Gate Research: Market Under Pressure and Consolidating | BTC Upside Momentum Constrained by Options Structure

Gate Research: Market Under Pressure and Consolidating | BTC Upside Momentum Constrained by Options Structure

Crypto Market Overview

- BTC (-2.01% | Current Price: 88,558.7 USDT): In the past 24 hours, BTC has pulled back from above $90,000, reaching a low of $87,581, and is now consolidating at a low level following a weak downtrend. The moving averages are aligned in a bearish formation of MA5 < MA10 < MA30, with the price continuing to trade below the MA30, indicating that both short- and mid-term trends remain bearish. During the decline, trading volume did not increase significantly, suggesting sustained selling pressure rather than panic-driven dumping, while bullish support remains limited. In the short term, watch the $87,500–88,000 support zone; if this level is breached effectively, BTC may further test the $86,500–86,000 range. For the mid-term, a clearer trend reversal signal would require the MA10 to turn upward or the daily price to reclaim the $90,000 level.

- ETH (-1.53% | Current Price: 3,079 USDT): ETH’s price movement is closely aligned with BTC and is currently in a low-level consolidation phase following a downward fluctuation. Since December 13, the price has consistently remained below the MA30, and multiple death crosses between MA5 and MA10 indicate a weak mid-term trend and limited short-term rebound momentum. The $3,100–3,120 range has repeatedly acted as resistance, forming a clear short-term pressure zone. Trading volume has not shown any extreme spikes, suggesting the decline is more a result of capital outflows and weakening momentum rather than panic selling. In the short term, attention should be paid to the key $3,000 support level. ETH’s rebound potential will still depend on whether BTC can stabilize and begin a recovery.

- Altcoins: The Fear Index remains at 16, placing the market in the extreme fear zone. Sentiment has cooled, and funds have temporarily flowed into stablecoins and defensive assets.

- Macro: On December 12, the S&P 500 Index fell by 1.07% to close at 6,827.41 points; the Dow Jones Index dropped 0.51% to 48,458.05 points; and the Nasdaq Index declined 1.69% to 23,195.17 points. As of 11:15 AM (UTC+8) on December 15, the spot price of gold is $4,327.5 per ounce, up 0.58% in the past 24 hours.

Trending Tokens

FHE Mind Network (+95.2%, Circulating Market Cap: $19.83M)

According to Gate market data, the FHE token is currently priced at $0.07969, having risen over 90% in the past 24 hours. Mind Network (FHE) is a decentralized privacy-preserving infrastructure project based on fully homomorphic encryption (FHE) technology, aiming to build a fully encrypted internet through secure encrypted data and AI computation.

FHE has been active recently, and this price surge is the result of technical collaboration, ecosystem incentives, and narrative resonance, providing strong psychological support to the community. Firstly, Mind Network partnered with Chainlink to launch an innovative FHE privacy bridge, using Chainlink CCIP in combination with ZK and FHE technologies to enable encrypted cross-chain messaging. Secondly, Mind Network announced it holds 1% of Pippin tokens as a long-term strategic reserve and has launched an FHE token lock-up airdrop incentive program. At the same time, the project is also promoting its encrypted AI infrastructure, further triggering FOMO sentiment.

ICE Ice Open Network(+46.08%, Circulating Market Cap: $17.34M)

According to Gate market data, the ICE token is currently priced at $0.002495, having surged over 46% in the past 24 hours. Ice Open Network (ICE/ION) is a Layer-1 blockchain platform aiming to reshape the Web3 user and developer interaction experience through decentralized services. It focuses on user data sovereignty, privacy protection, and global digital connectivity, offering core functionalities such as digital identity verification, social media interaction, content distribution, and secure data storage. A project highlight is its intuitive drag-and-drop dApp builder, enabling even non-technical users to easily create dApps.

The main driver behind ICE’s price surge may be the speculation triggered by the ICE <-> ION token migration. Users are required to migrate to the ION token (the new mainnet token) via the Online+ application. Although this event introduces short-term liquidity risks, it has also sparked FOMO sentiment, with many traders buying ICE in advance to complete the migration or capture arbitrage opportunities. Additionally, the migration marks the official transition to the ION mainnet, emphasizing zero-code dApp creation and privacy-focused transactions, which enhances its long-term narrative appeal.

BAS BNB Attestation Service(+48.02%, Circulating Market Cap: $23.82M)

According to Gate market data, the BAS token is currently priced at $0.0092, having risen over 48% in the past 24 hours. BNB Attestation Service (BAS) is a native verification and reputation infrastructure layer within the BSC ecosystem, focusing on building composable on-chain KYC (identity verification), asset attestation, and reputation profile systems. It integrates on-chain behavior, social data, and community contributions to provide privacy-preserving zero-knowledge verification solutions, applicable to scenarios such as RWA, DeFi, and AI agents.

