PVU vs ETH: Comparing the Performance and Potential of Two Blockchain Ecosystems

Introduction: PVU vs ETH Investment Comparison

In the cryptocurrency market, PlantVsUndead (PVU) vs Ethereum (ETH) comparison is an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset landscape.

PlantVsUndead (PVU): Since its launch, it has gained market recognition for its unique combination of gaming and NFT technology.

Ethereum (ETH): Since 2015, it has been hailed as the foundation for decentralized applications and smart contracts, and is one of the cryptocurrencies with the highest global trading volume and market capitalization.

This article will provide a comprehensive analysis of the investment value comparison between PVU and ETH, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?" Here is the report based on the provided template and information:

I. Price History Comparison and Current Market Status

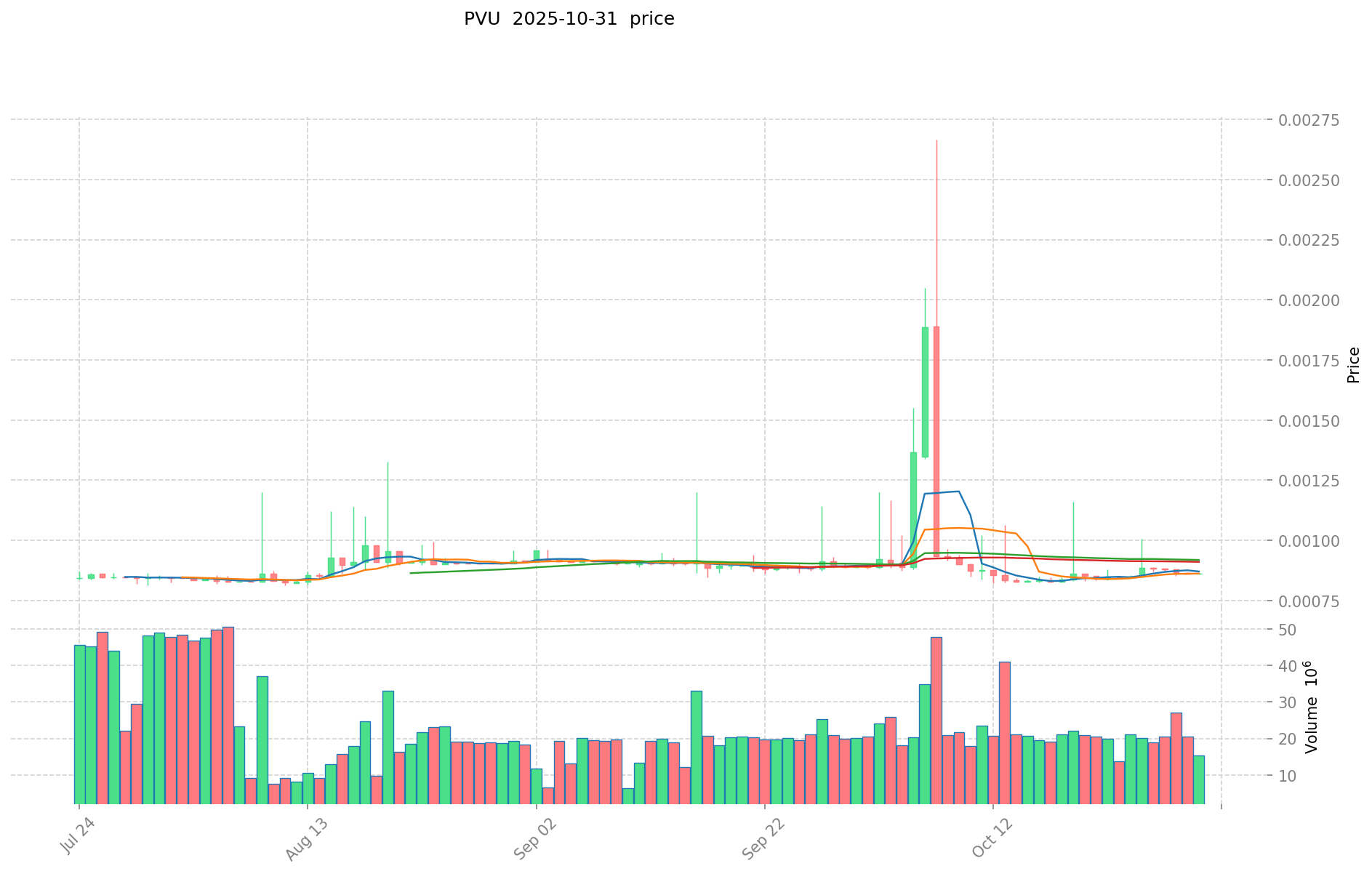

PlantVsUndead (PVU) and Ethereum (ETH) Historical Price Trends

- 2021: PVU launched and reached its all-time high of $24.73 on August 26, 2021.

- 2022: ETH completed "The Merge" upgrade, transitioning to Proof of Stake, impacting its price and market position.

- Comparative analysis: During the recent bear market cycle, PVU dropped from its all-time high of $24.73 to a low of $0.00081424, while ETH showed more resilience, maintaining its position as the second-largest cryptocurrency by market cap.

Current Market Situation (October 31, 2025)

- PVU current price: $0.00086

- ETH current price: $3841.54

- 24-hour trading volume: PVU $9,740.99 vs ETH $691,223,459.79

- Market Sentiment Index (Fear & Greed Index): 29 (Fear)

Click to view real-time prices:

- View PVU current price Market Price

- View ETH current price Market Price

II. Key Factors Affecting PVU vs ETH Investment Value

Technical Development and Ecosystem Building

- ETH Technical Upgrade: Ethereum 2.0 represents a significant upgrade to the current Ethereum network, enhancing its value proposition through improved scalability and efficiency

- ETH Ecosystem Development: Ethereum provides a robust foundation for DeFi applications, NFTs, and smart contracts, contributing to its market potential

Market Demand and Adoption

- Market sentiment appears positive toward Ethereum, with price appreciation noted in relation to political developments

- Long-term investment value exists for both assets, but political risk factors should be carefully considered

Risk Factors and Investment Considerations

- Price volatility: Cryptocurrency prices can experience significant fluctuations, requiring careful timing when purchasing assets

- Many investors make the mistake of buying at peak prices rather than when asset values are undervalued

- Political uncertainty represents a significant risk factor for investors in both assets

Macroeconomic and Regulatory Environment

- Regulatory policies across different jurisdictions affect investment value

- Political risks may limit recommended investment allocation despite long-term value potential

- When considering these assets, investors should thoroughly understand their technical features, market potential, and risk factors before making investment decisions

III. 2025-2030 Price Prediction: PVU vs ETH

Short-term Prediction (2025)

- PVU: Conservative $0.0008342 - $0.00086 | Optimistic $0.00086 - $0.0011868

- ETH: Conservative $2847.2092 - $3847.58 | Optimistic $3847.58 - $5540.5152

Mid-term Prediction (2027)

- PVU may enter a growth phase, with prices expected in the range of $0.0008811474 - $0.001374170

- ETH may enter a bullish market, with prices expected in the range of $4082.41319772 - $5704.91075066

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- PVU: Base scenario $0.00149314832667 - $0.001552874259736 | Optimistic scenario $0.001552874259736+

- ETH: Base scenario $6087.01742940486525 - $6878.329695227497732 | Optimistic scenario $6878.329695227497732+

Disclaimer: This analysis is based on historical data and market projections. Cryptocurrency markets are highly volatile and unpredictable. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

