After an 80% Price Drop, Is BitMine Suffering from a Value Mismatch?

The crypto market remains sluggish. Since November, Ethereum’s price has dropped nearly 40% from its peak, and ETFs have continued to see net outflows. Amid this systemic downturn, BitMine—the largest Ethereum treasury company—has become a focal point. Peter Thiel’s Founders Fund has cut its BMNR stake by half, while ARK Invest, led by Cathie Wood, and JPMorgan have instead increased their holdings against the prevailing trend.

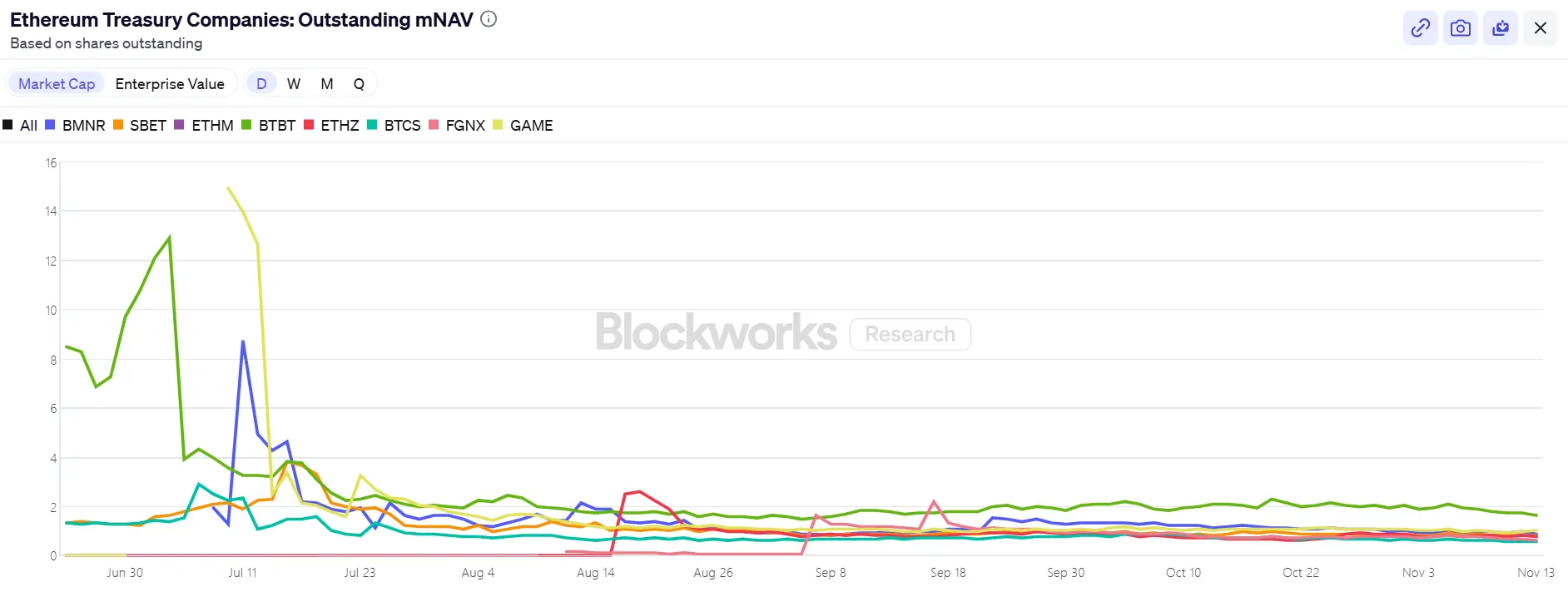

This split among major capital allocators has brought BitMine’s “5% Alchemy” under the spotlight: with 3.56 million ETH, $3 billion in unrealized losses, and mNAV down to 0.8, BitMine—one of the last strongholds for Ethereum accumulation—faces tough questions: How much longer can it keep buying? Is there a value mispricing? After the DAT flywheel loses momentum, who steps in to buy ETH?

1. BitMine’s 5% Alchemy: How Long Can Its Treasury Last?

As the second-largest crypto treasury after MicroStrategy, BitMine once aimed to accumulate tokens equal to 5% of Ethereum’s total circulating supply. On November 17, BitMine announced its Ethereum holdings reached 3.56 million ETH—nearly 3% of the circulating supply and more than halfway to its long-term target of 6 million ETH. The company now holds approximately $11.8 billion in crypto assets and cash, including 192 Bitcoins, $607 million in available cash, and 13.7 million shares of Eightco Holdings.

Since launching its large-scale token accumulation program in July, BitMine has commanded market attention. During that period, its stock price rose in lockstep with Ethereum’s price, and investors viewed BitMine’s market capitalization growth via token holdings strategy as a new model for the crypto sector.

However, as the market cooled and liquidity tightened, sentiment reversed. The decline in Ethereum’s price has made BitMine’s aggressive buying look increasingly risky. At an average purchase price of $4,009 per ETH, BitMine’s unrealized losses have neared $3 billion. Despite board chairman Tom Lee’s repeated public statements expressing bullishness on Ethereum and a commitment to continue buying at lower prices, investors have shifted their focus from “How much more can BitMine buy?” to “How long can BitMine keep this up?”

BitMine currently holds about $607 million in cash reserves, with funding coming primarily from two sources.

The first source is crypto asset income. BitMine generates short-term cash flow through immersion-cooled Bitcoin mining and consulting services, while pursuing long-term returns by staking Ethereum. The company states its staked ETH is expected to generate roughly $400 million in net income.

The second source is secondary market financing. BitMine implemented an ATM stock sale program, allowing it to issue new shares for cash at any time without preset price or size limits. To date, the company has issued several hundred million dollars in stock, attracting institutional investors such as ARK, JPMorgan, and Fidelity. According to Tom Lee, institutional purchases of BMNR shares directly fund further ETH acquisition.

By combining ETH accumulation with yield generation, BitMine seeks to redefine corporate capital allocation models. Yet, shifting market conditions are eroding the stability of this approach.

On the stock side, BitMine (BMNR) has come under significant pressure, falling about 80% from its July high. Its current market capitalization is around $9.2 billion—below the $10.6 billion value of its ETH holdings (at an ETH price of $3,000)—with mNAV falling to 0.86. This discount reflects market concerns over unrealized losses and the sustainability of BitMine’s capital position.

2. ETH’s Last Straw: Fragmentation of Three Major Buying Forces and the Retreat of Staking

At the macro level, the Federal Reserve’s hawkish signals and lower odds of a December rate cut have weakened the crypto market and sharply reduced risk appetite.

ETH has now dropped to $3,000, down over 30% from its August high of $4,900. This correction has refocused the market on a key question: if treasury companies and institutional accumulation previously supported prices, who will step in to buy when those flows dry up?

Among visible market forces, the three major buyers—ETFs, treasury companies, and on-chain capital—are diverging.