The driver behind BAS’s recent surge is a technical upgrade. Between December 12–14, the BAS team launched the ERC-8004 V1 protocol upgrade, which introduced a dedicated reputation tracking mechanism for AI agents. This enhances the intelligence of on-chain identity verification and boosts demand for the BAS token to pay for verification fees.

Alpha Insights

The Reason BTC Struggles to Rise Long-Term: Heavy Selling Pressure in the Options Market Structure

Bitwise advisor Jeff Park believes that the reason BTC’s current price cannot break out significantly is not due to a lack of demand, but because market supply—especially from large holders—is suppressing the upside. In particular, a large number of actions in the options market have created a “net short Delta structure,” which is restraining BTC’s upward momentum.

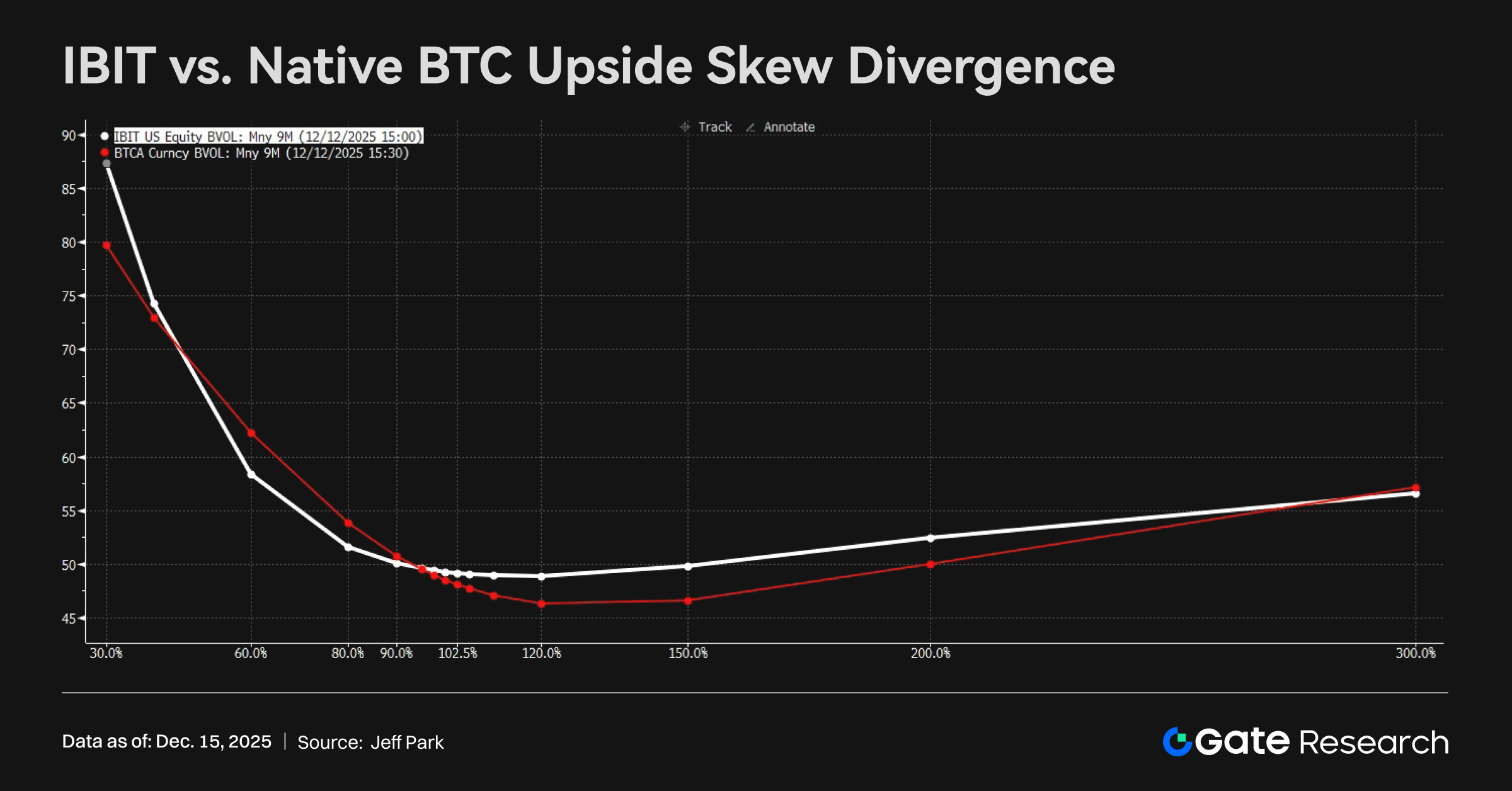

The chart above compares the “volatility skew” between two different markets: IBIT (BTC ETF options) and native BTC options. In the long term, call options on IBIT tend to have higher implied volatility than at-the-money (ATM) options → this suggests the market is more optimistic about future upside and is willing to pay a premium for “upside insurance.” In contrast, native BTC options (such as those on Deribit) show lower implied volatility for call options compared to ATM → indicating a reluctance in the market to pay a premium for significant upside.

