SKAI vs XRP: The Battle for Dominance in the AI-Powered Cryptocurrency Market

Introduction: Investment Comparison of SKAI vs XRP

In the cryptocurrency market, the comparison between SKAI vs XRP has been an unavoidable topic for investors. The two not only differ significantly in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency positioning.

XRP (XRP): Since its launch in 2012, it has gained market recognition for its efficiency in cross-border payments.

Skillful AI (SKAI): Introduced in 2024, it has been hailed as an advanced AI platform providing personalized virtual assistants and tailored AI solutions.

This article will comprehensively analyze the investment value comparison between SKAI vs XRP, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

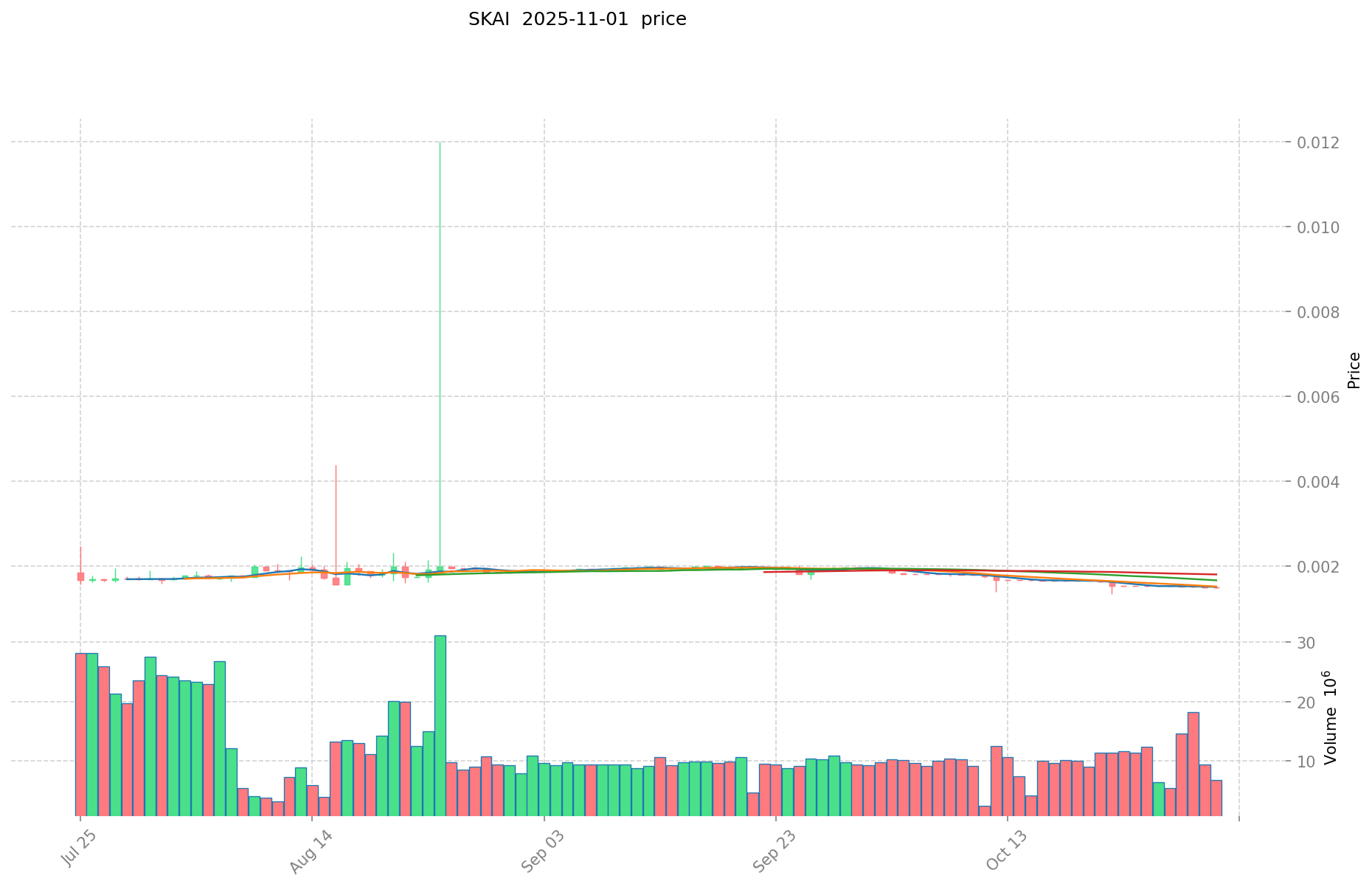

SKAI (Coin A) and XRP (Coin B) Historical Price Trends

- 2024: SKAI reached its all-time high of $0.25 on June 9, 2024.

- 2025: XRP hit a new all-time high of $3.65 on July 18, 2025.

- Comparative analysis: During the recent market cycle, SKAI dropped from its high of $0.25 to a low of $0.00111, while XRP has shown more resilience, maintaining a price above $2.

Current Market Situation (2025-11-01)

- SKAI current price: $0.001494

- XRP current price: $2.503

- 24-hour trading volume: SKAI $10,184.75 vs XRP $122,646,327.57

- Market Sentiment Index (Fear & Greed Index): 33 (Fear)

Click to view real-time prices:

- View SKAI current price Market Price

- View XRP current price Market Price

II. Core Factors Affecting Investment Value of SKAI vs XRP

Supply Mechanisms Comparison (Tokenomics)

- SKAI: Valuation primarily depends on user base size, asset value, and market visibility

- XRP: Value potential influenced by market dynamics and technological advancements

- 📌 Historical Pattern: Both tokens show high volatility as their indicators are closely linked to short-term market conditions

Institutional Adoption and Market Applications