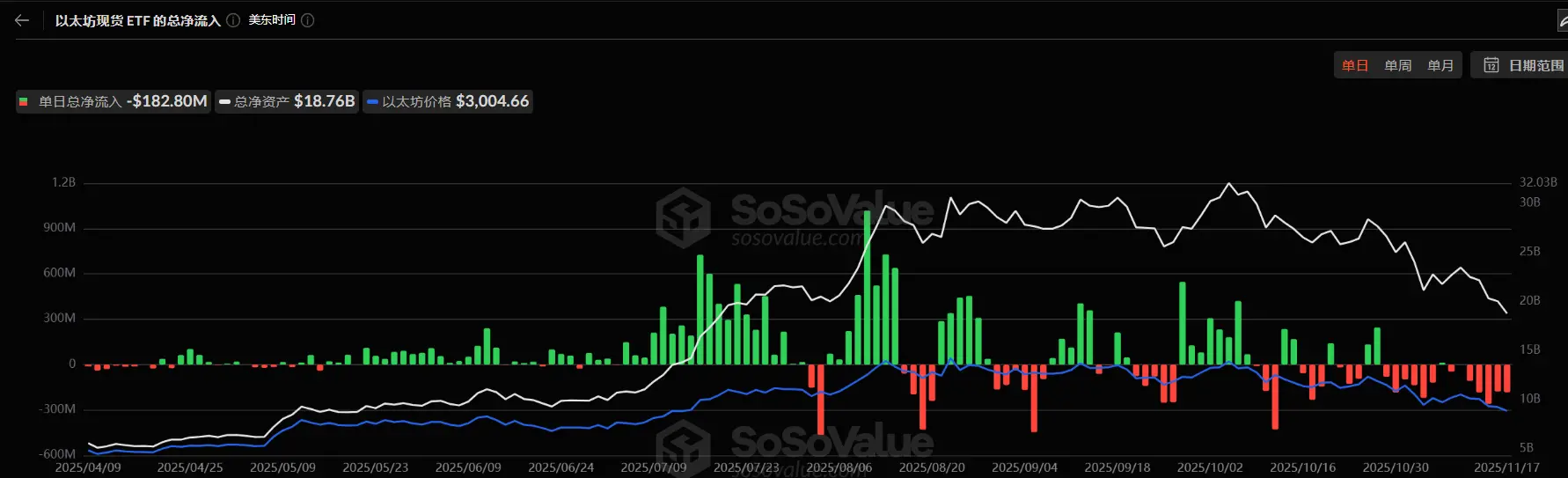

First, inflows into Ethereum-related ETFs have slowed considerably. Total ETF holdings now stand at about 6.36 million ETH, or 5.25% of supply. According to SoSoValue, as of mid-November, Ethereum spot ETFs had net assets of approximately $18.76 billion, but this month, outflows have significantly exceeded inflows, with single-day outflows reaching as high as $180 million. Compared to the steady inflows between July and August, capital flows have shifted from a steady rise to a choppy decline.

This decline not only weakens a major source of large-scale buying power but also signals that market confidence remains fragile. ETF investors typically represent medium- to long-term capital allocations; their exits mean incremental demand from traditional finance is waning. Without ETF support, volatility could rise in the short term.

Second, Digital Asset Treasury (DAT) companies are also diverging. Total treasury company Ethereum reserves now stand at 6.24 million ETH, or 5.15% of supply. Accumulation has slowed considerably in recent months, with BitMine almost the only major buyer left. In the past week, BitMine added another 67,021 ETH, continuing its accumulation strategy. SharpLink has not added to its 19,300 ETH purchase since October 18—at an average cost of $3,609, it is also underwater.

In contrast, some smaller treasury companies have been forced to retrench. ETHZilla sold about 40,000 ETH at the end of October to fund share buybacks, hoping to narrow its discount and stabilize its stock price by liquidating some ETH.

This divergence signals the treasury sector is shifting from broad expansion to structural adjustment. Leading companies can keep buying thanks to their capital and confidence, while smaller players are constrained by liquidity and debt pressures. The market has now shifted from widespread incremental buying to a minority of firms with significant capital reserves.

On-chain, whales and high-frequency addresses still drive short-term capital, but they do not support price. Recently, a prominent ETH bull was repeatedly liquidated, eroding trading confidence. According to Coinglass, ETH open interest has nearly halved since its August high; leveraged capital is quickly retreating, signaling a cooling in both liquidity and speculative fervor.

Additionally, some dormant Ethereum ICO wallets have recently been reactivated and started transferring funds after more than a decade. Glassnode data shows long-term holders (wallets holding ETH for over 155 days) are now selling about 45,000 ETH per day—about $140 million. This is the highest selling pace since 2021, suggesting that bullish forces are weakening.

Arthur Hayes, co-founder of BitMEX, recently wrote that while ETF inflows and DAT buying helped Bitcoin rise even as dollar liquidity shrank since April 9, that phase has ended. The basis is no longer rich enough for institutions to keep buying ETFs, and most DATs now trade at a discount to mNAV—so investors are steering clear of these derivative securities.

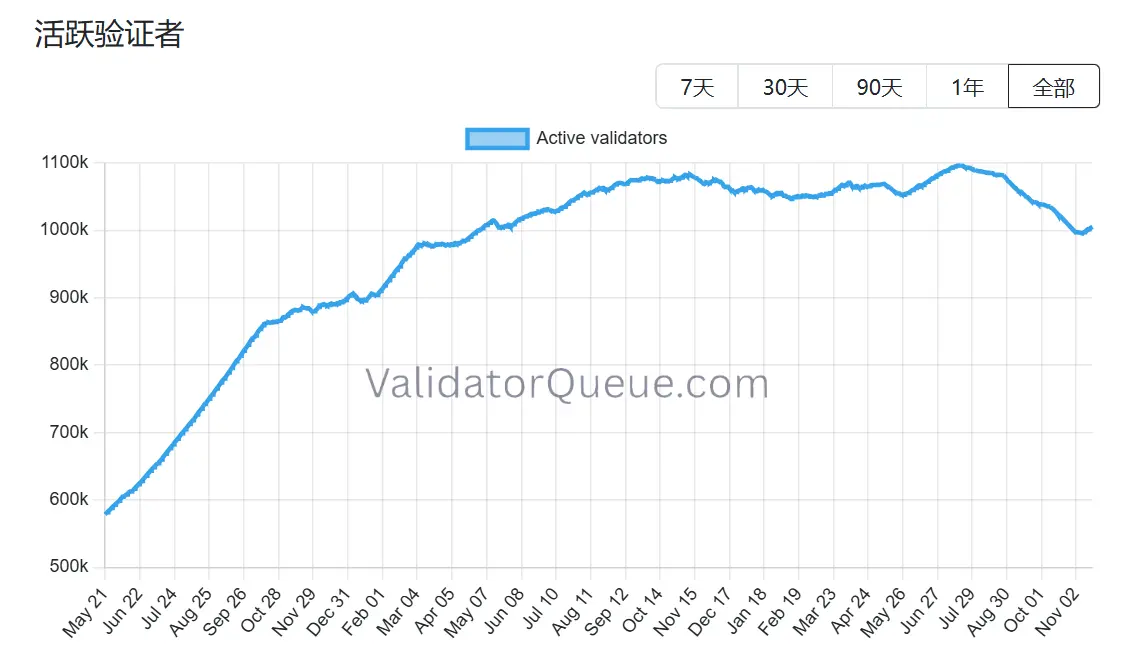

The same is true for Ethereum, especially as its staking ecosystem is showing signs of retreat. Beaconchain data shows daily active Ethereum validators have dropped about 10% since July, reaching their lowest level since April 2024. This marks the sharpest drop since the network shifted from proof-of-work (PoW) to proof-of-stake (PoS) in September 2022.

This decline is driven by two main factors:

First, Ethereum’s rally this year caused record validator exits, as staking operators rushed to withdraw and take profits.

