Espresso co-founder's ten-year journey in crypto

A decade ago, I embarked on my career in the crypto industry because I saw it as the most effective and appropriate tool to address the problems I witnessed during my brief time on Wall Street.

I observed that the current state of the financial system has led to three major societal issues, and I am convinced that cryptography can help solve them.

1) Poor Monetary Management

Hugo Chávez drove Venezuela’s inflation rate above 20,000%.

My career began as a bond trader specializing in Latin American sovereign debt, which gave me firsthand experience with the hyperinflation and capital controls in countries like Venezuela and Argentina. The unilateral decisions of national leaders stripped entire generations of their livelihoods and savings, widened sovereign bond spreads, and excluded these countries from global capital markets. The injustice faced by individuals in these circumstances has been a tragedy, both historically and today.

Of course, Hugo Chávez and Cristina Kirchner (the former presidents of Venezuela and Argentina, respectively) are not the only “villains” in this story.

2) Wall Street’s Financial Barriers

Remember the 2011 Occupy Wall Street protests in Zuccotti Park, Manhattan?

A few years after the 2008 financial crisis, I started my career on Wall Street. Before joining, I had read Michael Lewis’s *Liar’s Poker*, thinking the wild, speculative culture of 1980s Wall Street depicted in the book was just an outdated stereotype. I also knew the Dodd-Frank Act had been enacted the year before, which was supposed to clean up the speculative behavior on Manhattan’s trading floors.

From a regulatory perspective, reckless risk-taking did decrease, and most proprietary trading desks focused on directional bets were shut down. However, for those who knew where to look, speculation never really disappeared. Many of the leaders who emerged after the 2008 industry shakeout were young traders who took on their bosses’ risk positions at the market’s bottom, then profited enormously as Ben Bernanke’s quantitative easing fueled a rally. What kind of incentives does this create for these new trading “bosses”? Even after witnessing the devastation of the crisis, this new generation was taught that betting big with the firm’s balance sheet could still build a career.

During my first year on Wall Street, I walked past the Occupy Wall Street protesters every day. The longer I stayed, the more I identified with their cause—they wanted to break Wall Street’s privileges and end the status quo where reckless bets by banks left ordinary people to bear the consequences.

I supported their cause, but not their methods. Passing through the protest crowd was uneventful; their actions weren’t particularly forceful. They held signs and claimed to be the “99%,” but to me, they lacked a clear vision for what they wanted from the “1%.”

To me, the answer was clear: the problem wasn’t just Wall Street’s appetite for risk, but that Wall Street had access to opportunities, “casinos,” and information that ordinary people never could. And when Wall Street lost, it was the public who paid the price.

You can’t solve this by simply adding more rules for Wall Street. The real solution is to create a level playing field for everyone.

3) Obsolete and Opaque Financial Systems

Back in 2012, I realized that to make the financial system more open, fair, transparent, and inclusive, we needed to upgrade its core infrastructure.

As a junior trader, I spent hours after every market close on the phone with back-office teams, reconciling trades, tracking down bonds that should have settled weeks earlier, and confirming that all derivatives positions were free of “wrong-way risk.”

How could these processes not be fully digitized?

On the surface, many steps had become digital—we used computers and electronic databases. But every database still required manual intervention to update. Keeping information consistent across parties was a massive, expensive, and often non-transparent task.

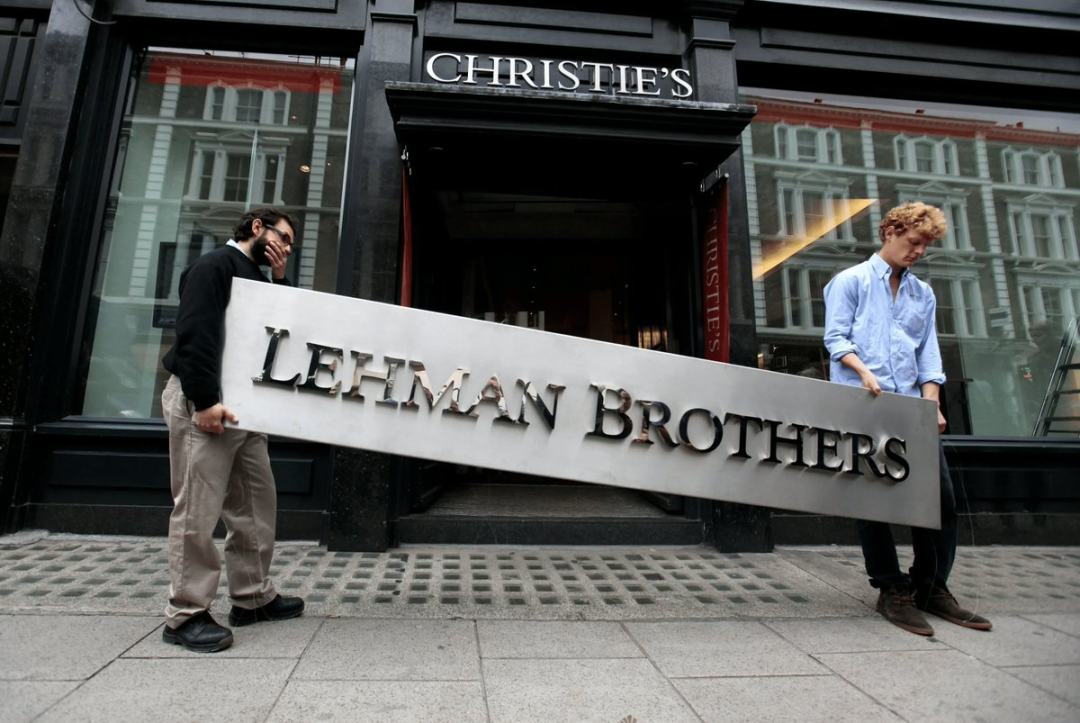

I’ll never forget this: even four years after Lehman Brothers collapsed, Barclays—who acquired its assets—still couldn’t fully determine Lehman’s actual assets and liabilities. It sounds unbelievable, but considering the conflicting and incomplete database records, it makes sense.

Bitcoin: A Peer-to-Peer Electronic Cash System

Bitcoin is truly revolutionary.

Like gold, it is immune to manipulation and independent of monetary policy. Its issuance and distribution model gave everyday people around the world a decade-long window to use it as an investment before institutions could enter at scale. It also introduced blockchain—a new kind of database that anyone can run and update directly, eliminating the need for clearing, settlement, or reconciliation.

Bitcoin was—and still is—the antidote to my disillusionment with Wall Street. Some use it to hedge against inflation and capital controls. It allowed the “99%” to invest before Wall Street. Its underlying technology could ultimately replace the opaque and inefficient systems banks rely on, building a digital and transparent new paradigm.

I knew I had to dedicate myself to this mission. But at the time, skepticism was everywhere. The prevailing view was, “Isn’t this just for criminals?” In 2014, apart from darknet markets like Silk Road, Bitcoin had almost no other use cases. It was tough to argue against the critics—you really had to imagine its potential.

During those difficult years, I sometimes wondered if this technology would ever become reality… then suddenly, the world started paying attention and projecting their hopes onto it.

The Height of Hype

For years, I hoped people would recognize blockchain’s potential, but by 2017, I found myself becoming an industry skeptic—a complicated feeling.

Partly, it was the Silicon Valley environment; partly, it was the times—everyone wanted to launch a blockchain project. People pitched me “blockchain + journalism” startup ideas, and I saw headlines like “Blockchain enters dentistry.” Every time, I wanted to say, “No, that’s not what it’s for!”

But most weren’t trying to scam anyone. They weren’t launching vaporware, issuing tokens to exploit retail investors, or creating meme coins. They genuinely believed in the technology’s potential, but their enthusiasm was often misguided and irrational.

From 2017 to 2018, the industry reached peak hype.

