BlackRock Bitcoin ETF Sees $570M Weekly Outflow: Institutional Profit-Taking or Temporary Pullback?

Background: The Importance of BlackRock IBIT

BlackRock’s iShares Bitcoin Trust (IBIT) stands as one of the most influential spot Bitcoin ETFs in the United States. Serving as a key entry point for institutional investment in the Bitcoin market, IBIT’s fund flows are widely viewed as a primary gauge of institutional sentiment. Over time, this ETF has attracted significant capital into the Bitcoin ecosystem.

Details of the $570 Million Net Outflow

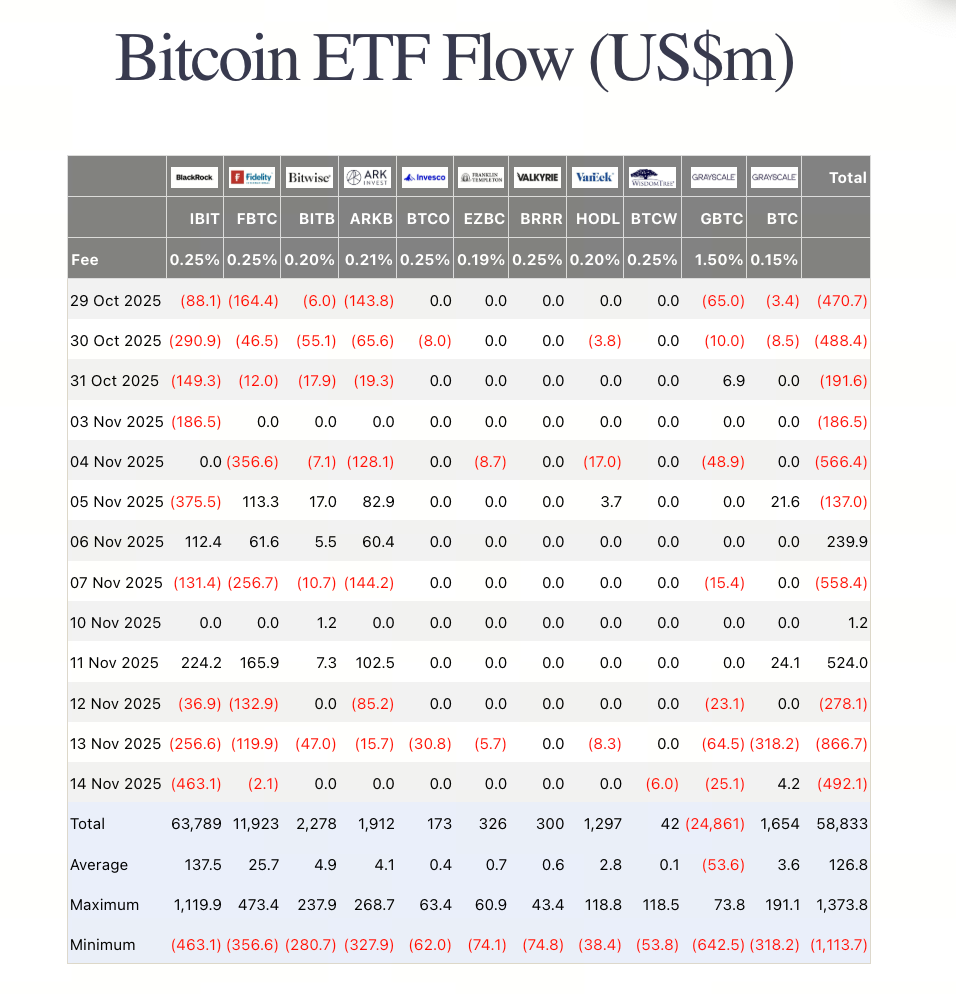

Source: https://farside.co.uk/btc/

Data from Farside Investor shows that BlackRock IBIT has seen continuous fund outflows since October 29, 2025. The most recent data indicates a net outflow of $570 million in the past week, marking the largest one-week withdrawal since February.

Investor Motivation: Profit-Taking vs. Portfolio Rotation

Profit-Taking: Some market participants interpret this net outflow as profit-taking activity. IBIT may have accumulated substantial holdings previously, and with Bitcoin’s price increase, certain investors are now realizing profits.

Portfolio Rotation: Another perspective suggests these funds may be rotating among ETFs. Some capital could be shifting to other crypto assets or different Bitcoin ETFs. Market observers speculate that if Bitcoin regains upward momentum, these funds may “flow back in.”

Impact on Bitcoin Price and Market Sentiment

Source: https://www.gate.com/trade/BTC_USDT

This sizable withdrawal has placed immediate pressure on the market. As the largest manager of Bitcoin ETFs, BlackRock’s capital flows strongly impact market confidence. The recent net outflow may trigger volatility in Bitcoin’s price.

Whether this withdrawal leads to broader selling remains uncertain and will depend on fund movements in other ETFs such as Fidelity and Grayscale. If the outflow is limited to short-term profit-taking, its long-term effect on price may be minor.

Analyst and Community Insights

- Crypto data analyst Ki Young Ju highlights that this is IBIT’s largest weekly withdrawal since February.

- Some crypto community members believe this may be a “major transfer between whales,” with large investors reallocating via ETFs.

- Other analysts suggest that if Bitcoin regains upward momentum, these funds could “return in force.”

Potential Future Impact and Risks

- Risk: If the outflow reflects a structural shift, such as long-term position reductions by major institutions, Bitcoin could face stronger downward pressure.

- Opportunity: If the capital outflow is temporary, it may set the stage for future inflows. Improved sentiment or price recovery could drive new investment into IBIT.

- Monitoring: In the coming weeks, it’s critical to closely track IBIT’s fund flows and net inflows/outflows in other Bitcoin ETFs.

Outlook and Conclusion

The $570 million net outflow from BlackRock IBIT this week has garnered significant attention. It may reflect profit-taking by some investors or temporary portfolio rotation among ETFs. Either scenario underscores institutional sensitivity to the current market environment. If the market resumes its upward trajectory, Bitcoin ETFs could see renewed inflows. Conversely, continued outflows warrant caution regarding weakening market confidence in Bitcoin.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data