GUSD: Turning Stablecoins into Interest-Bearing On-Chain Notes

Transitioning from Value Preservation to Yield Generation

Stablecoins have traditionally been viewed as on-chain representations of the US dollar, serving purposes such as trading, risk hedging, or short-term value storage. GUSD is designed to move beyond this conventional role. While maintaining its dollar peg, GUSD transforms the holding experience into a cash flow-generating process, turning idle stablecoins into digital notes that accrue yield.

Real World Assets (RWA) as Yield Drivers

GUSD’s stability and yield are not solely supported by cash deposits. Instead, they are backed by traditional financial assets with cash flow, such as short-term US Treasury bonds. These assets generate interest income, forming the basis for the token’s value appreciation. GUSD effectively brings the yield mechanism of conventional bonds onto the blockchain, enabling the token to offer both price stability and yield.

Flexible Entry Options

Users have two primary options for acquiring GUSD, allowing them to choose according to their needs:

- Direct purchase via trading platforms: Quickly acquire GUSD by exchanging USDT or other stablecoins on exchanges.

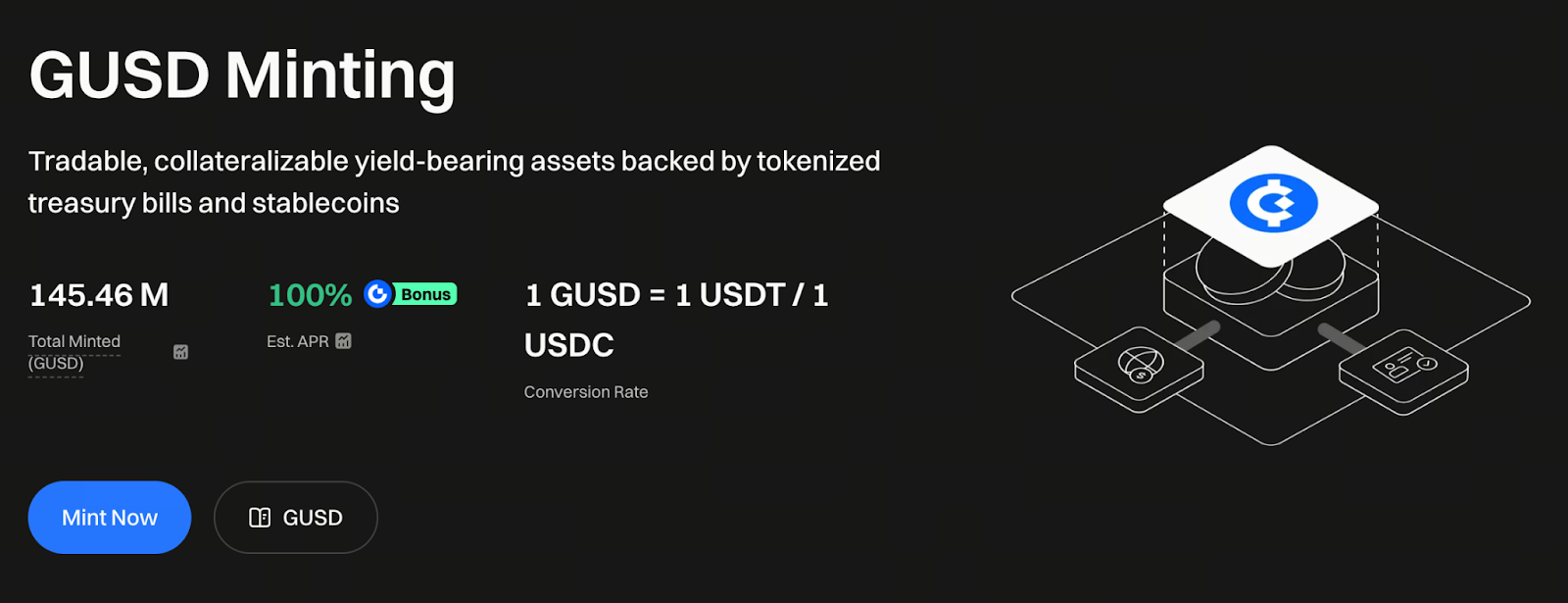

- On-chain minting (1:1): If you hold USDT or USDC, you can mint GUSD on-chain at a 1:1 ratio, ideal for long-term holders seeking to accumulate yield.

Both approaches provide users with flexibility to manage liquidity and investment duration.

Mint GUSD now to earn daily annualized yield: https://www.gate.com/staking/GUSD?gt_disable_intercept_jump=1

Yield Model

GUSD does not distribute returns as daily micro-payments. Instead, it accrues interest cumulatively and settles at maturity. For example, if you mint 100 USDT and the underlying assets generate a 20% return during the holding period, you may redeem close to 120 USDC at maturity. This model mirrors the cumulative yield of holding a bond, rather than instant dividends, allowing GUSD’s value to grow over time.

Ecosystem Incentives and Expanded Applications

To broaden use cases and drive ecosystem engagement, GUSD is often paired with various incentives and integration strategies, including:

- Staking rewards: Hold GUSD and participate in staking to earn additional yield;

- Limited-time promotions or airdrops: Encourage early adoption and boost user retention;

- Scenario integration: Gradually connect GUSD to lending, Launchpool, wealth management, and other Web3 applications to enhance utility.

These features enable GUSD to serve diverse functions across trading, wealth management, and liquidity provision.

Key Advantages of GUSD

- Time equals value: The longer you hold GUSD, the greater your potential yield, making it ideal for long-term allocation.

- Multiple entry and exit channels: Supports USDT, USDC, and other major stablecoins for minting, enabling seamless capital conversion.

- Versatility: GUSD can be used for trading margin, wealth management, or staking, maximizing asset utility.

Furthermore, maintaining transparent reserves and regular compliance audits helps build market trust.

Liquidity and Redemption Convenience

GUSD is engineered for high liquidity and low-friction redemption. Users can quickly redeem GUSD for USDC or USDT and trade across multiple channels. However, users should be aware of differences in fees and settlement times across platforms, especially since cross-chain transactions may introduce extra costs or delays.

Risk Disclosure

This material does not constitute an offer, solicitation, or investment advice. Please carefully evaluate risks and seek professional guidance before investing. Gate may restrict or prohibit service access from certain regions; refer to the user agreement for details.

User Agreement: https://www.gate.com/legal/user-agreement

Conclusion

GUSD aims to evolve stablecoins from simple value storage to dynamic value generation. By combining RWA backing with bond-like yield mechanisms, it offers on-chain capital a solution that bridges cash reserves and yield-generating products. As application scenarios expand and regulatory transparency improves, yield-generating stablecoins like GUSD are poised to become increasingly attractive within the on-chain wealth management and payment ecosystem.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution