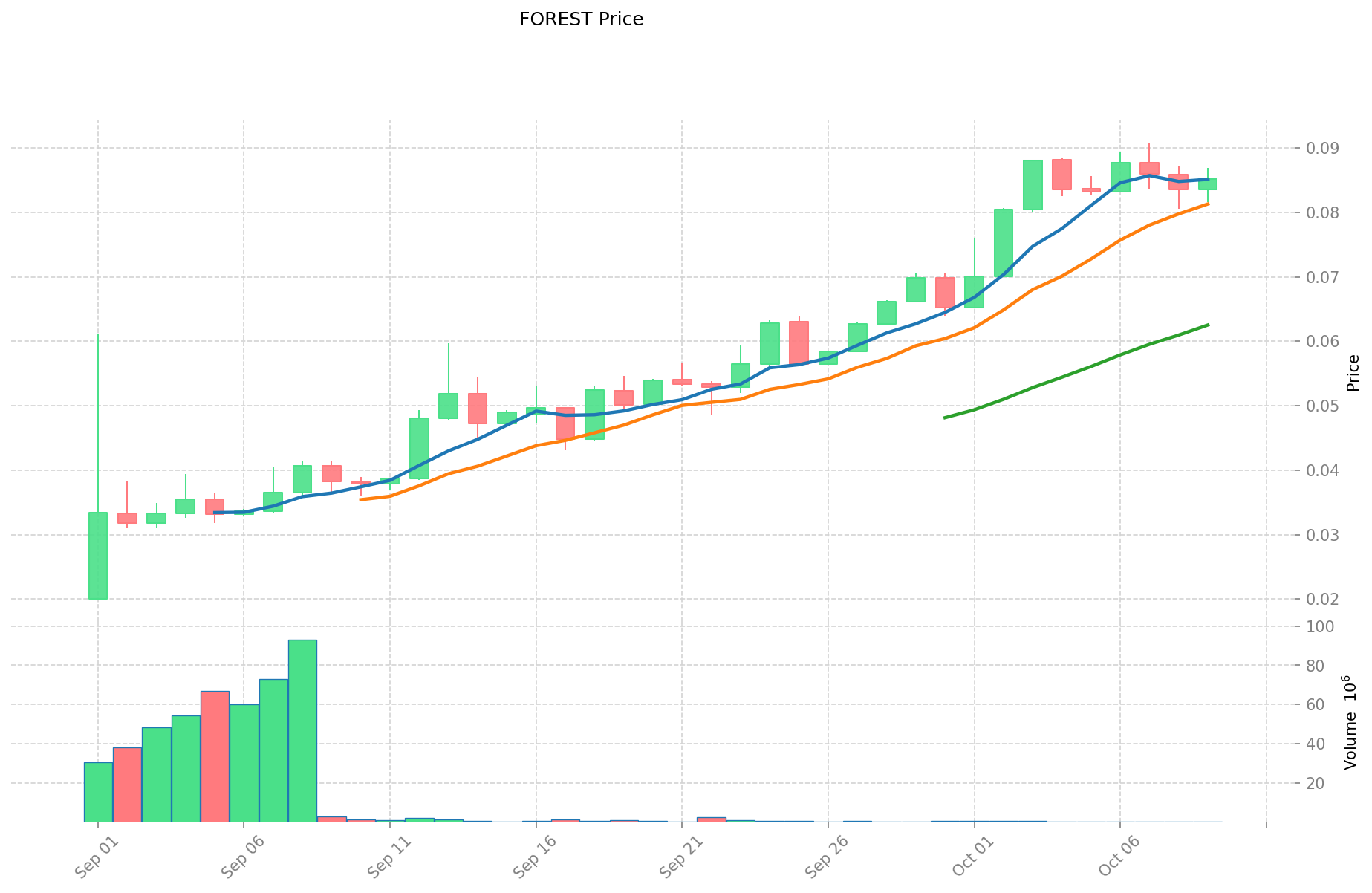

I. Price History Comparison and Current Market Status

FOREST (Coin A) and QNT (Coin B) Historical Price Trends

- 2025: FOREST launched at $0.02 and reached its all-time high of $0.09075 on October 7, 2025.

- 2021: QNT hit its all-time high of $427.42 on September 11, 2021.

- Comparative Analysis: While FOREST is a relatively new token showing strong growth since its launch, QNT has a longer price history with significant volatility.

Current Market Situation (2025-10-10)

- FOREST current price: $0.0856

- QNT current price: $100.6

- 24-hour trading volume: FOREST $26,587.49983 vs QNT $395,871.05055

- Market Sentiment Index (Fear & Greed Index): 64 (Greed)

Click to view real-time prices:

- View FOREST current price Market Price

- View QNT current price Market Price

II. Core Factors Affecting FOREST vs QNT Investment Value

Supply Mechanism Comparison (Tokenomics)

- FOREST: Fixed supply of 10 billion tokens with a deflationary mechanism through token burning

- QNT: Fixed supply of 14.6 million tokens with no additional issuance, creating natural scarcity

- 📌 Historical Pattern: Limited supply tokens like QNT have historically shown strong price appreciation during bull markets, while FOREST's burning mechanism aims to create long-term value through decreasing supply.

Institutional Adoption and Market Applications

- Institutional Holdings: QNT has gained more institutional interest with adoption by major financial institutions and inclusion in various crypto indices

- Enterprise Adoption: QNT has established partnerships with Oracle, SIA, and integration with SWIFT, while FOREST is focusing on Web3 infrastructure and gaming applications

- Regulatory Stance: QNT benefits from regulatory clarity as a utility token for enterprise blockchain solutions, while FOREST faces varying regulatory approaches across jurisdictions

Technical Development and Ecosystem Building

- FOREST Technical Upgrades: Layer-2 scaling solutions and cross-chain interoperability improvements

- QNT Technical Development: Overledger operating system enhancements and enterprise API upgrades

- Ecosystem Comparison: QNT focuses on enterprise blockchain connectivity and financial infrastructure, while FOREST emphasizes DeFi applications, gaming, and NFT marketplace development

Macroeconomic and Market Cycles

- Performance in Inflationary Environments: QNT has demonstrated stronger resilience during inflationary periods due to its fixed supply and enterprise utility

- Macroeconomic Monetary Policy: Both tokens show sensitivity to interest rate changes, with QNT typically showing less volatility during monetary tightening

- Geopolitical Factors: QNT benefits from increased demand for secure cross-border transaction systems during global uncertainties

III. 2025-2030 Price Prediction: FOREST vs QNT

Short-term Prediction (2025)

- FOREST: Conservative $0.0453 - $0.0855 | Optimistic $0.0855 - $0.0924

- QNT: Conservative $52.30 - $100.57 | Optimistic $100.57 - $139.79

Mid-term Prediction (2027)

- FOREST may enter a growth phase, with estimated prices of $0.0631 - $0.1608

- QNT may enter a steady growth phase, with estimated prices of $102.11 - $160.25

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- FOREST: Base scenario $0.1382 - $0.1552 | Optimistic scenario $0.1552 - $0.2234

- QNT: Base scenario $107.13 - $178.54 | Optimistic scenario $178.54 - $205.32

Disclaimer: The above predictions are based on historical data and market trends. Cryptocurrency markets are highly volatile and subject to rapid changes. These forecasts should not be considered as financial advice. Always conduct your own research before making investment decisions.

FOREST:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0923832 | 0.08554 | 0.0453362 | 0 |

| 2026 | 0.132552784 | 0.0889616 | 0.055156192 | 3 |

| 2027 | 0.1605979284 | 0.110757192 | 0.06313159944 | 29 |

| 2028 | 0.145174989414 | 0.1356775602 | 0.124823355384 | 58 |

| 2029 | 0.16991579251647 | 0.140426274807 | 0.09127707862455 | 64 |

| 2030 | 0.223446288472898 | 0.155171033661735 | 0.138102219958944 | 81 |

QNT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 139.7923 | 100.57 | 52.2964 | 0 |

| 2026 | 163.446364 | 120.18115 | 63.6960095 | 19 |

| 2027 | 160.24954541 | 141.813757 | 102.10590504 | 40 |

| 2028 | 184.2586144701 | 151.031651205 | 143.48006864475 | 50 |

| 2029 | 189.4390001064315 | 167.64513283755 | 132.4396549416645 | 66 |

| 2030 | 205.323376442789362 | 178.54206647199075 | 107.12523988319445 | 77 |

IV. Investment Strategy Comparison: FOREST vs QNT

Long-term vs Short-term Investment Strategies

- FOREST: Suitable for investors focusing on Web3 infrastructure and gaming potential

- QNT: Suitable for investors seeking enterprise adoption and interoperability solutions

Risk Management and Asset Allocation

- Conservative investors: FOREST 20% vs QNT 80%

- Aggressive investors: FOREST 60% vs QNT 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- FOREST: Higher volatility due to newer market entry and smaller market cap

- QNT: Potential overvaluation risk due to high institutional interest

Technical Risks

- FOREST: Scalability, network stability

- QNT: Centralization concerns, potential security vulnerabilities

Regulatory Risks

- Global regulatory policies may have differing impacts on both tokens, with QNT potentially facing less scrutiny due to its enterprise focus

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- FOREST advantages: Innovative launchpad, deflationary mechanism, gaming ecosystem potential

- QNT advantages: Established enterprise partnerships, fixed supply, interoperability solutions

✅ Investment Advice:

- Novice investors: Consider a balanced approach with a slight preference for QNT due to its established market presence

- Experienced investors: Explore a diversified portfolio with both tokens, adjusting based on risk tolerance

- Institutional investors: Focus on QNT for its enterprise solutions and regulatory clarity, while monitoring FOREST's ecosystem growth

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between FOREST and QNT? A: FOREST is a newer token launched in 2025, focusing on Web3 infrastructure and gaming applications with a deflationary mechanism. QNT, launched in 2018, targets enterprise blockchain solutions and interoperability with a fixed supply of 14.6 million tokens.

Q2: Which token has shown better historical price performance? A: QNT has a longer price history with significant volatility, reaching an all-time high of $427.42 in September 2021. FOREST, being newer, has shown strong growth since its launch in 2025, with an all-time high of $0.09075 in October 2025.

Q3: How do the supply mechanisms of FOREST and QNT differ? A: FOREST has a fixed supply of 10 billion tokens with a deflationary mechanism through token burning. QNT has a fixed supply of 14.6 million tokens with no additional issuance, creating natural scarcity.

Q4: Which token has greater institutional adoption? A: QNT has gained more institutional interest with adoption by major financial institutions and inclusion in various crypto indices. It has established partnerships with Oracle, SIA, and integration with SWIFT.

Q5: What are the key factors affecting the investment value of FOREST and QNT? A: Key factors include supply mechanisms, institutional adoption, technical development, ecosystem building, macroeconomic conditions, and market cycles. QNT benefits from enterprise adoption and regulatory clarity, while FOREST focuses on Web3 and gaming potential.

Q6: What are the long-term price predictions for FOREST and QNT by 2030? A: For FOREST, the base scenario predicts $0.1382 - $0.1552, with an optimistic scenario of $0.1552 - $0.2234. For QNT, the base scenario predicts $107.13 - $178.54, with an optimistic scenario of $178.54 - $205.32.

Q7: How should investors approach allocating between FOREST and QNT? A: Conservative investors might consider allocating 20% to FOREST and 80% to QNT, while aggressive investors might opt for 60% FOREST and 40% QNT. The allocation should be based on individual risk tolerance and investment goals.

Q8: What are the main risks associated with investing in FOREST and QNT? A: FOREST faces higher volatility due to its newer market entry and smaller market cap, as well as potential scalability issues. QNT risks include potential overvaluation due to high institutional interest and centralization concerns. Both tokens are subject to regulatory risks, though QNT may face less scrutiny due to its enterprise focus.

Share

Content