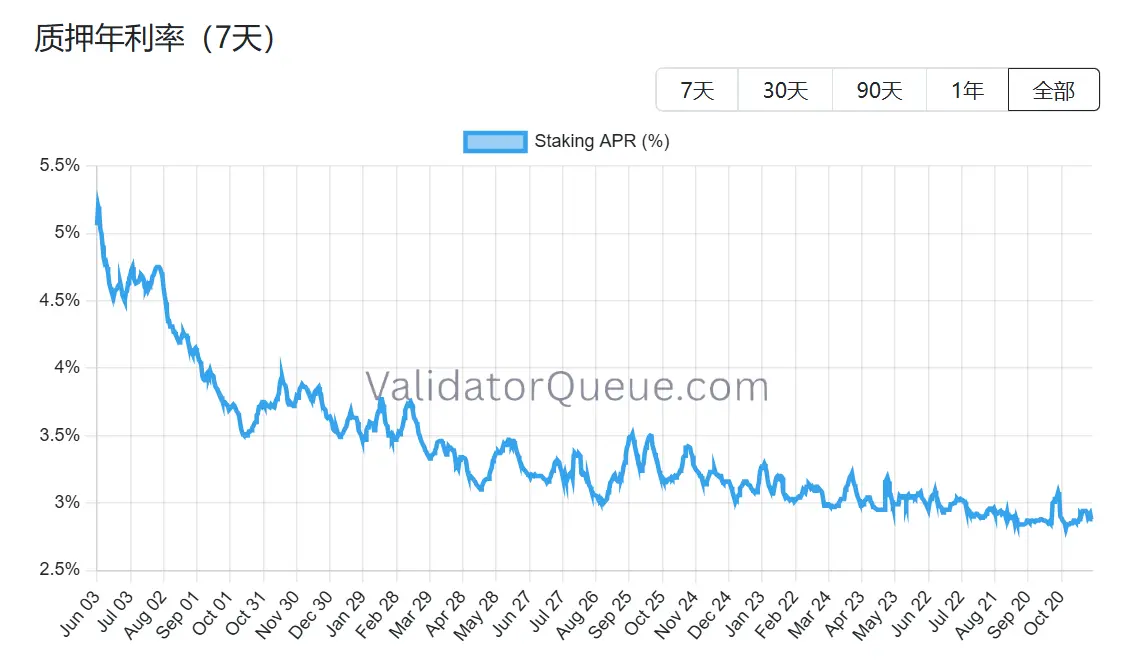

Second, lower staking yields and higher borrowing costs have made leveraged staking unprofitable. Current annualized staking yields are about 2.9% APR, far below the record 8.6% set in May 2023.

With all three major demand channels under pressure and the staking ecosystem retreating, Ethereum’s next phase of price support faces a structural test. BitMine is still accumulating, but is nearly fighting a lone battle. If even BitMine—the last pillar—can no longer keep buying, the market could lose not just a stock or a capital inflow, but the foundational faith in the Ethereum narrative itself.

3. Is BitMine Mispriced?

After discussing capital flows and waning buying power, a more fundamental question arises: Is BitMine’s story really over? The market’s current pricing clearly doesn’t fully reflect its structural differences.

Compared to MicroStrategy, BitMine started with a distinctly different approach. MicroStrategy relies heavily on convertible debt and preferred stock for secondary market fundraising, with annual interest burdens in the hundreds of millions and profitability dependent on Bitcoin’s unilateral gains. BitMine, by contrast, has diluted equity via new shares but carries almost no interest-bearing debt. Its ETH holdings generate $400–500 million in annual staking income—a resilient cash flow far less tied to price swings than Strategy’s debt costs.

Even more importantly, this yield is only the beginning. As one of the world’s largest institutional ETH holders, BitMine can use staked ETH for restaking (earning an extra 1–2% annualized yield), operate node infrastructure, lock in fixed returns through yield tokenization (for example, about 3.5% stable returns), or even issue institutional-grade ETH structured notes—none of which are options for MicroStrategy’s BTC holdings.

Yet BitMine (BMNR) currently trades at about a 13% discount to its ETH holdings. Within the DAT sector, this isn’t the deepest discount, but it’s clearly below the historical median for comparable assets. Bearish sentiment has magnified the visual impact of unrealized losses, obscuring both yield cushions and the value of ecosystem options.

Recent institutional moves suggest this gap is being noticed. On November 6, ARK Invest added 215,000 shares ($8.06 million), and JPMorgan held 1.97 million shares at the end of Q3. This isn’t mindless bottom-fishing, but a calculated bet on the ETH ecosystem’s long-term compounded growth. If Ethereum’s price stabilizes or rebounds, BitMine’s relatively stable yields could allow its mNAV to recover faster than more highly levered treasury firms.

Is there a genuine mispricing? The answer is already clear; the only question is when the market will pay for this scarcity premium. The current discount is both a risk and the starting point for market disagreement. As Tom Lee said, this pain is temporary and won’t derail ETH’s supercycle. Nor, arguably, will it diminish BitMine’s core role in this cycle.

Disclaimer:

- This article is republished from [ChainCatcher], and copyright belongs to the original author [Zhou, ChainCatcher]. If you have any objections to this republication, please contact the Gate Learn team, which will handle your request promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is mentioned, you may not copy, distribute, or plagiarize any translated version of this article.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?