PVU:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0011868 | 0.00086 | 0.0008342 | 0 |

| 2026 | 0.00107457 | 0.0010234 | 0.000726614 | 19 |

| 2027 | 0.00137417035 | 0.001048985 | 0.0008811474 | 21 |

| 2028 | 0.001308503889 | 0.001211577675 | 0.00115099879125 | 40 |

| 2029 | 0.00172625587134 | 0.001260040782 | 0.0007560244692 | 46 |

| 2030 | 0.001552874259736 | 0.00149314832667 | 0.000895888996002 | 73 |

ETH:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 5540.5152 | 3847.58 | 2847.2092 | 0 |

| 2026 | 5773.678548 | 4694.0476 | 2393.964276 | 22 |

| 2027 | 5704.91075066 | 5233.863074 | 4082.41319772 | 36 |

| 2028 | 6180.4072109329 | 5469.38691233 | 5195.9175667135 | 42 |

| 2029 | 6349.1377971782805 | 5824.89706163145 | 4601.6686786888455 | 51 |

| 2030 | 6878.329695227497732 | 6087.01742940486525 | 5478.315686464378725 | 58 |

IV. Investment Strategy Comparison: PVU vs ETH

Long-term vs Short-term Investment Strategy

- PVU: Suitable for investors interested in gaming and NFT ecosystems

- ETH: Suitable for investors seeking exposure to DeFi, smart contracts, and broader blockchain applications

Risk Management and Asset Allocation

- Conservative investors: PVU: 5% vs ETH: 95%

- Aggressive investors: PVU: 20% vs ETH: 80%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- PVU: High volatility, lower liquidity, and potential for rapid price swings

- ETH: Susceptible to broader cryptocurrency market trends and macroeconomic factors

Technical Risk

- PVU: Scalability, network stability

- ETH: Network congestion, gas fees, potential vulnerabilities during upgrades

Regulatory Risk

- Global regulatory policies may have different impacts on both assets, with ETH potentially facing more scrutiny due to its larger market presence

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- PVU advantages: Unique gaming and NFT ecosystem, potential for high growth in niche market

- ETH advantages: Established ecosystem, strong developer community, foundation for numerous DeFi and blockchain applications

✅ Investment Advice:

- Novice investors: Consider allocating a larger portion to ETH for its established market position and ecosystem

- Experienced investors: Diversify between ETH and PVU, with a higher allocation to ETH

- Institutional investors: Focus primarily on ETH, with potential small allocation to PVU for diversification

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between PVU and ETH? A: PVU is a gaming and NFT-focused token, while ETH is a major cryptocurrency with a broad ecosystem supporting smart contracts and decentralized applications. ETH has a much larger market cap, higher liquidity, and wider adoption compared to PVU.

Q2: Which asset is considered less risky for investment? A: Generally, ETH is considered less risky due to its established market position, larger ecosystem, and higher liquidity. However, both assets carry inherent risks associated with the cryptocurrency market.

Q3: How do the price predictions for PVU and ETH compare? A: By 2030, PVU is predicted to reach a base scenario of $0.00149314832667 - $0.001552874259736, while ETH's base scenario is $6087.01742940486525 - $6878.329695227497732. ETH shows higher potential for absolute price growth, but PVU may offer higher percentage gains from its current lower price.

Q4: What factors could impact the future value of PVU and ETH? A: Key factors include technological developments, market adoption, regulatory changes, macroeconomic conditions, and overall cryptocurrency market trends. For ETH specifically, the success of Ethereum 2.0 upgrades could significantly impact its value.

Q5: How should investors allocate their portfolio between PVU and ETH? A: Conservative investors might consider allocating 5% to PVU and 95% to ETH, while more aggressive investors could allocate 20% to PVU and 80% to ETH. The exact allocation should depend on individual risk tolerance and investment goals.

Q6: What are the main risks associated with investing in PVU and ETH? A: Both assets face market risks such as price volatility and regulatory uncertainties. PVU may have higher technical risks due to its smaller ecosystem, while ETH faces challenges related to network congestion and upgrade implementation.

Q7: Is it better to invest in PVU or ETH for long-term growth? A: While both assets have potential for long-term growth, ETH is generally considered a safer long-term investment due to its established ecosystem, ongoing development, and wider adoption. However, PVU may offer higher potential returns, albeit with increased risk.

Share

Content