- Institutional Holdings: XRP has attracted significant attention with 20 ETF applications in the US as of October 20, 2024

- Enterprise Adoption: XRP positions itself in cross-border payments and settlement systems

- Regulatory Attitudes: US regulatory landscape remains a significant factor for XRP adoption

Technical Development and Ecosystem Building

- XRP Technical Development: Ongoing advancements contribute to its future growth opportunities

- Ecosystem Comparison: XRP has established presence in cross-border payment solutions

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: Investors increasingly prefer index-type and actively managed ETFs to spread risk rather than holding single tokens

- Macroeconomic Monetary Policy: Traditional asset management firms are targeting index products for market entry

- Geopolitical Factors: Regulatory developments across different countries continue to shape the adoption landscape

III. 2025-2030 Price Prediction: SKAI vs XRP

Short-term Prediction (2025)

- SKAI: Conservative $0.00092938 - $0.001499 | Optimistic $0.001499 - $0.00200866

- XRP: Conservative $1.47677 - $2.503 | Optimistic $2.503 - $2.57809

Mid-term Prediction (2027)

- SKAI may enter a growth phase, with prices expected in the range of $0.00200813535 - $0.002891714904

- XRP may enter a steady growth phase, with prices expected in the range of $2.6906912095 - $3.688363231

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- SKAI: Base scenario $0.003249703184709 - $0.00435460226751 | Optimistic scenario $0.00435460226751

- XRP: Base scenario $3.20761350237552 - $4.0095168779694 | Optimistic scenario $4.129802384308482

Disclaimer: This analysis is based on historical data and market projections. Cryptocurrency markets are highly volatile and unpredictable. This information should not be considered as financial advice. Always conduct your own research before making investment decisions.