This difference reveals completely different behaviors among participants: the ETF market leans bullish (buying calls), while the native BTC market leans bearish (selling calls), particularly with OG holders selling call options to earn yield. This structural divergence results in a lack of strong upward momentum in BTC price.

Overall, OG BTC holders and their hedging strategies are suppressing Bitcoin’s upward momentum. Even though there is capital inflow (e.g., through ETFs), BTC still lacks the driving force for a strong price rally. Unless these OG players change their volatility-selling behavior, Bitcoin is likely to remain range-bound and struggle to break out. A shift in this structure—such as increased bullish demand and reduced options selling pressure—is needed for a sustained upward move.

Ant International Builds Enterprise Treasury Management Platform with Blockchain, AI, and Tokenization Technology

Ant International’s treasury platform is a “three-in-one” treasury stack composed of Whale + Bettr + AI (Falcon TST). Whale is a permissioned chain involving multiple banks that supports the issuance of tokenized deposits by banks. Its key functions include 24/7 real-time intra-group liquidity transfers, programmable rules (smart contracts) for automated cash sweeping and pooling, and multi-currency settlement, without the cut-off time constraints of traditional banks. Bettr is the customer-facing commercial brand that offers real-time treasury management, Settlement Tokens (a wholesale-grade tokenized electronic money licensed under MiCA in the EU), and embedded financial services. It mainly targets industries such as aviation, e-commerce, and cross-border trade, helping enterprises reduce costs and improve efficiency. Falcon TST is a time series transformer model with approximately 2 to 2.5 billion parameters, trained on historical data. It achieves over 90% accuracy in foreign exchange and cash flow forecasting, helping reduce costs related to liquidity and FX.

In summary, this innovative trend reflects several major industry directions: stablecoins and tokenized deposits are becoming foundational infrastructure for institutional fund settlements, extending beyond just the crypto market; AI financial forecasting models are beginning to replace traditional budgeting and hedging processes; and blockchain is evolving from a simple payment rail into a true core network for fund clearing and settlement.

Stable Mainnet Launch Falls Short of Expectations, On-Chain Activity Remains Sluggish

The Stable public chain, supported by Tether’s sister company Bitfinex, has seen underwhelming performance in its first week since launch, with fewer than 25k total on-chain addresses — significantly below market expectations. Meanwhile, the total number of tokens on Stable stands at just 339, and transaction fees in the past 24 hours were less than 0.5 gUSDT. The network has not exhibited the typical signs of an early-stage public chain launch, such as rapid address growth, spikes in interaction frequency, or application-driven activity.

Logically, the core issue Stable faces is not a lack of brand backing, but rather that its differentiated narrative has not translated into tangible on-chain demand. Against the backdrop of mature stablecoin settlement networks like Ethereum, Solana, and Tron, simply positioning itself as a stablecoin-friendly chain or leveraging its connection to Tether is not enough to drive mass migration of users and developers.

Moreover, without clear native applications, advantages in payments/settlements, or notable improvements in cost and efficiency, Stable is more likely to be viewed as a supplementary option to existing stablecoin infrastructure rather than an irreplaceable new main chain. This helps explain the subdued on-chain activity during its early mainnet phase. Future performance will depend on whether Stable can convert its stablecoin strengths into sustained on-chain use cases through real application deployment, financial incentives, or institutional partnerships, rather than remaining at the level of conceptual narrative.

References

- Gate, https://www.gate.com/trade/BTC_USDT

- Farside Investors, https://farside.co.uk/btc/

- Gate, https://www.gate.com/trade/ETH_USDT

- Farside Investors, https://farside.co.uk/eth/

- Gate, https://www.gate.com/crypto-market-data

- CoinGecko, https://www.coingecko.com/en/cryptocurrency-heatmap

- Jeff’s Substack, https://dgt10011.substack.com/p/the-one-chart-that-explains-why-bitcoin?r=4e7rq6&utm_campaign=post&utm_medium=web&triedRedirect=true

- Forbes, https://www.forbes.com/sites/zennonkapron/2025/12/13/inside-ant-internationals-treasury-platform-how-whale-bettr-and-ai-are-rewiring-global-liquidity/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025