What is CRV: Understanding the Curve DAO Token and Its Role in DeFi

Curve's Positioning and Significance

In 2020, Curve (CRV) was launched, aiming to solve the inefficiency of stablecoin trading. As a decentralized exchange platform on Ethereum, Curve plays a crucial role in the DeFi sector by providing extremely efficient and low-cost stablecoin trading.

As of 2025, Curve has become a core asset in the DeFi ecosystem, with a market cap of $1,041,595,211 and 94,542 holders. This article will delve into its technical architecture, market performance, and future potential.

Origin and Development History

Background

Curve was created in January 2020 to address the inefficiencies in stablecoin trading. It emerged during the DeFi boom, aiming to provide low slippage and low-fee trading for stablecoins. Curve's launch brought new possibilities for DeFi users and liquidity providers.

Important Milestones

- 2020: Mainnet launch, achieving efficient stablecoin trading with low slippage.

- 2020: Integration with DeFi protocols like iearn and Compound, providing additional benefits for liquidity providers.

- 2020 (August 14): CRV token price reached its all-time high of $15.37.

- 2025: Ecosystem expansion, with 64 exchanges now supporting CRV trading.

With the support of its community and development team, Curve continues to optimize its technology, security, and real-world applications in the DeFi space.

How Does Curve Work?

Decentralized Control

Curve operates on a decentralized network of computers (nodes) spread across the globe, free from the control of banks or governments. These nodes collaborate to verify transactions, ensuring system transparency and attack resistance, empowering users with greater autonomy and enhancing network resilience.

Blockchain Core

Curve's blockchain is a public, immutable digital ledger that records every transaction. Transactions are grouped into blocks and linked through cryptographic hashes to form a secure chain. Anyone can view the records, establishing trust without intermediaries.

Ensuring Fairness

Curve uses a consensus mechanism to validate transactions and prevent fraudulent behavior such as double-spending. Participants maintain network security through activities like providing liquidity and receive CRV rewards. Its innovative features include extremely efficient stablecoin trading with low slippage.

Secure Transactions

Curve uses public-private key encryption to protect transactions:

- Private keys (like secret passwords) are used to sign transactions

- Public keys (like account numbers) are used to verify ownership

This mechanism ensures fund security, while transactions remain pseudonymous. Curve's smart contract design and audits further enhance the security of the platform.