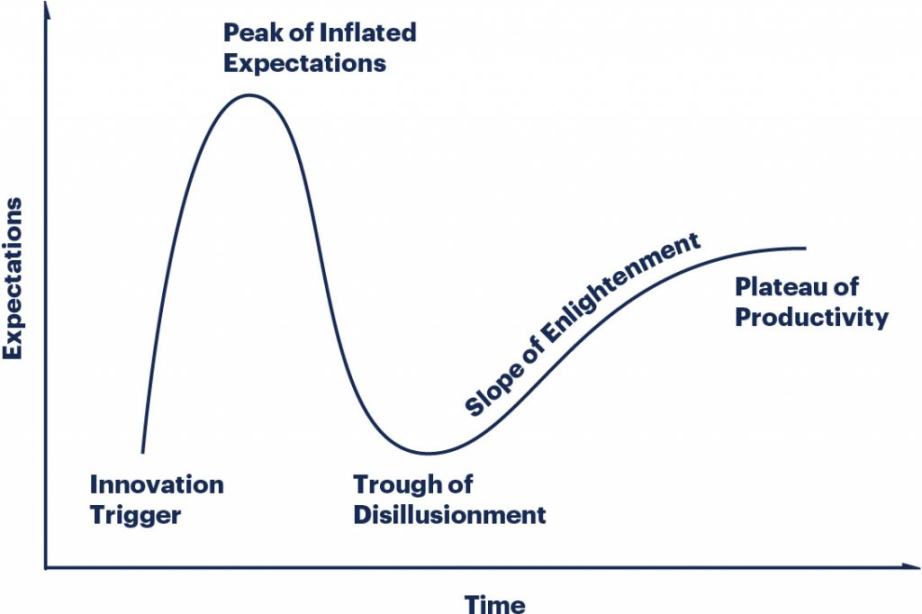

Gartner Hype Cycle

The crypto and blockchain industry hasn’t followed the steady “slope of enlightenment” shown in Gartner’s classic hype cycle. Instead, it swings between mania and despair every three to four years.

The reason is this: blockchain is a technology, but it’s tightly coupled with crypto assets—a highly volatile and risky asset class—making it extremely sensitive to macro market swings. Over the past decade, macro conditions have been turbulent: zero interest rates fueled risk appetite and crypto booms; trade wars and falling risk appetite led to crypto “deaths.”

To make matters worse, regulation in this space has been highly unstable. Disastrous events like Terra/Luna and FTX wiped out massive amounts of capital, so it’s no surprise the industry is so volatile.

Remember, We All Want to Change the World

Staying committed in this industry—whether building products, investing, commenting, or anything else—is incredibly challenging.

Everyone knows entrepreneurship is difficult, and it’s even harder in crypto. Market sentiment and funding conditions are unpredictable, product-market fit is elusive, legitimate founders can be subpoenaed or even jailed, and you might watch a president issue tokens for a scam, destroying what’s left of the industry’s credibility. It’s insane.

I completely understand why, after eight years in the industry, some people feel their lives have been wasted.

https://x.com/kenchangh/status/1994854381267947640

The author of this tweet admits he thought he was joining a revolution, but ended up helping build a giant casino, regretting his role in the “casino-ization” of the economy.

But no anti-establishment movement is perfect. Every revolution has a cost, and all change comes with growing pains.

Elizabeth Warren and the Occupy Wall Street movement tried to shut down Wall Street’s casino, but meme stock frenzies, altcoin bull markets, prediction markets, and decentralized perpetual exchanges have brought Wall Street’s casino to everyone.

Is this a good thing? Honestly, I’m not sure. Most of my time in crypto has felt like rebuilding consumer protection frameworks. But many so-called consumer protection rules are outdated or misleading, so I think pushing boundaries again might be positive. If my original goal was to create a level playing field, I have to admit—we’ve made real progress.

Reforming the financial system requires this step. If you want to fundamentally change who benefits and how in finance, you inevitably make the economy more “casino-like.”

Scorecard

Disillusionment comes easily; optimism is much harder.

But if I judge the industry by the goals I had at the start, things look pretty good overall.

On monetary mismanagement: We have Bitcoin and other sufficiently decentralized cryptocurrencies that provide real alternatives to fiat—they can’t be seized or devalued. With privacy coins, assets can’t even be tracked. That’s real progress for human freedom.

On Wall Street’s monopoly: The casino has been democratized. Now, it’s not just Wall Street that can blow itself up betting on junk assets! More seriously, society is progressing, with less paternalism about risk. We’ve always let people buy as many lottery tickets as they want, yet denied them access to the best-performing stocks of the last decade. Early retail investors in Bitcoin, Ethereum, and other quality assets have shown us what a more balanced world could look like.

As for outdated, opaque database systems: The financial industry is finally embracing better technology. Robinhood is using blockchain as the underlying technology for stock trading in the EU. Stripe is building a new global payments system on crypto rails. Stablecoins are now mainstream products.

If you entered this field for the revolution, take a closer look—everything you hoped for may already be here, just not in the form you imagined.

Statement:

- This article is republished from [Foresight News]. Copyright belongs to the original author [Jill Gunter, Co-founder of Espresso]. If you have any concerns about this republication, please contact the Gate Learn team, and the team will handle it promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without mentioning Gate.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market