SKAI:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00200866 | 0.001499 | 0.00092938 | 0 |

| 2026 | 0.0022624407 | 0.00175383 | 0.0012978342 | 17 |

| 2027 | 0.002891714904 | 0.00200813535 | 0.0019478912895 | 34 |

| 2028 | 0.00340539592653 | 0.002449925127 | 0.00203343785541 | 63 |

| 2029 | 0.003571745842653 | 0.002927660526765 | 0.002693447684623 | 95 |

| 2030 | 0.00435460226751 | 0.003249703184709 | 0.003152212089167 | 117 |

XRP:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 2.57809 | 2.503 | 1.47677 | 0 |

| 2026 | 3.5059521 | 2.540545 | 2.10865235 | 1 |

| 2027 | 3.688363231 | 3.02324855 | 2.6906912095 | 20 |

| 2028 | 4.42966377546 | 3.3558058905 | 1.711461004155 | 34 |

| 2029 | 4.1262989229588 | 3.89273483298 | 3.3477519563628 | 55 |

| 2030 | 4.129802384308482 | 4.0095168779694 | 3.20761350237552 | 60 |

IV. Investment Strategy Comparison: SKAI vs XRP

Long-term vs Short-term Investment Strategies

- SKAI: Suitable for investors focused on AI technology potential and ecosystem growth

- XRP: Suitable for investors seeking established cross-border payment solutions and institutional adoption

Risk Management and Asset Allocation

- Conservative investors: SKAI: 10% vs XRP: 90%

- Aggressive investors: SKAI: 30% vs XRP: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- SKAI: High volatility due to new market entry and uncertain adoption rates

- XRP: Regulatory uncertainty and market sentiment fluctuations

Technical Risk

- SKAI: Scalability, network stability

- XRP: Security vulnerabilities, potential technological obsolescence

Regulatory Risk

- Global regulatory policies may have different impacts on both tokens, with XRP facing ongoing legal challenges in some jurisdictions

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- SKAI advantages: Emerging AI technology potential, room for growth

- XRP advantages: Established presence in cross-border payments, institutional interest

✅ Investment Advice:

- New investors: Consider a small allocation to XRP as part of a diversified portfolio

- Experienced investors: Balanced approach with both SKAI and XRP, adjusting based on risk tolerance

- Institutional investors: Focus on XRP due to its established market presence and potential ETF developments

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between SKAI and XRP? A: SKAI is a newer AI-focused cryptocurrency introduced in 2024, while XRP is an established token launched in 2012 for cross-border payments. XRP has a larger market cap, higher trading volume, and more institutional adoption, while SKAI offers potential in the AI technology sector.

Q2: Which token has shown better price performance recently? A: XRP has shown more resilience in recent price performance. While SKAI dropped from its all-time high of $0.25 to $0.001494, XRP has maintained a price above $2 after reaching its all-time high of $3.65 in July 2025.

Q3: How do the supply mechanisms of SKAI and XRP differ? A: SKAI's valuation primarily depends on its user base size, asset value, and market visibility. XRP's value potential is influenced by market dynamics and technological advancements in the cross-border payment sector.

Q4: What are the key factors affecting the investment value of these tokens? A: Key factors include institutional adoption, regulatory attitudes, technical development, ecosystem building, and macroeconomic factors such as inflation and monetary policy.

Q5: What are the long-term price predictions for SKAI and XRP? A: By 2030, SKAI is predicted to reach between $0.003249703184709 and $0.00435460226751, while XRP is expected to be in the range of $3.20761350237552 to $4.129802384308482 in the base and optimistic scenarios, respectively.

Q6: How should investors approach risk management when investing in SKAI and XRP? A: Conservative investors might consider allocating 10% to SKAI and 90% to XRP, while aggressive investors might opt for 30% SKAI and 70% XRP. Hedging tools such as stablecoin allocation, options, and cross-currency portfolios can also be used to manage risk.

Q7: What are the potential risks associated with investing in SKAI and XRP? A: Both tokens face market risks due to volatility. SKAI has additional risks related to its new market entry and uncertain adoption rates, while XRP faces ongoing regulatory challenges in some jurisdictions. Technical risks include scalability and network stability for SKAI, and potential technological obsolescence for XRP.

Share

Content