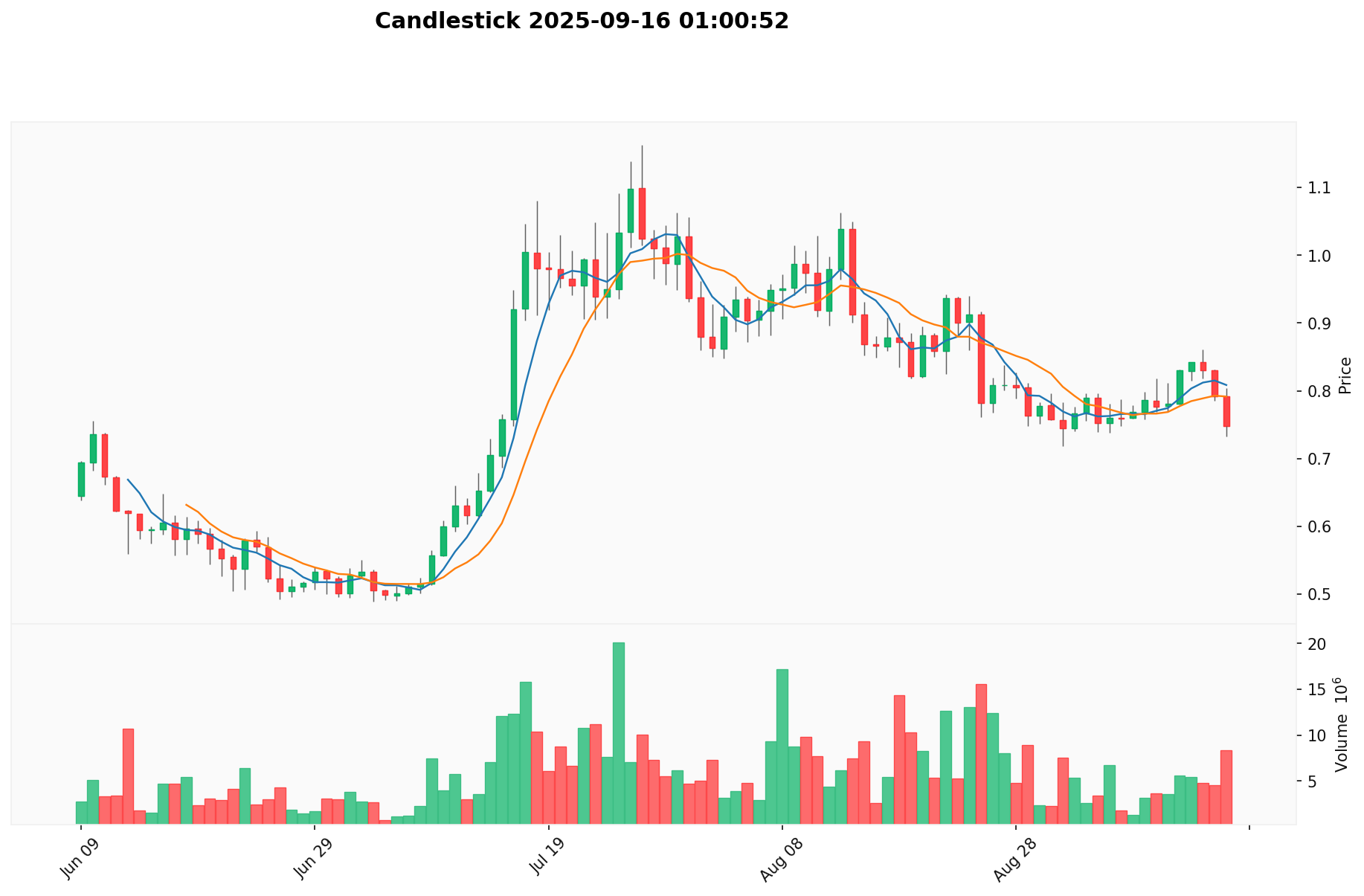

CRV Market Performance

Circulation Overview

As of September 16, 2025, CRV's circulating supply is 1,401,877,808 tokens, with a total supply of 2,304,770,020. The maximum supply is capped at 3,030,303,031 tokens.

Price Fluctuations

CRV reached its all-time high of $15.37 on August 14, 2020, driven by the DeFi boom and increased adoption of stablecoin trading platforms.

Its lowest price was $0.180354, recorded on August 5, 2024, likely due to broader market downturns or specific challenges in the DeFi sector.

These fluctuations reflect market sentiment, adoption trends, and external factors impacting the DeFi ecosystem.

Click to view the current CRV market price

On-chain Metrics

- Daily Transaction Volume: $6,255,215.66 (indicating network activity)

- Active Addresses: 94,542 (reflecting user engagement)

Curve Ecosystem Applications and Partnerships

Core Use Cases

Curve's ecosystem supports various applications:

- DeFi: Curve itself, providing efficient stablecoin trading and liquidity provision.

- Yield Farming: Protocols like Yearn Finance, enabling optimized yield strategies.

Strategic Collaborations

Curve has established partnerships with DeFi protocols like Compound and Yearn, enhancing its liquidity and yield offerings. These partnerships have solidified Curve's position in the DeFi landscape.

Controversies and Challenges

Curve faces the following challenges:

- Technical Issues: Scalability concerns and potential vulnerabilities in smart contracts.

- Regulatory Risks: Increasing scrutiny of DeFi platforms by regulatory bodies.

- Competitive Pressure: Emergence of other AMM protocols and DEXs.

These issues have sparked discussions within the community and market, driving Curve's continuous innovation.

Curve Community and Social Media Atmosphere

Fan Enthusiasm

Curve's community is vibrant, with over $6 million in 24-hour trading volume.

On X, posts and hashtags like #Curve frequently trend, with monthly post volumes reaching hundreds of thousands.

Price movements and new pool launches ignite community excitement.

Social Media Sentiment

Sentiment on X shows divergence:

- Supporters praise Curve's efficiency in stablecoin swaps and high yields, considering it a "cornerstone of DeFi".

- Critics focus on complex tokenomics and potential risks in yield farming.

Recent trends indicate generally bullish sentiment during DeFi market upswings.

Hot Topics

X users actively discuss Curve's governance decisions, new pool launches, and yield optimization strategies, highlighting both its innovative potential and the complexities of DeFi participation.

More Information Sources for Curve

- Official Website: Visit Curve's official website for features, use cases, and latest updates.

- White Paper: Curve's white paper details its technical architecture, goals, and vision.

- X Updates: On X, Curve uses @CurveFinance, with over 240,000 followers as of September 2025, posts covering protocol updates, community events, and governance proposals, generating thousands of likes and retweets.

Curve's Future Roadmap

- 2026: Launch improved cross-chain integrations, enhancing interoperability and liquidity across networks.

- Ecosystem Goals: Support integration with 100+ DeFi protocols and attract 1 million active users.

- Long-term Vision: Become the leading liquidity provider for stablecoin and low-slippage trading in DeFi.

How to Participate in Curve?

- Purchase Channels: Buy CRV on Gate.com

- Storage Solutions: Use Web3 wallets for secure storage

- Governance Participation: Engage in community decisions through the Curve DAO

- Ecosystem Building: Visit Curve's developer docs to develop integrations or contribute code

Summary

Curve has redefined DeFi through blockchain technology, offering efficient stablecoin trading, liquidity provision, and yield farming opportunities. Its active community, rich resources, and strong market performance set it apart in the cryptocurrency field. Despite facing regulatory uncertainties and technical challenges, Curve's innovative spirit and clear roadmap position it as a key player in the future of decentralized finance. Whether you're a newcomer or an experienced player, Curve is worth watching and participating in.

FAQ

What does CRV stand for?

CRV stands for Curve DAO Token. It's the governance token of Curve Finance, a decentralized exchange for stablecoin trading.

How much is CRV tax in California?

In California, the CRV tax is $0.05 for wine bottles under 24 ounces and $0.10 for bottles over 24 ounces.

What is CRV on a 12 pack of soda?

CRV on a 12 pack of soda is a deposit fee in California for recycling. It's typically 5 cents per container, refundable when returned to participating retailers.

What does CRV only mean?

CRV stands for Curve DAO Token, the governance token of Curve Finance, a decentralized exchange for stablecoin trading in the DeFi ecosystem.

Share

Content